WORD

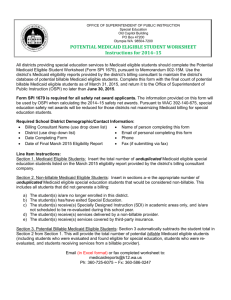

advertisement