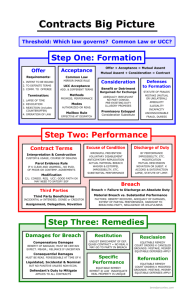

A. Is there an agreement?

advertisement