数理经济学研究 2006年第1辑(总第1辑)

advertisement

Research of Mathematical Economics

No. 1 2011

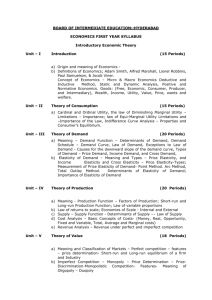

CONTENTS

The Effect of Income and Interest Rates on the Consuming Behavior of Chinese

Residents----Based on the Comparative Analysis on Statistics of Chinese Urban and Rural Areas

…………………………………………………Zhang Dongyang (5)

The Influence of Wealth Gap on China’s Economic Growth

………………………………………………………Guo Yumei (21)

Bundling Sales of Information Goods: Models and Analysis

……………………………………………………Shi Fangning (31)

The Introduction and Applications of RDEU Hypothesis

…………………………………………Wang Bo, Hong Beiyun (54)

Income Targets and Labor Supply Elasticities: Evidence from China Health and Nutrition Survey

……………………………………………………Zhang Luezhao (72)

A Dynamic Model of the Optimal Carbon Tax and Sustainable Development

……………………………………………………Feng Junlong (89)

A Study of Chinese Residential Electricity Demand Elasticities

…………………………………………………Ren Junqiushi (101)

The Factors that Determine a Firm’s Optimal Allocation of Capital Between Research and

Manufacturing

……………………………………Xu Lingjue, Wang Danna (118)

A Quantitative Analysis of the Influences of China’s Inflation to Different

Asset-Holding Classes

………………………………………………………Chen Jun (134)

Analysis of the Mechanism of “Dutch Disease”

……………………………………………………Wang Qizhi (161)

1

数理经济学研究

2011 年第 1 辑(总第 5 辑)

目

录

收入和利率对中国居民消费行为的影响——基于中国城乡统计数据的比较分析

…………………………………………………………………… 张冬洋 (21)

贫富差距对中国经济增长的影响

…………………………………………………………………… 郭豫媚 (47)

信息产品的捆绑销售:模型与分析

…………………………………………………………………… 施芳凝 (31)

REDU 假说的介绍与应用

………………………………………………………… 王

勃、洪蓓芸 (54)

收入目标与劳动供给弹性:来自《中国健康和营养调查》的证据

…………………………………………………………………… 张略钊 (72)

一个最优碳税和可持续发展的动态模型

…………………………………………………………………… 冯焌昽 (89)

中国居民电力需求的弹性探析

……………………………………………………………… 任君秋拾 (101)

决定公司在研究与制造之间资本最优配置的因素

……………………………………………………… 许龄珏、王丹娜 (118)

中国通货膨胀对不同财富持有阶层影响的定量分析

………………………………………………………………… 陈 军 (134)

荷兰病作用机制考察

………………………………………………………………… 王麒植 (161)

2

Research of Mathematical Economics

Organizers:

Economics and Mathematics Double Bachelor Program

Renmin University of China

Academic Adviser:

Yang Ruilong

Liu Yuanchun

Zhang Yu

Liu Rui

Guo Jie

Wang Jinbin

Zheng Xinye

Chen Yanbin

Wang Xianghong

Editorial Committee:

Li Tianyou

Zhang Yanhong

Yu Ze

Cheng Hua

Yu Yihua

Han Song

Instruct Teacher:

Cheng Hua

Editorial Director:

Ren Junqiushi

Xu Lingjue

Zhang Lingyun

Wang Jue

《数理经济学研究》编辑机构

主办单位: 中国人民大学经济学—数学(双学位)实验班

学术顾问: 杨瑞龙 刘元春 张 宇 刘 瑞 郭 杰 王晋斌 郑新业 陈彦斌

编

委: 李天有 章艳红 于 泽 王湘红 程 华 虞义华 韩 松

指导老师: 程 华

编 辑 部: 任君秋拾 许龄珏 张凌云 王 珏

3

4

Research of Mathematical Economics No. 1 2011

The Effect of Income and Interest Rates on the Consuming Behavior of

Chinese Residents----Based on the Comparative Analysis on Statistics

of Chinese Urban and Rural Areas

Zhang Dongyang

(School of Economics, Renmin University of China)

Abstract: This essay analyzes how to expand domestic demand and how to stimulate consumption. Based on the

random walk hypothesis and permanent income hypothesis, consumers are divided into two groups, one with

rational expectations and the other regarded as “short-sighted”. This paper uses ordinary least squares method and

uses data from 2003Q1 - 2008Q2 to estimate the aggregate consumption function of China’s urban and rural areas.

The conclusion is that the number of “short-sighted” consumers in rural areas of China significantly exceeds that

in urban areas. Also, this paper suggests that lowering interest rates has a strong stimulating effect on

consumption growth and verifies the parameters’ stability by hypothesis testing. Last, with regard to the statistics

obtained through econometric model, final conclusions of this essay and certain corresponding policy

recommendations are given out.

Keywords: Permanent Income Hypothesis, Uncertainty, Consumption, Interest Rates

1. Introduction

In 2008, the financial crisis swept the entire world including China, which imposed an

extremely large impact on China’s economy. On the other hand, China has been under reform and

opening-up policy for 30 years until 2008. Along with the ever-deepening reform, Chinese

economy system has gradually turned from traditional planned economy to socialist market

economy, from extensive to intensive. In the support of the three pillars of its development –

investment, domestic demand and foreign trade, the entire national economy follows an orderly

and stable development trend. Hence, in face of such a sudden shock, the problem of how to

expand domestic demand and stimulate China’s economy is put on core agenda once again.

In the traditional researches, Keynes pointed out that national income influences consuming;

5

The Effect of Income and Interest Rates on the Consuming Behavior of Chinese

Residents----Based on the Comparative Analysis on Statistics of Chinese Urban and Rural

Areas

Friedman and Modigliani put forward permanent income hypothesis and life-cycle hypothesis

respectively. These theories have been far-reaching. The basis of these theories, interest rates act

as a direct means to influence national income through adjusting saving rates----lowering interest

rates helps to increase the income for people’s consumption----have long been considered as an

effective approach to expand domestic demand.

However, from the “Ninth Five-Year” to the “Eleventh Five-Year”, a lot of scholars, such as

Long Zhiming, Zhou Haoming (2000), think that China’s economic development and consumer

behavior showed some kind of “rebellion” phenomenon: on one hand, the economy experiences

stable and fast growth and national income increases steadily; on the other hand, along with the

ever-deepening reform and opening-up policy, consumer behaviors have changed dramatically,

among which what worthies our particular attention is the fact that in spite of the continuously

increasing saving percentage, which to some extent reflects decreasing marginal consuming

propensity, consumption scale has grown slowly. In fact, it is still too early to draw the

conclusion of whether interest rate adjusting has positive effect on national consumption. Thus,

this paper will explore the effective factors, such as interest rate and income, and their

effectiveness on consumption increase.

Then, the problem is raised: what is the factor that coordinates the consuming behavior with

the trend of economy growth during the transition period of China? Focusing on this

phenomenon, domestic scholars have done a series of researches referring to foreign

consumption theories. For instance, under a unified economic logic framework, Yuan Zhigang

and Song Zheng (1999) conduct a comprehensive analysis of consuming behavior of urban

residents in China in the transition period: based on consumption theories such as Life Cycle

Hypothesis, Permanent Income Hypothesis, Precautionary Saving Theory and Liquidity

Constraint, they try to find out the reason for the variation in urban consumption behavior and the

way to stimulate urban household consumption. Li Yan (1999) makes use of the data from 1978

to 1998 to carry out the empirical analysis which aims to find out the role of interest rates on

household savings. The transfer channel for interest rates’ effect on saving is wealth: the low

level of income and the underdeveloped capital markets are the primary obstacles that restrict the

interest rates’ effect on household saving. That is to say, under the environment of low level of

income and underdeveloped capital markets, wealth value and wealth gains are not sensitive to

6

Research of Mathematical Economics No. 1 2011

interest rates changes. Wang Hongju and Zhang Huilian (2002) put forward the idea of using

modern Western economic theory to analyze the consumption growth in China. They point out

the restriction effect of Random Walk Hypothesis, Precautionary Saving Theory and Liquidity

Constraint on consumption and then analyze the impacts of these factors on China’s household

consumption. They conclude that Liquidity constraints depressed consumer’s current spending;

moreover, low income, uncertainty and liquidity constraints lead to the shortsightedness of the

residents.

However, theoretical research in this regard focused mainly on the analysis from 1999 to

2003 and few in recent years. This situation prompts us to refresh our understanding and study

the problem of consumer behavior both from the perspective of theory and practice, trace the

deep influencing factors behind these consumer behavior and then to give theoretical

explanations as well as pragmatically measures to direct the household consuming behavior.

The second part of this paper is literature review, pointing out the limitation of traditional

consumption theory on explaining consumer behaviors and the feasibility of using Residents

Consumption Excess Sensitivity Hypothesis and Random Walk Hypothesis to explain and

analyze the consumption problems in current China. The third section reviews the theoretical

models based on Random Walk Hypothesis. The fourth part gives out the quantitative results of

consumption functions about China’s urban and rural residents in the transition period with the

2003-2008 quarterly data on China’s urban and rural residents. And the fifth part takes advantage

of the theory and results of quantitative analysis to draw conclusions and policy

recommendations are given.

2.

Literature Review

Consumption function defines the relationship between household consumption expenditure

and the variables that determine the consumption. It was first proposed by Keynes (1936) in the

book “Employment, Interest and Money”. Absolute Income Hypothesis suggests that people’s

current consumption depends on current income and a stable functional relationship exists

between them. With the increase of income, consumption will also increase, but the increase of

consumption is slower than the increase of income: consumption increment in the proportion of

increased income is decreasing ---- that is diminishing marginal consumption propensity, showed

7

The Effect of Income and Interest Rates on the Consuming Behavior of Chinese

Residents----Based on the Comparative Analysis on Statistics of Chinese Urban and Rural

Areas

by

c y, 0 1

Yet, Duesenberry puts forward the Relative Income Hypothesis by negative the conditions

of Absolute Income Hypothesis. In his view, consumers are influenced by their surrounding

environment from time to time. The “model” of consumption is likely to make the low-income

group to get closer to the consumption level of their surrounding people. Hence, he believes that

the lower the income is, the high the marginal consumption propensity will be.

However, both Absolute and Relative Income Hypothesis only take consumers’ current

income into consideration and thus lack of microeconomic foundations. For that matter, within

the framework of neo-classical Friedman and Modigliani extended consumer decision to embrace

inter-stage selection and proposed Permanent Income Hypothesis and Life Cycle Hypothesis,

respectively. They believed that consumers’ decision for current expenditure is determined by

their life income.

Nevertheless, none of these econometric models can escape from Lucas critique. Lucas

(1976) pointed out that no matter how the traditional consumption function fits real data, they

have no value in policy making decisions, because any change in policy will after all alter the

relationship between aggregates in macroeconomic models. Therefore, Hall (1978) proposed a

consumption theory based on rational expectations. His idea is that consumption should follow

the first-order optimal conditions of a typical forward-looking rational consumer, which is also

known as “Euler Equation”. Hence, the Random Walk Model gives out the following equation

assuming the quadratic utility function:

Ct Ct 1 t E t 0

(1)

This means that the changes in consumption are unpredictable, that is the current

consumption depends only on the consumption in the last period and independent of any other

economic variables. In view of Hall’s hypothesis, later researchers have done a lot of empirical

analysis but end up with no satisfied results. So Cambell and Mankiw (1990) proposed the idea

that aggregate consumption function does not necessarily satisfy the general random walk. They

put consumers into two categories: one to meet the Permanent Income Hypothesis of rational

expectations and the other to spend their current income which

8

, also

Research of Mathematical Economics No. 1 2011

known as Excess Sensitivity. The greater

is, the more sensitive consumption will reflect on

1 , then consumption depends entirely on the current

0 , it means the Permanent Income Hypothesis of rational

expectations is verified.

Chinese scholars have made some progress in the research of “random walk” consumption

theory. Wan Guoguang (2001) use the model of Hall and the idea of Campbell and Mankiw

through the data from 1961 to 1998 in China and come to the conclusion that with the

ever-deepening economic reform in China, the consuming behavior of Chinese households has

experienced structural change in the early 1980s. They believe that both the rise in the proportion

of liquidity constrained consumers and the increased uncertainty are responsible for the low

consumption growth rate in China and insufficient domestic demand. Hang Bin and Shen

Chunlan (2004) believe that Excess Sensitivity in the sample period is likely to change due to

policy changes, so they conducted a varying parameters analysis on the consumer sensitivity of

urban residents through data from 1978 to 2002. They come to the results that before 1990

Excess Sensitivity had dropped dramatically, but after 1990, Excess Sensitivity had experienced

stead growth, at about 0.64. Also, the substitution effect of changes in interest rates is greater than

the income effect; that is to say, consumption expenditure will increase along with the rise in

interest rate. Through the analysis of relevant macroeconomic data about rural areas from 1978 to

2003, Zhu Xinkan (2005) concluded that 62.5% of rural household limited by liquidity constraint

are short-sighted. By the analysis of residents’ consumption behaviors on durable and

non-durable goods, Liu Hinquan (2003) found that household savings in China have significant

“precautionary savings” components and future expected income is extraordinary uncertainty.

Zhou Jian through the research into the variable parameter space state model of the consumption

function studied the sensitivity of consuming behavior of rural residents in the transition period.

Empirical results showed that there exists significant “precautionary savings” motivation among

the rural residents. Zhang Xuheng (2007) made use of precautionary saving, Liquidity

Constraints Hypothesis and the dynamic modeling method to compare the characteristics of

consumer behavior in China’s rural areas and urban areas. His empirical results implied that the

proportion of urban residents who were affected by liquidity constraints is greater than that of

rural ones, and rural residents’ responses to uncertainty and real interest rates are more sensitive

than urban people.

9

The Effect of Income and Interest Rates on the Consuming Behavior of Chinese

Residents----Based on the Comparative Analysis on Statistics of Chinese Urban and Rural

Areas

However, these models are based on annual statistics and lack research in recent years. This

paper’s main logic is as follows: the Random Walk Hypothesis and the Excess Sensitive

Hypothesis are used as theoretical foundation and the statistics from 2003Q1 to 2008Q2 may be

processed according to the model to solve out China’s consumer function. Then, this paper will

go on to verify the effectiveness of interest rates and income on consumption so as to fill the

bland area in this research field.

3.

Mathematics Model

Campbell and Mankiw (1990) pointed out that consumers can be divided into two types:

one part meets the Hall's permanent income hypothesis of rational expectations, they maximize

the expected utility function:

Et (1 ) s U (Ct s )

(2)

s 0

where

is subjective discount rate, C is the consumption, U satisfies the first derivative to be

greater than 0, the second derivative to be less than 0, and Et is the conditional expectation

which based on the t period information, if the consumption can borrow by interest rates r , then

the optimal first-order conditions as

EtU ' Ct 1 =

1+

U ' Ct

1 r

(3)

If it is assumed r , and marginal utility satisfies the conditions of linear, then the

consumption reduces to the random walk, that’s to say Et Ct 1 Ct , or Ct 0, Et t 0 .

And the other part those who spend their current income, share of

, also known as Excess

Sensitivity. If the total income of these two types of consumers, respectively Y1t Y2t , the

equation can be:

Ct C1t C2t Yt (1 ) t

However, the residual

(4)

t may be correlated with yt , this formula cannot be directly

used for estimating model. Alternative methods are mainly divided into two types, one is Hall

10

Research of Mathematical Economics No. 1 2011

(1978), which is to see whether lag period consumption and income can predict the current

consumption or not; the other method was proposed by Campbell and Mankiw (1989), by setting

a set of instrumental variables to estimate the equation. This paper uses instrumental variables

method, because any lag and stationary time series may be orthogonal with

t , so they can be

an effective tool for the candidate instrumental variables. Also a good set of instrumental

variables is also possible to be relevant with yt , so we need to select some of the lag variables

which can predict future income variables. Because in reality, the number of consumption and

income data is closer to log-linear and nonlinear, and therefore we need to adopt all the variables

on the number (with lowercase letters to replace the original variable capital letters), replace the

original regression equation ct yt (1 ) t , using the set of instrumental variables to

do regression

ct X t ct

(5)

yt X t yt

where X t is the set of instrumental variables, with the dimension n k , k is the number of

instrumental variables. We can get the solution of vector

Re-use the relationship function

to estimate the value of

, , from the regression function.

v u , which is constituted by k simple equations

, ,u , noted that when k > 3, the equation may have no solution, while

k < 3, there may be many solutions. X t adopted the set of instrumental variables which is no

less than three to avoid multiple solutions in this case. And when k 3 , we use two-stage least

squares to estimate the solution.

4.

The Empirical Results of China's Consumption Function

4.1 Data Selection and Data Processing

Based on the permanent income hypothesis of rational expectations models emphasizing the

microeconomic foundation, the general recommendation is to use quarterly data. In addition, the

annual data model’s spread is too long to avoid the Lucas critique ---- a change in policy will

change the total relationship between macroeconomic models. Monthly data is not a good choice

11

The Effect of Income and Interest Rates on the Consuming Behavior of Chinese

Residents----Based on the Comparative Analysis on Statistics of Chinese Urban and Rural

Areas

because there is a big seasonal problem. Therefore, in accordance with established practice of the

total consumption curve model, the paper uses quarterly data for empirical research in China. The

time span is from the 1st quarter, 2003 (2003Q1) to the 2nd quarter, 2008 (2008Q2). We need the

following three types of data: per capita disposable income of urban residents, real per capita

consumption expenditure of urban residents, per capita disposable income, and per capita

consumption expenditure of rural households, rural household, and real interest rates. Data is

collected from China Monthly Economic Indicators and the People's Bank of China website.

(1) Urban per capita actual disposable income.

As the National Bureau of Statistics data is presented quarterly cumulative nominal per

capita consumption expenditure of urban residents, firstly we need to process accumulate data

into quarterly data, that is, the first quarter of each year’s data keeps unchanged, while the other

quarter with this quarter cumulative minus the cumulative data of last quarterly data. Secondly,

we also need to deflate the nominal data the actual data’s deflator. Using the index of disposable

income of urban households is a common approach. However, National Bureau of Statistics did

not give the index of the quarter of the disposable income of China in order to match the data; we

decided to use urban residents’ price index to calculate the deflator. With multiplication of the

quarter’s urban residents with the annulus data, we can get the fixed base quarter price index of

urban residents. The selected base period is December 2002.

(2) Real per capita consumption expenditure of urban residents, real per capita cash income of

rural households, real per capita consumption expenditure of rural households.

In the same way, we handle these data into quarterly data of the urban and rural areas.

(3) Real interest rates.

Since this article takes the quarterly data, and uses the Fisher equation ( r i ), I use

after-tax deduction of three-month nominal deposit rate minus the current rate of urban consumer

price’s changes, and then real interest rates can be obtained.

Thus, descriptive statistics results of the main variables above in the regression analysis are

in Table 1 below.

12

Research of Mathematical Economics No. 1 2011

Table 1

Descriptive Statistics Results of the Variables

Variables

Mean

Median

Standard

Deviation

Max

Min

Urban per capita actual disposable income

2591.643 2526.235 466.1033 3619.182 1960.499

Rural real per capita cash income

887.749 836.417 279.294 1370.027 421.8753

In- urban per capita actual disposable income

7.8452

7.8345

0.1750

8.1940

7.5810

In- rural per capita actual disposable income

6.7393

6.7291

0.3281

7.2226

6.0447

1.3001

2.8210

15.5045 27.0464 -23.9000

0.6587

0.3493

37.2562 52.6574 -54.6100

Growth rate of urban per capita actual disposable income

Growth rate of rural real per capita cash income

Urban real per capita consumption expenditure

1922.109 1884.996 253.4658 2378.568 1450.421

Rural real per capita consumption expenditure

498.7701 477.9494 115.3829 700.0013 296.4340

In- urban real per capita consumption expenditure

7.5528

7.5417

0.1327

7.7743

7.2796

In- rural real per capita consumption expenditure

6.1856

6.1695

0.2392

6.5511

5.6918

Growth rate of urban real per capita consumption expenditure 1.3015

-0.5442 10.9334 17.2387 -17.5775

Growth rate of rural real per capita consumption expenditure

0.7738

12.216 23.67100 25.2864 -39.0509

Urban real interest rates

0.8291

0.4778

1.2581

3.6633

-1.1525

Rural real interest rates

0.6158

0.4674

1.1467

2.8643

-1.3548

If the random process is non-stationary, then usually, it must be very difficult and imprecise

to use a simple algebraic model to reflect the past and future time series. Therefore, we usually

require that the time series are stationary. Generally we use the ADF test, including the choice of

three parameters: intercept, time trend term, the lag periods. In addition, for the traditional

econometric theory, people think that the overall economic time series are identified as having a

fixed trend, therefore, the general practice is to get rid of overall fixed trend of economics from

fixed-trend model, and then the series are stationary which can be analyzed. However, Nelson

and Plosser (1982) found that the majority of overall economic time series have a stochastic trend,

so I just get rid of the fixed overall trend of economic time series, and did not remove the time

series of the stochastic trend. Then the analysis turns to be a big problem.

In addition to the amendments to the traditional unit root test, Ng and Perron (2001) have

13

The Effect of Income and Interest Rates on the Consuming Behavior of Chinese

Residents----Based on the Comparative Analysis on Statistics of Chinese Urban and Rural

Areas

modified information criterion for the selection of the most suitable augmented lag phases, called

the modified AIC, MAIC and modified SIC, MSIC and so on.

In reality, the time series data are often non-stationary processes that cannot be used in the

classical regression model, or will cause regression error (Granger, 1987). However, if stable

relationship exists between the long-term time series of the same order, regression equation

(co-integration) can be made by the classical regression model.

From the above theory, in order to ensure the reliability of estimates, we must firstly

consider the time series of each variable must satisfy a single whole order. Under the modified

AIC, the method used to test is ADF test. Table II shows the variables of the ADF test, ct and

yt are I (1) processes, the consumption of rural areas is I (1) process and rt is a stationary

series.

Use Eviews to do ADF test, with intercept models, with trend models, neither trend nor

intercept models, and also both with the trend and intercept model. Test results are as follow:

14

Research of Mathematical Economics No. 1 2011

Table 2

Variable Unit Root Test Results

Test form

Variable category

p-value

ct (Urban)

ct (Rural)

yt (Urban)

yt (Rural)

ct (Urban)

ct (Urban)

ct (Urban)

ct (Rural)

ct (Rural)

ct (Rural)

yt (Urban)

yt (Urban)

yt (Urban)

yt (Rural)

yt (Rural)

yt (Rural)

rt (Urban)

rt (Urban)

rt (Urban)

rt (Rural)

rt (Rural)

rt (Rural)

0.9562

(0,0,0)

0.6865

(0,0,0)

0.9848

(0,0,0)

0.3566

(0,0,0)

0.0000

(1,1,1)

0.0001

(0,0,1)

0.0000

(1,0,1)

0.0005

(1,1,1)

0.0000

(0,0,1)

0.0000

(1,0,1)

0.0001

(1,1,1)

0.0000

(0,0,1)

0.0000

(1,0,1)

0.0013

(1,1,1)

0.0001

(0,0,1)

0.0000

(1,0,1)

0.0020

(1,1,0)

0.0003

(1,0,0)

0.0014

(0,0,0)

0.0035

(1,1,0)

0.0005

(1,0,0)

0.0006

(0,0,0)

(Intercept, Trend, Lag phases)

Conclusion

Non- stationary

Non- stationary

Stationary

Stationary

Stationary

Stationary

Stationary

Stationary

To prove that the time series is stationary, it must meet the test results of three types of

models (with intercept model, with a trend term model, both a trend and intercept term model)

are stable. So, under the significance level of 0.05, from the p-value of Table 2, we could get

0-order, that all the p-value of ct (urban), ct (rural), yt (urban), yt (rural) are over 0.05. So

every variable is non- stationary. However, after a lag, also from the p-value, every variable can

15

The Effect of Income and Interest Rates on the Consuming Behavior of Chinese

Residents----Based on the Comparative Analysis on Statistics of Chinese Urban and Rural

Areas

pass the test, 1-order steady. Therefore equation (6) can be analyzed by quantitative analysis.

4.2 Econometrics Results

The above analysis shows that all of the variables and explanatory variables are stationary

time series of regression model, which meets the requirements to establish the mathematics

model. Thus, we can use a mathematical model which was established to calculate, using Eviews

second-order least squares to get the regression results shown in Table 3:

Table 3

Regression Result

Adjusted

Set of instrumental variables (***)

Category (OLS)

λ(*)

Intercept

θ(*)

R2 (**)

urban

rural

urban

rural

urban

rural

urban

rural

1.71

3.42

0.49

0.50

0.50

-4.84

0.59

0.87

(.43)

(.14)

(.00)

(.00)

(.45)

(.03)

(.00)

(.00)

yt 2 , yt 3 , yt 4

4.59

5.23

0.33

0.48

-4.25

-7.01

0.61

0.83

rt 2 , rt 3 , rt 4

(.15)

(.13)

(.07)

(.00)

(.13)

(.04)

(.00)

(.00)

ct 2 , ct 3 , ct 4

4.77

5.28

0.35

0.48

-4.49

-7.10

0.60

0.83

rt 2 , rt 3 , rt 4

(.13)

(.12)

(.07)

(.00)

(.12)

(.04)

(.00)

(.00)

0.79

5.90

0.50

0.48

-0.79

-6.20

0.64

0.82

(.78)

(.09)

(.00)

(.00)

(.72)

(.04)

(.00)

(.00)

1.90

5.90

0.47

0.48

-1.93

-6.20

0.63

0.82

(.51)

(.09)

(.01)

(.00)

(.42)

(.05)

(.00)

(.00)

None

yt 2 , yt 3 , yt 4 , yt 5 , yt 6

r t 2 , r t 3 , r t 4 , r t 5 , r t 6

ct 2 , ct 3 , ct 4 , ct 5 , ct 6

r t 2 , r t 3 , r t 4 ,, r t 5 , r t 6

Note: (*) Under probability at 5% confidence level coefficient’s The probability levels, that’s t-value.

(**) The probability levels under all regression coefficients are 0, F-statistics of the whole equation.

(***) Instrumental variables set includes constant item, but save them in table.

The first column is a set of selected instrumental variables the second column gives the

intercept of two stage least squares (2SLS) regression results. The third column is the consumers’

16

Research of Mathematical Economics No. 1 2011

income proportion of total income, of which the consumers satisfy "Rule of Thumb". The fourth

column is the interest rate’s intertemporal elasticity of consumption. The last column is adjusted

R 2 , while each column shows the coefficients of the measurement of regression of urban and

rural areas respectively, values in brackets are coefficient under t test’s p-value.

First, no set of instrumental variables’ least squares regression results show that intercept

and

of the town are not significant, which in line with the results of earlier data analysis in

this article; secondly, with a lag of two to six after the instrumental variables y , r and c, r ,

their least squares regression results of second-order show that urban with intercept and

are

not significant; finally, containing the lag two to four of the instrumental variables y , r and

c, r , the second least squares regression results of them are more stable.

When considering the income proportion of the consumers satisfying "rule of thumb" is only

of total income, although in no set the value of the results of the least squares instrumental

variables and the results with lags two to six after the second-order least squares instrumental

variables y , r and c, r of urban and rural areas are nearly equal, due to other poor

regression results, they should be abandoned; Containing the lag two to four of the instrumental

variables y , r and c, r , after using the second-order least squares,

while

(Urban) is about 0.33,

(Rural) about 0.48, which means the urban consumers is greater rational expectations

than the consumers in rural areas, more generally, the higher income people get the higher

proportion of rational expectations consumers will be (Campbell and Mankiw, 1989), so in order

to expand consumption, firstly we should aim at increasing rural people's income, followed by

increasing the incomes of the low-income people in urban.

Considering about the interest rate’s intertemporal elasticity, we found that all the results are

showing that urban is lower than rural, while with the lag two to four of the instrumental

variables y , r and c, r

(Urban) is about -4.3, while (Rural) is about -7.0, generally

lower interest rates can help to promote growth in consumption; The main reason is reflected in

two aspects. Direct utility is mainly reflected in that lower interest rates reduce the opportunity

cost of future transactions so that people will choose more current consumption, thus stimulate

consumption; From the point of view of indirect utility, as the investment diversifies among

urban residents, the risk can be passed on by other means, compared with single investment in

17

The Effect of Income and Interest Rates on the Consuming Behavior of Chinese

Residents----Based on the Comparative Analysis on Statistics of Chinese Urban and Rural

Areas

rural areas, and thus the risk-shift capacity is weak, then a larger intertemporal elasticity appears.

5. Conclusions

Through quantitative analysis of this paper, I think we can improve the level of consumption

of Chinese urban and rural residents from the following aspects:

(1) Lowering interest rates contributes to growth in consumption. Different from previous

researches on consumption which come to the conclusion that consumption is not sensitive to

interest rates, I believe that lowering interest rates is an effective measure of China’s

consumption. Of course, while lower interest rate brings growth to consumption, we also need to

pay attention to the possible cost of the inflation.

(2) It is highly recommended to continue sparing no effect on economic growth and improving

national income levels, thereby stimulating consumption and thus promoting economy growth.

Particularly, in the face of significant "short-sighted" behavior of the rural residents, great efforts

should be made to improve the income level of rural population and poor urban population.

(3) If the "short-sighted" consumer account for the main component of total consumption, and

rapid growth in total income cannot be achieved, then as long as the benefits of consumption

growth are greater than the cost of income redistribution, the redistribution of income may

become a possible way to stimulate consumption demand.

(4) It is suggested to establish a convenient and wholesome credit environment available to the

public. In an incomplete market, residents have a great tendency to be "self-insurance", which is

expected to increase savings in order to alleviate the impact of the uncertainty of income. Thus, a

comprehensive credit market is conducive to smooth their consumption and reduce the

uncertainty of the future, thus contributing to the increase in current consumption. Improving the

credit market and the social security system are the fundamental way of expanding domestic

demand.

(5) The government should focus more on accelerating the establishment of market-oriented

social security system, strengthening the support for social security funds, and maximizing the

possible scope of coverage of the population to eliminate the worries of the residents and to

change the residents of their expected future uncertainty. Because of the imperfection of credit

18

Research of Mathematical Economics No. 1 2011

market in our country, the fees in medical, education and other industries will strengthen the

residents of their precautionary saving motive, thus inhibit the growth of consumption

(6) The government also needs to vigorously promote the development of consumer credit

markets to ease residents of their liquidity constraints. To be more specific, in the present

circumstances, what we need to do is: firstly, to gradually realize mercerization of the interest

rate market, thus to provide both supply and demand sides with a relaxed environment; secondly,

to speed up banking reform and simplify loan procedures, and establish wholesome mechanisms

of internal constraints; thirdly, to gradually improve individual credit system; and finally, to

further improve relevant laws and regulations of consumer credit, thus to maintain the normal

order for the credit economy.

References

杭斌、申春兰, 经济转型期中国城镇居民消费敏感度的变参数分析, 数量经济技术经济研究第 9 期,

2004.

李焰, 关于利率与我国居民储蓄关系的探讨, 经济研究第 11 期, 1999.

龙志和、周浩明, 中国城镇居民预防性储蓄实证研究, 经济研究第 11 期, 2000.

施建淮、朱海, 中国城市居民预防性储蓄及预防性动机强度: 1999-2003, 经济研究第 10 期, 2004.

宋铮, 中国居民储蓄行为研究, 金融研究第 6 期, 1999.

陶长琪、齐亚伟, 转轨时期中国城乡居民预防性储蓄比较研究——中国城乡居民消费的理论框架及实

证研究, 消费经济第 5 期, 2007.

万广华、张茵、牛建高, 流动性约束、不确定性与中国居民消费, 经济研究第 11 期, 2001.

汪红驹、张慧莲, 不确定性和流动性约束对我国居民消费行为的影响, 经济科学第 6 期, 2002.

袁志刚、宋铮, 城镇居民消费行为变异与我国经济增长, 经济研究第 11 期, 1999.

朱信凯, 流动性约束、不确定性与中国农户消费行为分析, 统计研究第 2 期, 2005.

朱春燕、臧旭恒, 预防性储蓄理论——储蓄 (消费) 函数的新进展, 经济研究第 1 期, 2001.

Campbell, J. and Mankiw, G., “Consumption, Income, and Interest Rates: Reinterpreting the Time Series

Evidence”, NBER Working Paper, 1989.

Hall, Robert E., "Stochastic Implications of the Life Cycle-Permanent Income Hypothesis: Theory and

Evidence", Journal of Political Economy, 1978, 86(6), pp. 971-987.

Hall, R., “Intertemporal Substitution in Consumption”, Journal of Political Economy, 1988, 96(2), pp.

339-357.

19

The Effect of Income and Interest Rates on the Consuming Behavior of Chinese

Residents----Based on the Comparative Analysis on Statistics of Chinese Urban and Rural

Areas

Ng, Serena and Pierre Perron, “Lag Length Selection and the Construction of Unit Root Tests with Good

Size and Power”, Econometrica, 2001, 69(6), pp. 1519-1554.

(Responsible Editor: Xu Lingjue) (Proofreader: Wang Jue)

20

Research of Mathematical Economics No. 1 2011

The Influence of Wealth Gap on China’s Economic Growth

Guo Yumei

(School of Economics, Renmin University of China)

Abstract: With the development of China’s economy, the gap between the rich and the poor is increasingly

severe day by day. People hold different opinions on the influence of the gap. This paper wants to use

Cobb-Douglas production function as the basis of the model and introduces an income distribution coefficient t to

represent Gini coefficient in order to show the positive effect of the gap of wealth. At the same time, we try to

prove the positive effect of the gap through ternary linear regression based on China’s GDP, capital and industrial

income from 2003 to 2008. The positive effect of the gap through ternary linear regression based on China’s GDP,

capital and industrial income from 2003 to 2008 will be proved.

Keywords: The Gap of Wealth, Economic Growth, Reinvestment, Gini Coefficient

1. Introduction

As the reform and opening-up policy goes, China’s economic makes a big difference.

However, the gap of wealth has been widening day by day. China’s GDP reached 34.05 trillion

RMB in 2009 while it is just about 0.36 trillion in 1978, leaping to the third place in the world.

The average real economic growth is over 9.8%, which is a rare occurrence in the development

history. Though the world economy slowed down in 2008, the economic growth of China was

still above 9%. At the same time, as the World Bank said, Gini coefficient of China in 2005 was

over 0.42, which broke through the world cordon. The income of the first 20% people who gets

the highest income is ten times much more than the income of the last 20%.

The gap between rich and poor is a two-edged sword. On one hand, the expansion of the gap

of wealth will contribute to economy. As the rule of diminishing marginal consumption, the gap

will increase savings which will accelerate capital investment. The more capital is invested, the

more rapidly economic will grow. On the other hand, the expansion of economic gap between

rich and poor has inhibition and will cause social problems. Again according to the principle of

21

The Influence of Wealth Gap on China’s Economic Growth

diminishing marginal consumption, the poor consumption ratio is on the increase and rich

consumption ratio is reduced, which will lead to insufficient total consumption demand.

Meanwhile, the gap has caused serious social phenomenon such as anxiety. When overnight and

night laid-off appear frequently, people begin to come up with uncertainty about the future and

are discontent with the gap.

Scholars have different opinions on the influence of wealth gap on China’s economy. Sun

Liping says it is the insufficiency of consumption demand that matters instead of increasing

reinvestment. Combining static and dynamic analysis method, time series data and section data,

Liu Ying thinks about the relationship between income distribution and economic growth of

Beijing based on its Gini coefficient and GDP and she finds the positive correlation. But Xiang

Shujian finds the unemployment rate is the most prominent among the four explanatory variables

of unemployment rate, the first industrial added value of GDP, social relief pension financial

expenditure and average wage growth in relation with Gini coefficient through multiple

regression models. From this, he concludes that if the income distribution is even or not has

nothing to do with economic growth.

However, according to current situation of China’s economic development, a widening gap

between rich and poor influences economic growth dominated by promoting effect in general. As

we all know, China is in and will remain so for a long time of socialist development stage.

Therefore, the effect of capital accumulation and capital reinvestment on economic development

is rather obvious. Since 2005, total capital formation of GDP by expenditure has been above 45%.

Although many scholars believe that the promoting influence of capital is no longer as significant

as it is in 1990s, the negative effect caused by insufficient domestic demand cannot be compared

to the positive effect brought by capital.

Thus, this paper would make some improvements on the basis of past research. First, we

will use Cobb-Douglas production as the basis of the model and introduce an income distribution

coefficient t to represent Gini coefficient. With the rule of diminishing marginal consumption, we

take the first-order of production function to intuitively see how the widening gap influences

economic growth. So far, many researches are based on Solow model which focuses on capital

per unit labor and output per unit labor. The author thinks that capital per unit labor is not

convenient to describe the gap between rich and poor. Capital per unit labor is the average of

capital in labor, which is contradictory to reflect the difference in wealth. Thus, we introduce t

22

Research of Mathematical Economics No. 1 2011

coefficient to make the model simple and intuitive. Second, we will take a ternary linear

regression based on China’s GDP, capital and industrial income from 2003 to 2008 in order to see

the correlation between the gap and economic growth. Instead of word describing, we show the

comprehensive effect of wealth gap in econometrics method.

The structure is as follows: the first part is mainly about the situation and impact of the gap

between rich and poor and the author’s opinions and perspective; in part two, we would build a

simple model to find the function of economic growth involving GDP, capital and the gap in

order to prove that the expansion of the gap of wealth contributes to the reinvestment of capital

and it will promote the economic growth; in part three, we try to prove the positive effect of the

gap through ternary linear regression based on China’s GDP, capital and industrial income from

2003 to 2008 according to the function in the second part; finally, we will comprehensively make

some conclusions and properly make suggestions.

2. Theoretical Model

From the standpoint of capital accumulation, we try to prove that the expansion of the gap

of wealth will contribute to the reinvestment of capital and it will promote the economic growth

in the end.

We would like to build a simple model to represent the economic environment with the view

of that inequality will increase output because Gini coefficient is in direct proportion to the rate

of capital reinvestment and the growth rate. Alien from the previous research, we want to make

some assumptions as below: Firstly, the society is made up of two groups and each group may

have one person or more and we regard each group as a labor unit. But in this paper, we just want

to focus on the gap of wealth between the two groups regardless of the gap within each group.

Secondly, the two groups produce the same product while we don’t distinguish wage income or

capital income. The way to distribute income between the two groups is on the basis of the ratio

of capital each group has. Thirdly, we introduce the t index to represent the gap so that we can

indirectly see the relationship between Gini coefficient and capital reinvestment. Fourthly, loan

market is unavailable and we don’t need to take r into account. Lastly, we assume a concave

consumption function, which indicates that the richer group has higher marginal propensity to

save than the poorer group.

23

The Influence of Wealth Gap on China’s Economic Growth

In the model, we will begin by considering the Cobb-Douglas production function:

Y K L ,

where 0 1,0 1 . Since the society is made up of two labor units, we can change the

production function into that:

Y BK

And we assume it is a concave returns to scale production function. Also, we can reach that:

Y Y1 Y2

K K1 K 2

As we distribute income between the two groups on the basis of the ratio of capital each

group has, we assume that the capital group Ⅰ has is no more than the capital group Ⅱ has. And

the proportion of group Ⅰ’s capital is t so that 0 t 0.5 . Thus,

K1 tK

K 2 (1 t ) K

Y1 tY

Y2 (1 t )Y

If the total capital is K 0 at beginning, the group Ⅰ has K1 tK 0 and group Ⅱ has

K 2 (1 t ) K 0 . So the output or income is distributed as:

Y0 BK 0

Y10 tY0

Y20 (1 t )Y0

At this time, each group begins to decide how much to make consumption and how much to

reinvest. Due to the concave consumption function, the proportion of income group Ⅰ makes

reinvestment is lower than that of group Ⅱ. If we assume that p is the reinvestment proportion, q

is proportion of income to the total income, p is the function of q and Y, p (qY ) , and p (qY )

is an increasing function involving qY . Thus,

24

Research of Mathematical Economics No. 1 2011

K1 p(tY0 )tY0

K 2 p(1 t )Y0 (1 t )Y0

K K1 K 2 p(tY0 )tY0 p(1 t )Y0 (1 t )Y0

From the production function, we obtain,

Y

K

L

Y

K

L

For L = 2, then L = 0 and

Y

K

Y

K

Thus, when the capital is K 0 , the relationship between reinvestment and output growth is

showed below:

p(tY0 )tY0 p(1 t )Y0 (1 t )Y0

Y

K

Y0

K0

K0

(1)

This is a growth function of t when K 0 is given. In fact, t represents the gap of wealth.

Due to 0 t 0.5 , the gap of wealth is larger when t converges to 0 and smaller when t

converges to 0.5. So we can obtain:

t G (Gini ) , 0 t 0.5 , G '(Gini ) 0

(2)

which means that t is inversely proportional to Gini coefficient and the function is monotonic

decreasing. Then, make derivation of function (1):

Y

p ' (tY0 )tY02 p(tY0 )Y0 p ' (1 t )Y0 (1 t )Y02 p(1 t )Y0 Y0

K0

Y0

'

Here, we assume that p (qY ) is linear,

p(qY ) a * t * Y b

where a > 0, then,

p ' (qY ) a

Thus,

25

The Influence of Wealth Gap on China’s Economic Growth

Y

atY02 p(tY0 )Y0 a(1 t )Y02 p(1 t )Y0 Y0

K0

Y0

atY02 a(1 t )Y02 p(tY0 )Y0 p(1 t )Y0 Y0

K0

'

where 0 t 0.5 , then 0 t 1 t . Thus,

atY02 a (1 t )Y02 0

Given that p (qY ) is an increasing function involving qY ,

p(tY0 ) p(1 t )Y0

p(tY0 )Y0 p(1 t )Y0 Y0 0

With all above, we can conclude that

Y

atY02 p(tY0 )Y0 a(1 t )Y02 p(1 t )Y0 Y0

0

K0

Y0

'

And only when t = 0.5, we can obtain the equation. So, we can learn that

monotonic decreasing about t, which means that the smaller t is, the larger

and (3),

(3)

Y

is

Y0

Y

is and with (2)

Y0

Y

is directly proportional to Gini coefficient. Thus, the expansion of the gap of

Y0

wealth will contribute to economic growth.

3. Empirical Research Based on Chinese Economy

From the simple model in part 2, we can conclude that, theoretically, the expansion of the

gap of wealth would contribute to reinvestment which will result in the growth of economy.

Besides the influence of t index, Y0 has an effect on reinvestment next year. Thus, we’d like to

find the empirical evidence of the relation between the gap and economic growth with the data of

capital, GDP and Gini coefficient.

From the model, we can learn that:

26

Research of Mathematical Economics No. 1 2011

p(tY0 )tY0 p(1 t )Y0 (1 t )Y0

Y

K

Y0

K0

K0

t G (Gini )

Economic growth rate is a function involving GDP, total capital and Gini coefficient. Thus,

we try to find the relationship between growth rate and Gini coefficient adopting linear regression.

We would take growth rate as the dependent variable and GDP, total capital and Gini coefficient

last year as independent variable.

First of all, we will show the method of calculating Gini coefficient. Firstly, population is

divided into N groups and was labeled A1 , A2 ,

, An by the average wage of each group on

lower-to-upper motion. Then we can get the percentage of the first i group’s total wage named

Yi and the percentage of the first i group’s total population named X i . Y0 and X 0 are equal

to zero. After that, we get the equation of calculating Gini coefficient with its definition.

Graph 1

Lorenz Curve

27

The Influence of Wealth Gap on China’s Economic Growth

1 n 1

1 1 n

X i X i 1 Yi Yi 1 X i X i 1 Yi 1

X i X i 1 Yi Yi 1

2 i 1 2

2 2 i 1

Gini

1

1

2

2

Thus, with the wage and population of 19 industries, we can obtain Gini coefficient from

2003 to 2007.

By now, specific date is showed below,

No.

G (growth rate)

K (capital)

Y (GDP)

Gini

1

0.17710944

0.268341054

135822.8

0.472367

2

0.156738594

0.259603788

159878.3

0.46738

3

0.169662816

0.239086846

184937.4

0.461608

4

0.228814633

0.24841952

216314.4

0.457987

5

0.181464375

0.258545672

265810.3

0.450935

The result of linear regression by SAS is that

g = -8.77045 + 0.000018K - 8.23E - 6Y + 19.17453Gini

(0.5984) (7.666E-7)

(3.965E-7) (1.241567)

2

N=5, R 0.99852 , R 0.99408

2

2

From R 2 and R , we can learn that GDP, total capital and Gini coefficient explain

almost all the changes of growth rate. The degree of fitting is high enough to guarantee

credibility of the regression.

By the way, Gini coefficient has a positive correlation with the growth rate that the growth

rate will increase about 20% if Gini coefficient increase 1%, for the t-value is 15.44. So we can

reject H0 at significance level of 5%.

Summarily, we can make a conclusion based on the regression that the gap will contribute to

economic growth.

4. Conclusions

From the paper, we can conclude that:

28

Research of Mathematical Economics No. 1 2011

(1) Based on the model and regression, the widening gap of wealth will contribute to China’s

economic growth in nowadays;

(2) The Gini coefficient in China is about 0.45, which has crossed the international warning line

of 0.4. Therefore, the gap of wealth is a two-edged sword. We cannot blindly negative the gap

between rich and poor. Of course, the increasingly widening gap may cause serious problems

because Chinese regard common prosperity as development goals; meanwhile, complete equality

is not desirable as it will slow growth steps down. Thus, state and local government should take

some measures to maintain the widening gap in a modest and relatively stable level.

From part three, we can learn that the gap in China is about 0.45. According to the UN

organizations, income is absolute average if Gini coefficient below 0.2, while compare average if

0.2-0.3. Gini coefficient of 0.3-0.4 means relatively reasonable and 0.4-0.5 indicates a bigger gap.

And income distribution is extremely bad if Gini coefficient is over 0.5. So, the gap is bigger in

China. Enjoying the fast economic development, the government should take timely measures,

such as tax reform policies, to actively deal with the widening gap and try their best to guarantee

the GINI coefficient around 0.3 to 0.4. Together with the fast development, the government also

needs to stop the reproduction of economy.

However, we wonder if the gap of wealth in China is reasonable. China is a socialist country,

with economic development and common prosperity for a common goal. Given that common

prosperity is established on the basis of development, to realize common prosperity must develop

economy. This will inevitably cause a widening gap between rich and poor. It is easy to

understand that in certain period the richer get richer and the poor get poorer. It is said in Bible

Matthew: a king gives 1000 coins to three people. After a period of time, the first person changes

1000 coins into 5000 coins and the second person gets 2000 coins while the last person is still

holding the 1000 coins. Therefore, the king gets back the 1000 coins and gives it to the first

person. It is the famous Matthew Effect, which seems unfair but is reasonable indeed. For one,

people who have a lot are almost people who have succeeded. They obtain social recognition and

trust, which makes them easier to get more chances. Conversely, people who get little social

recognition and trust have less opportunities. At the same time, rich people are more able to make

big investments. As the effect of capital accumulation is not simply the sum of unit capital, the

expected income of big investment is much higher. This is obviously one of the reasons why the

gap is widening. However, from the angle of efficiency and fairness, these reasons are anyhow

29

The Influence of Wealth Gap on China’s Economic Growth

reasonable.

References

郭熙保, 经济发展: 理论与政策, 中国社会科学出版社, 2000.

李实、赵人伟等, 中国经济改革中的收入分配变动, 管理世界, 1998(1): 43—56.

刘长庚、吕志华, 改革开放以来我国居民边际消费倾向的实证研究, 消费经济, 2005(8): 21-4.

刘红慧, 转型期经济增长与收入分配关系研究, 硕士学位论文.

刘颖, 北京市收入分配与经济增长关系实证研究, 硕士学位论文.

权衡, 收入分配与经济增长的相关性现代分析框架及其争论, 社会科学, 2004 年第 6 期.

王德祥、李建军, 财政分衩、经济增长与外贸依存度----基于 1978-2007 年改革开放 30 年数据的实证

分析, 开放战略探索三十年回归与展望.

向书坚, 我国城镇居民收入分配差距变化定量分析Ⅲ, 当代经济科学, 1998(20): 1-5.

杨俊、张宗益, 收入分配与经济增长近代西方理论与实证考察, 重庆大学学报, 2002, 25(10).

叶礼奇, 基尼系数计算方法, 中国统计, 2003(4).

张汉斌、刘庆华, 浅谈贫富差距对经济增长的影响》, 邢台职业技术学院学报, 2000, 17(2).

朱平, 贫富差距的合理性及其限度, 南京师大学报 (社会科学版), 2001(05).

Alesina A., Perotti R., “Income distribution, political instability and investment”, 1996(06).

Alesina A., Rodrik D., “Distributive politics and economic growth”, 1994.

Barror, “Government spending in a simple model of endogenous growth”, 1990(02).

Barror, “Inequality and Growth in a Panel of Countries”, 2000.

Bourguignon F., “Pareto superiority of unegalitarian equilibria in Stiglitz's model of wealth distribution with

convex saving function”, 1981(49).

Deininger K., Squire L., “Measuring income inequality: A new data-base”, 1996(03).

Deininger K., Squire L., “Inequality and growth: Results from a new data set”, 1998.

Persson T., Tabellini G., “Is inequality harmful for growth? Theory and evidence 1994 development”, 1999.

Romer P. M., “Increasing Returns and Long-Run Growth”, 1986.

Stiglitz J. E., “The distribution of income and wealth among individuals”, 1969.

(Responsible Editor: Xu Lingjue) (Proofreader: Wang Jue)

30

Research of Mathematical Economics No. 1 2011

Bundling Sales of Information Goods: Models and Analysis

Shi Fangning

(School of Economics, Renmin University of China)

Abstract: This paper studies the impact of bundling sales on merchandising of information goods. Our analysis

focuses on seller’s profits and consumer’s surplus, as well as the optimal bundle prices. We consider two common

bundling types: bundling of single-product in amount and bundling of multiproduct. For the two cases, we

develop models to calculate the optimal pricing and its condition, profits and consumer surplus. Our analysis

implies that, under certain situation, bundling sales yields more profits, but harms the consumers’ interest.

Keywords: Information Goods, Bundling Sales, Price Discrimination, Optimal Pricing

1. Introduction

Information good is a type of commodity aiming at spreading information with its main

value derived from the information it contains. In essence, any products which can be digitized

are information goods, such as newspapers and magazines, movies and music. Usually,

information products also contain information service, that is, the seller provides services like

collecting and processing information, or provides a platform where users can share information,

such as search service on web, mailbox and MSN. In this paper, we study only information goods

which can be digitized and traded, like software, newspapers, database, financial information and

research reports and so on, but not information service.

Information goods have several characters which make themselves distinctive from other

commodities. First, values of information goods depend on individual’s preference. Different

consumers value the same information goods bundle differently. For example, individual’s

knowledge, the ability to use the commodity, the necessity of the information for the person,

these factors will all affect individual’s value of the information goods. Consumers do not

consider the costs or the sources of the information but the utility they bring. Second, information

goods have the feature of high fixed costs and low marginal costs. Obviously, it determines that,

31

Bundling Sales of Information Goods: Models and Analysis

to make a lucrative investment, information goods cannot be sold by its marginal price. This

character also means that there exists explicit scale economy, that is, the more the information

goods are produced, the lower the average cost is. So it is more proper to bundle a large number

of information goods than other commodities. On the other hand, this character also leads to

natural monopoly within this industry. Third, information goods have strong network effect.

Growing market penetration or access to the products helps improve their function. For instance,

more users make software spread faster, and also lead to better function.

Bundling sales is a merchandising strategy that is often used by sellers to conduct price

discrimination or enhance their monopoly power. It means sellers provide goods in packages,

which can be the same goods provided in quantity-dependent packages or two even more

different goods provided in a package. Bundling sales is very common in daily life: airline

companies provide both single-way and round-trip tickets; banks offer a series of comprehensive

service which cannot be divided; restaurants usually provides complete dinners which contains

several different dishes; and daily commodities like toothpaste and detergent are sold in small

and large packages.

As for information goods, the cases of bundling sales are also very popular. In this paper, we

divide them into two broad classes: bundling of single-product and bundling of multiproduct.

Bundling of single-product means sellers provide the same goods in quantity-dependent packages.

When providing commodities like internet access and messages, sellers usually charge in this

way. For example, the following tables are price policies of China telecom Beijing Corporation

for 3G cellphones’ charge for Internet tariff and messages1.

1

32

Usually when consumers purchase for the next month’s cell phone services, they will always avoid using the

service exceed the amount contain in the bundle. So we see the price policies as bundling sales, but not two-part

pricing.

Research of Mathematical Economics No. 1 2011

Basic Tariff (per month)

Internet Tariff of the Bundle

(per month)

Tariff for Excessive Amount

5 yuan

30MB

0.005yuan/KB,with upper limit

500 yuan

10 yuan

100MB

20 yuan

200MB

50 yuan

1G

100 yuan

2G

sources: http://bj.ct10000.com/pages/tianyi_taocan5_1.action

Amount of Messages of the Bundle

(per month)

Tariff for Excessive Amount

5 yuan

60

0.10 yuan per message

10 yuan

130

20 yuan

200

50 yuan

300

Basic Tariff (per month)

100 yuan

500

sources: http://bj.ct10000.com/pages/tianyi_taocan5_1.action

Bundling of multiproduct means the seller provides two or more different goods which are

similar to each other in a package. For example, Microsoft sells its office software in bundle;

some websites provide financial information and research reports of stock, time-bargain in

bundles; sales of music discs and newspapers are also cases of multiproduct bundling.

So far, theoretical research for bundling sales concentrated on two aspects. One is to use

bundling to conduct price discrimination and extract more consumer surplus. The phenomenon of

bundling sales was firstly referred to by Burnstein (1960) and Stigler (1980). After that, utilizing

the framework of Stigler, Adams and Yellen (1976) analyzed bundling strategies of the

single-product monopolist in a duple-product market. They compared the three ways of bundling:

pure components strategy (set the single price on each commodity separately), pure bundling

(offer two commodities for sale only in a package), mixed bundling (offer each commodity

separately and a package of both). They illustrated that in most situations, various types of

bundling can be more or less profitable than unbundling sales. Following this, Schmalensee

33

Bundling Sales of Information Goods: Models and Analysis

(1984) extended their model by assuming that the distribution of reservation prices follows a

bivariate normal distribution. He confirms that in the mixed bundling case, it is always more

profitable than unbundling sales if the two goods are complements. Also extending the Adams

and Yellen model, McAfee, McMillan and Whinston (1989) confirmed mixed bundling is often

more profitable than pure bundling, and also provided a general sufficient condition for the

situation when mixed bundling is optimal in a duple-product case. Salinger (1995) developed a

graphical analysis of bundling and illustrates the benefits of bundling depends on the cost of the

individual products, its relative magnitude to the reservation prices and the correlation of

demands between the products. More recently, McCardle, Rajaram and Tang (2007) studied the

impact of bundling products on retail merchandising. They established conditions and insights

under which bundling is profitable, and confirmed again that bundling profitability depends on

individual product demands, bundling costs, and the nature of the relationship between the

demands of the products to be bundled.

The other aspect is to use bundling as a market strategy, so that a monopoly firm can

enhance its monopoly power as well as extend its power to other newly emerged relevant markets.

M.D. Whinston (1990), S. Martin (1999), Carlton and Waldman (2002) have discussed on this

problem elaborately and derived some important results. But in this paper, we do not discuss

effects of bundling in monopoly power, so we don’t talk about these theories.

However, multiproduct of large bundles has received little attention until recent years.

Armstrong (1996) showed that in some certain cases, the optimal pricing in the multiproduct case

can be determined using the techniques typically used in the single-product case. He found that

the optimal bundle price will exclude some low-demand consumers. Bakos and Brynjolfss (1999)

studied the strategy of bundling a large number of information goods. They found that when the

marginal cost of information goods is close to zero, as the number of bundling goods increases,

the deadweight loss per good and the consumer’s surplus per good for a bundle converge to zero,

and the seller’s profit per good increases to its maximum value. That is to say, bundling of large

amount of information goods is profitable. By assuming that consumer types and consumer

valuations are discrete, they also found that, in many cases, consumers can be induced to reveal

information about their valuations through their choices by offering them a menu of bundles at

different prices. Thus the monopolist may gain profit by pursuing a mixed bundling strategy of

offering several bundles, each including a subset of the available information goods.

34

Research of Mathematical Economics No. 1 2011

Our paper differs from the previous work in two aspects. Firstly, in this paper, we consider

two different types of bundling sales, bundling of single-product and multiproduct, in terms of

price discrimination. For single-product case, we refer to Jean Tirol’s (1998) model of optimal

nonlinear pricing and compare the optimal prices, profits, consumers’ surplus and net welfare of

the total society of bundling and unbundling cases. We get one of our results, that is, for the

single-product case, bundling sales can bring more benefits to sellers, but reduce the consumers’

surplus and total welfare of the society in certain circumstances. For the multiproduct case, by

assuming the consumer types and valuations are continuous, we extend Bakos and Brynjolfss’s

(1999) model, which discusses two ways to segment the market and compare them with pure

bundling and unbundling sales. We get the other result that under certain circumstances, price

discrimination through mixed bundling is profitable and extract the consumers’ surplus more

efficiently than pure bundling and unbundling sales. Secondly, our results imply that, in the

single-product case, the effect of bundling is relevant to the difference between the consumers’

types. The bigger the difference is between the consumers’ types, the more consumers’ surplus

the seller can extract by bundling sales. In the multiproduct case, the effect of mixed bundling is

dependent on consumers’ average valuation of products in package and the degree of discount the

seller set. The two bundling patterns can only efficiently segment the market and make profits

when consumers’ average valuation is not too high and the seller set the discount large enough.

This paper is organized as follows. In the second section, we present our model and

analysis of sing-product bundling sales. We use this model to determine the optimal bundle prices

and prices of unbundling sales, seller’s profits and consumers’ surplus. We establish conditions

under which bundling is profitable. In section 3, we present our model and analysis of

multiproduct bundling sales. We discuss the “quality discount” and “quantity discount” of

bundling separately and repeat this analysis. In section 4, we present some intuitive explanations

for the results we get. In the conclusion section, we summarize our key results and provide future

research directions.

2.

Model and Analysis of Single-Product Bundling

When provide commodities like internet tariff and cellphone messages, sellers usually

provide different bundles containing different amount of products according to various consumer

35

Bundling Sales of Information Goods: Models and Analysis

types. Consumers choose the bundles which maximize their utility. In this way, sellers can

segment the market and extract more consumers’ surplus.

Now, we develop a model to illustrate that the bundling strategy is more profitable than

unbundling sales. To simplify the model, we assume that the sellers only provide two bundles

which contains q1 and q 2 amount of goods, aiming at high-demand consumers and

low-demand consumers separately. Consumer types are continuous, denoted by taste parameter

, , . Usually the information goods tend to have zero or very low marginal costs of

production, so in our model, we ignore the effect of marginal costs.

First, we assume consumers have the following utility function2:

U V (q) T , if they purchase q units;

U 0,

if they purchase nothing.

where V (0) 0 , V (q ) 0 and V (q) 0 (that is, in this utility function, consumers have

decreasing marginal utility); T (q ) is the consumers’ total expenditure of the q units of goods;

is consumer’s taste parameter, differs from one person to another; V (.) is identical for all

the consumers. Then, assume taste parameter follows uniform distribution in , , with

f ( ) being the uniform density. Setting

f ( )

f ( )d 1 ,

it is easy to know that

1

.

In this model, we can get the following two propositions in the single-product case:

Proposition 1: For information goods, a single-product bundling sale is more profitable

than unbundling sale.

Proposition 2: As long as / is large enough, consumers’ surplus under bundling sale

is less than that under unbundling sale; at the same time, bundling sales reduce net surplus of the

whole society.

Now we present the proof.

2

36

Refered in Jean Tirole, 1994, Industry Organization Theory (7e).

Research of Mathematical Economics No. 1 2011

2.1 Bundling Sales

If the seller provides bundle I with q1 amount of goods and price of T1 to consumers

with taste parameter

, 0 , and provides bundle II with q 2 amount of goods and price

of T2 to consumers with taste parameter

0 , , in which / 2 , then the profit of

the seller is:

0

0

1 T1 f ( )d T2 f ( )d

(1)

The seller will maximize this profit under two kinds of constraints.

The constraint of the first kind requires consumers to be willing to purchase, that is, the

individual rationality constraints.

V (q1 ) T1 0 , if , 0 ;

V (q2 ) T2 0 , if 0 , .

That is,

V (q1 ) T1 0

0V (q 2 ) T2 0

(2)

The constraint of the second kind requires that the consumers do not exercise personal

arbitrage. These are known as “incentive-compatibility constraints”. In particular, the

high-demand consumers should not want to consume the low-demand consumers’ bundle and

vice versa.

So,

V (q1 ) T1 V (q2 ) T2 , if , 0 ;

V (q2 ) T2 V (q1 ) T1 , if 0 , .

From these constrains, we get,

0

T2 T1

V (q 2 ) V (q1 )

(3)

Substituting for 0 in (1) using the formula (3), we yield the function of profit in term of

37

Bundling Sales of Information Goods: Models and Analysis

T1 , T2 and q1 , q 2 :

1 T1 f ( ) ( 0 ) T2 f ( ) ( 0 )

T2 T1

1 T2 T1

T1

T2

V (q 2 ) V (q1 )

V (q 2 ) V (q1 )

(4)

T2 T1 2

1

T2 T1

V (q 2 ) V (q1 )

Differentiating

1 in respect to T1 and T2 separately, we have

1

2(T2 T1 )

1

1

2 0

T 1

V (q2 ) V (q1 )

1

2T2 T1

1

1

2 0

T2 V (q 2 ) V (q1 )

It is obvious that

1

0 always satisfies. So combining with the inequality (2), the

T 1

seller will choose

T1 V (q1 ) .

Setting

(5)

1

0 , we get

T2

0 / 2 , T2

1

V (q 2 ) V (q1 ) V (q1 ) ;

2

(6)

The seller maximizes his profit at this point3. Substituting for T1 , T2 in function (4)

using (5) and (6), we can derive the maximum profit:

2

( 2 ) 2

V

(

q

)

V (q1 )

max 1

2

4( )

4( )

Consumers’ surplus is:

3

38

The second-order condition is satisfied, for

2 1

2

0

2

T2

V (q 2 ) V (q1 )

Research of Mathematical Economics No. 1 2011

CS1 V (q1 ) T1 f ( )d V (q 2 ) T2 f ( )d

0

0

0

1

V (q1 ) V (q1 ) f ( )d V (q 2 ) (V (q 2 ) V (q1 )) V (q1 ) f ( )d

0

2

1

1 2 1 2

1 2 1

1

1 2

V (q1 ) ( 0 0 ) V (q 2 ) ( 0 0 )

2

2

2

2

2

2

1

4

8

2

2

2

V (q1 ) V (q 2 )

2.2 Unbundling Sales

Assume the seller sets price at p for per unit of goods, then T (q ( )) pq ( ) , and

each consumer chooses q ( ) to maximize his own utility: U (q ) V (q ) pq .

Setting U (q ) V (q ) p 0

,

we

get

p V (q ) ,

the

profit

is

2 pq( ) f ( )d .

The seller chooses p to maximize this profit.

Setting

2

q

q f ( ) pf ( ) d 0 , we can get the optimal value of p .

p

p

Consumers’ surplus is,

CS 2 (V (q( ) T (q( )) f ( )d (V (q( )) pq( )) f ( )d

2.3 Comparison

To simplify the model, let V (q )

1 (1 q) 2

, and V (q) 1 q ,

2

(1) If the products are sold in bundles, the profit is,

39

Bundling Sales of Information Goods: Models and Analysis

2

( 2 ) 2

1

V (q 2 )

V (q1 )

4( )

4( )

2

2

2

2q 2 q 2

( 2 ) 2 2q1 q1

2

2

4( )

4( )

The seller choose q1 and q 2 to maximize the profit, that is, q2 1 , q1 0 4. We get

the maximum profit:

2

2

V (q1 ) V (q 2 )

1

,

max 1

4( ) 2 8( )

Consumers’ surplus is,

CS1

1

4

8

2

2

2

2

2

1

8 2 16( )

(2) If the products are sold separately, the adverse demand function is p (1 q) , the profit

is 2

p

pqf ( )d p(1

Setting

) f ( )d p

p 2 (ln ln )

.

2

2(ln ln ) p

1

0 , we get p

,

p

2 ln( / )

max 2

.

2 ln( / ) 4 ln( / ) 4 ln( / )

Consumers’ surplus is,

CS 2 (V (q( )) pq( )) f ( )d

1

(

2q q 2

pq)d

2

1

3 ( )

( )