Answers - WordPress.com

advertisement

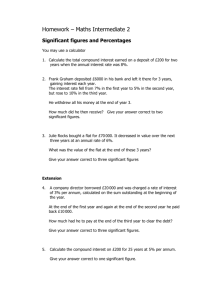

REVISION QUESTIONS ON FINANCIAL MATHEMATICS 1 Calculate the simple interest on the following amounts: a $12 000 invested at 5% per annum for 6 years b $100 000 invested at 4% per annum for 10 years c $1000 invested at 6% per annum for 3 years 2 How long will it take, to the nearest year, for $3300 invested at 4.2% per annum simple interest, to double in value? 3 A personal loan of $15 000 over a period of three years costs $480 per month. a How much money will be repaid in total? b What equivalent rate of simple interest is being charged over the three years? 4 Find the rate of simple interest rate per annum paid on the following investments: a $15 300 invested for 4 years and earning $2142 interest b $6920 invested for 1 year and earning $519 interest c $200 000 invested for 2.5 years and earning $21 250 interest 5 Ron has calculated that he needs $25 000 per year in order to be able to live comfortably in retirement. How much money needs to be invested in order to generate this amount in interest each year, if the interest is calculated at 3.5% per annum simple interest? 6 Find the time taken for the following investments to earn the amount of interest given: a $13 500 at 6% per annum simple interest earns $1215 interest b $24 350 at 4.9% per annum simple interest earns $3579.45 c $3433 at 3.45% pa earns $1184.39 interest 7 The local department store advertises a television set for $1085 or $100 deposit and $12.80 per week for three years. a How much does the television end up costing under the hire purchase scheme? b What is the flat rate of interest per annum? c What is the effective rate of interest per annum? 1 8 A personal loan of $8000 over a period of 18 months costs $590 per month. a What is the flat rate of interest per annum? b What is the effective rate of interest per annum? 9 Sandi borrows $3000 and makes repayments of $220 per month over a period of 16 months. a What is the flat rate of interest per annum? b What is the effective rate of interest per annum? 10 Calculate the compound interest earned on each of the following investments: a $12 000 invested at 3.8% per annum compounding annually for 3 years b $10 000 invested at 6.2% per annum compounding annually for 5 years c $28 300 invested at 5.5% per annum compounding annually for 3 years 11 Calculate the compound interest earned on each of the following investments: a $115 5000 invested at 3.6% per annum compounding quarterly for 4 years b $9900 invested at 5.2% per annum compounding quarterly for 7 years c $45 600 invested at 4.5% per annum compounding quarterly for 10 years 12 Calculate the compound interest earned on each of the following investments: a $6578 invested at 9.2% per annum compounding monthly for 3 years b $100 000 invested at 3.2% per annum compounding monthly for 5 years c $320 000 invested at 5.5% per annum compounding monthly for 3.5 years 13 Amie wishes to buy a new car in 5 years’ time, and she estimates that it will cost $35 000. Her bank offers her an interest rate of 4.25% pa compounded quarterly for the 5-year term. a How much money should she invest now in order to have sufficient funds to buy the car in 5 years’ time? b If the interest were compounded monthly, how much less would she need to invest? 14 What initial investment is required to produce a final amount of $30 000 in 4 years if an interest rate of 4.7% per annum compounded quarterly is guaranteed? 2 15 How long would it take for $1000 to grow to $20 000 if it was invested at an interest rate of 5.75% per annum, compounded monthly? Give your answer to the nearest year. 16 How long will it take for $7500 to double if invested at an interest rate of 4.65% per annum compounded monthly? Give your answer to the nearest year. 17 How long will it take for $10 000 to double if invested at: a 4% per annum compounded quarterly? b 5% per annum compounded quarterly? Give your answers to the nearest quarter. 18 Peter bought a painting for $14 000 seven years ago which is now worth $28 000. What annual compound interest rate does this mean that his painting is returning? Give your answer correct to one decimal place. 19 A sum of $5000 doubles in 8 years. What is the interest rate being paid on this investment if the interest is compounded: a yearly? b quarterly? c monthly? 20 A machine costs $17 000 new and depreciates at a flat rate of 12.5% per annum. If its scrap value is $4250 find: a the book value of the machine after 3 years b the number of years until the machine can be written off 21 The value of their computer system is considered by a company to decrease at a rate of 12% of the previous year’s value each year. If the cost of purchase of the system is $128 000, find: a the book value after 7 years b the total depreciation after 7 years c the number of years until the value of the computer system is below the scrap value of $40 000 3 22 A car costing $32500 depreciates at a rate of 14.5% per year, on a reducing balance basis. a What is the book value of the car at the end of 5 years? b What is the total amount of depreciation after 5 years? c What would be the equivalent rate of flat rate depreciation over the same time period? 23 A bank offers a home loan of $280 000 at the compound interest rate of 5.35% per annum compounded monthly. a If repayments are $1650 per month, calculate the amount still owing on the loan after 12 years. b If the loan is to be fully repaid after 12 years, calculate the amount of the monthly repayment. 24 A reducing balance loan of $150 000 is borrowed at an interest rate of 6.75% per annum compounded quarterly. Calculate the quarterly repayment if: a the amount still owing after 10 years is $50 000 b the amount still owing after 20 years is $50 000 c the loan is fully repaid after 10 years d the loan is fully repaid after 20 years 25 A couple negotiates a mortgage of $250 000 at a fixed rate of 6.5% per annum compounded monthly for the first 5 years, then at the market rate for the remainder of the loan. They agree to monthly repayments of $2500 for the first 5 years. Calculate: a the amount still owing after the first five years b the new monthly repayments required to pay off the loan over a total of 25 years if the interest rate after the first 5 years has risen to 7.5% per annum compounded monthly. 26 Suppose that inflation is recorded as 4.1% in 2006, 3.2% in 2007 and 3.8% in 2008, and that the rent on a certain property is $230 per week at the end of 2005. If the real estate agent increases the rent in line with inflation: a what is the weekly rent at the end of 2008? Give your answer to the nearest cent. b what is the total percentage rise in the rent over the three year period? Give your answer to one decimal place. 4 27 Suppose that a particular house is sold at auction for $700 000. If the price of houses increases with the inflation rate, what will be the price of the house in 10 years’ time (to the nearest one hundred dollars): a if the average inflation rate over the 10-year period is 2.5%? b if the average inflation rate over the 10-year period is 6.5%? 28 Suppose that you purchase an annuity for $200 000, with interest of 5.5% per annum compounded monthly. a If you receive payments of $2000 per month, how long, to the nearest month, will the annuity last? b If the annuity lasts for 10 years, how much, to the nearest dollar, would you receive in payments each month? 29 Suppose that you purchase an annuity for $500 000, from which you wish to receive monthly payments for 20 years. a If you receive payments of $3000 per month, what interest rate are you being paid on the annuity? Give your answer to one decimal place. b If you receive an interest rate of 6.6%, how much, to the nearest dollar, would you receive in payment each month? 30 Jenny saves $350 each month in an account that pays an interest rate of 6.1% per annum compounding monthly. How much, to the nearest dollar, will she have in the account after 14 years? 31 Harry pays 5% of his salary into a superannuation fund each month, and his company matches this with a contribution of 10% of his salary. Suppose he earns $65 340 per year. a How much is paid into the superannuation fund each month? b If the superannuation fund pays 4.5% per annum compound interest, compounding monthly, and Harry’s salary remains constant, what is the amount of superannuation he will have after 10 years? Give your answer to the nearest dollar. 5 32 In order to buy a property, the Smiths take out an interest-only loan of $235 000 from the bank. If the interest on the loan is 6.25% per annum, compounding monthly, what is the monthly repayment? Give your answer to the nearest dollar. 33 Lyndall takes out an interest-only loan of $35 700. If the interest on the loan is 7.45% per annum, compounding fortnightly, what is the fortnightly repayment? Give your answer to the nearest dollar. 34 Sandra wins $780 000 in a lottery, and decides to invest the money in a perpetuity which pays 6.89% per annum interest, compounding monthly. What monthly payment does she receive? Answers 1 a $3600 b $40 000 c $180 2 24 years 3 a $17 280 b 5.07% 4 a 3.5% b 7.5% c 4.25% 5 $714 285.71 6 a 1.5 years b 3 years c 10 years 7 a $2096.80 b 34.2% c 68.0% 8 a 21.8% b 41.4% 9 a 13% b 24.5% 10 a $1420.64 b $3508.98 c $4931.03 6 11 a $12 178 032.21 b $4313.46 c $25 735.59 12 a $2081.68 b $17 326.10 c $67 757.91 13 a $28 331.35 b $21.11 14 $24 885.70 15 52 years 16 15 years 17 a 70 quarters = 17 years and 6 months b 56 quarters = 14 years 18 10.4% 19 a 9.1% b 8.8% c 8.7% 20 a $10 625 b 6 years 21 a $52 310 b $75 690 c 9 years 22 a $14850 b $17650 c 10.9% 23 a $199 135 b $2639.13 24 a $4301.97 b $3130.88 c $5187.33 d 3430.70 25 a $16 9019.41 b $1361.61 26 a $256.48 b 11.5% 27 a $896 100 b $1 314 000 7 28 a 11 years and 2 months b $2171 29 a 3.9% b $3757 30 $92 534 31 a $816.75 b $123 491 32 $1224 33 $102.29 34 $4478.50 8