October 11, 2011 (att)

advertisement

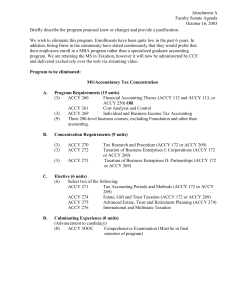

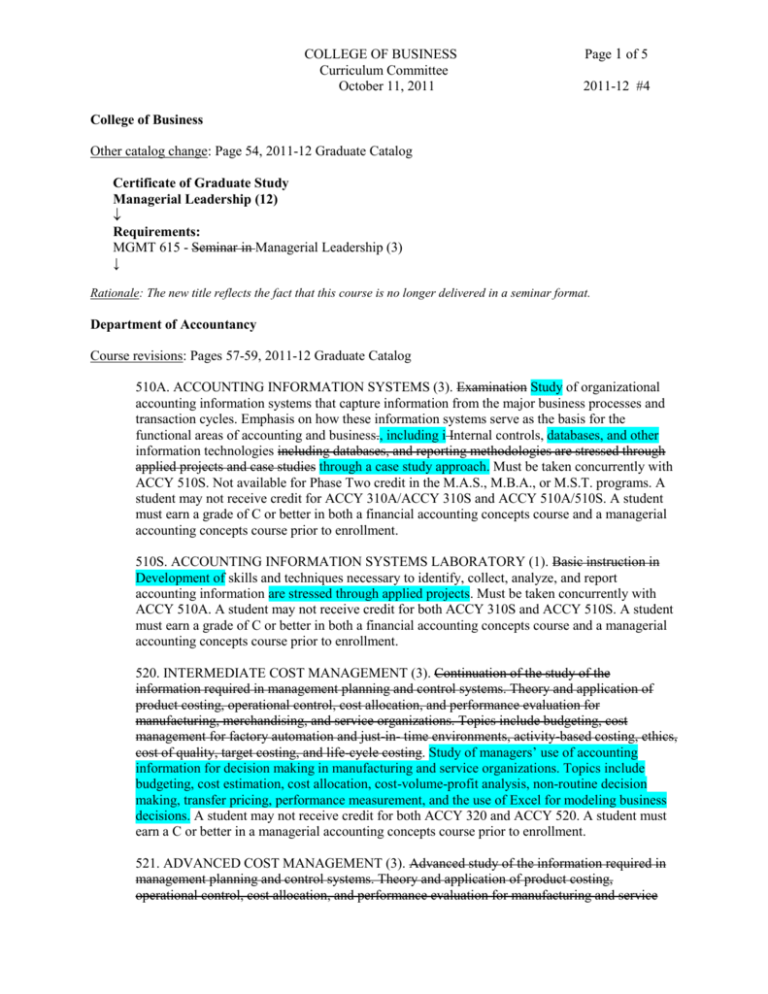

COLLEGE OF BUSINESS Curriculum Committee October 11, 2011 Page 1 of 5 2011-12 #4 College of Business Other catalog change: Page 54, 2011-12 Graduate Catalog Certificate of Graduate Study Managerial Leadership (12) Requirements: MGMT 615 - Seminar in Managerial Leadership (3) ↓ Rationale: The new title reflects the fact that this course is no longer delivered in a seminar format. Department of Accountancy Course revisions: Pages 57-59, 2011-12 Graduate Catalog 510A. ACCOUNTING INFORMATION SYSTEMS (3). Examination Study of organizational accounting information systems that capture information from the major business processes and transaction cycles. Emphasis on how these information systems serve as the basis for the functional areas of accounting and business., including i Internal controls, databases, and other information technologies including databases, and reporting methodologies are stressed through applied projects and case studies through a case study approach. Must be taken concurrently with ACCY 510S. Not available for Phase Two credit in the M.A.S., M.B.A., or M.S.T. programs. A student may not receive credit for ACCY 310A/ACCY 310S and ACCY 510A/510S. A student must earn a grade of C or better in both a financial accounting concepts course and a managerial accounting concepts course prior to enrollment. 510S. ACCOUNTING INFORMATION SYSTEMS LABORATORY (1). Basic instruction in Development of skills and techniques necessary to identify, collect, analyze, and report accounting information are stressed through applied projects. Must be taken concurrently with ACCY 510A. A student may not receive credit for both ACCY 310S and ACCY 510S. A student must earn a grade of C or better in both a financial accounting concepts course and a managerial accounting concepts course prior to enrollment. 520. INTERMEDIATE COST MANAGEMENT (3). Continuation of the study of the information required in management planning and control systems. Theory and application of product costing, operational control, cost allocation, and performance evaluation for manufacturing, merchandising, and service organizations. Topics include budgeting, cost management for factory automation and just-in- time environments, activity-based costing, ethics, cost of quality, target costing, and life-cycle costing. Study of managers’ use of accounting information for decision making in manufacturing and service organizations. Topics include budgeting, cost estimation, cost allocation, cost-volume-profit analysis, non-routine decision making, transfer pricing, performance measurement, and the use of Excel for modeling business decisions. A student may not receive credit for both ACCY 320 and ACCY 520. A student must earn a C or better in a managerial accounting concepts course prior to enrollment. 521. ADVANCED COST MANAGEMENT (3). Advanced study of the information required in management planning and control systems. Theory and application of product costing, operational control, cost allocation, and performance evaluation for manufacturing and service COLLEGE OF BUSINESS Curriculum Committee October 11, 2011 Page 2 of 5 2011-12 #4 organizations. Topics include transfer pricing, competitive costing, division performance measurement, regression analysis, statistical quality control, activity-based costing, automation and cost management, target costing, and Japanese cost management. Study of advanced topics related to managers’ use of accounting information for management planning and control systems. Topics include advanced costing techniques, division performance measurement, customer profitability analysis, incentive systems, and other contemporary cost management issues. A student may not receive credit for both ACCY 421 and ACCY 521. A student must earn a grade of C or better in an intermediate cost management course prior to enrollment. 531. FINANCIAL REPORTING I (3). In-depth s Study of financial accounting and reporting standards issues, including the contemporary economic and political forces that lead to the development of standards relating to statement of cash flows, financial statement analysis, foreign currency translation, conceptual framework, balance sheet and income statement preparation, revenue recognition, conversion from cash to accrual basis, time value of money, monetary assets, inventories, plant assets, research and development costs, current liabilities, and long-term debt. Use of databases Employ authoritative sources in researching accounting issues. and in analyzing and preparing financial statement disclosures. Not available for Phase Two credit in the M.A.S., M.B.A., or M.S.T. programs. A student may not receive credit for both ACCY 331 and ACCY 531. A student must earn a grade of C or better in a financial accounting concepts course prior to enrollment. 532. FINANCIAL REPORTING II (3). In-depth s Study of financial reporting standards including the contemporary economic and political forces that lead to the development of standards relating to accounting for income taxes, pension and other benefit plans, leases, earnings per share, accounting changes, stockholders’ equity, and investments including equity method; and an introduction to consolidated financial statements. Use of databases in researching accounting issues and in analyzing and preparing financial statement disclosures accounting and reporting issues, including accounting for income taxes, pension and other benefit plans, leases, earnings per share, accounting changes, stockholders’ equity, investments, and statement of cash flows. Employ authoritative sources in researching accounting issues. Not available for Phase Two credit in the M.A.S., M.B.A., or M.S.T. programs. A student may not receive credit for both ACCY 432 and ACCY 532. A student must earn a grade of C or better in an intermediate financial reporting I course prior to enrollment. 533. FINANCIAL REPORTING III (3). In-depth study of financial reporting standards including the contemporary economic and political forces that lead to the development of standards relating to business combinations and for consolidated financial statements, for companies operating internationally, for interim financial reporting, and the disclosure standards for disaggregated operations. Study and evaluation of the special accounting and reporting required for entities going through corporate insolvency, including the restructuring and impairment of financial instruments, for partnership forms of business entities, for publicly held companies that must meet SEC reporting standards, and for specialized industrial reporting. Research projects include the use of accounting data and literature bases; electronic bases such as the Internet. Team projects used throughout the course. Study of financial accounting and reporting issues, including accounting for business combinations, consolidated financial statements, conversion of foreign financial statements, foreign currency denominated transactions, and derivatives and hedging activities. Employ authoritative sources in researching accounting issues. A student may receive credit for only one of the following: ACCY 433, ACCY 533, ACCY 633. A student must earn a grade of C or better in an intermediate financial reporting II course prior to enrollment. COLLEGE OF BUSINESS Curriculum Committee October 11, 2011 Page 3 of 5 2011-12 #4 550. PRINCIPLES OF TAXATION (3). Study of the principles basic concepts of federal income taxation with focus on learning taxation concepts related to income, deductions, and related to business entities and individuals. Includes the study of property transactions. for businesses and individuals. These concepts applied to common transactions and issues encountered by individuals, corporations, partnerships, S corporations, and limited liability companies. Not available for Phase Two credit in the M.A.S., M.B.A., and M.S.T. programs. A student may not receive credit for both ACCY 450 and ACCY 550. A student must earn a grade of C or better in an intermediate financial reporting I course prior to enrollment. 556. ADVANCED FEDERAL TAXES (3). Study of federal taxes imposed on business entities with emphasis on corporations, partnerships, and S corporations. Also includes an overview of tax research techniques. A student may receive credit for only one of the following: ACCY 456, ACCY 556, ACCY 644, ACCY 650. A student must earn a grade of C of or better in an income tax concepts course prior to enrollment. 560. ASSURANCE SERVICES (3). Study of the accumulation and evaluation of information and data in order to provide assurance to decision-makers. Overview of the variety of assurance services including auditing, and attestation. Emphasis on underlying concepts, standards, and procedures associated with assurance services, including engagement planning, risk assessment, internal control testing, evidence gathering and documentation, and communication of findings. operational, and compliance services. Practices and procedures of assurance services including planning, assessing risk, testing controls, and obtaining and documenting evidence. Focus on analysis of business processes and decisions (both financial and nonfinancial) and analytical skills needed to evaluate evidence, develop recommendations, and communicate findings. Not available for Phase Two credit in the M.A.S., M.B.A., and M.S.T. programs. A student may not receive credit for both ACCY 360 and ACCY 560. A student must earn a grade of C or better in an accounting information systems course prior to enrollment. 562. INTERNAL AUDITING (3). Study of internal audit objectives, processes and reporting. Topics include internal audit standards, internal controls, risk assessment, evidence and riskbased audit procedures, documentation, and communications. Auditing techniques including sampling and use of systems -based audit techniques. Review of ethics, Employ authoritative sources to examine ethical issues, emerging issues, and industry specific matters issues. A student may not receive credit for both ACCY 462 and ACCY 562. A student must earn a grade of C or better in an assurance services course prior to enrollment. 565. FORENSIC ACCOUNTING/FRAUD EXAMINATION (3). Focus on Study of fraud detection and control from the perspective of public, internal, and private accountants. This course covers areas such as Topics include principles and standards for fraud-specific examination;, fraud-specific internal control systems;, and proactive and reactive investigative techniques. Implications for further research are also considered. A student may not receive credit for both ACCY 465 and ACCY 565. A student must earn a grade of C or better in an intermediate financial reporting I course and an assurance services course prior to enrollment. 580. GOVERNMENTAL AND NOT-FOR-PROFIT ACCOUNTING (3). In-depth sStudy of accounting and financial reporting for the federal government, state and local governments, accounting; and not-for- profit organizations. accounting including tax issues and industry COLLEGE OF BUSINESS Curriculum Committee October 11, 2011 Page 4 of 5 2011-12 #4 specific issues in healthcare and colleges and universities; Government Auditing Standards and the Single Audit Act; and federal government accounting. Financial statement oriented approach. Unique aspects of governmental auditing, including GAO Audit Standards and the Single Audit. Unique ethical situations arising in governments. Students may not receive credit for both ACCY 480 and ACCY 580. A student must earn a grade of C or better in an intermediate financial reporting I course prior to enrollment. 667. INFORMATION SYSTEMS AUDITING (3). Study of the practical aspects of information systems auditing (ISA). Includes assurance services, internal control assessments, and evidencegathering activities in advanced accounting information systems. Study of the auditing of computer-based accounting information systems with a focus on control and security. Topics include information technology as it relates to assurance services, internal control assessments, and evidence-gathering activities. A student may not receive credit for both ACCY 467 and 667. A student must earn a grade of C or better in an assurance services course prior to enrollment. Rationale: These graduate course descriptions are being revised to reflect changes made to corresponding undergraduate course descriptions in the 2011-2012 undergraduate catalog. The Department recognizes that some of these courses may fulfill Phase I graduation requirements, while others may be used to fulfill Phase II graduation requirements. When a difference in expectation between a student enrolled in the graduate course and a student enrolled in the undergraduate course exists, the difference will be enumerated in the appropriate course syllabus. Other catalog change: Page 55-56, 2011-12 Graduate Catalog Master of Accounting Science ↓ Leadership Area of Study Students pursuing the Leadership area of study must also complete ACCY 679, Seminar in Accounting, MGMT 615, Seminar in Managerial Leadership, … Financial Reporting and Assurance Track ↓ MGMT 615 - Seminar in Managerial Leadership (3) ↓ Managerial Accounting Systems Track MGMT 615 - Seminar in Managerial Leadership (3) ↓ Taxation Track MGMT 615 - Seminar in Managerial Leadership (3) ↓ Rationale: Course title change approved by the Management Department Curriculum Committee and the College of Business Curriculum Committee (refer to MGMT 615 title revision elsewhere in these minutes). COLLEGE OF BUSINESS Curriculum Committee October 11, 2011 Page 5 of 5 2011-12 #4 Department of Management Course revision: Page 81, 2011-12 Undergraduate Catalog 411. ENTREPRENEURSHIP IN MICROFINANCE ORGANIZATIONS (3). … PRQ: MGMT 311 Junior or senior standing or consent of department. Rationale: Success in the course as currently delivered does not require specific course prerequisites, but does require the general body of knowledge encompassed in lower-division courses. Course revision: Page 81, 2011-12 Undergraduate Catalog 427. ENTREPRENEURSHIP AND BUSINESS MODEL DESIGN (3). … PRQ: MGMT 327 UBUS 310 or MGMT 320 or consent of department. CRQ: MGMT 327. Rationale: Changes necessary to assure background knowledge necessary to succeed in the course. Concurrent or prior enrollment in corequisite enhances development of knowledge and student learning. Course revision: Page 81, 2011-12 Undergraduate Catalog 457. MANAGERIAL DECISION MAKING AND NEGOTIATIONS (3). Analysis of the processes used by Examination of the negotiation techniques and strategies relevant to individuals, groups, and organizations organizational decision making to make both unilateral and bilateral managerial decisions, as well as the development of skills to enhance managerial decision making the resolution of personal and professional conflicts. PRQ: Grade of C or better in MGMT 335 and MGMT 355 or consent of department. Rationale: Revisions to course description clarify the emphasis on negotiations to better match current course content. Revised title focuses on the emphasis on negotiations. Course revision: Page 62, 2011-12 Graduate Catalog 615. SEMINAR IN MANAGERIAL LEADERSHIP (3). Examination of new ideas and current trends in classic and emerging leadership theory, and its role in a rapidly changing business environment with an emphasis upon meeting the challenges and opportunities of effective leadership. Discussion focused on An accompanying focus is the identification of individual leadership skills and limitations, as well as the it is recognized, developed, development of new skills and strategies. and applied in current business situations. PRQ: All Phase One courses and MGMT 635, or consent of department. Rationale: The new title reflects the fact that this course is no longer delivered in a seminar format. The new course description provides a more comprehensive description of the course goals and emphasis as currently being taught.