2013-05BWG - National Association of Insurance Commissioners

advertisement

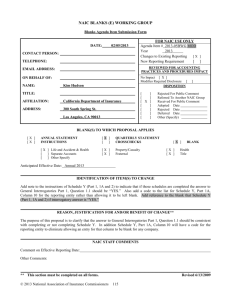

NAIC BLANKS (E) WORKING GROUP Blanks Agenda Item Submission Form DATE: 02/05/2013 CONTACT PERSON: TELEPHONE: FOR NAIC USE ONLY Agenda Item # 2013-05BWG Year 2013 Changes to Existing Reporting [X ] New Reporting Requirement [ ] EMAIL ADDRESS: REVIEWED FOR ACCOUNTING PRACTICES AND PROCEDURES IMPACT ON BEHALF OF: No Impact [ X ] Modifies Required Disclosure [ DISPOSITION NAME: Kim Hudson TITLE: AFFILIATION: California Department of Insurance ADDRESS: 300 South Spring St. Los Angeles, CA 90013 [ ] [ ] [ X ] [ ] [ ] [ ] [ ] ] Rejected For Public Comment Referred To Another NAIC Group Received For Public Comment Adopted Date Rejected Date Deferred Date Other (Specify) BLANK(S) TO WHICH PROPOSAL APPLIES [X ] [X ] ANNUAL STATEMENT INSTRUCTIONS [ [ ] ] [ X ] Life and Accident & Health [ ] Separate Accounts [ ] Other Specify [X ] [X ] QUARTERLY STATEMENT CROSSCHECKS Property/Casualty Fraternal [ [X ] [X ] ] BLANK Health Title Anticipated Effective Date: Annual 2013 IDENTIFICATION OF ITEM(S) TO CHANGE Add note to the instructions of Schedule Y (Part 1, 1A and 2) to indicate that if those schedules are completed the answer to General Interrogatories Part 1, Question 1.1 should be “YES.” Also add a code to the list for Schedule Y, Part 1A, Column 10 for the reporting entity rather than allowing it to be left blank. REASON, JUSTIFICATION FOR AND/OR BENEFIT OF CHANGE** The purpose of this proposal is to clarify that the answer to General Interrogatories Part 1, Question 1.1 should be consistent with completing or not completing Schedule Y. In addition Schedule Y, Part 1A, Column 10 will have a code for the reporting entity to eliminate allowing an entry for that column to be blank for any company. NAIC STAFF COMMENTS Comment on Effective Reporting Date: Other Comments: ___________________________________________________________________________________________________ ** This section must be completed on all forms. Revised 6/13/2009 © 2013 National Association of Insurance Commissioners 115 ANNUAL STATEMENT INSTRUCTIONS – LIFE, PROPERTY, HEALTH, FRATERNAL AND TITLE SCHEDULE Y – INFORMATION CONCERNING ACTIVITIES OF INSURER MEMBERS OF A HOLDING COMPANY GROUP PART 1 – ORGANIZATIONAL CHART The term “holding company group” includes members of a holding company system and controlled groups. All insurer and reporting entity members of a holding company group shall prepare a common schedule for inclusion in each of the individual annual statements. If the company is required to file a registration statement under the provisions of the domiciliary state’s Insurance Holding Company System Regulatory Act, then Schedule Y, Part 1, Organizational Chart must be included in the annual statement. See SSAP No. 25, Accounting for and Disclosures about Transactions with Affiliates and Other Related Parties, for further information NOTE: If the reporting entiy completes this schedule, it should have answered “YES” to General Interrogatories, Part 1, Question 1.1. Attach a chart or listing presenting the identities of and interrelationships between the parent, all affiliated insurers and reporting entities; and other affiliates, identifying all insurers and reporting entities as such and listing the Federal Employer’s Identification Number for each. The NAIC company code and two-character state abbreviation of the state of domicile should be included for all domestic insurers. The relationships of the holding company group to the ultimate controlling person (if such person is outside the reported holding company) should be shown. Only those companies that were a member of a holding company group at the end of the reporting period should be shown on Schedule Y, Part 1, Organizational Chart. Where interrelationships are a 50%/50% ownership, footnote any voting rights preferences that one of the entities may have. However, any person(s) (that includes natural person) deemed to be an ultimate controlling person, must be included in the organizational chart. The Social Security number for individual persons should not be included on this schedule. © 2013 National Association of Insurance Commissioners 116 SCHEDULE Y PART 1A – DETAIL OF INSURANCE HOLDING COMPANY SYSTEM All insurer and reporting entity members of the holding company system shall prepare a schedule for inclusion in each of the individual annual statements that is common for the group with the exception of Column 10, Relationship to Reporting Entity. NOTE: If the reporting entiy completes this schedule, it should have answered “YES” to General Interrogatories, Part 1, Question 1.1. Column 1 – Group Code If not applicable for the entity in Column 8, leave blank. Detail Eliminated To Conserve Space Column 10 – Relationship to Reporting Entity Use the most applicable of the following codes to describe the relationship of the entity in Column 8 to the reporting entity for which the filing is made. Relationship Codes: UDP = UIP = DS = IA = NIA = OTH = RE = Upstream Direct Parent Upstream Indirect Parent Downstream Subsidiary Insurance Affiliate Non-Insurance Affiliate Other (explain relationship in the footnote line) Reporting Entity Detail Eliminated To Conserve Space © 2013 National Association of Insurance Commissioners 117 SCHEDULE Y PART 2 – SUMMARY OF INSURER’S TRANSACTIONS WITH ANY AFFILIATES This schedule was designed to provide an overview of transactions among insurance holding company system members. It is intended to demonstrate the scope and direction of major fund and/or surplus flows throughout the system. This schedule should be prepared on an accrual basis. All insurer and reporting entity members of the holding company system shall prepare a common schedule for inclusion in each of the individual annual statements. NOTE: If the reporting entiy completes this schedule, it should have answered “YES” to General Interrogatories, Part 1, Question 1.1. Include transactions between insurers; and between insurers and non-insurers within the holding company system. Exclude transactions between non-insurers that do not involve an affiliated insurer. Include all shareholder dividends, capital contributions and reinsurance recoverable (payable), Columns 4, 5 and 13, respectively, and transactions involving one-half of one percent or more of the largest insurer’s admitted assets as of December 31. Exclude transactions of a non-insurer with an affiliated insurance company that are of a routine nature (e.g., the purchase of insurance coverage). Detail Eliminated To Conserve Space W:\QA\BlanksProposals\2013-05BWG.doc © 2013 National Association of Insurance Commissioners 118