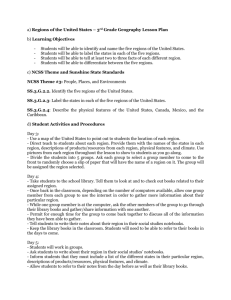

IBP_Project_PinPane - Pc

advertisement