Topic 6 - Income Underwriting

advertisement

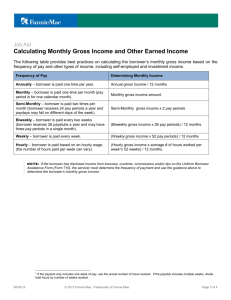

CVS Training & Development – www.caryvalentine.com – 816-985-2437 Topic 6 - Income Underwriting (LINK TO CVS HOME PAGE) To continue with our study of underwriting borrower capacity to pay, we now seek to asses the borrower's ability to make the payment based on income stability. When we are analyzing income for a tolerable risk, we must be concerned about two primary issues in regards to capacity to repay: 1.) Does the borrower posses a current and previous pattern of income stability? 2.) Is the borrower's income sufficient to support the proposed mortgage payment and all other debt the borrower may have? At the end of this chapter you will be able to: - Identify documents required to verify types of income. - Calculate monthly income. As we have pointed out repeatedly in the previous topics, what we are told about a borrower's capacity is a tool to get to the proper documentation of pertinent facts. Without documentation, what we say, hear, or just know is worthless in getting a decent approval. The source of income impacts the documentation required for verification (i.e., a borrower that is currently employed may require a pay stub and W2, while another who receives Social Security Income and may require copy of an award letter. However, regardless of the source of income and type of documentation required - the intent of this information is the same - to establish income stability and the likelihood that a similar pattern of income can be reasonably expected in the future. We will first examine some of the more common sources of income, the move on to explain how the borrowers' monthly income is calculated for underwriting purposes. For starters review the chart below which you may download in printable form for future reference: (Printable Version Download) Source of Income Salaried/Hourly Income Documentation Requirements Obtain the following: -Most recent pay stub showing year-to-date earnings (pay stub must be dated within 30 days from date of application to be valid). -W2's covering the most recent two tax years. -Verbal verification of employment (verbal VOE). Verbal Verification Process must: 1. Be completed within 30 Days of closing. 2. Independently obtain phone numbers & addresses of borrowers' employers. 3. Document names & titles of persons who confirm employment. 4. Document the date of the phone call & and source of phone number. 5. Include the name and title of the processor/underwriter that performed the verbal verification. 1 CVS Training & Development – www.caryvalentine.com – 816-985-2437 Note: If a pay stub becomes outdated, you may do best to get a second one if another pay period transcends the time spent in loan processing. Self-Employment Income -Individual federal income tax returns for the most recent two years. -Obtain most recent two years of federal business tax returns only if the following conditions are present: 1. Borrower owns 25% or more of the business, and 2. Business structure is a corporation, an 'S' corporation or partnership. Commission Income -Most recent YTD pay stub covering past 30 days. -W2's covering the most recent two tax years. -Individual federal income tax returns for the most recent two years. Income Per Job or Contract Basis -Individual federal income tax return for most recent two years and, if applicable: -Most recent YTD pay stub to document the most recent one full month of earnings if provided by employer. -W2's covering the most recent two tax years if provided by employer. Rental Income -Individual federal income tax returns for the most recent two years as evidence of the receipt of rental income. Note: If the property is listed on "Schedule E" of the tax return, provide a copy of the lease to verify rental income. Alimony, Child Support or Separate Maintenance -Select pages from the applicable agreement supporting three years of continuance from the closing date. -Document proof of receipt for most recent 12 months from one of the following: 1. Court payment record, 2. Cancelled checks, or 3. Bank statements showing the deposits. 'Other' Sources of Income (i.e., Retirement, Social Security, etc..) -Document the source of income, as applicable with: 1. Award letter 2. Pension statement 3. Two most recent bank statements 4. IRS 1099, etc., OR -Provide complete individual federal income tax returns for the most recent two years. -YTD pay stub covering most recent 30 days, and Employed by Property Seller, Real Estate Broker or a Closely Held Family Business -W2's covering the most recent two tax years, and IRS Form 4506 or 8821 -Have the borrowers sign IRS form 4506 or 8821 covering the most recent two years at application and/or closing, and send to IRS. -Individual federal income tax returns for the most recent two tax years. Note: Forms 4506 and 8821 permit the lender to obtain the borrower's income tax return form direct from the IRS. Employment Gaps -Document employment gaps of more than 60 days with a letter of explanation (LOX) from the borrowers. 2 CVS Training & Development – www.caryvalentine.com – 816-985-2437 Calculating Monthly Income Because income can come from a number of different sources, with each source potentially reporting income differently, it is important that you know how to calculate your borrowers' gross monthly income accurately. A rule of thumb when calculating income is: If the income fluctuates, it will usually be averaged over the last two years to determine the gross monthly income figure that will be used in qualifying. Look at list of different income types below and check those with the greatest potential to fluctuate: Self-Employed Income Commission Social Security Income Bonus Income Salaried Income If you selected self-employed, commission and bonus incomes, you're right. Because these types of income are less predictable than Salaried or Social Security income they require special handling when underwritten for risk. This is how the practice of averaging over two years comes into play because a history of prior success over multiple years is the best indicator of what may occur in the coming multiple years. The formula for averaging income might look like this: Tax Year Gross W2 Earnings 2004 Gross Earnings $24,580 2005 Gross Earnings $42,310 TOTALS $66,890 2 year total divided by 24 months $66,890 / 24 = $2,787.08 (qualifying monthly income) As stated earlier, self-employment income is somewhat, difficult to describe in this tutorial format. Underwriting this type of income involves special rules of analyzing federal tax returns and identifying the borrower's business structure for proper documentation of income. One thing I can tell you for sure, is that W2's prepared by a self-employed individual of wages paid to him/her self will not normally, fly in underwriting. Think about it, if we were all allowed to make our own documents for qualifying whether they represent legitimate pay or not, then why have any income documentation requirements at all? Again remember, that any borrower who owns at least 25% of a business trigger's the need for income tax returns and subsequently, requires special care in processing. If they have this kind of interest and influence within the entity we are trying verify their income to be from, the secondary mortgage market investor would be especially, vulnerable to fraud and our job as always, is to prevent fraud. This leads us to the fact that the self-employed or commissioned borrower may not like averaging because it usually, means less qualifying income for them than more. If they just 3 CVS Training & Development – www.caryvalentine.com – 816-985-2437 came out of a GOOD year (when they are applying for a loan), then they may be mad because we are bringing DOWN their qualifying income by averaging over a prior year with poor earnings (OUCH!). Your only savior in this case may be a few itemized, income tax return items known as "phantom deductions" like depreciation, depletion or other that can be added back to the adjusted gross income figure. However, these 'add-backs' rarely amount to much with the exception of higher-income borrower scenarios. In fact, the only significant amounts of 'add-back' income are sourced from depreciation for which most borrowers may include investment property listed in 'Schedule E' of the income tax return. If you would like more help on qualifying an income-volatile borrower, please contact your instructor at admin@caryvalentine.com for individual assistance. Just one more morsel regarding the self-employed borrower.... Even though we don't have the time here to efficiently and thoroughly instruct you on originating, processing and underwriting the self-employer borrower, please download the .pdf Fannie Mae form file below and take a look at it before moving on to the next topic: (Fannie Mae Cash-Flow Analysis Worksheet) This form (affectionately, called Fannie Mae 1084) is a worksheet used to analyze of selfemployed, rental income, or otherwise branded, "volatile-income" borrower. As you analyze the borrower's income tax return, you will add certain deductions BACK to the adjustedgross income for qualifying and may just find out, that you can get that self-employed borrower with four GU-GU-GILLION deductions to document enough income for a Fannie Mae loan approval anyway! Simply follow the instructions on the 1084 form and '+' or ' -' income and/or deductions right back in or out of the gross figure to see if you can land within the conforming qualifying parameters. This form is the best though, way too underused way of qualifying the income-volatile borrower effectively. Salaried-Income Payroll Periods Now let's turn our focus on the most common, salaried borrower. If a person receives a fixed salary we might assume that it is easy to figure out for qualifying purposes but that isn't necessarily, so. Salaried borrowers may receive payroll on various types of time frequency such as, monthly, semi monthly, weekly or bi-weekly. You must seek to discern how these differences in pay frequency can alter monthly qualifying income for underwriting. Below are some of the most common pay frequencies and formulas for arriving at the right qualifying amount: Weekly This would generally reflect the normal work week of 40 hours. You would take the number of guaranteed hours per weeks times 52 weeks to get annual gross income and divide the number by 12 months to get the monthly income figure for qualifying. Note the formula below: 40 hours x hourly rate x 52 weeks = monthly qualifying income 12 months Bi-Weekly Bi-weekly or every other week would generally reflect 75-80 hours. In this case, 4 CVS Training & Development – www.caryvalentine.com – 816-985-2437 you would take the base pay, if provided, times 26 pay periods (annual figure) and divide the number by 12 months to get a monthly figure as shown below: 80 hours x hourly rate x 26 weeks = monthly qualifying income 12 months Semi-Monthly Often times, processors, loan originators and even underwriters make the mistake of confusing "bi-weekly" pay with "semi-monthly" pay. They are pretty similar for obvious reasons but in the end, the semi-monthly system allows for only 24 pay periods instead of 26. Note the difference between the two in the formula below: 80 hours x hourly rate x 24 weeks = monthly qualifying income 12 months Monthly Monthly pay periods will typically, not state hours on a pay stub. To underwrite a monthly-paid borrower, look for a statement on the pay stub like "Pay Period ending __________ (applicable date ) or under "current earnings" or "earnings for period ending" or similar language that implies a monthly pay style. A monthly payroll might break down like this: 160 hours x hourly rate = monthly qualifying income 12 months Multiple-Income Source Borrower This is our own special term for a borrower who receives a combination of two or more types of income for qualifying. If the borrower is using rental income and salary income to qualify, you would simply need to calculate each of the different income sources per formulas shown above and then combine the incomes on the applicable lines of page two of the 1003. If you recall, the 1003 or loan application has a space for 'salary', 'overtime', 'net-rental income' and other income on the second page that can be itemized out for qualifying purposes. Make sure you separate the incomes per the 1003's instructions or the underwriter wont have a clue what you trying to claim for allowable qualifying income. Analyzing the Income Documents Now, look at the income documents and answer the questions below each of them to help you get into the mindset of seeking the most important data for income qualifying: 5 CVS Training & Development – www.caryvalentine.com – 816-985-2437 Pay Stub Exercise 1.) What type of pay period is reflected on this pay stub? 2.) Based on information listed on this pay stub, what is the current gross amount being paid to the employee? 3.) What is the 'year to date' earnings for this employee? 4. Does the pay stub indicate that the borrower is paid on an hourly-basis or in some other fashion? This is a tricky pay stub to underwrite but a good example of how to zero in on the most relevant information. Again, we are seeking a gross income figure which we cannot confuse with the net pay figure. It appears from reviewing the year to date earnings and mathematically calculating that with the gross pay will lead us to believe that the borrower is paid on a semi-monthly basis. If it was a bi-weekly pay schedule, we would arrive at a figure based on 26 pay periods a year instead of 24. The pay stub in this case, specifically states that the borrower is paid on a "contracted" basis which clarifies that hourly pay-rules are not applicable here. Now give the W2 below a try: 6 CVS Training & Development – www.caryvalentine.com – 816-985-2437 W2 Exercise 1.) What are the wages, tips, other compensation for this employee? 2.) What would be the monthly qualifying income for the borrower issued this W2 by their employer? Again we present this exhibit to purposefully, confuse you a bit. You may be wondering which income we are talking about. Is it, 'wages, tips, other compensation' or 'Medicare wages and tips' that will be used to figure gross monthly income for qualifying? For our purposes, we will differentiate the two income designations apart per the IRS interpretation of their specific taxable or non-taxable use: Wages, Tips, Other Compensation: This Box is numbered 1 on the Form W-2. This amount includes total wages, tips and other compensation paid to the employee during the calendar year based on dollars received from the first pay day in January to the last pay day in December. In addition, any amounts received as fringe benefits -- for example, the value of group-term life insurance plan coverage in excess of $50,000 -- are also added to the wages in Box 1. However, salary reductions for health and dental insurance plan coverage, flexible spending account for health, flexible spending account for dependent care benefits up to $5000, and contributions to a retirement plan, will reduce the income reported in Box 1. Medicare Wages (HI): This Box is numbered 5 on the Form W-2. The wages and tips subject to Medicare tax are the same as those subject to Social Security tax (Box 3), except that there is no income base limit for Medicare tax. Are you more confused after reading that? Most people are in this context but you should know the official difference when your asked which income will be used for qualifying. My personal experience is that the underwriter will always take the smaller amount of the two which will be the 'wages, tips and other compensation'. Underwriters are concerned about audits of their work and most often seek the conservative routes on income capacity underwriting to appease the powers that they answer to. Check with your underwriter, underwriters or investor matrix to survey multiple industry responders to this question. Most of them don't even know the difference in what the two boxes are meant to communicate per the local, state and federal government for taxable income purposes but now YOU do. Calculating Debt-to-Income Ratio (DTI) Debt-to-income ratio or 'DTI' is the percentage of a consumer's monthly gross income that goes toward paying debts. It is usually expressed as two numbers. The first number, most often known as the "front-end" ratio, indicates the percentage of income that goes toward paying off a mortgage principal and interest, mortgage insurance, hazard insurance, property taxes (PITI) and homeowner's association dues if applicable. The second number, most often referred to as the "back-end" ratio, indicates the percentage of income that goes toward paying all recurring debts, including those covered by the first number, and other debts such as credit card payments, car loan payments, and child support payments. Lenders in the past stuck to requirement of a debt-to-income ratio of 28/36 to qualify for a conventional mortgage but these ratios are often exceeded in automated underwriting scenarios. Federal Housing Administration (FHA) loan ratios have typically, stayed close to 29/41 . An example of calculating the front-end ratio, might be as follows: 7 CVS Training & Development – www.caryvalentine.com – 816-985-2437 We want to find out what percentage of a monthly gross income figure of $3,000 would be necessary to cover a monthly, PITI payment of $800. Here's the formula for this calculation: Borrower's Gross Monthly Income: $3,000 Proposed Monthly PITI: $800.00 or.. $800 / $3,000 = .266_ or 26% 26% is considered the "front-end" DTI ratio for this borrower scenario on this property. The "back-end" ratio is the percentage of gross monthly income used for the proposed PITI payment added with all other monthly payments/liabilities: Try this formula for calculating the back-end ratio: Borrower's Gross Monthly Income: Proposed Monthly PITI: $3,000 $800.00 Total of Other Monthly Payments: $600.00 Total Proposed Monthly Debt Load: $1,400.00 or.. $1,400 / $3,000 = .466_ or 46% So, 46% is your back-end ratio. Front and back ratios are combined in to the final DTI Ratio calculation and are written like this: 26%/46% Why are these calculations soooo... important? Because lenders set maximum DTI ceilings on the ratios they will accept to prove that enough income capacity exists to approve the loan. In the past, conventional lenders stuck to 28/36 ratios on high LTV loans. Since the revolution of automated underwriting systems, there has been less emphasis on set DTI ratios however, they still exist. Because of DTI restrictions, many self-employed borrowers' fail to qualify because they take too many deductions and reduce their taxable gross income down. Other borrowers' simply maintain so much revolving and installment monthly debt that they fail to qualify from having too high of a back-end DTI ratio. Our DTI calculations in the example above would indicate that the applicant is within their housing allowance but will have too much total monthly debt to qualify. By knowing this, we would seek ways to reduce debt or advise buying less house to lower the back-end or total debt ratio. In other words, the DTI calculation signals certain choices you'll make in originating and processing the loan so you must consider it early on. A number compensating factors can get you exceptions on higher-than expected, DTI ratios which we will study more in the upcoming topic. The real benefit of knowing how to calculate DTI is so you can make the best recommendation to the applicant about their prospective loan terms early in the process. If their DTI ratios are excessive, you may need 8 CVS Training & Development – www.caryvalentine.com – 816-985-2437 to prepare them for a more liberal set of guidelines and programs that may not have the attractive loan terms initially, hoped for. Again, contact your instructor at: admin@caryvalentine.com for a personal tutorial on underwriting the income-volatile and/or self-employed borrower if you would like more details about this special type of underwriting scenario. Do you have questions or comments about what you just read? Contact your instructor at: admin@caryvalentine.com The "Back" button on your browser or the "FAST101" link at the top of the page should return you to the prior page so you can continue to the next resource. 9