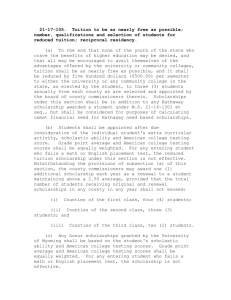

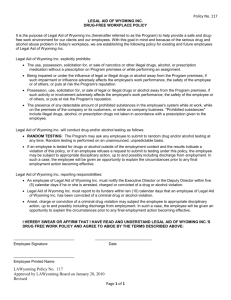

Title 9 - Wyoming State Legislature

advertisement