3. Open market share repurchases

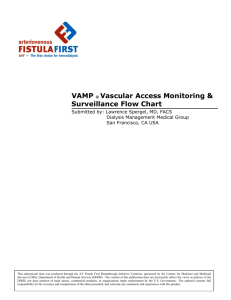

advertisement