complete memo here

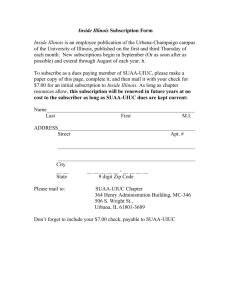

advertisement

HORWOOD MARCUS & BERK CHARTERED OPPORTUNISTIC “WHISTLEBLOWER” EXPLOITS ILLINOIS FALSE CLAIMS ACT March 12, 2012 If you have any questions regarding this memorandum, or any other state or local tax matter, please contact any of Horwood Marcus & Berk’s state and local tax professionals: Fred O. Marcus (312) 606-3210 fmarcus@saltlawyers.com Marilyn A. Wethekam (312) 606-3240 mwethekam@saltlawyers.com Jordan M. Goodman (312) 606-3225 jgoodman@saltlawyers.com David A. Hughes (312) 606-3212 dhughes@saltlawyers.com David S. Ruskin (312) 606-3235 druskin@saltlawyers.com Jennifer A. Zimmerman (312) 606-3247 jzimmerman@saltlawyers.com Breen M. Schiller (312) 606-3220 bschiller@saltlawyers.com David A. Fruchtman (312)281-1111 dfruchtman@hmblaw.com There is something troubling when relying on guidance by a Department of Revenue can get you sued. Even more fundamentally perplexing is the possibility that such a lawsuit could be brought by a private party purporting to act in the interests of the Department of Revenue that issued the guidance you had so diligently followed. A frightening prospect, but that is exactly what is happening in Illinois today. As of the date of this writing, approximately 200 lawsuits have been filed against retailers operating on a nationwide basis, alleging that they have fraudulently failed to collect tax on the shipping portion of sales to Illinois customers. These actions, colloquially referred to as “qui tam” or “whistleblower” actions, have been brought under the under the Illinois False Claims Act (“Illinois FCA”), which itself is modeled on the Federal False Claims Act (“Federal FCA”). The lawsuits accuse the retailers of committing fraud by not collecting tax on shipping charges to Illinois customers, a position that the Department of Revenue has endorsed explicitly in the case of several of the taxpayers, and more generally in over 30 information letters. Both the Illinois FCA and the Federal FCA were intended “to reward private individuals who take significant personal risks to bring wrongdoing to light, to break conspiracies of silence among employees of malfeasors, and to encourage whistleblowing and disclosure of fraud.” State ex rel. Beeler, Schad & Diamond, P.C. v. Target Corp., 367 Ill. App. 3d 860, 866 (Ill. App. Ct. 1st Dist. 2006), quoting United States ex rel. Matthews v. Bank of Farmington, 166 F.3d 853, 858 (7th Cir. 1999). Actions under the Illinois FCA can be brought by a private person known as the “relator.” See 740 ILCS 175/4(b). The classic relator is a “whistleblowing insider”: an individual that is a close observer or otherwise involved in the fraudulent activity. Id. at 1161. The most valuable relators are “typically insiders with direct and independent knowledge of fraud.” United States ex rel. Poteet v. Bahler Med., Inc., 619 F.3d 104 (1st Cir. Mass. 2010). The law requires that the relator give the information it has regarding the alleged fraud to the proper state authority, and the state then decides whether to intervene and take over the action. If the state declines to intervene, the relator may go forward with its action. Those found to have violated the Illinois FCA may be liable to the state for a civil penalty in addition to three times the amount of damages sustained by the state. 740 ILCS 175/3. In case you are wondering why anybody would want to be a relator, a quick glance at the Illinois FCA reveals a possible answer: the statute provides that the relator is entitled to not less than 25% and not more than Horwood Marcus & Berk Chartered 500 W. Madison Street Suite 3700 Chicago, IL 60661 Phone: (312) 606-3200 Fax: (312) 606-3232 http://saltlawyers.com 30% of the proceeds of the action or any settlement. In the context of a proper whistleblower action, where the relator is being rewarded for taking “significant personal risk to bring wrongdoing to light”, such financial incentives may make sense. However, where the relator is less a personally-invested whistleblower than a disinterested busybody, financial rewards risk distorting behavior in ways that run contrary to the original intent of the law. Such distortions, referred to judicially as “parasitic claims”, are eliminated by insisting that relators “must possess substantive information about the particular fraud, rather than merely background information which enables a putative relator to understand the significance of a publicly disclosed transaction or allegation.” United States ex rel. Stinson, Lyons, Gerlin & Bustamante, P.A. v. Prudential Ins. Co., 944 F.2d 1149, 1160 (3d Cir. N.J. 1991). The current spate of cases, all 200, were filed by the same Chicago-based law firm (“the Relator”). The Relator is not itself, nor is it working with, an entity or person that would traditionally be thought of as a whistleblower. The Relator has no “insider knowledge”, and it would be ludicrous to suggest that it is taking great personal risk to bring wrongdoing to light. Instead, the Relator is an opportunist taking advantage of a law that was never intended to apply to relators like it or to cases like these. In fact, the cases alleging fraud against retailers for not collecting Illinois tax on shipping charges are not the first attempt by the Relator to exploit the Illinois FCA. Beginning in 2002, the Relator brought suit against numerous out-of-state retailers alleging that they had fraudulently failed to collect use tax on purchases made over the Internet by customers in Illinois. The Relator’s law firm purchased goods over the Internet from retailers that were not themselves physically present in Illinois, but that were affiliated with “bricks and mortar” entities operating retail stores in the state. The Relator was not charged use tax on its purchase. Upon receipt of the goods purchased, the Relator returned the goods to the “bricks and mortar” store operated by the retailer’s Illinois affiliate. It was the Relator’s position that the ability to return the good in Illinois created nexus between Illinois and the out-of-state retailers sufficient to impose a use tax collection responsibility on those retailers. This electronic newsletter is provided to clients and friends of Horwood Marcus & Berk. The information described is general in nature, and may not apply to your specific situation. Legal advice should be sought before taking legal action based on the information discussed. Rules of certain state supreme courts may consider this advertising and require us to advise you of such designation. In addition to questioning whether the Relator is a proper whistleblower under Illinois FCA, the current cases involving shipping charges strike many as substantively suspect. Any taxpayer attempting to understand Illinois law on the proper taxation of shipping charges will likely finish the exercise with more questions than answers. Lending to the confusion, some of the retailers currently being sued for fraud had their tax treatment of shipping charges approved under audit by the Department of Revenue. Others had relied upon a leading provider of transaction tax management software to calculate and record transaction taxes on sales to Illinois, and the software was designed by its provider to treat “shipping charges” as exempt from Illinois use tax. Most of the retailers facing actions under the Illinois FCA have locations in Illinois and are registered as Illinois retailers. And while specific details vary, all of the retails facing suit have been operating within a legal landscape that is muddled and confusing. The fact that these actions involve a disputed legal question about which more than one reasonable interpretation exists can be clearly seen by reference to the Department’s own publicly available guidance, along with widely-used and respected tax research tools, such as RIA Checkpoint’s State Tax Chart and CCH’s Smart Chart. Nevertheless, the lawsuits filed by the Relator are a reality even though many find it frankly offensive, if not completely illogical, that a taxpayer making a good-faith effort to understand and apply a confusing aspect of the tax law could find themselves in court, being sued for fraud. HMB COMMENT The qui tam actions described above have paved the path for the filing of additional, opportunistic lawsuits, brought by relators who exploit legal uncertainties to their own financial advantage. One legal area ripe for such exploitation is unclaimed property, where the law is evolving at a rapid pace, and causing mass confusion about what property is subject to the law and who must report to the state. In fact, a suit under the Illinois FCA filed in Cook County Court and unsealed in January of 2012, alleges that two insurance companies perpetrated a "massive fraud" when they kept more than $524 million in unclaimed life insurance money that should have been turned over to Illinois. While the surrounding details remain unknown, the suit against the insurance companies evidences a worrying trend in whistleblower actions for businesses that are attempting to follow uncertain and often confusing laws, including legal grey areas spawned by court decisions that raise more issues than they address. Although businesses may find some comfort in knowing that suits premised on violations of the Illinois Income Tax Act are disallowed under the Illinois FCA, the recent foray into unclaimed property is troubling. * * * Horwood Marcus & Berk Chartered * * * You receive emails from HMB as a friend or client of our law firm. If you would like to opt out, please contact Maria Arellano at (312) 606-3200 or reply to this email.