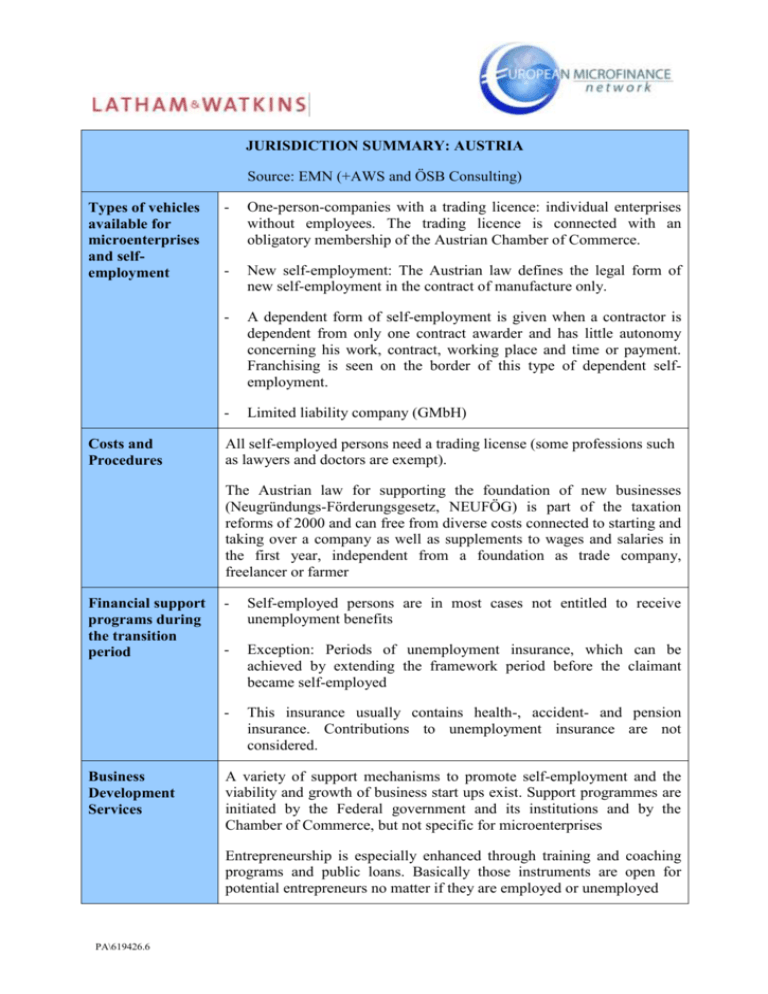

Legal Survey on Microcredit in Europe

advertisement