Currency - click me

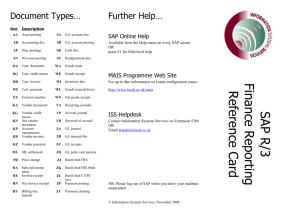

advertisement