TIC Feasibility Study

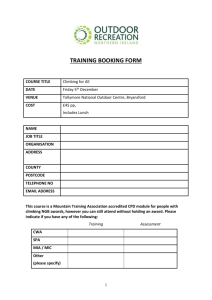

advertisement