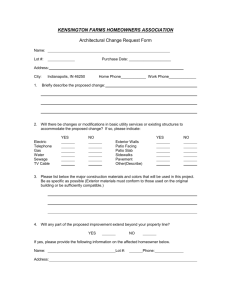

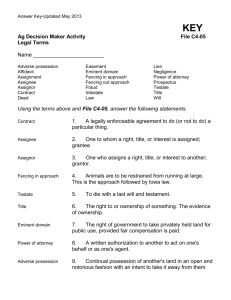

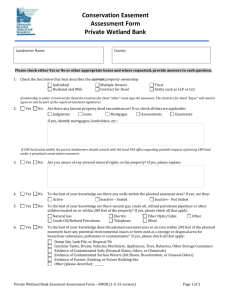

Property

advertisement