GST & PST Journal Entries

advertisement

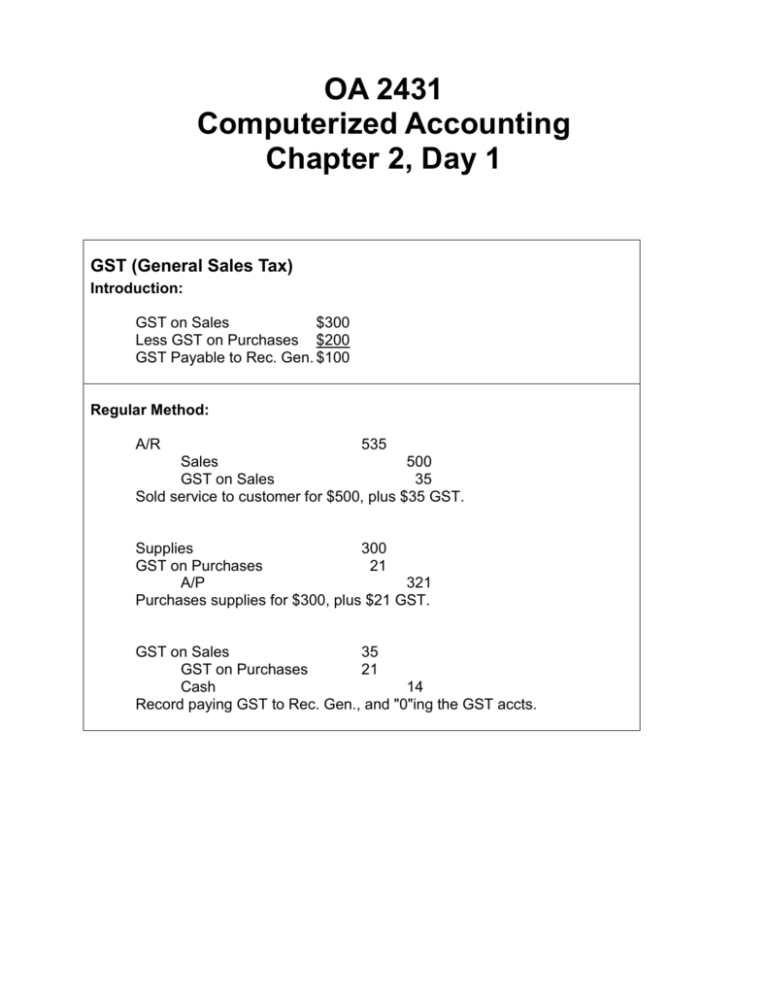

OA 2431 Computerized Accounting Chapter 2, Day 1 GST (General Sales Tax) Introduction: GST on Sales $300 Less GST on Purchases $200 GST Payable to Rec. Gen. $100 Regular Method: A/R 535 Sales 500 GST on Sales 35 Sold service to customer for $500, plus $35 GST. Supplies 300 GST on Purchases 21 A/P 321 Purchases supplies for $300, plus $21 GST. GST on Sales 35 GST on Purchases 21 Cash 14 Record paying GST to Rec. Gen., and "0"ing the GST accts. OA 2431 Computerized Accounting Chapter 2, Day 2 GST and Provincial Sales Taxes Introduction: PST (Provincial Sales Tax) - Record PST on Purchases Added to cost of item purchased. - Record PST on Sales $150 - Total PST on Sales is submitted to Provincial Treasurer $150 submitted to Receiver General A/R 575 Sales 500 GST on Sales (7%) 35 PST (8%) 40 Sold service to customer for $500, plus $35 GST. Note: $40 PST is recorded so it can be remitted to the Prov. Treasurer. Supplies 324 GST on Purchases 21 A/P 345 Note: PST is added to the cost of the item. PST Payable 40 Cash 40 Note: Total PST collected is remitted to the Provincial Treasurer. GST on Sales 35 GST on Purchases 21 Cash 14 Record paying GST to Rec. Gen., and "0"ing the GST accts. (GST is remitted as shown before.) Name: ________________ GST Journal Entries – 1 OA 2431 ACCPAC Simply Accounting Complete the Journals: Accounts Receivable (A/R)--when you sell something and will be paid later. Then you own the customer’s promise to pay the bill in the future, an Asset. Accounts Payable (A/P)--when you buy something and don’t pay for it right away. Then you promise to give up an asset in the future, a Liability. Assets: Cash A/R Liabilities: A/P GST on Sales GST on Purchases Owner’s Equity: Sales Auto Expense Telephone Expense All transactions involve 7% GST. Debits come before Credits when making Journal Entries. See the sample. Paid $500 for gas and minor auto repairs, plus taxes. Auto Expense (Note, Debit Entries go first and are left justified.) GST on Purchases Cash (Note, Credit entries are indented.) 500 35 535 (Note, indent.) (Note, imaginary “T” account!) Sold $200 service plus taxes, received cheque. Received bill for telephone service, $300, plus taxes. Paid above telephone bill. (Careful: you are paying the bill—telephone expense is not affected! Also, is GST affected? No, it isn’t, you just paid the bill!) (From now on supply you own imaginary “T” account) Name: ________________ GST Journal Entries – 2 OA 2431 ACCPAC Simply Accounting Complete the Journals: Make sure you can complete these questions without referring to the key. Drawings. When the boss withdraws assets (cash usually) from the business and the reason isn’t related to earning revenue. Assets: Cash A/R Supplies Liabilities: A/P GST on Sales GST on Purchases PST Owner’s Equity: Drawings Sales Auto Expense All transactions involve 7% GST. Boss handed in receipt for shoeshine, paid $5.00 plus.35 for GST. Careful! The firm pays back the owner for GST but, on Drawings, does not record the taxes separately. Boss handed in receipts for gasoline used on sales calls, paid $100, plus GST $7. Bought supplies on account, $300 plus 21 GST. Sold services for $1,000, plus $70 GST. Received $600 cash. (Balance is A/R) Name: ________________ GST Journal Entries – 3 OA 2431 ACCPAC Simply Accounting Complete the Journals: Make sure you can complete these questions without referring to the key. Assets: Cash A/R Supplies Liabilities: A/P GST on Sales GST on Purchases Owner’s Equity: Sales All transactions involve 7% GST. Sold services worth $800 plus $56 GST, for cash. Sold services for $800 plus $56 GST, received $500 in cash. Received invoice for office supplies, $200 plus GST $14. Paid $100 on the above invoice. (Is GST affected? No, it isn’t, you just paid the bill!) Name: ________________ GST Journal Entries – 4 OA 2431 ACCPAC Simply Accounting Complete the Journals: Assets: Cash A/R Automobile Liabilities: A/P Bank Loan GST on Sales GST on Purchases Owner’s Equity: Sales Auto Expense Entertainment Expense Postage Expense All transactions involve 7% GST. Sold Consulting Service for $1,000 plus GST $70, on account. Bought car for $10,000 plus $700 GST, paid $7,000 cash, borrowed the rest. Paid $1,000 on the loan from the previous transaction. (Are the car or taxes affected? Nope!) Name: ________________ GST & PST Journal Entries – 5 OA 2431 ACCPAC Simply Accounting Complete the Journals: Accounts Receivable (A/R)--when you sell something and will be paid later. Then you own the customer’s promise to pay the bill in the future, an Asset. Accounts Payable (A/P)--when you buy something and don’t pay for it right away. Then you promise to give up an asset in the future, a Liability. Assets: Cash A/R Liabilities: A/P GST on Sales GST on Purchases PST Owner’s Equity: Sales Auto Expense Telephone Expense All transactions involve 7% GST and 8% PST. Debits come before Credits when making Journal Entries. See the sample. Paid $500 for gas and minor auto repairs, plus taxes. GST = $35, PST = $40 Auto Expense (Note, Debit Entries go first and are left justified.) GST on Purchases Cash (Note, Credit entries are indented.) 540 35 575 Sold $200 service plus taxes, received cheque. GST = $14, PST = $16 Received bill for telephone service, $300, plus taxes. GST = $21, PST = $24 Paid above telephone bill. (From now on supply you own imaginary “T” account) (Note, indent.) (Note, imaginary “T” account!) Name: ________________ GST & PST Journal Entries – 6 OA 2431 ACCPAC Simply Accounting Complete the Journals: Make sure you can complete these questions without referring to the key. Drawings. When the boss withdraws assets (cash usually) from the business and the reason isn’t related to earning revenue. Assets: Cash A/R Supplies Liabilities: A/P GST on Sales GST on Purchases PST Owner’s Equity: Drawings Sales Auto Expense All transactions involve 7% GST and 8% PST. Boss handed in receipt for shoeshine, paid $5.00 plus.35 for GST and .40 for PST. Careful! The firm pays back the owner for GST and PST but, on Drawings, does not record the taxes separately. Boss handed in receipts for gasoline used on sales calls, paid $100, plus GST $7, PST $8 Bought supplies on account, $300 plus 21 GST and 24 PST. Sold services for $1,000, plus $70 GST and $80 PST. Received $600 cash. (Balance is A/R) Name: ________________ GST & PST Journal Entries – 7 OA 2431 ACCPAC Simply Accounting Complete the Journals: Make sure you can complete these questions without referring to the key. Assets: Cash A/R Supplies Liabilities: A/P GST on Sales GST on Purchases PST Owner’s Equity: Sales All transactions involve 7% GST and 8% PST. Sold services worth $800 plus $56 GST and $64 PST, for cash. Sold services for $800 plus $56 GST and $64 PST, received $500 in cash. Received invoice for office supplies, $200 plus GST $14 and PST $16. Paid $100 on the above invoice. (Is GST affected? No, it isn’t, you just paid the bill!) Name: ________________ GST & PST Journal Entries – 8 OA 2431 ACCPAC Simply Accounting Complete the Journals: Make sure you can complete these questions without referring to the key. Assets: Cash A/R Automobile Liabilities: A/P Bank Loan GST on Sales GST on Purchases PST Owner’s Equity: Sales Auto Expense Entertainment Expense Postage Expense All transactions involve 7% GST and 8% PST. Sold Consulting Service for $1,000 plus GST $70 and PST $80, on account. Bought car for $10,000 plus $700 GST and $800 PST, paid $7,000 cash, borrowed the rest. Paid $1,000 on the loan from the previous transaction. (Are the car or taxes affected? Nope!)