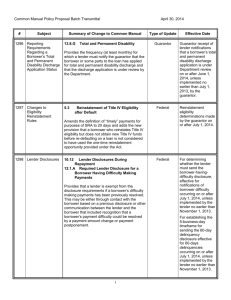

7530 - Commitment Letter - Oil and Gas

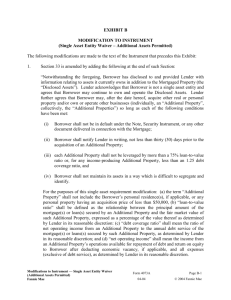

advertisement