Computerized Accounting & Financial Reporting in Uganda

advertisement

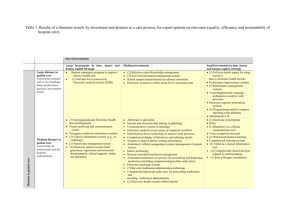

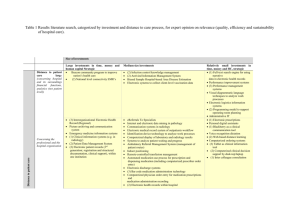

THE IMPACT OF COMPUTERIZED ACCOUNTING ON FINANCIAL REPORTING IN MANUFACTURING FIRMS IN UGANDA A CASE STUDY OF UGANDA BREWERIES LIMITED BY BYENKYA DENIS MARK REG: NO. 07/U/4799/EXT SUPERVISED BY: MR. KINTU ISMAlL A RESEARCH REPORT SUBMITTED TO THE SCHOOL OF DISTANCE AND LIFE LONG LEARNING IN PARTIAL FULFILLMENT OF THE REQUIREMENT FOR THE AWARD OF THE BACHELOR OF COMMERCEOF MAKERERE UNIVERSITY JULY 2011 DECLARATION I, Byenkya Denis Mark, declare that the following research report is my original work and to the best of my knowledge has never been submitted to any university for any academic purpose. Signed…………………………….. Date:……………………………. Byenkya Denis Mark i APPROVAL This work entitled “the impact of computerized accounting on financial reporting in manufacturing firms in Uganda” has been compiled under my supervision and I approve it fit for examination. Signed:________________________ Date:_________________ Mr. Kintu Ismail ii DEDICATION This book is dedicated to my dear family especially the late Dad John Byenkya, Mum Mrs. Margaret Kiwanuka, my brothers David, John and sisters Mary and Cissy and all my friends who tirelessly encouraged me throughout my course never to give up on any battle. I am sure they will celebrate with me for my success. iii ACKNOWLEDGEMENT This work would not have been completed without the efforts of my Supervisor, fellow students and friends. Am grateful for their help. I would like to thank my Supervisor – Mr. Kintu Ismail for his tireless efforts and professional advice for inspiring me compile this piece of work. I am grateful to my family especially mum, sis and bro for financial and moral support my God bless them abundantly. Also special regards to all the lecturers of Makerere University Kampala who taught me for the knowledge I acquired which has made me a better person. Finally am very grateful to the Almighty God, for His love, kindness, endless support and protection throughout my life. I will praise you for ever Amen iv ACCA LIST OF ABBREVIATIONS -Associated of the Chartered Association of Certified Accountants IFRS - International Financial Reporting Standards v TABLE OF CONTENTS DECLARATION ............................................................................................................................. i APPROVAL ................................................................................................................................... ii DEDICATION ............................................................................................................................... iii ACKNOWLEDGEMENT ............................................................................................................. iv LIST OF ABBREVIATIONS ......................................................................................................... v TABLE OF CONTENTS ............................................................................................................... vi LIST OF TABLES .......................................................................................................................... x ABSTRACT ................................................................................................................................... xi CHAPTER ONE ......................................................................................................................... - 1 10. Introduction ......................................................................................................................... - 1 1.1 Background to the Study ..................................................................................................... - 1 1.2 Problem Of Statement ......................................................................................................... - 3 1.3 Purpose of the Study............................................................................................................ - 3 1.4 Objectives of the Study. ...................................................................................................... - 3 1.5 Research Questions. ............................................................................................................ - 4 1.6 Subject Scope ...................................................................................................................... - 4 1.7 Time Scope .......................................................................................................................... - 4 1.8 Geographical Scope ............................................................................................................. - 4 1.9 Significance of the study ..................................................................................................... - 4 CHAPTER TWO ........................................................................................................................ - 5 LITERATURE REVIEW ........................................................................................................... - 5 vi 2.0 INTRODUCTION ................................................................................................................ - 5 2.1 COMPUTERIZED ACCOUNTING SYSTEMS ................................................................. - 5 2.1.1Overview on computerized accounting .............................................................................. - 5 2.1.2 Computerized accounting .................................................................................................. - 5 2.1.3 Benefits of computerized account system.......................................................................... - 6 2.2 QUALITY OF GOOD FINANCIAL REPORTING .......................................................... - 7 2.2.1 The qualities of financial reports ..................................................................................... - 8 2.3 RELATIONSHIP BETWEEN COMPUTERIZED ACCOUNTING AND FINANCIAL REPORTING ............................................................................................................................ - 10 2.3.1 Computerized accounting on financial reporting is linked to benefits applying computer system while generating financial reports................................................................................. - 10 2.4 CONCLUSION ................................................................................................................. - 11 CHAPTER THREE .................................................................................................................. - 13 RESEARCH METHODOLOGY.............................................................................................. - 13 3.1 INTRODUCTION ............................................................................................................. - 13 3.2 RESEARCH DESIGN ...................................................................................................... - 13 3.3 POPULATION OF THE STUDY ..................................................................................... - 13 3.3.1 Population size ........................................................................................................... - 13 - 3.3.2 Sampling size and composition .................................................................................. - 14 - 3.3.2 Sampling design ......................................................................................................... - 14 - 3.4 SOURCES OF DATA COLLECTION ............................................................................. - 14 3.4.1 Primary data ............................................................................................................... - 14 vii 3.4.2 Secondary data ........................................................................................................... - 14 - 3.5 DATA COLLECTION TOOLS ........................................................................................ - 15 3.5.1 Questionnaires ............................................................................................................ - 15 - 3.5.2 Interviews ................................................................................................................... - 15 - 3.6 DATA PRESENTATION AND ANALYSIS ................................................................... - 15 3.7 DATA ANALYSIS ........................................................................................................... - 15 3.8 LIMITATIONS OF THE STUDY .................................................................................... - 15 3.8.1 Limited source of information.................................................................................... - 15 - 3.8.2 Scarcity of time .......................................................................................................... - 16 - CHAPTER FOUR ..................................................................................................................... - 17 PRESENTATION, ANALYSIS AND INTERPRETATION OF THE STUDY FINDINGS . - 17 4.1 Introduction ....................................................................................................................... - 17 4.2 Characteristics of Respondents ........................................................................................ - 17 4.2.1 Age and Gender .......................................................................................................... - 17 - 4.2.2 Marital status .............................................................................................................. - 18 - 4.2.3 Level 1 of Education .................................................................................................. - 18 - 4.2.4 Duration the employees have been in the firm .......................................................... - 19 - 4.3 The benefits of computerized accounting systems to the firm .......................................... - 20 4.3.1 Computerization of the accounting function .............................................................. - 20 - 4.3.2 Computerized accounting packages used in the firm ...................................................... - 20 4.3.3 Benefits of the computerized accounting systems to the firm ................................... - 21 - 4.4 The qualities of financial reports ....................................................................................... - 23 viii 4.5 The relationship of computerized accounting systems on financial reporting ................. - 25 4.5.1 Computerized accounting and financial reporting ..................................................... - 25 - 4.5.2 The relationship between computerized accounting systems and financial reporting. .... - 25 CHAPTER FIVE ...................................................................................................................... - 27 5.0 DISCUSSIONS, SUMMARY, CONCLUSION AND RECOMMENDATIONS ............. - 27 5.1 INTRODUCTION .............................................................................................................. - 27 5.2 DISCUSSIONS OF THE FINDINGS ................................................................................ - 27 5.2.1.1 Quick financial reports .................................................................................................. - 27 5.2.1.2 Improvement in business performance ......................................................................... - 28 5.2.1.3 Understandability .......................................................................................................... - 28 5.3 SUMMARY OF THE FINDINGS ..................................................................................... - 28 5.3.1 Characteristics of the respondents ................................................................................... - 28 5.3.2 Computerized accounting and its benefits ....................................................................... - 28 5.4 FINANCIAL REPORTING AND ITS QUALITIES ......................................................... - 30 5.5 RELATIONSHIP between COMPUTERIZED ACCOUNTING SYSTEM AND FINANCIAL REPORTING...................................................................................................... - 30 5.6 CONCLUSION ................................................................................................................... - 31 5.7 RECOMMENDATIONS .................................................................................................... - 31 REFERENCE:........................................................................................................................... - 34 APPENDIX 1: RESEARCH QUESTIONNAIRE.................................................................... - 36 - ix LIST OF TABLES Table 1: Sample size and composition..................................................................................... - 14 Table 2: Shows respondents’ Age and Gender ........................................................................ - 17 Table 3: Shows the Marital status of the respondents.............................................................. - 18 Table 4: Shows duration the employees have worked in the firm ............................................ - 19 Table 5:Shows responses on whether the accounting functions of the firm are computerized - 20 Table 6: Computerized accounting packages used in the firm ................................................ - 21 Table 7: Benefits of the computerized accounting systems to the firm .................................... - 21 Table 8:Responses on assessing the benefits of computerized accounting system to the firm expressed in numerical term. .................................................................................................... - 22 Table 9: Responses on examination of qualities of financial reports generated by the firm .... - 24 Table 10: Responses on the relationship of computerized accounting on financial reporting - 25 Table 11: Correlations............................................................................................................... - 26 - x ABSTRACT This study was conducted to assess the impact of computerized accounting on financial reporting in Uganda Breweries Limited. The study was set to address the objectives of assessing the benefits of computerized accounting in Uganda Breweries Limited, examining the qualities of financial reports produced by Uganda Breweries and the relationship of computerized accounting and financial reporting in manufacturing firms. The researcher used a descriptive and analytical research design to establish a relationship between two variables and to exhaust all areas in the research. A sample size of 30 employees from various department was used and sampled on a nonrandom purposive method. Questionnaires and interviews were used to collect data which was processed by tabulation, and also narrations inform of description was accounted for for easy understanding of the findings. While assessing the benefits of computerized accounting system, the findings indicated that 67.7% respondents were in agreement that computerized accounting systems minimizes errors and allows easy posting of transactions on ledger, 24.44% disagree with the view. On examining the qualities of financial reports generated by firm, 87.5% of the respondents accepted that financial reports produced are reliable and 12.5% respondent disagreed. The researcher found out that Uganda Breweries runs a fully computerized accounting system in financial reporting thus benefiting from the system. The firm is able maintain the financial report qualities of timeliness, reliability, accuracy because of computerized accounting system. xi The research recommended that there is need to consult with system analyst to match the company’s information needs with available software. Training staff, proper authorization and use of appropriate accounting software will save time, and fewer mistakes in the company. xii xiii CHAPTER ONE 10. Introduction This study was about assessing the impact of computerized accounting on financial reporting in manufacturing firm in Uganda. The chapter presented the background of the study, statement of problem, objectives of the study, research questions, and the significance of the study. 1.1 Background to the Study Financial reporting information that is useful to present or potential investors, creditor and other users in assessing the amount timing and uncertainties of prospective net cash inflow to the related enterprise or organization (William 1998) Financial reports can be described as a comprehensive summary of a firm’s financial data over a period of time, such as a month, three month, a year or even the life of the business (Everand 1998) There are different types of financial reporting which includes the statement of financial position which indicates the financial position of the firm. The statement of affairs of business of a particular moment of time, statement of comprehensive income which explains what happened to a business as a result of operations. Financial reports should be perceived to true and fair and this depends on the existence of proper internal control/systems. Manufacturing firms have been in operations for decades in Uganda. Majority of them have been successful is the operation (Indira 2008). The success of these firms in the eyes of the potential stake holders is seen in the financial performance. The financial performance of the firms is visible in the financial reports prepared by the firms. -1- Manufacturing firms every where in the world can improve on their state of reporting financial affairs by employing use of computer systems referred to as computerized accounting system which ease processing of accounting data. Computerized accounting system is the application of the computer based software used to input process, store out put accounting information (Millichamp 1995). The application is to support advancing technologies that enable firms to use computer programmes to perform tasks that were previously done manually. The need for computerization of accounting system is due to increase in the number of transactions as a result of the policy of continuous expansion of the business. It is noted that business accounting records can not be accurately maintained when the firm expands and when the system is not computerized it is the computer based system that the firm can use to post numerous transaction to the right ledgers and prepare proper financial statements. It is from this need that Uganda breweries industry considers it very important to computerize its systems and different functions as it considers two mandatory rules that govern its operations, technology must benefit your business and if technology does not benefit your business then you don’t need it. For this reason, the accounting section which the firms considers very important is highly computerized for the purpose of improving on record keeping, proper maintenance of different loss of cash or loss of accounting records. Computerized accounting system in commercial organization that will help to integrate, simplify and streamline all the business processes and transaction cost effectively and easily (Indira 2008) Business organization should adopt a suitable accounting package in order to derive benefits from it (Mike et al 2006) for instance for a small business, personal finance organizer like -2- quicken, Microsoft money and quick books are usually good enough to handle accounts of a small businesses. It’s however noted that the way accounting data is entered, processed and stored has considerably changed. It is no longer necessary to have huge roomful of ledgers and record, there is accuracy and efficiency in keeping records, low case of omission and loss of accounting records. These changes in financial reporting might be due to several factors. Therefore the researcher focuses on investigating the impact of computerized accounting in manufacturing firms. 1.2 Problem Of Statement Manufacturing firms have changed the way they present their financial reports with developments in new innovations of accounting softwares. A report from survey on manufacturing firms in East Africa indicate a way of financial statements have tremendously improved (Indire 2008) However lack good financial reporting will not ensure efficiency and effectives in record keeping hence miss leading reports or accounts. This has prompted the researcher to investigate into the phenomenon. 1.3 Purpose of the Study. The purpose of the study was to assess the impact of computerized accounting on financial reporting in manufacturing firms in Uganda. 1.4 Objectives of the Study. (i) To assess the impact of computerized accounting to manufacturing firms in Uganda. (ii) To examine the qualities of financial reports produced by the manufacturing firms in Uganda. -3- (iii) To establish the relationship of computerized accounting and financial reporting in manufacturing firms in Uganda. 1.5 Research Questions. (i) What is the impact of computerized accounting to manufacturing firms in Uganda? (ii) What are the qualities of financial reports produced by the manufacturing firms in Uganda? (iii) What is the relationship between computerized and financial reporting in manufacturing firms in Uganda? 1.6 Subject Scope The scope of the study was confined on impact of computerized accounting on financial reporting in a manufacturing firm in Uganda. 1.7 Time Scope The study covered the period of (2006-2010) 1.8 Geographical Scope The researcher carried out in Uganda breweries located in Luzira, Kampala. 1.9 Significance of the study The study is expected to make the following contribution. The study help management of different organizations in determining what best accounting soft wares to adopt in order to improve on performance of the firms. The management will be able to understand the significance of preparing quality and reliable financial reporting. The research will help me be awarded bachelors degree in commerce -4- CHAPTER TWO LITERATURE REVIEW 2.0 INTRODUCTION This section of literature review focused on subject matter of computerized accounting in relation to financial reporting in a manufacturing firm. The literature was presented in order of the stipulated objectives of the study. 2.1 COMPUTERIZED ACCOUNTING SYSTEMS 2.1.1 Overview on computerized accounting An accurate accounting record is a virtual part of any organization apart from helping it to keep its float financially and legally. Its requirement of small groups to manage with simple book keeping procedures but bigger groups juggling with large sums of money and complex financial transactions may find their workload used by using a computerized system (Marivic, 2009). 2.1.2 Computerized accounting Computerized accounting involves the use of computers to handle large volume of data with speed, efficiency and accuracy aimed at overcoming the fundamental however, does not mean change in principle, the principle of accounting remains the limitations of manual accounting and hence producing quality and reliable work same with day books ledgers double entry only that the accounting processing is done by computer packages (ACCA, 2007). -5- A computerized accounting system is a delivery system of accounting information for purpose such as providing reliable accounting information to users (Nash and Hearly, 2003). Computerization of system can certainly help in minimizing some errors when preparing accounting records (Mike et al, 2006). Other view adds that computerized systems are advantageous in consolidating information channels meaning that files which had previously been duplicated by several departments are now consolidated into a single file (Mc Rae, 1998). A computerized accounting system is a system that uses computers to input, process, store and output accounting information in form of financial reports. It records all transactions that routinely deal with the events that affect the financial position and performance of the entity. 2.1.3 Benefits of computerized account system Different scholars have expressed views on computerized accounting packages as below: A computerized package can quickly generate all types of records needed by management. Data processing and analysis are faster and more accurate which meets the manager’s needs for accurate and timely information for decision making (Mc Bride, 2000). -6- The benefits of computer accounting include among others improving reporting to users, better record keeping and minimized errors. With the system automatically generating reports, a lot of time will be saved in the long run and unnecessary cost. Few staff will also be needed to operate the system (Vanbriefing, 2005). In support of above view, computerized accounting is used to maintain journals, ledgers and prepare financial statements (Meigs and Meigs, 1998). Easy posting transaction to ledger and principles of double entry to do accounting function using computerized accounting system. It can be largely automated by use of systems (Cook, 2001). 2.2 QUALITY OF GOOD FINANCIAL REPORTING Financial reporting refers to preparation of financial statements by the business necessary in making decision by management (Kakuru, 2003). Good financial reporting is all about presenting useful information to users so that proper decision can be made and data presented. Financial reporting should provide information about entity’s economic resources, claims against those resources, owner’s equity and changes in the resources and claims (Frankwood, 1999). -7- Financial reporting should provide information that is useful to present or potential investors, creditors and other users in making national investment, credit and similar decision making (Larson et al, 1995). 2.2.1 The qualities of financial reports Quality information Quality information depends on the intended users of the information and should be evaluated with respect to the users. Accounting qualities include relevance and reliability, neutrality, comparability, consistency and understandability/timeliness. Reliability: Information is said to be reliable if it is from material errors and bias and represents faithfully that is purport to represent emphasized (Frankwood, 1999). Reliable information is verifiable faithfully representative. Neutrality: The demand of accounting information should not be selected to benefit one class and neglect the other. Reliable information is verifiable neutral. Comparability: Is another characteristic of quality information; user must be able to compare financial statements of enterprises over time in order to identify trends in financial position (Frankwood, 1999). -8- The relationship between two or more pieces of information that enables users to identify and explain the difference between financial data (Nacubo, 2000). Timeliness: Financial information to benefit user must be presented at the right time otherwise it loses relevance (Frankwood, 1999). Understandability: Information can be put to use easily by the users and formatted in a way that is understandable (Wood, 1997). The users are assumed to have reasonable knowledge of business and willing to study and understand the information (Thatcher, 2005). Relevance: Financial information is relevant if investor can use it to make investment decisions and the information should enable investors to estimate the risk of an investment (Turner, 2000). Preparation of financial statements Statement of financial position It provides information about an entity’s assets and liabilities, the entity’s resource structure (major classes and amounts of assets) and its financial structure (major classes and amounts of liabilities) and ownership interests (Neil, 1996). -9- Statement of comprehensive income It records sales and purchases as well as expenses incurred during the financial reporting. Statement of cash flow A cash flow statement (together with its related notes) reflects an entity’s in flows and outflows during a period information helps user to assess factor such liquidity, risk relationship between profits and cash flow. 2.3 RELATIONSHIP BETWEEN COMPUTERIZED ACCOUNTING AND FINANCIAL REPORTING 2.3.1 Computerized accounting on financial reporting is linked to benefits applying computer system while generating financial reports. Computerized accounting systems have been credited for their quick processing speed and large storage capacity. Using computerized accounting system ensures up-to-date account balances are available any time for management to make quick decisions (Lancouch, 2003). Quality of financial reports is assured with computerized accounting system as compared to manual systems. The method of inputting and processing data is sophisticated thus accuracy of data is improved. This means that financial reports will bear minimum errors. - 10 - Computerized system will foster accessibility and faster transformation of information stored in computers, hence financial reports can easily be accessed through online system without delay and timely decision making (Kwarijuka, 1998). The use of computer based systems in manufacturing firms will enable employees from various function areas and branches to generate timely financial reports which enable managers to monitor business operations and important finance decisions (Wailes, 1999). A computerized accounting system is a delivery system of accounting information as providing reliable accounting information to users. So records of expenditure and incomes and assets, liabilities, revenue expenses must be documented and transferred to general ledger of firm’s financial details to be analyzed for future financial decisions. 2.4 CONCLUSION Computerized accounting is faster and efficient in processing information. As the properties of information continue to change, the accounting system should become flexible enough to meet the need of users. Automated generation of accounting document like invoices, cheques and statement of accounting with the larger reduction in the cost of hardware and software and availability of user-friendly accounting software package with relative cheap maintenance. In order to promote quality of financial reporting, there is need of feedback regarding the way in which user determines quality (Mangiameli et al, 1999). - 11 - Financial reports need provide feedback in order to prepare good reports enable constantly updating the system. - 12 - CHAPTER THREE RESEARCH METHODOLOGY 3.1 INTRODUCTION This Chapter presents the research designs, techniques, method of data collection, study population, sampling and procedures of data collection, data presentation and analysis and the limitations. 3.2 RESEARCH DESIGN The researcher used a descriptive and analytical research design in establishing a relationship between financial reporting and computerized accounting in manufacturing firms. Both methods were applied in order to exhaust all the areas in research. The study is based on a single case study to enable a broad cross section of researchers in order to facilitate the great understanding of the phenomenon and apply a series of statistical tests to help in the presentation of the data to the researcher. 3.3 POPULATION OF THE STUDY The study population consisted of mainly employees who use the computerized accounting software. 3.3.1 Population size The study population was about 30 members mainly employees who use computerized accounting software and these include sales department team, accounting team and procurement team. - 13 - 3.3.2 Sampling size and composition Table 1: Sample size and composition Respondent Population size Sample Top level management 5 3 Financial Controller 10 5 Finance Manager 15 10 Source: Researcher computation 3.3.2 Sampling design The study was carried out using purposive sampling. It is the sampling method used to carry out research for data for a specific purpose and this was applied by selecting top level and lower level management. 3.4 SOURCES OF DATA COLLECTION The researcher used both primary and secondary sources of data. 3.4.1 Primary data This was obtained from the respondents who included the above mentioned levels of management representatives. 3.4.2 Secondary data This was obtained from periodical reports and company profile, book reviews and other publications and surfacing internet on specific websites. - 14 - 3.5 DATA COLLECTION TOOLS The researcher used questionnaires, and interviews to obtain up-to-date information. 3.5.1 Questionnaires The researcher set questions and devices to respondents to fill and the researcher used responses to make conclusion. 3.5.2 Interviews These involved face-to-face interactions with the respondents where the interviewer asked questions that respondents answered. 3.6 DATA PRESENTATION AND ANALYSIS The researcher analyzed and made complete interpretation of results. The data was collected together, compared and this enabled the researcher to develop new ideas of other sources. The data presented in a report was documented and was in form of tables, graphs and SSPS. The questionnaire was edited to remove inconsistence. 3.7 DATA ANALYSIS After the collection of raw data, it was presented using frequency tables in raw figures and percentages of the results were then to be calculated using tools like SPSS and Spearman’s Correlation were used to analyze data. 3.8 LIMITATIONS OF THE STUDY 3.8.1 Limited source of information The research in this area was few therefore was limitation of information on the study/research topic, however the researcher used internet to get information. - 15 - 3.8.2 Scarcity of time The limitation of time factor to complete the research, however the researcher tried to budget time properly to see that the report was finished in time. The researcher was limited by finance To facilitate conduct of research in terms of printing and looking for information, however the researcher tried to solicit for funds to enable a successful compilation of the research report or work. - 16 - CHAPTER FOUR PRESENTATION, ANALYSIS AND INTERPRETATION OF THE STUDY FINDINGS 4.1 Introduction This Chapter is about presentation, analysis and interpretation of the study findings. This presentation, analysis and interpretation were done using computational percentage tables, graphs and also narrations in form of description was accounted for easy understanding of the findings. 4.2 Characteristics of Respondents The respondent’s bio-data was looked at in terms of gender, age, marital status and level of education. 4.2.1 Age and Gender The gender and age of the respondents were revealed as shown below: Table 2: Shows respondents’ Age and Gender Gender Age Total Percentage 18-25yrs 26-35yrs Above 36yrs Male 7 10 4 21 70 Female 3 5 1 9 30 Total 10 15 5 30 100 Source: Primary data - 17 - From the table above, 70% of the respondents were males while 30% of them were females. This implies that the data obtained was gender biased because the human resources Uganda Breweries Ltd is more of males than females. Most of the respondents were aged between 26-35 years which is a very active and productive age bracket. 4.2.2 Marital status The marital status of the respondents obtained from the study was shown as below: Table 3: Shows the Marital status of the respondents Marital status No. of respondents Percentage (%) Single 10 67 Married 20 33 Total 30 100 Source: Primary data The findings indicated that 33% of the respondents are married and only 67% are single which implies that the data was obtained mainly from responsible and credible respondents hence its reliability. 4.2.3 Level 1 of Education The response about the education level of the respondents was presented in the table below: Table 3: Shows level of education of respondents Education level No. of respondents Percentage (%) Certificate 5 17 Diploma 7 23 Degree 15 50 - 18 - Masters 3 10 Total 30 100 Source: Primary data The findings in the table above show that 50% of the respondents are degree holders, 23% are diploma holders, 10% have masters qualification and only 17% have certificate qualification. This implies that data for the study was obtained from learned respondents who have easily got adopted to use computer based systems hence the reliability of the data. 4.2.4 Duration the employees have been in the firm The respondents were asked for how long they have been working in the firm. However, the responses to the question were tabulated as indicated below: Table 4: Shows duration the employees have worked in the firm Duration No. of respondents Percentage (%) Less than 2 years 2 6 3-4 years 8 27 Above 5 years 20 67 Total 30 100 Source: Primary data The findings in the table above show that 67% of employees have worked in the firm for over 5 years which therefore an indication of low labour turnover, 27% have worked for the period between 3-4 years and only 6% have been in the firm for a period less than 2 years. This implies that the data was obtained from respondents who had gotten experience on the use of the computerized systems and were also more familiar with the variables under study that is computerized accounting and financial reporting. - 19 - 4.3 The benefits of computerized accounting systems to the firm In assessing the benefits of computerized accounting, the researcher considered whether the firm’s accounting function was computerized, then the computerized packages used and their benefits to the firm. 4.3.1 Computerization of the accounting function When the respondents were asked whether the firm’s accounting functions are computerized, the responses obtained were tabled as below: Table 5: Shows responses on whether the accounting functions of the firm are computerized Response Frequency Percentage (%) No 11 36.7 Yes 19 63.3 Total 30 100 Source: Primary data From the table above, majority of the respondents (63.3%) responded that the firm’s accounting functions are fully computerized while only 36.7% said that the system is not computerized. This implies that the firm’s accounting functions are computerized and efficiency in preparing and handling accounting records. 4.3.2 Computerized accounting packages used in the firm When asked on what computerized accounting packages the firm uses the responses obtained were shown as below: - 20 - Table 6: Computerized accounting packages used in the firm Response Frequency Percentage (%) Quick Books 4 13.3 Sage 26 86.7 Tally 0 0 Others 0 0 Total 30 100 Source: Primary data The above table shows that Sage (86.7%) is the mostly used computerized accounting package in the firm while Quick Books (13.3%) and no other packages are used in the firm. 4.3.3 Benefits of the computerized accounting systems to the firm When the researcher asked the respondents on whether computerization of accounting function benefits the firm. The following were responses tabled below: Table 7: Benefits of the computerized accounting systems to the firm Responses No. of responses Percentage (%) Yes 20 66.7 Not sure 4 13.3 No 6 20 Total 30 100 Source: Primary data The above presentation (66.7%) of the respondents pronounced that computerized accounting benefits the firm while 20% of them did say it has no benefits and only 13.3% were not sure of - 21 - the benefits to the firm. This therefore implies that the employees of the firm are aware of the benefits that the system offers to the firm. After enquiring whether computerized accounting benefits the firm, the researcher focused on assessing the benefits in form of statement that presented the elements of the system on financial reporting and findings were summarized. Table 8: Responses on assessing the benefits of computerized accounting system to the firm expressed in numerical term. Benefits Responses Total A N D Quick financial/reports 20 5 5 Improvement in business 15 3 Accuracy and efficiency 25 Simplified posting Percentage (%) A N D 30 60.5 14.5 25 12 30 80 7.5 12.5 0 5 30 70 5 25 25 3 2 30 75 5 20 Minimized errors 18 0 12 30 90 0 10 Easy auditing 19 6 5 30 63.3 20 16.7 Total responses 122 13 44 180 Responses percentage 67.7 7.22 24.44 100 Source: Primary data The above shows the following: 60.5% of the respondents agreed that financial statements are quickly generated while 25% disagreed with the statement and only 14.5% had neutral idea on the statement. 80% of the respondents agreed that computerized accounting system improves business performance, 12.5% disagreed with the statement while only 7.5% were neutral. - 22 - 70% agreed that accurate and efficient records are kept with computerized systems, while 25% disagreed with the statement and 5% were of a neutral view. 75% of the respondents agreed that posting transaction to ledgers are simplified with computerized accounting while 20% disagreed and only 5% were neutral. Findings also showed that 90% of the respondents agreed on the minimization of the arithmetic errors and 10% disagreed and no one had a neutral view. 63.3% of the respondents agreed that auditing of financial statement is eased when accounting system is computerized, 20% had neutral view and 16.7% disagreed with the statement. However, the overall findings indicate that 67.7% responses were in agreement with the statements while 7.22% disagreed with the statement and 24.44% have mixed views on the notion. These findings imply that the computerized accounting bears a lot of benefits in minimization of errors and easy posting transaction on ledger and easing auditing of the statement. The researcher established that Uganda Breweries Ltd considers two mandatory rules that govern its operations, technology must benefit the business. 4.4 The qualities of financial reports The Researcher was interested in examining the financial reports generated by the firm in order to find out whether they meet the basic qualities. The qualities were examined in terms of reliability, relevance, understanding and timeliness. The findings are below: - 23 - Table 9: Responses on examination of qualities of financial reports generated by the firm Qualities Responses Percentages (%) Yes No Total Yes No Reliability 25 5 30 87.5 12.5 Timeliness 20 10 30 80 20 Relevance 22 8 30 70 30 Comparability 27 3 30 95 5 Understandability 30 0 30 100 0 Source: Primary data From the above presentation, it was found out that 87.5% of the respondents accepted that that the financial reports produced are very reliable while only 12.5% said that the reports are not reliable. 80% of them also sided with the timeless of the reports. 20% did not say that the financial reports produced are not timely to the user. Also 70% of the responses agreed that the financial reports are of relevance while 30% did not side. 95% pronounced that financial reports can easily be compared with previous reports while 5% did not side. 100% of the respondents said that the financial reports produced are easily understood. - 24 - 4.5 The relationship of computerized accounting systems on financial reporting 4.5.1 Computerized accounting and financial reporting When the researcher asked whether computerized accounting has relationship on financial reporting of the firm, the following responses were obtained: Table 10: Responses on the relationship of computerized accounting on financial reporting Responses No. of respondents Percentage (%) Yes 22 73.3 Not sure 2 6.7 No 6 20 Total 30 100 Source: Primary data The above table shows that 73.3% of the respondents responded Yes while 20% said No and only 6.7% were not sure therefore it implies that the relationship of computerized accounting on financial reporting in the firm. 4.5.2 The relationship between computerized accounting systems and financial reporting. To establish the relationship of computerized accounting on financial reporting in manufacturing firms under this objective the researcher used Person correlation coefficient to establish the relationship between the variables. (Computerized accounting and financial reporting) - 25 - Ho: computerized accounting systems have an effect on financial reporting Ha: computerized accounting systems have no effect on financial reporting Table 11: Correlations Spearman's rho Computerized accounting Correlation Computerized Financial accounting reporting 1.000 Coefficient Sig. (2-tailed) . .035 N Financial reporting .669* Correlation 30 30 .669* 1.000 Coefficient Sig. (2-tailed) N .035 . 30 30 *. Correlation is significant at the 0.05 level (2-tailed). From the above findings, it shows that there is a strong relationship between financial reporting and computerized accounting. At Pearson correlation coefficient r =0.669 The results as depicted from the table above (r2=0.669, P=0.35) suggest a positive effect on financial reporting on the management of Uganda breweries limited other factor taken care of - 26 - CHAPTER FIVE 5.0 DISCUSSIONS, SUMMARY, CONCLUSION AND RECOMMENDATIONS 5.1 INTRODUCTION This Chapter looks at discussions and summary of the findings based on the objectives, conclusions and recommendations of the study and suggested areas of further research. 5.2 DISCUSSIONS OF THE FINDINGS The researcher in his study based the discussions on the objectives of the study. 5.2.1 The benefits of computerized accounting to the firm The researcher when assessing the benefits of computerized accounting on financial reporting found out the following: 5.2.1.1 Quick financial reports The researcher found out that through computerized accounting financial reports can be generated very quickly. The quickness in generation of reports is due to the fact that through computerized accounting, data processing and analysis are faster and more accurate. With such advantage, managers can instantly access different information which leads to easy and quick decision making. - 27 - 5.2.1.2 Improvement in business performance The researcher observed that computerized accounting system results into improvement in business performance. That computerized system is a highly integrated application that transforms the business processes with its performance enhancing features. Accounting functions, inventory control and statutory reporting can easily be done hence resulting in access to business information for good decision making (Indira, 2008). 5.2.1.3 Understandability The researcher found that financial reports generated are very understandable to user. Financial information may be put easily by the user, financial reports need to be easily understood by the users as report acts as a way of communication between firm and stakeholders (Wood, 1996). 5.3 SUMMARY OF THE FINDINGS 5.3.1 Characteristics of the respondents The researcher revealed issues on computerized accounting and financial reporting. They survey basically covered employees in Uganda Breweries Limited a manufacturing firm in Uganda to assess how computerized accounting has impacted on financial reporting in the firm. The response rate was amazing that is all the selected respondents returned their questionnaires. 5.3.2 Computerized accounting and its benefits The research revealed that Uganda Breweries’ accounting systems are computerized and the most used accounting package is Sage as 86.7% of the respondents revealed so. The package has all functions of data entry, double entry system and report generation. Sage Software is used in the accounting section to handle the accounting function. Other accounting packages used are Quick Books which the firm uses in procurement and sales sections. The study also revealed - 28 - that the firm greatly benefits from computerization of accounting system as shown by 63.3% of the respondents. The illustrated benefits are summarized as below: Financial reports can quickly be prepared when required. There is a bearable improvement in business performance. Accuracy and efficiency in record keeping. Posting transactions in the ledgers are simplified. Arithmetic errors are also easily minimized. Auditing of financial statement is simplified as all records of transactions are recorded safely. Other benefits include handling automated book-keeping, bank reconciliation, payroll, VAT returns or large amounts of data. The study revealed the following shortfalls of using computerized accounting packages (Sage) by the firm: The software (Sage) is very expensive to acquire and also difficult to maintain. Human errors greatly affect the functionality of the system. It’s costly in case of breakdown or repair. Comparing the benefits and the shortcomings as revealed by the study, it is fair to assert that computerized accounting systems have been of great benefit to the firm notwithstanding the - 29 - short comings as indicated in many weaknesses as a result of human errors. If addressed, the firm can benefit more from use of computerized accounting system. 5.4 FINANCIAL REPORTING AND ITS QUALITIES The basic qualities of financial reports found out from the study include the following relevance, reliability, comparability and understandability. Others included completeness, accuracy and efficiency. The researcher also observed that companies must first recognize the users of financial information such as customers. To a customer, a quality financial report is one that helps one to make better decisions. Financial reports must be comprehensive, complete, easy to understand and accurate. Firms or companies need to have continuous improvement in the quality of their financial reporting. 5.5 RELATIONSHIP BETWEEN COMPUTERIZED ACCOUNTING SYSTEM AND FINANCIAL REPORTING Using the above finding, it implies that there is a strong relationship between computerized accounting system and financial reporting. Therefore computerized accounting has a strong relationship of (r2=0.669, P=0.35) this suggests a positive effect on financial reporting. - 30 - 5.6 CONCLUSION From the findings, it is evident that computerized accounting system contributes a lot towards financial reporting in manufacturing firms and other organizations that prepare financial reports. The study reveals that firms are able to maintain financial reports with qualities of timeliness, liability, relevancy and understandability, accuracy and efficiency because of computerized accounting system. The researcher sides with findings of the study and concludes that computerized accounting has greatly led to improved financial reporting because of the advantages it offers to preparation of financial reports. 5.7 RECOMMENDATIONS Basing on the findings of the study, the researcher made the following recommendations for the firm and similar organizations in improving on their financial reporting. The firm should recruit a professional to handle computerized accounting systems. This is because any wrong entry of data will certainly generate inaccurate and unreliable results. Staff must therefore be adequately trained to enable them efficiently operate the system. The firm should select packages or software that are user friendly and should consider customization of the systems to fit specific needs. Other than adopting off-shelf packages with customized packages, training costs will be reduced. The systems should suit business environment adapt to changes. There should be routine system maintenance programmes put in place so that the system can be rid of shortfalls such as viruses and fraud among others that may affect the system operations. This should be done so that the system can operate to the expectation of management. - 31 - This firm should ensure that deadlines within which a report should be ready. This will enable the accountant to work within the set schedules. The firm should set aside budgets for research and development specifically for its computerized projects. These will improve and update the computerized accounting system. Data manager of the firm should ensure that all financial information capture and backed up, computerized systems security is sometimes prone to threats such as virus attacks. It is important that the data is backed up so that in case of a system breakdown, the data would have been secured. Internal control system also needs to be put in place so that in case errors occur, they can be traced and corrected. The researcher also recommends that the firm should run the computerized accounting systems alongside the manual system where some data can be captured manually. This is important because should the computerized system breakdown, important source information can still remain available. One other fact is that the computerized system very much relies on human effort which justifies the simultaneous run with the manual system. Areas of further study There is need for more to be undertaken to establish the role of management in promoting the quality of financial reporting. There is need to explore whether computerized accounting can be run alongside the manual system. Therefore there is need to investigate if the two systems can be used concurrently. More research on business process re-engineering and how essential can be used in computerized accounting to achieve better goals in firms. - 32 - There is need for more research on how accounting records can be maintained in providing in depth exposure to accounts and quality of financial reports - 33 - REFERENCE: Carol L. Cook (2002); How computers have simplified Accounting, http://www.Yala.edu Denis, G.E. (1996) “An Assessment of Accounting Information Security” The CPA Journal New York (Vol.67), pp.28-34. Elliot Berry and Robbin Javis (1997); Accounting Business Context 3rd Edition, Thomson Business Press London United Kingdom. Frank W. and Alans (1999); Business Accounting: Sixth Edition (International Student Edition Pitman Publishing). George J. Nacubo and Gerald W. Mc Kean (2000), Business Data Processing 2nd Edition Houghton Mifflin Company, Printed in United States of America. Kakuru (2003); Financial Decisions and Business; Business Publishers, Kampala. Lancouch, A.A. (2003), “The Perceived Threats to the security of computerized Accounting Information Systems” The Journal of American Academy of Business Cambridge USA, Vol.3 No.1. Larson et al (1998) Fundamental Accounting Principal; Eleventh Edition (Statement of Cash flow edition). Marivic A. (2009), “Evaluating the security of computerized information systems: An Empirical study on Egyptian Banking Industry” Ph.D Thesis, Aberdeen University, U.K. Mihir and Bijan (2002), Financial Accounting, 3rd Edition, Heinemann Publishers. Redman F. Thomas (2006), Building Trust in Financial Reporting. - 34 - Robert F. Meigs, Mary A. Meigs et al (1998), Financial Reporting, 9th Edition, Irwin McGraw Hill Publishers New York United States of America. Thatcher (2005) Financial Reporting; http://www.navesink.com Turner E. Lynn 2000; Characteristics of High Quality Financial Reporting. www.sac.gov/news. Vanbriefing (2005), Introduction to Accounting; http://www.navesink.com Wood, F and Sangster, A (1997) Business Accounting 2, 8th Edition, Prentice Hall London. - 35 - APPENDIX 1: RESEARCH QUESTIONNAIRE Dear Respondent, The Researcher is a student of Makerere University pursuing Bachelor’s of Commerce External. This questionnaire is designed for academic purposes only. This information will be treated very confidential and will be an aid in obtaining data necessary for my research topic “The impact of computerized accounting on financial reporting.” This will contribute to the partial fulfillment of the requirement for the award of Bachelor’s of Commerce of Makerere University. Instruction: Tick the right option in box or fill in the blank spaces. A) Bio-data Name (optional)…………………………………………………….. Gender: Male Female Age: 18-25 yrs 26-35 yrs Marital status: Single 35 and above Married Educational level Certificate Degree Diploma Masters For how long have you worked in the firm? Less than 2 years 3-4 years above 5 years - 36 - B) To assess the impact of computerized accounting systems in firms. Is the firm’s accounting system computerized? Yes No What computerized accounting packages are used in this firm? 1. Sage 2. Quick books 3. Tally 4. Others (specify)…………………………………………………………………………… In your view, do you think computerization of the accounting system has benefits to the firm? Yes Not sure No If yes, please tick any one option for the statements below: A-Agree, N-Neutral D-Disagree Statements A Financial reports are quickly generated There is improvement in business performance due to computerization of the accounting system There is accuracy and efficiency in account record keeping through computerization Accounting functions like posting transaction to the ledger and - 37 - N D double entry are simplified. Arithmetic errors are easily minimized through application of computerized accounting systems. Auditing of the financial statement is eased with use of computerized accounting systems. Other benefits:………………………………………………………………………………… ……………………………………………………………………………………………………. ……………………………………………………………………………………………………. C) To examine the qualities of financial reports produced by the firm. In this section, the respondent is required to tick any one option for each statement below. The financial reports produced are very reliable that is free from material errors and bias and represents that real status of the firm. Yes No Financial reports can influence the decision of the stakeholders regarding issues in the organization. Yes No The financial reports are easily compared with previous period’s reports. Yes No The reports are always generated at the right time when needed by the stakeholders. Yes No - 38 - The reports are always understood well by the stakeholders. Yes No The investors greatly rely on the financial reports to make their investment decisions. Yes No Other qualities:……………………………………………………………………………………….. …………………………………………………………………………………………………… …………………………………………………………………………………………………… D) The relationship of computerized accounting systems and financial reporting. Do you think computerized accounting has an impact on financial reporting? Yes Not sure No In this section, the respondent is required to tick any one option for each statement below: SA-Strongly agree A-agree N-neutral D-Disagree SD- Strongly disagree Statements SA Financial reports are timely generated for decision making purposes by the users. The financial reports can be prepared at regular intervals with much ease as a result of computerization of the accounting - 39 - A N D SD systems. Arithmetic errors in the financial reports have greatly reduced due to computerized accounting systems. Keeping of records and maintenance of accounting data have become easy and simple to perform. The stakeholders can greatly rely on the reports generated because of accuracy and quality of the financial reports. There is a guaranteed quick speed of processing financial statements. Others (please specify):……………………………………………………………………… ……………………………………………………………………………………………………. ……………………………………………………………………………………………………. Thanks for your cooperation. God bless you. - 40 -