1. introduction - Rochdale Metropolitan Borough Council

advertisement

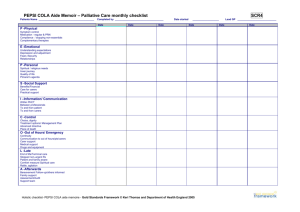

Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) ROCHDALE METROPOLITAN BOROUGH COUNCIL ADULT CARE AND SUPPORT SERVICES POLICY ADULT CARE AND SUPPORT SERVICES POLICY PUTTING PEOPLE FIRST 1. INTRODUCTION 1.1 Rochdale MBC has a statutory duty to provide social care services to meet the eligible assessed social care needs of service users and carers. 1.2 Adult Care and Support Services, in accordance with the Putting People First directive, introduced a system of self directed support (SDS). 1.3 Self directed support introduced personal budgets that can be taken as either a cash payment or a managed budget where Adult Care and Support Services commission support services, or a combination of both 1.4 Personal Budgets promote independence, health and well-being by giving choice and control over planning and managing support. 2. 2.1 3. SCOPE This policy is applicable to all service users and carers who have been assessed against the Fair Access to Care Services criteria as being eligible to receive a Personal Budget OUTCOMES and GUIDING PRINCIPLES 3.1 Adult Care and Support Services will ensure that service users and carers are able to use a personal budget flexibly and be empowered to have greater choice and take more control over the form and management of their own support to meet their eligible needs. 3.2 Support services should be personalised and designed around the needs of service users and carers. 3.3 The role of Adult Care and Support Services is to help service users and carers maintain or regain their independence, regardless of age, impairment, ethnicity, sexual orientation or personal circumstances. 3.4 Service users and carers will be given more responsibility for planning and managing their support. 4. 4.1 LEGISLATION & GUIDANCE The statutory framework for Adult Care and Support Services as set by Central Government and generally defined by the Department of Health. Final Policy Page 1 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) 4.2 Relevant to: Putting People First, Independence, Wellbeing and Choice, Our Health Our Care Our Say. 4.3 Main legislation but not limited to referenced in Appendix 1 (Key Policy Documents and Legislation) 5. ELIGIBILITY FOR ADULT CARE AND SUPPORT SERVICES 5.1 To be eligible to receive support from Adult Care and Support Services, service users and carers are required to have a health and social care assessment and, when appropriate, a period of further assessment and re-ablement. 5.2 Where appropriate, and with the person’s consent, (in accordance with the Mental Capacity Act 2005) Adult Care and Support Service will complete a Department of Health NHS Continuing Healthcare checklist (screening tool) as part of the assessment. 5.3 If the outcome of the Department of Health NHS Continuing Healthcare checklist indicates possible eligibility for NHS Continuing Health Care, the CCG will be informed. 5.4 Service users and carers will have a financial assessment to establish whether they will have to make a financial contribution towards the cost of meeting their eligible assessed needs. 5.5 All the above assessments to determine eligibility will be conducted in line with the Fair Access to Care Service Guidelines and the Charging Policy. 6. SUPPORT PLANNING OUTCOMES and GUIDING PRINCIPLES 6.1 Following assessment, and when eligible care needs are identified, a Resource Allocation System will determine an indicative budge. A Support Plan is then drawn up by the service user or carer with assistance from a Support Planning Officer. 6.2 A Support Plan endorses the desires, aspirations and outcomes for service users and carers and how they intend to use their Personal Budget to address them. 6.3 The proposals for meeting a service user’s or carer’s assessed eligible needs, as set out in their Support Plan must be: Lawful – the proposals are within the scope of the funds and resources available Effective – the proposals will meet the assessed eligible social care needs and support a service user or carer’s independence and well being and make effective use of the funds and resources available in accordance with the principle of best value Affordable – all costs have been identified and can realistically be met within the available budget 6.4 Once eligibility has been determined a risk assessment must be carried out as part of the planning process. Final Policy Page 2 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) 6.5 Adult Care and Support Services will make available up to date information and advice to support service users and carers to make informed decisions about how they wish to manage their Personal Budget. 6.6 In cases where a service user’s or carers financial contribution negates a contribution from Adult Care and Support Services the Support Planning process should still be applied. 7. WHAT A SUPPORT PLAN SHOULD INCLUDE? 7.1 A Support Plan should detail all support needed by service users or carers to achieve their outcomes which will vary depending on what approach a person decides to use 7.2 As a minimum a Support Plan should include responses to the following questions: 7.3 8. What is important to you? What do you want to change? How will you arrange your support? How will you spend your money? How will you manage your support? How will you stay in control? What will you do next? Acknowledging the statutory responsibilities placed on Adult Care and Support Services, the following must also be addressed in a Support Plan: Support needs, desired outcomes and how they will be achieved Identification and management of risks Contingency plans to address sudden unanticipated changes in need Information about all funding streams that make up a Personal Budget (gross) including the service user’s assessed financial contribution The choice of how a service user or carer has decided to receive their Personal Budget e.g. direct payment (either to self or a third party), trust fund or managed budget Consent from a service user or carer to allow aspects of their Support Plan to be shared with other organisations. VALIDATION 8.1 Once a service user or carer has drawn up their Support Plan it will be submitted to the relevant Operational Team Manager for validation. 8.2 No money will be released to a service user or carer until a Support Plan has been validated. Final Policy Page 3 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) 8.3 Where a Support Plan cannot be validated it should be returned to the service user, carer or their support planner with details of what further development is required before it can be re-submitted for validation. 8.4 In cases where a Support Plan needs further development the Operational Team Manager should consider whether the Support Plan can be partially validated in order to avoid any delay in meeting a service user or carer’s needs. 8.5 Where necessary Adult Care and Support Services will authorise temporary commissioned services to meet a service user’s or carer’s assessed eligible social care needs while support planning continues which will ensure that their needs are met in line with the Council’s statutory duties. 8.6 Where a Support Plan is in excess of the maximum amount calculated by the Resource Allocation System (RAS) it will be necessary for a Senior Manager or Risk and Validation to consider and validate or reject the Support Plan. 8.7 If a Support Plan meets a person’s assessed eligible social care needs within the available budget then it should be validated. However, if the actual budget indicated is less than the indicative budget the lower budget becomes the validated budget. 8.8 If a service user or carer is saving a proportion of their Personal Budget for a longer term identified eligible need the amount per month should be stated and factored within their validated support plan. 9. MENTAL CAPACITY 9.1 In cases where there is uncertainty about whether a service user or carer has sufficient capacity to be able to manage a direct payment, it will be necessary to undertake an assessment of capacity (Mental Capacity Act 2005). 9.2 9.3 The principles of the Mental Capacity Act, 2005 are: A presumption of capacity - every adult has the right to make his or her own decisions and must be assumed to have capacity to do so unless it is proved otherwise; The right for individuals to be supported to make their own decisions people must be given all appropriate help before anyone concludes that they cannot make their own decisions; That individuals must retain the right to make what might be seen as eccentric or unwise decisions; Best interests – anything done for or on behalf of people without capacity must be in their best interests; and Least restrictive intervention – anything done for or on behalf of people without capacity should be the least restrictive of their basic rights and freedoms A person is unable to make a decision for themselves if they are unable to: Understand the information relevant to the decision, Retain that information, Final Policy Page 4 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) Use or weigh that information as part of the process of making the decision, or Communicate their decision (whether by talking, using sign language or any other means). 9.4 Where an assessment of capacity determines that a service user or carer does not have capacity, a decision may be taken in their best interests about whether a direct payment is appropriate and about how such a payment will be managed. 9.5 A person deemed to be without capacity should, where appropriate, be referred to an Independent Advocate and/or a Best Interest Meeting arranged. 9.6 The Mental Capacity Act 2005 allows a person to create a Lasting Power of Attorney (LPA) regarding property and finance and/or health and wellbeing) by which they nominate someone to act on their behalf if they should lose capacity to make decisions in the future. 9.7 Adult Care and Support Service will require evidence that a relevant LPA is in place and registered with the Office of the Public Guardian (OPG) in order to ensure that the nominated person has the authority to manage the finances of a person who lacks capacity. 10. 10.1 11. 11.1 11.2 SAFEGUARDING Personal Budgets should be arranged to minimise the possibility of abuse occurring by: Putting a person in control of their life Making sure people who know the person are enabled to be part of the support planning process Designing an agreed system of support and safeguards that fit a person’s preferred lifestyle. DELIVERY OF PERSONAL BUDGETS Service users and carers will have the choice of taking their personal budget as: A cash payment paid directly to them net of any service user contribution; A cash payment to a nominated third party net of any service user contribution; A commissioned service which may include payment of a service user contribution to Rochdale MBC following a financial assessment. A combination of the above (mixed budget) Service users, carers or nominated third party must agree to and sign a Formal Contractual Agreement to confirm their decision to receive a personal budget via a direct payment Final Policy Page 5 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 12. PPF1(a) MANAGEMENT OF A PERSONAL BUDGET VIA A DIRECT PAYMENT 12.1 Adult Care and Support Services will not be responsible for the arrangement, direction, management or day to day organisation of services purchased with a cash budget 12.2 When a service user or carer agrees to receive a cash payment in preference to a managed budget they assume the responsibilities associated with managing their support. 12.3 In the case of payments to a nominated third party, the third party assumes responsibilities associated with managing the support of the service user or carer. 12.4 Service users, carers and nominated third parties will assume responsibility for: Employing staff and risks associated with the employment of staff; Establishing a separate bank account for the receipt of payments; Achieving outcomes of support choices identified within the support plan; Informing Adult Care and Support Services if circumstances or needs change; Ensuring they take out insurance cover, public liability insurance to the value of £2million and employee liability insurance to the value of £5million; where appropriate; Ensuring the expenditure is within budget and be responsible for any bank charges or legal costs incurred as a result of any overdraft; Contributing (if appropriate) towards the cost of their social care support or, if a nominated third party, ensuring payment of the client contribution as identified by RMBC’s Fairer Contributions Charging Policy; Complying with Rochdale Metropolitan Borough Council’s audit requirements, including permission to see copies of all original bank statements and any other information in relation to the Direct Payment account; Returning any unused monies. 12.5 Adult Care and Support Services will make sure that service users, carers, and nominated third parties have access to appropriate information to self manage their direct payment / personal budget if required. Support can be offered to: Understand the formal contractual agreement (direct payment) Signpost to care providers, personal assistants Signpost to information re: Insurance and Employment law 12.6 Adult Care and Support Services require that a Personal Budget via a Direct Payment is only used to meet the eligible assessed needs of individual service users and carers in accordance with their validated Support Plan. 13. PAYMENT OF A PERSONAL BUDGET VIA DIRECT PAYMENTS 13.1 Adult Care and Support Services will make a payment into a designated bank account every four weeks in line with predetermined RMBC pay dates. Final Policy Page 6 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) 13.2 Where a service user, carer or nominated third party receives a direct payment and is required to make a financial contribution towards the cost of their eligible support need, the payment will be made net of any service user contribution. 13.3 Rochdale MBC is unable to recover VAT on goods and services which are bought with a personal budget. Therefore any goods and services purchased are regarded as being purchased directly by the service user, carer or nominated third party and they are liable for any VAT that is incurred. 13.4 In order to extend the benefits of choice and control to as many service users and carers as possible, particularly those who lack capacity Adult Care and Support Services will permit payments to a nominated third party to manage the delivery of support to meet the eligible needs of service users and carers. 13.5 Service users and carers are permitted to enter into a contractual arrangement with a broker to act on their behalf to either receive a direct payment and/or take on any employment and payroll responsibilities associated with meeting their eligible needs. 13.6 For such an arrangement to be permitted the service user or carer must remain in control of directing his or her service and making key decisions, with assistance if required, for example deciding who their personal assistant will be. 13.7 The service user, carer or nominated third party will have responsibility for arranging the agreement with a broker. The arrangement will be between the service user or carer and the third party. Adult Care and Support Service will not be a party to any such agreement. 13.8 Setting up a trust fund is a way of enabling a service user to benefit from the choice and control that direct payments bring. 13.9 The direct payment recipient cannot be one of the trustees but, as the person getting the care, should be central in any planning meetings and have their wishes respected. 13.10 Adult Care and Support Services recommend that trustees should seek independent financial advice and legal advice concerning the legal obligations of becoming a trustee. 14. 14.1 DIRECT PAYMENT USES AND EXCLUSIONS It is impossible to draw up a comprehensive list of services and goods that a direct payment can be spent on. The underlying principle is that a service user must be able to demonstrate that all services and goods purchased address their eligible social care support outcomes and: Link to the Support Plan and the positive outcomes identified Will maintain or improve quality of life Will ensure health, safety and wellbeing Respect identity, faith and cultural traditions Are a reasonable cost and in proportion to the Direct Payment Final Policy Page 7 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 14.2 Direct payments can be spent on: Employing support workers and personal assistants Employing a family member or partner or any close relative who does not live in the same household Buying services from an agency, organisation or the voluntary sector Buying equipment which will reduce longer term support needs 14.3 15. PPF1(a) Direct payments cannot be spent on: Employing a family member or partner or any close relative who lives in the same household (this includes; parent, parent-in-law, aunt, uncle, son, daughter, son-in-law, daughter-in-law, step-son or daughter, brother, sister, or the spouse or partner of any of these) Equipment that has been purchased from an auction, including on line sites such as eBay, Equipment that does not meet required safety standards Health services that the National Health Service would ordinarily provide, for example, registered nursing care, medication Anything illegal Any employment practice in breech of employment law which includes not paying employees the minimum wage, not registering an employee with Revenue and Customs, ‘cash in hand’ payments or not following any other employment regulations (nationality checks) Gambling Purchasing illegal substances Alcohol, cigarettes or tobacco Bills for everyday living that other sources of income would normally pay for including utility bills, household insurance, rent or mortgage payments, television licensing fee Daily living expenses including food shopping, newspapers, gas, or electricity Items that are a choice not associated with eligible social care needs and where purchase by the general public would normally be dependent on their circumstances, eg transportation/vehicle related costs, white goods, gym/leisure membership etc. PERSONAL BUDGET - MANAGED BUDGET 15.1 Adult Care and Support Services recognise that not all service users have the desire or capacity to plan for and meet their own support needs with a cash payment. 15.2 Adult Care and Support Services will commission support services on behalf of service users or carers who choose to take all or part of their personal budget as a managed budget. 15.3 In such cases, a personal budget will be allocated and validated, and services will be commissioned within the agreed resources and in line with the service user or carer’s validated support plan. Final Policy Page 8 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) 15.4 Adult Care and Support Services will be responsible for the arrangement, direction, management and day to day organisation of commissioned support services. 15.5 All service users and carers who have eligible assessed needs are eligible to take all or part of their personal budget as a managed budget. 16. APPEAL 16.1 In cases where there is a dispute about a decision, the matter will be addressed in line with the Validation of Support Plans and the Use of a Personal Budget and Appeals Process (PPF 1 (b)) and ultimately with the joint health and social care complaints process. 16.2 The following aspects of self-directed support may be raised as an appeal: The ‘final agreement’ response on an assessment The amount of money allocated by the Resource Allocation System The way that the money has been varied to reach the final amount of a Personal Budget Limitation of choice in how a direct payment can be spent Refusal of a direct payment 16.3 For further information see the Appeal Procedure (PPF1(b)) 17. REVIEW 17.1 Reviews should be planned, and held, prior to leaving the STARS service or within six weeks of social care services being provided and,thereafter, on an annual basis or sooner if eligible needs change. 17.2 It is necessary to undertake a review in the event of any major changes being experienced by the service user or a service providers’ request. 17.3 During a review, there are six key areas to be addressed: i. Determine the person’s continued eligibility for support; ii. Establish how the services being provided have achieved the outcomes, as set out in the Support Plan; iii. Re-assess individual needs of the service user or carer by exploring the domains and sub-domains of the FACE documentation; iv. Where minimal support or assistive technology is being provided, by reassessing those domains which were previously explored; v. Commenting on the effectiveness of the use of personal budgets to address support outcomes, where appropriate; vi. Confirming, or amending, the current support plan, or considering closure if support is no longer required or eligibility criteria is no longer met. Final Policy Page 9 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) 17.4 A review may also determine that there are no longer any eligible needs in which case a personal budget will cease. 17.5 In the event of changes being required to the support plan it must be updated, and a copy given to the person and all involved professionals. 18. INITIAL FINANCIAL REVIEW 18.1 The purpose of an initial financial review, which is carried following the first 13 weeks of commencing a Personal Budget via cash payments, is three fold: Monitoring of services Monitoring of finances Monitoring of employer’s responsibilities 18.2 During an initial financial review the following issues must be addressed: Establish what services or goods have been purchased towards achieving support outcomes as defined in the Support Plan; Where appropriate, ensure that any client contributions towards the cost of social care support are being paid into the designated bank account on a regular basis; Confirm registration with Her Majesty’s Revenue and Customs (HMRC); Ensure sufficient public liability insurance to the value of £2m and employee liability insurance to the value of £5m if employing staff is in place 18.3 To assist with the initial financial review a checklist is available for use (Appendix 1). 18.4 A completed initial financial review checklist must be scanned onto ALLIS. 19. AUDIT OF BANK STATEMENTS AND EVIDENCE OF EXPENDITURE 19.1 In order to ensure that the monitoring of services, finances and employer’s responsibilities are proportionate the following bands have been introduced, each with a corresponding audit requirement. 19.2 If the total gross amount of the cash budget is less than £2,500 per annum and providing that the service user (or their nominated third party) does not have any difficulties and there are no administrative concerns we will adopt a light touch approach and carry out an annual audit of bank statements and evidence of expenditure. 19.3 If the total gross amount of the annual cash budget is less than £10,000 per annum an initial financial review will take place after 13 weeks and, providing there are no administrative concerns, annually thereafter in which all bank statements and evidence of expenditure relating to the Direct Payment account will be audited. Service users will be informed that Adult Care and Support Services reserve the right to carry out a random sample audit. Final Policy Page 10 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) 19.4 If the total gross amount of the annual cash budget is less than £25,000 per annum an initial financial review will be carried out after 13 weeks and providing there are no administrative concerns an audit of bank statements and evidence of expenditure will be carried out every six months thereafter. 19.5 If the total gross amount of the annual cash budget is more than £25,000 per annum an initial financial review will be carried out after 13 weeks and providing there are no administrative concerns an audit of bank statements and evidence of expenditure will be carried out every three months thereafter. 19.6 Any concerns regarding an audit of bank statements or evidence of expenditure could result in suspension or termination of the cash budget. 19.7 To assist with the audit of bank statements and evidence of expenditure a record of expenditure has been designed for use by staff and cash budget recipients (Appendix 2) 19.8 A completed record of expenditure to be scanned onto ALLIS. 20. SUSPENSION, TERMINATION & REPAYMENT OF A PERSONAL BUDGET DIRECT PAYMENT 20.1 A service user or carer can choose to terminate a direct payment at any time by providing four weeks notice in writing. 20.2 When a service user or carer chooses to end a direct payment, Adult Care and Support Services will undertake a review to determine how best to meet eligible assessed needs. 20.3 When a service user or carer chooses to terminate a direct payment and requires Adult Care and Support Services to commission services, Adult Care and Support Services will require a minimum of four weeks notice to make appropriate arrangements. 20.4 Adult Care and Support Services will suspend or terminate a direct payment when one or more of the terms of the formal contractual agreement are breached. 20.5 Adult Care and Support Services will provide sufficient notice to a service user or carer regarding a suspension or termination of their direct payment. The notice period will depend on the individual circumstances of each case, including the cause of the suspension or termination, an evaluation of risks and consideration of any other relevant factors. 20.6 In cases of illegal, fraudulent and/or wilful misuse of a direct payment on the part of the service user, a nominated third party or carer, Adult Care and Support Services will take action to recover all or part of the monies, where appropriate in accordance with Client Contribution and Debt Recovery Policies. Safeguarding Procedures will be followed in any cases of suspected abuse. 20.7 In all cases of illegal, fraudulent and/or wilful misuse of a direct payment the service user or carer will no longer be able to receive a direct payment and will receive a managed budget instead. Final Policy Page 11 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) 20.8 Adult Care and Support Services retains the option of taking over the management of a service user’s or carers’ direct payment for a short period of time, in circumstances when they have been assessed as no longer having capacity to manage their direct payment. 20.9 There are circumstances where service users or carers may have their direct payment suspended for a short but significant period as a result of hospital admission or some other unforeseen eventuality. 20.10 In such circumstances, Adult Care and Support Services will, together with the service user, carer and any representatives, review the particular circumstances of the case, including any ongoing contractual responsibilities, to determine the most appropriate course of action. 20.11 Adult Care and Support Services will act in a way that balances regard for the contractual obligations of service users and carers and promotion of continuity of services with the need to make best use of resources. 20.12 Service users and nominated third parties will be required to return to Adult Care and Support Services any portion of their cash budget: That is surplus to meeting their needs as agreed in their support plan That is not being held in order to save for an agreed purpose, or to make payment on any outstanding accounts or taxation liabilities. 20.13 If Adult Care and Support Services is not satisfied that the direct payment has been used for its intended purpose or if the conditions imposed in the support plan and formal contractual agreement have not been met, action will be taken to recover all or part of the monies in line with Client Contribution and Debt Recovery Policy. 20.14 In cases of wilful misuse or fraud, Adult Care and Support Services will take action to recover all or part of the monies, in accordance with Client Contribution and Debt Recovery Policies. 21. REVIEW This policy will be reviewed no later than December 2014. 22. KEY POLICY DOCUMENTS Legislation • • • • • • • • • National Assistance Act 1948 Health Services and Public Health Act 1968 (subject to LAC (93) 10) Chronically Sick and Disabled Persons Act 1970 Race Relations Act 1976 National Health Service Act 1977 Health and Social Services and Social Security Adjudications Act 1983 Mental Health Act 1983 Disabled Persons (Services Consultation and Representation) Act 1986 National Health Service and Community Care Act 1990 Final Policy Page 12 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 • • • • • • • • • • • • • • • • • PPF1(a) Carers (Recognition and Services) Act 1995 Data Protection Act 1998 Human Rights Act 1998 Health Act 1999 Freedom of Information Act 2000 Race Relations Amendment Act 2000 Local Government Act 2000 Care Standards Act 2000 Health and Social Care Act 2001 Local Government Act 2003 Community Care (Delayed Discharges etc.) Act 2003 Carers (Equal Opportunity) Act 2004 Mental Capacity Act 2005 Disability Discrimination Act 1995 as amended by the Disability Discrimination Act 2005 Equalities Act 2006 Safeguarding Vulnerable Groups Act 2006 Mental Health Act 2007 Policy and Guidance: • • • • • • • • • • • • • • • Independent Living Fund (1983) National Service Framework for Older People (2001) Valuing People (2001) Fair Access to Care Guidance (2002) Code of Practice for the Mental Capacity Act 2005 Independence, Well-being and Choice (2005) Improving the Life of Disabled People (2005) Independent Living Strategy (2006) Our Health, Our Care, Our Say: a new direction for community services (2006) Strong and Prosperous Communities: Local Government White Paper (2006) A Stronger Local Voice (2007) Building on Progress Public Services (2007) Putting People First (2007) The New Performance Framework for Local Authority and Local Authority Partnerships (2007) National Carers Strategy: Carers at the heart of 21st century families and communities: a caring system on your side, a life of your own (2008) Local Authority circulars: • • • • • LAC (2001) 6 Better Care Higher Standards LAC (2001) 32 Fairer Charging Policies for Home Care and Other non-residential Social Services - Guidance for Councils with Social Care Responsibilities LAC (2003) 14 Changes to Local Authorities Charging Regime for community equipment and intermediate care services LAC (2004) 24 Community Care Assessment Directions LAC (2008) 1 Transforming Social Care Final Policy Page 13 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) APPENDIX 1 INITIAL FINANCIAL REVIEW CHECKLIST (6 WEEKS) Name: ALLIS ID Number: Date of First Payment: Date of Review: If only using a provider agency complete 1, 2, 7 and 8 (if appropriate) 1 Payments into DP account? 2 Evidence of client contributions? 3 4 5 Public liability insurance to the value of £2m + employee liability insurance to the value of £5m? Criminal Records Bureau checks relating to those employed to provide care and support have been obtained? Confirmation of HMRC registration or Appointed Agent 6 Contracts of employment in place? 7 Any change in financial circumstances? 8 Any other issues? Signature of Direct Payment Recipient or Nominated Third Party: Signature of Reviewing Officer: Date document scanned onto ALLIS Final Policy Page 14 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) APPENDIX 2 DIRECT PAYMENT AUDIT – RECORD OF EXPENDITURE Name: Date: I confirm that the information I have provided is an accurate record of how I have spent my / my client’s Direct Payment Signature: 1. 2. Date: Balance brought forward from previous summary: Direct Payment amount: Other income: Interest: TOTAL: 3. Unpresented cheques from previous quarter: PA / Agency / Invoice Cheque Date Bank Number Number Statement Number Amount £ TOTAL: Final Policy Page 15 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 4. PPF1(a) Payments to PAs / Care Agencies / Invoices: PA / Agency Name / Invoice Number Cheque Number Date Bank Statement Number Amount £ TOTAL: Final Policy Page 16 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 5. PPF1(a) Other Expenses: Description Cheque Number Date Bank Statement Number Amount £ TOTAL: 6. Total Expenditure: (Boxes 3, 4 and 5) 7. Balance carried forward to next summary: (Boxes 1 + 2 minus box 5) 8. All cheques issued but not yet cashed for this quarter only: Final Policy Page 17 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) 9. Income tax to pay next quarter: Employee’s National Insurance to pay next quarter: Employer’s National Insurance to pay next quarter: TOTAL: 10 11 12 £ Unspent combined start-up (£0 if quarter 4): Total calculated amount of 4 week contingency money (including client contribution) for quarters 1 to 3: Total to return to Rochdale Metropolitan Borough Council: Direct Payment Support Manager Brook House Oldham Road, MIDDLETON, M24 1AY £ COMMENTS: Date sent to Direct Payment Support Manager Final Policy Page 18 of 19 Adult Care and Support Services Manual Issued February 2011, Amended October 2013 PPF1(a) Date document scanned onto ALLIS Final Policy Page 19 of 19