Steps for Advanced Workshop Return 35

advertisement

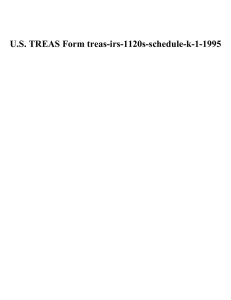

Advanced Workshop Return 35 Title: Summary: Advanced Workshop Return 35 In this lesson, you will learn the following: 1) Determine filing status; 2) Complete Schedule K-1, Shareholder’s Share of Income, Credits, Deductions, etc.; 3) Complete Schedule B, Interest and Ordinary Dividends; 4) Complete Schedule A, Itemized Deductions; 5) Complete Schedule E, Supplemental Income and Loss; 6) Complete Form 1116, Foreign Tax Credit; 7) Complete Form 5884, Work Opportunity Credit; 8) Complete Form 6251, Alternative Minimum Tax; 9) Complete Fed/State Estimated Tax Payments Worksheet; 10) Create a paper return. Average completion time: 40 minutes Steps for Advanced Workshop Return 35 Log in to your user name. Use “TRAINING” if you plan to practice electronically filing these returns through the TaxWise Training Electronic Filing Center. Start a new return using 335-XX-XXXX. Use your company’s EFIN for “XX-XXXX” if you are in the Training user name. Otherwise, use a unique number agreed upon by your company. Rachel’s husband, Richard, died on August 15, 2004. She is raising her son, Aaron, whose birth date is January 5, 1996. Aaron is in school and Rachel owns part of a business, so she can work while he is at school and be at home when she needs to be there for him. The ordinary income from the restaurant is nonpassive. The interest income was from a foreign bank account and is high withholding tax interest that was paid on December 15. Aaron goes to school in Franklin Township, which is in Marion County. Rachel’s birth date is June 18, 1973. She paid estimated tax payments of $2,500 per quarter to the IRS, and $600 each quarter to Indiana. These were all paid on time. Rachel would like to mail this return. Social Security Card Social Security Card RACHEL ELAINE POPE AARON MICHAEL POPE 335-XX-XXXX 522-XX-XXXX 1 Advanced Workshop Test Return 35 Final K-1 Schedule K-1 20XX 1 Ordinary business income (loss) (1120S) Department of the Treasury Internal Revenue Service Tax year beginning __January 1__, 20XX and ending _December 1, 20XX Shareholder’s Share of Income, Deductions, Credits, etc. Amended K-1 Part III Shareholder’s Share of Current Year Income, Deductions, Credits, and Other Items 13 Credits & credit recapture J $832.26 $70,732.03 2 Net rental real estate income (loss) 3 Other net rental income (loss) 14 Foreign transactions 4 Interest income A B C L See back of form and separate instructions $3,500.79 Part I Information About the Corporation 5a Ordinary dividends A Corporation’s employer identification number 23-5XXXXXX B Corporation’s name, address, city, state, and ZIP code 5b Qualified dividends Martini Restaurant 2320 Freedom Drive Indianapolis, IN 46241 6 Royalties C IRS Center where corporation filed return: Atlanta 7 Net short-term capital gain (loss) D Tax shelter registration number, if any ___________________________ 8a Net long-term capital gain (loss) Switzerland $5,304.22 $3,500.79 $ 338.26 E Check if Form 8271 is attached Part II Information About the Shareholder 8b Collectibles (28%) gain (loss) F Shareholder’s identifying number: 8c Unrecaptured section 1250 gain 15 Alternative minimum tax (AMT) items 335-XX-XXXX G Shareholder’s name, address, city, state and ZIP code: Rachel E. Pope 4564 Evergreen Road Indianapolis, IN 46241 9 Net section 1231 gain (loss) 10 Other income (loss) 16 Items affecting shareholder basis 11 Section 179 deduction H Shareholder’s percentage of stock ownership for tax year ___66%___% For IRS Use Only A $1,165.28 12 Other deductions: 17 Other information A G $5,610.00 $ 330.24 2