organizational structure

advertisement

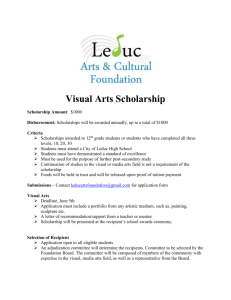

Shelton State Community College Special Team Report April 9, 2007 INTRODUCTION On January 25, 2007, Dr. Thomas E. Corts, then Interim Chancellor of the Alabama College System, after consulting with legal counsel for the Department of Postsecondary Education, appointed a team to review various allegations regarding the hiring, qualifications and compensation of employees, the awarding of financial aid to students, and questions regarding management and financial operations, and relationships between the campus and certain campus-related organizations at Shelton State Community College in Tuscaloosa, Alabama. The team was composed of Mr. Donald Edwards, Executive Consultant to the Chancellor, who acted as Chair, Ms. Joan Davis, General Counsel and Vice Chancellor for Legal Services and Human Resources, Dr. Michelle Sylvester, Director of Student Services, Mr. Nace J. Macaluso, State Administrator, G.E.D. Testing Program, and Mr. Jack Burrow, Dean for Business and Finance, Calhoun Community College. Dr. Corts charged the team to review material at the Department relative to Shelton State Community College (hereinafter “Shelton State”); to identify areas to be reviewed; to schedule on-site visits to Shelton State, conduct interviews, review documents; and to provide a written report detailing findings, conclusions, and/or recommendations for his review and for review and consideration by the Department’s legal counsel. The team initially categorized the areas to be reviewed into the following subjects: 1. Organizational structure. Scope of responsibility of key leaders; qualifications of personnel in key leadership positions; supervisory and management practices. 2. Personnel. Salary schedule C positions; hiring; number and responsibilities of retired personnel working for the college; evaluations, file maintenance, payroll classifications and policy compliance. 3. Relationship between the college and the college foundation; corporate structure, governance and operations; agreements/arrangements between the college and the foundation; use of college staff and/or facilities; foundation financial practices, sources of funds, cash flow, assets and operations; compliance with DPE policies, tax mandates; financial reporting. 4. Relationship of the college and the foundation with Theatre Tuscaloosa. Financial arrangements; reporting; compliance. 5. College financial and budgeting procedures, contracting and procurement practices, financial reporting; accuracy, adequacy, timeliness, relevance, compliance. 6. Scholarship awards and financial aid. Categories, compliance, process and propriety. 7. Presidential residence. Ownership, use, condition, financial relationships, tax and policy compliance. 8. Respiratory therapy program. Qualifications of instructors, program evaluation, continuing accreditation. 9. Other matters, as they might appear. The summary of findings and recommendations that follows presents conclusions of the review team after a limited review of documentation and interviews with a selection of Shelton State Community College personnel during several campus visits over a three week period, and should be considered as strictly limited to those subjects and findings discussed in the review. Any findings represent the opinions of the investigative team based upon its review. Any and all legal (civil and/or criminal) opinions or actions which may be indicated by these factual findings are reserved for the Department’s legal counsel. Committee Note: The responses of Shelton State Community College follow the various recommendations of the committee in the body of this report, and are each labeled "Response." The committee has not conducted deliberations on the content of the proffered responses. ORGANIZATIONAL STRUCTURE 1) Finding: Key leaders at the College appear to possess at least the minimum academic qualifications and experience called for by their respective job titles. Senior offices are filled, and scopes of responsibility are generally in customary and appropriate alignment, except that apparent disagreements between the Dean of Business Services and an Associate Dean have caused the Acting President to redirect the Associate Dean to report directly to the Acting President. Documentation: Interviews with the Acting President and senior officers of the College. Recommendation: Determine whether issues between the Dean of Business Services and the Associate Dean require personnel action or permanent structural change to normalize reporting structures. Review and determine whether this situation is more widespread or are otherwise compounded, and take appropriate action as needed. Response: The Acting President is recommending to the Department of Postsecondary Education that the title of the Associate Dean for Business Services be changed to Associate Dean for Facilities and Auxiliary Services, a title which more accurately 2 reflects her job responsibilities. Additionally, the facilities and auxiliaries departments are well placed in a direct reporting responsibility to the President. 2) Finding: Administration at the College has a history of issues regarding policy compliance and management, especially with regard to deficiencies in hirings and transfers of personnel, awarding of scholarships, issues regarding presidential housing, procurement and management of construction contracts, accounting for the use of state assets and facilities, establishing and managing appropriate relationships with associated entities, and establishing effective comprehensive internal controls. Documentation: Interviews with the Dean of Student Services and the Director of Human Resources; Uniform Guidelines; proceedings in Shuford, et al v. Alabama State Board of Education, et al, Civil Action No.89-T-196-N in United States District Court for Middle District of Alabama, and Kennedy v. Alabama State Board of Education, et al, Civil Action No.CV-89-T-196-N in the United States District Court for Middle District of Alabama; Uniform Guidelines; Alabama Code §16-22-15; SBE Policy No. 602.02; personnel files. Employee rosters; interviews with the Acting President, the Dean of Student Services; correspondence; personnel files; The Principles of Accreditation, Commission on Colleges, Southern Association of Colleges and Schools; interview with Foundation Executive Director/SSCC Director of Advancement; Lease by and between Shelton State Community College and Shelton State Foundation [sic], dated August 1, 1989, expiring February 1, 1990; Foundation scholarship records and forms; Family Educational Rights and Privacy Act (FERPA) (20 U.S.C. § 1232g; 34 CFR Part 99) the Gramm-Leach-Bliley Act (P.L. 106-102) and the Federal Trade Commission’s Safeguards Rule (16 CFR Part 314); Financial Statements and records of the Shelton State Community College Foundation, Inc.; Contract (“Partnership”), as of January 1, 2000 through December 31, 2009, between Buffalo Rock Company and “New Campus Foundation, Inc. of Shelton State Community College” [sic]; interview with Foundation Executive Director; “Agreement for the Use of Vending Space” by and between Shelton State Community College and Shelton State Community College Foundation, dated April 1, 2000;” payroll and personnel records of the College; interview with the Dean of Student Services; Joint Operating Agreement between Shelton State Community College Foundation, Inc. and Theatre Tuscaloosa; review of College expense accounts; interview with the Dean for Business Services; telephone interview with the Executive Producer of Theatre Tuscaloosa; Alabama College System Contract Report; Theatre Tuscaloosa Website; review of scholarship and financial aid records; review of purchase orders. Recommendation: Take appropriate personnel actions in response to violations of established policies and legal mandates; establish a comprehensive internal control program and internal audit office; establish periodic training for senior officers and directors regarding policies and procedures; follow additional recommendations set forth in the individual subject areas set forth below. Response: Although the College has a review process in place for selected programs and 3 services, the College understands and supports the need for a more formalized process for internal review and/or auditing and for professional development regarding policies and procedures and will cause both issues to be strengthened. PERSONNEL 1) Finding: Some positions at the College were improperly filled in violation of the Shuford/Johnson/Kennedy Partial Consent Decrees or the State Board of Education's “Uniform Guidelines,” posting laws and Shelton State policies. It appears that several employees were given new jobs or transferred to new titles without a search or reorganization of the position as required. Prior to December 31, 2005, hiring, promotion and transfer of personnel in all of the institutions of the Alabama College System were subject to the provisions of Consent Decrees entered in two Federal lawsuits. The current version of the Department's Uniform Guidelines, which supplanted the Consent Decrees, was adopted by the State Board of Education on May 25, 2006, and contains substantive provisions modeled after the Consent Decrees. It appears that no search was conducted for appointment to the position of Special Assistant to the President. Likewise, a number of Adult Education positions were improperly filled, including positions where instructions were received from the Department of Postsecondary Education to appoint specific persons to positions which were then funded or paid by the Department, without required postings or searches. One such employee is the spouse of the College President. Additionally, a part-time clerk related to the Dean of Business Services was appointed to the position without the position being posted. It was also noted that the employment of one Adult Education employee was retained by the College for more than two years despite indications of poor performance and his continued refusal to sign an employment contract. In a number of Salary Schedule E positions and some part-time positions there were neither postings nor searches. These same deficiencies were noted in the appointment of at least one office manager position on the Fredd Campus. The Lifelong Learning Center Director, who is the spouse of the Dean of Instructional Services, was appointed to the position without application, reportedly after a search failed to yield qualified applicants. One staff member stated that the Dean of Business Services requested him and other College officials to hire her sister-in-law upon passing her G. E. D. The sister-in law was subsequently hired in the Adult Education Program. The employment records of three other individuals in Adult Education show no indication of postings or searches associated with their hirings. Documentation: Interviews with the Dean of Student Services the Director of Human Resources, and the Lifelong Learning Director; Uniform Guidelines; proceedings in Shuford, et al v. Alabama State Board of Education, et al, Civil Action No.89-T-196-N in United States District Court for Middle District of Alabama, and Kennedy v. Alabama State Board of Education, et al, Civil Action No.CV-89-T-196-N in the United States 4 District Court for Middle District of Alabama; Uniform Guidelines; Alabama Code §1622-15; SBE Policy No. 602.02; personnel files. Recommendations: Hiring and modifications to title, duties or salary, must comply with the Uniform Guidelines, posting laws, and other State Board and College policies. Insubordinate or incompetent employees should be disciplined in accordance with policies. Response: The College located documentation that four of the above referenced positions had been properly filled through reorganizations approved by the Chancellor. These include the Assistant Dean of Students—Athletics and Student Organizations (2000), Assistant Dean of Health Services (2004), Assistant Dean for Student Services (2004), Director of the C.A. Fredd Campus (2006). The College has revised the hiring process for E and H salary schedule personnel to insure that all jobs are properly posted and that the College is in full compliance with equal employment opportunity requirements. The College has, at times, been directed by the Department of Postsecondary Education to employ specific individuals, particularly in the Adult Education Division, without using proper hiring procedures. Committee Note: When the committee first conducted its review, it appeared that appointments of the Assistant Dean for Student Services and the Assistant Dean for Health Services were made by "assignment," and also that the positions of the Assistant Dean of Students-Athletics and Student Organizations, and the Director of the C. A. Fredd Campus were filled in violation of the Consent Decrees, which were in effect through December 31, 2005. However, on April 2, 2006, the College provided the committee with documents which confirm that the appointments were made as part of reorganizations approved by the Chancellor. As such, those positions appear to have been filled in compliance with the Consent Decrees. The committee has revised its report accordingly. 2) Finding: The College has employed and currently employs several individuals without proper justification or need, some of whom provide little or no service to the College and do not regularly appear at the College. Other hirings carry the appearance of political motivation. One person, a City Councilman, received a part-time employment contract as "Coordinator of Communications" at the same time that he had a $5,400 contract with the College to provide media services for the academic year of '06-'07. Interviews with College personnel indicate that this individual did not report to the campus regularly for work nor were there evaluations or documentation in his personnel file to indicate what work he performed. There was no indication that the position was posted, or that a search 5 was conducted. A State Representative has been employed by the College since November, 1999, and is currently employed in the title of "Coordinator" on a part-time basis, receiving $49,677.00 per year. College personnel interviewed by the committee indicate that this person has no office on campus, does not regularly appear at the campus, and is of limited service to the College. This employee has another part-time position with Bevill State at a similar rate of compensation, in addition to maintaining a law practice and his legislative duties. Another legislator, now deceased, was employed as a "Special Populations Coordinator" from December, 2002 until his resignation on May 31, 2006. There do not appear to be any evaluations or other documentation to indicate what work he performed, and there was no indication that the position was filled by a posting or a search. Another State legislator was employed as an "Adult Education Instructor" in January, 2006, without a posting or a search. This individual resigned in December, 2006. A fourth legislator, who was for a time the College's Director of Human Resources, left employment with the College in 2006 after entering a guilty plea in Federal court to a public corruption charge involving the College and the Fire College Foundation. Another individual was employed as a part-time administrative assistant from May, 2000 until he resigned in January, 2007. There are no evaluations or other documentation in his personnel file to indicate what work he performed. It appears that the position was not advertised, nor was a search conducted. Another individual was employed as a part-time “Coordinator” in November, 2002. While there are evaluations covering the period of December 2002 through August, 2004, interviews with College personnel indicate that he had no office on campus, did not regularly appear on campus, and did not appear to render significant service to the College. This individual resigned on 11/5/05. Another individual was employed in May 2002 and his personnel file contains an employment contract as “Medical Director” dated 10/3/05. There are no evaluations or any documentation to indicate what work he performed. The position was not advertised nor was a search conducted. This individual resigned in November, 2006. Documentation: Employee rosters; interviews with the Acting President, the Dean of Student Services and the Director of Human Resources; correspondence; personnel files. Recommendations: All employees should be required to regularly appear for work at assigned work locations in accordance with their work hours. Job duties should be clearly defined, and based upon proper justification and a bona fide need for the services to be provided. Hiring and transfers of all employees covered by the Uniform Guidelines should be accomplished only in compliance with the Guidelines. Human Resources should be consulted in advance of any change of employee status, duties or title. All employee contracts, evaluations and other employee documentation should be maintained in personnel files. The hiring of elected officials, if any, must occur in strict, substantive and bona fide compliance with all laws, policies and procedures, and should be closely scrutinized to avoid the fact or appearance of impropriety. 6 Response: As of April 9, 2007, all of the employees in the categories described by the finding have either resigned or been terminated. COLLEGE/FOUNDATION RELATIONSHIP 1) Finding: No formal agreement exists to comprehensively define the relationship between the College and the Foundation. Not having such an agreement is inconsistent with Core Requirement 3.2.13 of The Principles of Accreditation of the Commission on Colleges, Southern Association of Colleges and Schools, which describes the need for an agreement which accurately describes the relationship between the institution and the Foundation and any liability associated with that relationship, and for assurance that the relationship is consistent with the institution’s mission. Documentation: The Principles of Accreditation, Commission on Colleges, Southern Association of Colleges and Schools; interview with Foundation Executive Director/SSCC Director of Advancement; Lease by and between Shelton State Community College and Shelton State Foundation [sic], dated August 1, 1989, expiring February 1, 1990. Recommendations: The College and the Foundation should enter into a formal agreement comprehensively defining the financial and operational relationship between the College and the Foundation, providing for Foundation compliance with College and Department policies, and increased financial accountability, by obligating itself to provide the College periodic financial statements and audits, assuring the proper handling of student records, coordination of activities, description of organizational roles, restriction of conflicts of interest, and management of services and resources for the exclusive benefit of the educational mission of the College. Response: Since the founding of the Shelton State Community College Foundation, Inc. in 1984, the Articles of Incorporation, Foundation By-laws, and Guidelines have governed the relationship between the College and the Foundation. The purpose of the Foundation is to support Shelton State Community College and its students. To comply with Core Requirement 3.2.13 of the Principles of Accreditation of the Commission on College, Southern Association of Colleges and Schools, a Memorandum of Understanding between the Foundation and the College is currently under development and will be presented to the Foundation Board of Directors, legal counsel, and appropriate administrative officials of Shelton State for approval. 2) Finding: A review of the Foundation’s scholarship process and application forms indicates that the Foundation receives certain student information from the College in a manner that may not be sufficiently protective of the privacy of such information, which 7 must be protected in accordance with the Family Educational Rights and Privacy Act (FERPA) (20 U.S.C. § 1232g; 34 CFR Part 99) and may also maintain information which must be protected under the Gramm-Leach-Bliley Act (P.L. 106-102) and the Federal Trade Commission’s Safeguards Rule (16 CFR Part 314). Documentation: Foundation scholarship records and forms; Family Educational Rights and Privacy Act (FERPA) (20 U.S.C. § 1232g; 34 CFR Part 99) the Gramm-Leach-Bliley Act (P.L. 106-102) and the Federal Trade Commission’s Safeguards Rule (16 CFR Part 314). Recommendations: The College should make available to the Foundation protected records and information concerning students and alumni only in accordance with the requirements of the above-referenced statutes and regulations. Should the Foundation receive access to confidential information on students, alumni or financial customers of the College, the Foundation should formally agree with the College to comply with FERPA and the Gramm-Leach-Bliley Act (P.L. 106-102) and the Federal Trade Commission’s Safeguards Rule (16 CFR Part 314), wherever applicable. Response: The only potential violation of rights to privacy that the College and the Foundation could identify was an occasional request from the Foundation to the College for student transcript information for the purpose of awarding scholarships without the express consent of the student. All future scholarship application forms will include the applicant’s consent for the Foundation to obtain transcript information from the College. 3) Finding: The Foundation, as the apparent assignee of a now-dissolved Collegerelated entity, known as “Shelton State Community College New Campus Foundation, Inc.” has received and continues to receive substantial financial revenues from an outside entity for the “exclusive” use of State-owned College facilities for profit. Documentation: Financial Statements and records of the Shelton State Community College Foundation, Inc.; Contract (“Partnership”), as of January 1, 2000 through December 31, 2009, between Buffalo Rock Company and “New Campus Foundation, Inc. of Shelton State Community College” [sic]; interview with Foundation Executive Director; “Agreement for the Use of Vending Space” by and between Shelton State Community College and Shelton State Community College Foundation, dated April 1, 2000.” Recommendations: Revenues generated from the possession or use of State assets should be received by the College and accounted for as State funds within College revenue accounts. Where the Foundation or another College-related supporting organization seeks to contract with a third party for the possession or use of State assets, such asset must first be formally leased or rights to its use otherwise conveyed by the College to the Foundation for reasonable consideration. Commercial opportunities within College facilities should be afforded to outside entities by the College or the 8 Foundation only after a competitive process which assures a reasonable return and fair access for potential contractors to be considered for such commercial opportunities. Response: As referenced in the above documentation, there is currently in place an “Agreement for the Use of Vending Space” between the College and the College Foundation. Although this agreement has an ending date of 2009, the College and the Foundation Executive Director have agreed to evaluate the agreement to be certain that the Foundation is in compliance with all laws, regulations, and guidelines of the State of Alabama, the College, and the Department of Postsecondary Education. 4) Finding: The Director of Advancement for the College also serves as Executive Director of the Foundation, and receives a salary from the College (as a full-time employee) and a salary from the Foundation. Since the Director of Advancement is the College employee acting in the role as the primary overseer of the activities of the Foundation, this officer’s also serving in the role of Executive Director of the Foundation creates an inherent and irresolvable conflict. Although a member of the Department's staff recalls that the former Chancellor authorized this person's dual role, the conflict remains, and receiving compensation from both entities in such a circumstance further exacerbates the potential ethical dilemmas of this arrangement. Documentation: Financial records and minutes of the Foundation; payroll and personnel records of the College; interview with the Acting President; interview with the Director of Advancement/Executive Director of the Foundation; interview with the Dean of Student Services. Recommendations: The positions of Director of Advancement and Executive Director of the Foundation should be held by two different people. College officers and employees should not receive additional compensation from College-related entities. Response: Absent the existence of Board Policy relative to the operation of college foundations, the College seeks further clarification from the Board and the Department of Postsecondary Education regarding policies as they apply to the relationship between a college and its foundation, particularly as those policies may apply to shared employees. 5) Finding: For academic years ‘04-’05 and ’05-’06, the Shelton State Community College Foundation, Inc. granted some thirty-five “Presidents Discretionary” scholarships, upon the President’s authority, without formal committee review, and with inadequate documentation. Documentation: Scholarship awards printout provided by the Foundation; interview with the Executive Director of the Foundation; interview with the Dean of Student Services. 9 Recommendations: Grants of “discretionary” presidential scholarships from the Foundation should cease. (It appears that the Acting President has not approved the award any such scholarships since her appointment.) All Foundation scholarships should be granted only after committee review upon pre-established criteria. Awards should not be made to family members of Foundation officers or staff. Applications, records and minutes documenting each award should be kept to permit periodic reviews and audits of the propriety of awards. Response: The College agrees with the guidelines and suggestions offered in the recommendation. No “discretionary” presidential scholarships have been offered since fall 2006 and the Executive Director of the Foundation reports that there are no plans to continue the offering of such scholarships. 6) Finding: Upon the direction of the Dean of Business Services, the revenues generated from enrollment fees in the Lifelong Learning Program for senior citizens had been transferred on a periodic basis to the Shelton State Community College Foundation, Inc., in spite of the fact that administrative and certain instructional staff Lifelong Learning staff are paid by the College. Documentation: Interview with Director of Lifelong Learning, SSCC; Memorandum from the Dean of Business Services, dated February 9, 2004; excerpts from financial records of the College and the Foundation. Memo from Dean of Business Services to the Acting President dated February 20, 2007, regarding "Lifelong Learning Institute Internal Review." Recommendations: Revenues generated from State-funded programs or from the use of State assets should be received by the College and accounted for as State funds within College revenue accounts. Where services provided by the Foundation or other organizations are provided and reimbursement is sought, payment should be upon approved invoices. Shared or exchanged services between the College and the Foundation for College programs should be provided for by an appropriate written agreement. Response: The issue regarding revenues generated from enrollment fees in the Lifelong Learning Program has been resolved by the College. Those fees and all expenses for the program are now accounted for properly in the unrestricted funds of the College. Some revenues from Lifelong Learning held by the Foundation were expended for the benefit of the Lifelong Learning Center. All excess revenues will be returned to the College. 10 COLLEGE/THEATRE TUSCALOOSA RELATIONSHIP 1) Finding: The College provides Theatre Tuscaloosa, (an incorporated, free-standing 501(c)(3) not-for-profit community arts organization, which has had a continuing relationship with the College for more than three decades), substantial College-owned or College-funded resources, including theater facilities, theater management and staffing provided by State employees, and other in-kind operational support to promote and stage Theater Tuscaloosa’s productions, without the College’s fully tracking the costs involved, and without reimbursement to the College for the use of College assets and cost of College-provided operating resources. The College and Theatre Tuscaloosa were parties to a "Joint Operating Agreement" dated November 15, 2000, which provides for use of College facilities by Theatre Tuscaloosa, including offices, support equipment, a right of first refusal on the use of the theater, Theatre Tuscaloosa being "exclusive booking agent," and receiving all concession profits associated with its events. The agreement provides, in part, that "TT shall provide its own concessions equipment, supplies and personnel for its events on the campus of SSCC and retain the profits from the same." The agreement expired after five years according to its terms, which also provided for a mutual five-year renewal option. There is no indication whether this agreement was renewed. This agreement appears to have replaced a "Joint Operating Agreement" dated October 1, 1997, which had provided for the College to assume payment of some of the employees of Theatre Tuscaloosa. Theatre Tuscaloosa, through a January, 2005 “Joint Operating Agreement” with the Shelton State Community College Foundation, Inc., pays the Foundation net annual revenues in excess of $85,000.00, (on a quarterly basis), much of which is attributable to the use of College facilities, resources and staff. Beyond this, Theatre Tuscaloosa has occasionally received substantial monetary payments from the College, including some $74,050.00 paid from State funds during fiscal ’05-’06, the largest portion of which is the College's subsidy of Theatre Tuscaloosa's bi-annual Gala. Theatre Tuscaloosa’s VP/President-Elect also appears to have received $12,000.00 in consulting fees from the College to identify and solicit funding sources for SSCC and the Community College of Fine Arts. It was noted that much of the theater's interior infrastructure was initially provided to the College by contributions solicited by Theatre Tuscaloosa, Inc., and portions of this infrastructure (i.e. lighting, sound and associated stage equipment), continue to be maintained by the corporation. Documentation: Financial Statements and records of the Shelton State Community College Foundation, Inc.; Joint Operating Agreements (October 1, 1997 and November 5, 2000) between Shelton State Community College and Theatre Tuscaloosa; Joint Operating Agreement between Shelton State Community College Foundation, Inc. and Theatre Tuscaloosa; review of College expense accounts; interview with the College’s Acting President; interviews with the Foundation Executive Director and Deans for Business Services and Student Services; Alabama College System Contract Report; Theatre Tuscaloosa Website; telephone interviews with the Executive Producer of 11 Theatre Tuscaloosa. Recommendations: Generally, revenues generated from the possession or use of State assets should be received by the College and accounted for as State funds within College revenue accounts. Where a College-related supporting organization seeks to use or possess State assets for its operations, the use of such assets and disposition of resulting revenues should be the subject of a current lease or operating agreement with the College and any other parties involved. Expenses associated with staffing and use of State resources should be separately accounted for. The fiscal and operational relationships among the College, the Foundation and Theatre Tuscaloosa should be documented by a current agreement or agreements comprehensively defining the relationship among the entities, fully defining shared services, consideration paid and received, and reciting intangible and educational benefits to the College and its mission which may exist in lieu of financial reimbursement of known costs. Response: The “Joint Operating Agreement," which expired in November 2005 had a renewal clause that, through oversight, was not exercised. However, both parties have continued to operate in compliance with the Agreement as if the formality of renewal had been executed. Shelton State recognizes that its partnership with Theatre Tuscaloosa needs review by both parties to ensure that all aspects of its current relationship are accounted for properly. Upon completion of the review, a new operating agreement will be developed and submitted for approval to appropriate legal counsel and to the Department of Postsecondary Education. The Gala referenced in the Committee report is a recognition event sponsored by in part by Shelton State because of the College’s identification by the legislature as the Alabama Community College of the Fine Arts. Additionally, the referenced consulting contract with the Vice President/President Elect of Theatre Tuscaloosa was cancelled at his request. COLLEGE FINANCIAL AND BUDGETING PROCEDURES* 1) Finding: The College has frequently delegated procurement of construction services to a single outside construction management firm, and has failed to maintain records in the possession of the College pertaining to the means of procurement of such construction services. Charges appear to be excessive and duplicative of architectural services. Documentation: Interview with Acting President; interview with the Associate Dean of Business Services and her staff; Alabama College System Contract Report; 12 correspondence, work orders and invoices. Recommendation: Retrieve all procurement records for construction contracts from outside firms and parties; maintain and preserve all procurement records within the College's files; assure that all College procurements for construction contracts are processed in accordance with applicable laws and policies by College personnel, or under the continuing supervision of College personnel. It is recommended that the transactions involved all such vicarious procurements by the College be audited to determine compliance with procurement laws, policies and procedures. Response: Original documents pertaining to construction at Shelton State and housed off-site have been retrieved, are housed in the office of the current Associate Dean for Business Services, and will be maintained there for the period required by the State Records Retention Manual. The Associate Dean has the responsibility for closely monitoring the construction contracts to assure that they are processed in accordance with applicable laws and policies. The College is currently being audited by the Examiners of Public Accounts who routinely examine construction contracts. 2) Finding: Since March 24, 2005, the College has hired several firms utilizing state funds, which records indicate are potentially associated with lobbying state and federal officials. Documentation: Interview with Acting President; interview with Director of Advancement; Alabama College System Contract Report; SBE Policy §215.01; Shelton State contract files. Recommendation: All institutional contracts or consultancies using State funds for lobbyist services should be terminated. All lobbying activities for the Alabama College System must be coordinated by the Chancellor. Any College contracts with firms intended to assist in grant applications should specifically and narrowly describe the services sought, and reflect only authorized services. Response: All potential lobbying contracts at Shelton State were cancelled effective August 2006 with the exception of one which was approved by the Chancellor. Regarding grant applications, all proposed applications must be screened by the Office of the Director of Advancement and subjected to all appropriate departmental approvals before the proposals are submitted. Any contracts with outside firms for writing grant applications must be approved by the President. 3) Finding: Shelton State Community College has paid substantial royalties to outside parties for materials published by the College and sold in the College bookstore, as follows: a. To Shelton State Foundation, 1994-1996, $24,150.95; b. to Alabama Fire 13 College Foundation, 1997-2006, $269,077.28; c. to Alabama Fire College $11,312.04. To the extent that it appears that such materials may have been developed totally or partially on College time, with the use of college materials or facilities or with college funding, no royalties should be payable. Documentation: "Copyright Agreement" between Alabama Fire College Foundation, Inc., and Shelton State Community College, dated September 1, 1997; "Copyright Agreement," between Shelton State Community College Foundation, Inc., and The Alabama Fire College, dated February 17, 1995; SBE Policy §321.01, issued 12/8/94; reissued 3/24/05. Recommendation: Cease royalty payments to other entities for copyrighted materials developed totally or partially on College time, with the use of college materials or facilities, or with college funding; seek refunds where appropriate. Response: The issue of royalty payments is an item that is subject to review during the audit currently underway at the College. Any findings or comments will be addressed and appropriate actions taken. *References to various financial practices are also included in other topic areas. SCHOLARSHIPS/FINANCIAL AID The team reviewed the following: A. B. C. D. E. Institutional and athletic scholarship procedures from 2004-current Business office records for all institutional and athletic scholarship recipients from 2004-current All athletic team rosters from 2004-current All athletic scholarship recipient listings from 2004-current National Junior College Athletic Association (NJCAA) Letters of Intent and Scholarship Awards for all athletic programs Institutional Scholarships State Board Policy 805.02 provides that each community college shall be allowed to award 300 institutional scholarships. Further, the policy allows a college to award one additional scholarship per every 100 additional FTEs above 2,000. State Board Policy 805.01 provides that each college shall appoint a scholarship committee representative of faculty, staff and students to review all scholarship applications as outlined in the committee’s policies and procedure. 14 Committee Note: Scholarships may be awarded by the College as full-time or partial. It is important to note that several partial scholarships may equal one full-time scholarship. The review team requested documentation regarding the number of partial scholarships that may have been awarded. The College was unable to provide the team with accurate documentation regarding this request. As such, the team was unable to conclusively identify the numbers of scholarships awarded by the College expressed as full-time equivalent totals. Therefore, it was often difficult or impossible to tell whether the College awarded institutional scholarships in excess of its allotments. The College has indicated that it intends to modify its record-keeping to resolve this dilemma in the future. 1) General Findings: A) Fall term of the 2006-2007 Academic Year. Shelton State Community College awarded 453 institutional scholarships during the Fall Term of the 2006-2007 school year in the following categories: Presidential, Technical, Academic, Performing Arts and Ambassador. The College had an FTE of approximately 4,000 for the 2006-2007 Fall Term, 2,000 FTE above the base number of 2,000. Based on the College's FTE, State Board of Education Policy would permit the college to award 320 institutional scholarships. See "Committee Note" above this section. B) 2005-2006 Fall Term. For the fall term, the college awarded a total of 542 institutional scholarships, including 269 Presidential Scholarships. College records show an FTE count of 4,052 for the 2005-2006 Fall Term, 2052 above the 2,000 FTE base number. State Board of Education Policy would permit the College to award an additional 20 scholarships for a total of 320 scholarships. See "Committee Note" above this section. C) 2004-2005 Fall Term. For the fall term, the College awarded a total of 523 institutional scholarships. According to College records, the college had a total FTE count of 4346 for the 2004-2005 academic year, 2346 above the 2,000 FTE base number. State Board of Education Policy would permit the College to award an additional 23 scholarships, for a total of 323 scholarships. See "Committee Note" above. Supporting Documentation and Interviews Conducted: Financial Aid billing reports for 2006, Financial aid year-to-date reports from 2004-2005, Alabama College System website; current scholarship award letters from a random selection covering 2004current; scholarship applications from a random selection covering 2004-current; Interview with the Dean of Student Services on February 5, 2007. Recommendations: 1. The College should obtain additional data to determine the extent to which it may have exceeded the number of scholarships allowed by State Board of Education Policy, and in the future should maintain data permitting accurate calculation of total scholarships awarded. 15 2. In the event that the college has awarded scholarships in excess of its allotment, the College should reduce the number of scholarships awarded to the number allowed by State Board of Education Policy. 3. Copies of scholarship packets shall remain on file in a centralized location of the college for a period of three years. Response: The College agrees that the findings in the Scholarship section are substantially correct and has taken action to refine the scholarship award process. The revised process is described below and will be followed in the awarding of scholarships for the 20072008 academic year. All scholarships at Shelton State will be awarded by an oversight Scholarship Committee that will evaluate and potentially approve recommendations based on input from five sub-committees. The sub-committees, each chaired by a member of the Scholarship Committee, include Academic, Technical, Performing Arts, Athletics, Courage and Perseverance, and Economically Disadvantaged. The award criteria for each scholarship will be posted on the website, made available in the College counseling centers, and mailed with all scholarship application packets. The number of awards in each category, as defined by Board policy, will be the maximum number of awards allowed. When partial scholarships are awarded, the award letter will specify a onefourth, one-half, or three-quarter scholarship and will also include the number of credit hours covered by the scholarship. Agendas and minutes of the Scholarship Committee will reflect scholarship awards and will be kept on file in the office of the Dean of Student Services for a period of three years. Complete scholarship award records and related information identifying student recipients will be kept in the Office of the Financial Aid where they will be imaged and retained following the guidelines for record retention. 2) Finding: Shelton State Community College does not have an active scholarship review committee for all of its institutional scholarship categories. Supporting Documentation: Interview with the Dean of Student Services on February 5, 2007. Recommendation: Shelton State should immediately create an active scholarship committee for each institutional scholarship category in existence without an active committee currently in place. Each scholarship category committee shall be charged with creating effective policies and procedures for guidance in issuing scholarships. 16 Response: See the Response to recommendations under General Finding #1 above. (p. 16) Presidential Scholarships 3) Finding: Shelton State Community College does not have an active scholarship committee that reviews and recommends Presidential Scholarship applications. In 2005, the college formed a Presidential scholarship committee consisting of the President, the Dean of Instructional Services, the Dean of Student Services, and the Dean of Business Services. The document creating the Presidential Scholarship/Tuition Waivers (Institutional) Committee consists of a statement of purpose, and a description of the process under which the committee shall award scholarships. However, the team was unable to substantiate whether or not this was an active committee. The team requested copies of agendas and committee minutes, but received no such documentation to review. The team reviewed copies of award letters and scholarship request forms which contained information suggesting a possible link between the President and the scholarship recipient. In some cases, notations were made on the scholarship request form such as “friends of Rick” or “friends of RR”. In other cases, the team reviewed emails and award letters which indicated a prior knowledge of either the scholarship recipient or parents of the recipient. The team also noted recommendations for Presidential scholarships from members of Shelton State Community College’s staff and faculty. Supporting Documentation Reviewed and Interviews Conducted: Financial Aid billing and year end reports for 2004-2005, 2005-2006 and 2006-2007; a random review of scholarship award letters from 2004-current, a random review of scholarship applications and score sheets from 2004-current; emails and an interview with the Dean of Student Services on February 5, 2007. Recommendations: 1. 2. The College should activate the scholarship committee for the Presidential Scholarship Copies of scholarship application packets shall remain on file in a centralized location of the college for a period of 3 years. Response: Presidential scholarships will no longer be awarded. Additionally, see the Response to recommendations under General Finding #1 above. (p. 16) Academic Scholarships 4) Finding: In accordance with State Board Policy 805.01, the College created a scholarship 17 committee for the purpose of reviewing academic scholarship application packets. The committee met at least annually and did not operate under an established set of guidelines. Supporting Documentation Reviewed: Committee minutes; score sheets; student applications; financial aid billing and year to date statements from 2004-current; Shelton State Community College website. Recommendations: 1. The committee shall convene to establish written policies and procedures for guidance in issuing scholarships, including the number of academic scholarships the committee may award. 2. The committee shall continue to maintain all scholarship application packets; score sheets, notes, minutes, memorandums identifying scholarship recipients in a centralized location of the college for a period of 3 years. 3. In addition to maintaining minutes, the committee shall develop agendas for all meetings and copies of agendas in a centralized location of the college for a period of 3 years. Response: See the Response to recommendations under General Finding #1 above. (p. 16) Technical Scholarships 5) Finding: A committee composed of a technical instructor, the Associate Dean of Instruction and a Technical Prep Coordinator administers the Technical Scholarships. The committee meets at least annually. According to financial aid billing reports, the committee awarded 173 technical scholarships for the fall term of 2006-2007, 121 technical scholarships in the fall of 2005-2006, and 118 technical scholarships during the fall of 2004-2005. Supporting Documentation Reviewed and Interviews Conducted: Financial aid billing and year to date reports for 2004-2005, 2005-2006 and 2006-2007 and interview with the Dean of Student Services on February 5, 2007. Recommendations: a) The process for awarding scholarships and the responsibilities of the technical scholarships committee should be stated in writing. 18 b) The guidelines for awarding scholarships should be published in the College’s General Catalog and any other student publication. c) The scholarship committee should maintain an agenda and minutes and maintain copies in a centralized location of the college for 3 years. Response: The majority of technical scholarships are issued as partial scholarships and are designated as such in the award letters, thus making the total number of scholarships less that the cited number. However, the College acknowledges that record keeping regarding partial scholarships needs refinement. This refinement is in process as outlined in the Response to recommendations under General Finding #1 above. (p. 16) Ambassador Scholarships 6) Finding: Ambassador scholarships are another category of institutional scholarships. An active committee is in place and meets at least annually. According to financial aid year-to-date reports reviewed by the team, the Ambassador Scholarship committee awarded 36 scholarships during 2004-2005, 38 scholarships in 2005-2006, and 37 scholarships in 2006-2007. Supporting Documentation Reviewed and Interviews Conducted: Selection process materials; application; memorandum listing ambassador scholarship recipients for 20062007; scholarship award letters for 2006-2007; Financial aid year-to-date reports for 2004-2005, 2005-2006 and 2006-2007. Interview with the Dean of Student Services. Recommendations: a) The process of awarding scholarships and the responsibilities of the Ambassador Scholarship Committee should be stated in writing. b) The college should publish guidelines in the College’s General Catalog and any other student publication. c) The college should continue to maintain committee agendas, minutes and any other documentation relevant to awarding scholarships in a centralized location for a period of 3 years. Response: Effective Fall 2007-08, Ambassador Scholarships will no longer be awarded as a separate scholarship category. 19 Performing Arts Scholarships 7) Finding: Performing Arts Scholarships are another category of institutional scholarships. Interested students must audition for the performing arts committee. The committee meets at least annually to award scholarships to qualified students. Supporting Documentation Reviewed: Financial aid billing and year-to-date reports from 2004-current; brochure for 2006-2007 auditions; scholarship application. Recommendations: The committee should continue to maintain copies of agendas, brochures and minutes in a centralized location of the college for a period of 3 years. Response: See the Response to recommendations under General Finding #1 above. (p. 16) Other Scholarships In addition to the above mentioned institutional scholarships, the college also awarded other scholarships included in Board Policy such as Senior Citizen and Dependent of Blind Parents. 2004-2005 Senior Citizen 22 Dependent of Blind Parents 5 2005-2006 Senior Citizen 13 Dependent of Blind Parents 4 2006-2007 Senior Citizen 13 Dependent of Blind Parents 3 Committee Note: The team did not count either Senior Citizen or Dependent of Blind Parents scholarships against the 300 institutional scholarships permitted by Board policy. These scholarships are listed only to describe their presence in the College's variety of scholarship categories. Athletic Scholarships State Board Policy 805.02 (4.2) states the total number of athletic scholarships in effect at an institution may not exceed 125. State Board Policy 805.02 (4.4) states all scholarships will be awarded according to the criteria and procedures established through the institution’s scholarship committee (805.01). National Junior College Athletic Association (NJCAA) rules and regulations require that athletic scholarships be processed in the same manner as all other scholarships; however in practice, the coaches of each respective team award scholarships to athletes. 8) Finding: Athletic Scholarships are not reviewed by a committee as directed in State 20 Board of Education Policy 805.01; rather, scholarships are awarded by each team sport coach. National Junior College Athletic Association (NJCAA) rules and regulations require that athletic scholarships be processed in the same manner as all other scholarships. Supporting Documentation Reviewed Interviews Conducted: NJCAA handbook; team rosters, NJCAA Letters of Intent. Recommendation: The College should establish a procedure for awarding athletic scholarships consistent with NJCAA regulations and State Board Policy and publish the procedure in all official College publications including the College’s website. Response: See the Response to recommendations under General Finding #1 above. (p. 16) Baseball The National Junior College Athletic Association (NJCAA) allows colleges to award up to 24 baseball scholarships per season. 9) Finding: According to financial aid year-to-date reports reviewed by the team, the College awarded and/or maintained 24 players on athletic scholarships during the 20062007 season. NJCAA rules and regulations, Article 5, section 13 C require copies of Letters of Intent and Scholarship Award Letter be kept on file by the athletic officials. Shelton State Community College maintained 39 players on scholarships during the 2005-2006 season and 32 players during the 2004-2005 season, according to financial aid year-to-date reports reviewed by the team. NJCAA rules and regulations, Article 5, Section 13 C require hard copies of Letters of Intent and Scholarship Award Forms (Letters) be kept on file by athletic officials of the College. The team requested copies of Letters of Intent for its review in an effort to confirm that actual number of players on scholarship for the 2004-2005 seasons, however, documentation for the 2004-2005 and 2005-2006 seasons were not made available to the review team. Therefore the team is unable to conclude whether the College awarded more baseball scholarships than the College was allotted for those periods. Supporting Documentation Reviewed: Team rosters; National Letters of Intent for 2006-2007 season; financial aid year-to-date reports for 2004-2005, 2005-2006 and 20062007; NJCAA Handbook Recommendations: 1. The College should maintain copies of Letters of Intent, team rosters and scholarship recipient lists for a period of 3 years. Copies should be maintained in the office of the athletic director. 21 2. Athletic officials should conduct a self review and should immediately self-report any violations of NJCAA rules to the NJCAA and Alabama Community College Conference (ACCC). Response: The College is currently reviewing athletic scholarship reports to determine if and where irregularities may have occurred as they pertain to the baseball program. Appropriate measures will be taken to ensure that any discrepancies regarding the awarding of baseball scholarships will be addressed. Appropriate measures will be taken to afford compliance with Board policy, ACCC, and NJCAA regulations. In addition, the College will maintain copies of Letters of Intent in the Office of the Assistant Dean responsible for athletics. The Assistant Dean will also keep the team roster, submit eligibility lists, and assure that scholarship numbers comply with NJCAA regulations. All records will be retained as required by record retention guidelines. Softball The National Junior College Athletic Association (NJCAA) allows colleges to award up 24 softball scholarships per season. 10) Finding: According to financial aid year-to-date reports, Shelton State Community College awarded 18 softball scholarships for the 2006-2007 season, 20 during the 20052006 season, and 24 during the 2004-2005 season. Supporting Documentation Reviewed: Team rosters; National Letters of Intent for 2006-2007; financial aid year-to-date reports for 2004-2005, 2005-2006 and 2006-2007; NJCAA handbook. Recommendations: The College should maintain copies of Letters of Intent, completed NJCAA eligibility forms, team rosters and scholarship recipient lists for a period of 3 years in the office of the athletic director. Response: The documentation listed above-- Letters of Intent, NJCAA eligibility forms, team rosters, and scholarship recipient lists-- will be maintained in the Office of the Assistant Dean responsible for athletics. Women’s Basketball National Junior College Athletic Association (NJCAA) allows colleges to award up to 16 basketball scholarships per season. 22 11) Finding: Shelton State Community College awarded and/or maintained 14 women’s basketball scholarships for the 2006-2007 season, 16 in 2005-2006 and 17 in 2004-2005. Supporting Documentation Reviewed: team rosters; National Letters of Intent; financial aid year-to-date reports for 2004-2005, 2005-2006 and 2006-2007; NJCAA handbook Recommendations: The College should maintain copies of Letters of Intent, team rosters and scholarship recipient lists for a period of 3 years in the office of the athletic director. Response: The documentation listed above-- Letters of Intent, NJCAA eligibility forms, team rosters, and scholarship recipient lists-- will be maintained in the Office of the Assistant Dean responsible for athletics. Men’s Basketball National Junior College Athletic Association (NJCAA) allows colleges to award up to 16 men’s basketball scholarships per season. 12) Finding: According to the College's financial aid year-to-date reports, Shelton State Community College awarded and/or maintained 18 men’s basketball scholarships for the 2006-2007 season, 22 in 2005-2006 and 22 in 2004-2005, exceeding the number allowed by NJCAA regulations. The team requested copies of Letters of Intent for its review in an effort to confirm the actual number of players on scholarship for the 2004-2005 and 2005-2006 seasons, however, documentations for the 2004-2005 and 2005-2006 seasons were not made available to the review team. Therefore, the team cannot draw any conclusions about whether the College awarded more basketball scholarships than it was allotted for those periods. Supporting Documentation Reviewed: team rosters; National Letters of Intent; financial aid year-to-date reports for 2004-2005, 2005-2006 and 2006-2007; NJCAA handbook. Recommendations: The College should maintain copies of Letters of Intent, team rosters and scholarship recipient lists and completed hard copies of NJCAA eligibility forms for a period of at least 3 years in the office of the athletic director. Athletic officials should conduct a self review and self-report any violations of NJCAA rules to the National Junior College Athletic Association (NJCAA) and to the Alabama Community College Conference (ACCC). The College should also immediately implement procedures to prevent toe over-issuance of athletic scholarships allowed by the National Junior College Athletic Association (NJCAA). 23 Response: The College is currently reviewing athletic scholarship reports to determine if and where irregularities may have occurred as they pertain to the men’s basketball program. Appropriate measures will be taken to ensure that any discrepancies regarding the awarding of basketball scholarships will be addressed. Appropriate measures will be taken to afford compliance with Board policy, ACCC, and NJCAA regulations. In addition, the College will maintain copies of Letters of Intent in the Office of the Assistant Dean responsible for athletics. The Assistant Dean will also keep the team roster, submit eligibility lists, and assure that scholarship numbers comply with NJCAA regulations. All records will be retained as required by record retention guidelines. Soccer National Junior College Athletic Association (NJCAA) allows colleges to award up to 18 soccer scholarships per season. 13) Finding: There were a total of 19 scholarships awarded during the 2006-2007 season. Shelton exceeded its number of allowed scholarships by 1. In 2005-2006, Shelton State Community College awarded and/or maintained 20 soccer players on athletic scholarships, according to the College's financial aid year-to-date report, exceeding the number allowed by 2. According to the College's financial aid year-to-date report, in 2004-2005, Shelton State Community College awarded and/or maintained 20 players on soccer scholarships during the season again exceeding the number allowed by 2 for the season. The team requested copies of Letters of Intent for its review in an effort to confirm the actual number of players on scholarship for the 2004-2005 and 2005-2006 seasons, however, documentations for the 2004-2005 and 2005-2006 seasons were not made available to the review team. Therefore, the team cannot draw any conclusions about whether the College awarded more soccer scholarships than it was allotted for those periods. Supporting Documentation Reviewed: team rosters; financial aid year-to-date reports for 2004-2005, 2005-2006 and financial aid billing report for 2006-2007; NJCAA handbook. Recommendations: 1. The College should conduct a self review and self-report any violations to the Alabama Community College Conference (ACCC) and the National Junior College Athletic Association (NJCAA). 2. The College should also immediately implement procedures to prevent the over 24 issuance of scholarships allowed by NJCAA. Response: The College is currently reviewing athletic scholarship reports to determine if and where irregularities may have occurred as they pertain to the soccer program. Appropriate measures will be taken to ensure that any discrepancies regarding the awarding of soccer scholarships will be addressed. Appropriate measures will be taken to afford compliance with Board policy, ACCC, and NJCAA regulations. In addition, the College will maintain copies of Letters of Intent in the Office of the Assistant Dean responsible for athletics. The Assistant Dean will also keep the team roster, submit eligibility lists, and assure that scholarship numbers comply with NJCAA regulations. All records will be retained as required by record retention guidelines. Cheerleader Scholarships State Board Policy 805.02 provides the guidance for issuing cheerleader/dance team scholarships. Policy states that each college shall be allowed to award up to 10 dance team/cheerleader scholarships. 14) Finding: Shelton State Community College awarded 19 cheerleader scholarships to members of the cheering squad for the 2006-2007 fall term, 15 in 2005-2006 according to financial aid year-to-date reports and 14 in 2004-2005 according to financial aid year-todate reports, exceeding the maximum number of scholarships State Board Policy allows to be awarded. Supporting Documentation Reviewed: Team rosters; financial aid billing and year to date reports for 2004-2005, 2005-2006 and 2006-2007. Recommendation: The number of cheerleader scholarships awarded should be reduced to conform to State Board Policy 805.02. Response: The number of cheerleader/dance scholarships awarded by the College will equate to ten as provided for by Board Policy, although some or all may be partial scholarships. Dance Scholarships State Board Policy 805.02 provides the guidance for issuance of cheerleader/dance team scholarships. Policy states that each college shall be allowed to award up to 10 dance team/cheerleader scholarships. 15) Finding: Shelton State Community College awarded 12 dance scholarships to members of the Starlet Dance Team for the 2006-2007 fall term, 14 in 2005-2006 25 according to financial aid year-to-date reports, and 12 in 2004-2005 according to financial aid year-to-date reports, exceeding the maximum number of scholarships provided by State Board Policy. Supporting Documentation Reviewed: Team rosters; financial aid billing and year to date reports for 2004-2005, 2005-2006 and 2006-2007. Recommendation: The number of dance scholarships awarded should be reduced to conform to State Board Policy 805.02. Response: Effective Fall 2007, dance team scholarships will not be awarded by the College. Manager Scholarships State Board Policy 805.02 (4.3) states institutions may award up to 10 manager/trainer scholarships (not to exceed three per team). 16) Finding: There were 11 manager/trainer scholarships awarded for fall 2006-2007, 16 in 2005-2006 according to financial aid year-to-date reports, and 14 in 2004-2005 according to financial aid year-to-date reports. Supporting Documentation Reviewed: Financial aid billing reports for 2006-2007 and year to date reports for 2004-2005, 2005-2006; NJCAA handbook Recommendations: The number of scholarships awarded should be reduced to conform to State Board Policy 805.02. Response: The number of manager/trainer scholarships awarded by the College will equate to ten as provided for by Board Policy, although some or all may be partial scholarships. PRESIDENTIAL RESIDENCE 1) Finding: College documents and purchase orders indicate that the Dean of Business Services authorized the charging of more than $90,000 in various costs to State funds for construction of the “Presidential Residence" owned by Shelton State Community College Foundation, Inc. in the Woodbank Subdivision, Tuscaloosa. Purchase orders included shrubbery and landscaping, topsoil, concrete and construction labor, driveway and carport pad installation, drainage pipes, downspouts, gravel for site preparation, several months of backhoe rentals, trencher rental, dump truck and chipper rental, a sprinkler 26 system, an entrance gate and gate operators, framing labor, siding installation, masonry blocks, water line and meter, tree removal and chipping, dumpster, lighting, curbing, and inside and outside cleanup after construction. A staff member of the Associate Dean of Finance and Business Services stated that he was directed by the President to personally provide supervision to the house project and a College contractor that was engaged at the project site, and to provide landscaping work at the site. Some materials appear to have been acquired through purchase orders in amounts which would have required competitive bidding. Documentation: Lease by and between Shelton State Community College Foundation, Inc. and Shelton State Community College, dated June 19, 2003; Hall-Taylor Construction Co., Inc. construction itemization dated May 7, 2003; interview with Associate Dean of Business Services; purchase orders; Letter from Larry W. Willard, Director, Education Audit Division, Alabama Department of Examiners of Public Accounts, to Dr. Roy W. Johnson, Chancellor, dated February 13, 2003. Recommendations: College-provided goods and services associated with construction, improvement, or capital maintenance of the Presidential Residence owned by the Foundation should be separately accounted for and either: a.) reimbursed to the College by the Foundation, or b.) attributed to the cost of the leasehold pursuant to the Lease. Where required, goods and services must be competitively procured. Response: A review of the purchase orders included in the reference to “more than $90,000” revealed that competitive bidding was used when required or the purchase was made from a documented sole source supplier. The referenced expenditures were made as lease-hold improvements after the College had signed a lease agreement with the Foundation on June 19, 2003. The College will seek further advice from legal counsel and the Department of Postsecondary Education related to these expenditures. 2) Finding: In addition to providing ordinary maintenance pursuant to the Lease of the Presidential Residence from the Foundation, the College has also provided a range of personal services to the presidential household, including such items as laundry and maid service, and mundane domestic maintenance activities such as, hanging pictures and a mirror, moving furniture, painting and sealing patio furniture, spraying for wasps, hanging bird houses, changing light bulbs, repairing an icemaker, hanging a tree decoration, and unplugging drains. By direction of the Dean for Business Services, work orders for maintenance to the Presidential Residence after its completion were logged in the computerized work order system as follows: “Campus Location: Martin Campus” “Building Name: Outside” “Facility 00003 Building 00004 Room 0099.” Documentation: Lease by and between Shelton State Community College Foundation, Inc. and Shelton State Community College, dated June 19, 2003; Lease by and between Shelton State Community College and the College President, dated January 1, 2004; interview with the Associated Dean of Business Services; review of work order details. 27 Recommendations: College-provided goods and services associated with domestic services and use of other State resources to provide services to the President and his household should be separately accounted for. Goods or services provided by the College to the President in excess of approved compensation levels should be terminated, and unless reimbursed, goods or services with taxable excess value should be appropriately reported to State and Federal tax authorities as presidential income. Response: The College will seek further advice from legal counsel and the Department of Postsecondary Education related to the referenced expenditures. RESPIRATORY THERAPY PROGRAM Finding: Respiratory Therapy Program is currently operating under the status of probationary accreditation. The program has consistently been plagued with poor passage rates. Supporting Documentation Reviewed and Interviews Conducted: Interview with the Dean of Instructional Services; interview with the Director of the C.A. Fredd Campus and Director of Title III. Recommendations: The College should continue to work with the program’s accrediting body to ensure continued compliance with program guidelines, and continue to implement procedures for addressing the student retention rate, admissions requirements, and board passage. Conduct self reports periodically to ensure all relevant areas of concern are addressed. Response: The probationary accreditation status of the Respiratory Program was imposed by the Commission on Accreditation of Allied Health Education Programs (CAAHEP) on January 26, 2007, for the express reason that “the program did not meet the threshold for RRT (advanced registry) success.” The College has documented efforts to improve the program over the past several years but does not consider the current attrition rate of 14% excessive. The Director and the Assistant Dean for Allied Health have worked with the assigned CAAHEP referee to develop a plan for improvement which has been submitted to and approved by CAAHEP. While Shelton State RPT graduates enjoy a high rate of success in employment and entry level certification, steps are being taken to improve their success on the advanced registry examinations. Prerequisite courses have been implemented, admission requirements have been strengthened; the curriculum has been revised; every course has been reviewed 28 for content; the grading scale has been raised (C=75-79); and additional preliminary testing opportunities have been required for students to prepare them for advanced registry exams. Required annual reports to COARC mandate continued monitoring of the program. 29