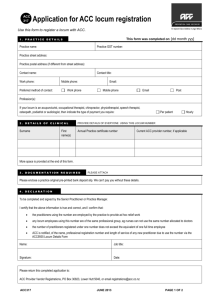

being a locum

advertisement

Working After the GPR Year – Tax & Money 1. Stay in the loop Ask your trainer about email support! Sessional GP groups – local & NASGP RCGP First 5 initiative FPH Wednesday GP meetings, VTS friends 2. Where to find work Distribute CV to local practice managers Register with NHUC/ FPCS for OOH work Posts - word of mouth - OOH service - LMC website - BMJ - Pulse/ GP (you can register for free magazines at home address) 3. Medical Performers List Remember to change status Stay registered with PCT where most sessions worked in the last year 4. Defence Organisation Suddenly very expensive. Can pay monthly. If part-time, pay less 5. Book-keeping Keep some records (see later) Invoice each session worked or monthly if a regular job 6. Tax & National Insurance Sort out National Insurance Contributions - see later Locum = self-employed = mandatory to complete tax return Put aside 30% of all your locum earnings 7. Pension GP locum work can help build your NHS pension entitlement. Try this link - http://www.nhsbsa.nhs.uk/Pensions/2665.aspx or Google “NHS GP locum pension” 10 week window; miss this = lose the pension for that work. Forms A&B to complete Deduct 10% as “expenses” – you can only put 90% of locum earnings forward for pension How much do you contribute? It varies according to your estimate of the year’s locum earnings. Corrected at year if your estimate was wrong (2011 figures) <£22K = 5% contribution by self £22-70K = 6.5% contribution by self £70-110K = 7.5% contribution by self >110K = 8.5% contribution by self GP locum work only – for OOH earnings, pension deduction should be made by the OOH provider 8. Car Keep record of expenses and keep record of mileage – can claim from home address May wish to charge practice if living a long way away Declare any car expenses received on tax return (form P11D) 9. Holiday / Sickness Pay None! – plan well 10. What to charge Ask your training practice / other locums (2011 guide = £175 - £200 per ½ day session) Contact local sessional doctors group Money & Savings Consider a financial advisor if you have a lot of money (over £25K) in savings They will help you get the best returns Two general “healthy finances” rules: 1. Minimum savings try and keep 3-months expenditure in cash reserves 2. Splitting savings 1/3 in zero risk quick-access cash accounts (eg bank savings, instant access ISA) 1/3 in zero/ low-risk longer tied accounts (100-day notice, national savings certs) 1/3 in non-cash “ other risk” schemes (eg Unit Trust ISA) Level of risk is your call Could lose everything if the world collapses (1920’s) Could lose if you need to sell during a down Should be a winner if you can wait RdF recommendation – Hargreaves Lansdowne Income Insurance Just like taking out the value-for-money insurance offered every time you take out a loan??? You can choose to insure yourself against not being able to work in the longer-term. It is a personal decision as to whether this is important for you but something you should seriously consider if you are in a partnership and have people depending on your income. There is a well-established mutual assurance society called Weslyan Assurance (www.wesleyan.co.uk). Used to be called the Medical Sickness Society. They also offer general financial advice and pension planning You should certainly consider taking advice from them if you become a full partner in a practice as you almost certainly need to take out locum insurance. Most practice agreements will allow you to take your full drawings for 12 months of sickness. Most practice agreements will ask you to provide locum cover after 13 weeks or 6 months absence Absent less than 13 weeks: partners cover you & you still take your full pay Absent 13 – 52 weeks: you still take your full pay but will it will cost you about £5,000 a month to hire a locum. Your locum insurance policy helps to pay for this Absent over 52 weeks: you will leave the partnership and lose your income. This is where income protection insurance would then come in Tax and Finances – www.hmrc.gov.uk Simple advice – put about 30% of any self-employed earnings into a separate account for tax/ NI/ pension If you want HMRC to calculate the tax/ NIC you owe (highly recommended) submit return by end September Employee vs. Self-Employed You can be both – be an employee but also doing self-employed work Employee Tax will be deducted automatically (PAYE) NI (see below) will be deducted automatically Some expenses are allowable and you will only see the benefit of this if you choose to complete a tax-return Self-employed Tax is calculated by a compulsory tax return NI is NOT paid automatically More expenses are allowable How much tax will I pay? The basics of self-assessment: Completing a self-assessment tax return will lead you through the following: Total everything you earn in the year = gross pay Subtract everything that is allowable expenses = net pay Apply your personal allowance You get taxed on whatever is left, according to tax bands/ rates Any tax you have already paid (PAYE) gets taken into account Tax Forms P45 When you leave a job this summarises tax paid in the current tax year P60 Sent by every employer at the end of the tax year to show tax paid already for that tax year April next year - You should get a P60 from your training practice (tax paid April – July) - You will need this for your first tax return P11D Record of car allowances received as an employee National Insurance Contributions (www.hmrc.gov.uk) In theory pays for statutory sick pay, statutory maternity pay and state pension In practice, an additional 9% tax… £100 fine if delay by more than a few months Class 2 - low cost (£2.50 per week), set up monthly direct debit Class 4 - higher cost (effectively additional 9% tax) - calculated and billed from your tax return on your PROFITS (income minus expenses) Allowable Expenses Some expenses are considered necessary for the job and are tax-deductible (employee or self-employed) GMC fees RCGP membership (but not exam fees) BMA membership MDU/ MPS payment CPD costs - FPH postgraduate annual membership - Course fees - Medical books/ journals Equipment REPLACEMENT Car expenses are complex. Employee - usually paid a car allowance - this is taxable and amount paid is declared on P11D with tax return Self-employed - simple way: record mileage exactly as you did as a trainee travel to/ from work is allowable claim at the standard HMRC rate (currently 40p per mile for 1st 10K) - complex way: record all your car expenses including the car depreciation allowance, petrol, insurance, road tax, repairs, AA…. keep a (VAT) receipt for everything record all car mileage as personal or business calculate percentage of business mileage claim this proportion of total car expenses Don’t go beyond this without an accountant Other grey areas include computer costs, phone bills, use of a study at home… Example of Where the Money Goes These numbers are plucked out the air so DO NOT use them as a basis for your own tax return! You finish your ST3 year in July 2011 and from August onwards you are working as a locum As an ST3 you were earning £5,000 per month GROSS PAY (£20,000 April to July) P60 summary £20,000 earned £1,600 pension contributions £1,300 NIC deductions £3,000 Income tax deductions As a locum, you earned £32,000 between August and April 5th GROSS PAY £24,000 was GP locums £8,000 was for OOH work - £520 deducted by them for pensions NIC April to July was paid out your salary as ST3 and is detailed on your P60 You registered to start paying class 2 in August (£2.50 per week by monthly Direct Debit) You will be billed for class 4 with your tax bill (9% on profits over £7225) Pension April to July was paid out your salary as ST3 and is detailed on your P60 OOH Provider deducted £520 for the money you earned from them In August you downloaded forms A & B and you have been sending 6.5% of 90% of what you earned as a locum each month, remembering that you must send this within 10 weeks of earning it. Tax April to July was paid out your salary as ST3 and is detailed on your P60 From August you were putting 30% of your locum earnings into a separate account = £9,600 You have been paying your GP locum pension out of this (£1404 = 0.065 x 0.90 x 24,000) You hope the remaining £8,196 is enough to pay your tax and class 4 NIC In April 2012 you will now be expected to submit a tax-return If it is received by 30th September 2012, you just need to give them income/ expenses and they do the maths Income Employee (ST3) will be detailed on the P60 from your training practice Self-employed – the total of all your locum earnings Odds and ends – some bank interest from a non-ISA savings account….. Expenses (you have receipts for all of this…) £420 GMC fees £450 RCGP membership (but not exam fees) £360 BMA membership £4500 MDU/ MPS payment £250 CPD costs - FPH postgraduate annual membership, Course fees, Medical books £80 Replacement stethoscope £320 Car mileage (100 miles per month all logged, allowance is 40p per mile) £6380 Total expenses Profits as a locum = £32,000 - £6380 = £25,620 Crude example of how HMRC do the sums: NIC due 9% of £18,395 = £1,656 Tax due Total earnings = £52,000 Minus personal allowance £6,475 Minus pension payments £3,524 Minus allowed expenses £6,380 Taxable pay = £35,621 Tax already paid (ST3) = £3,000 (profits minus £7,225) (you keep this without tax) (you don’t pay tax on these) Taxed at 20% = £7,124 tax due Tax still to pay = £4,124 Jan 2013 Bill for £2,062 tax and £828 NIC July 2013 Bill for £2,062 tax and £828 NIC Total was £5,780 – you had £8,196 left for this Note the only reason it looks like you saved too much was the ST3 tax that had been paid. Save 30%...