United States

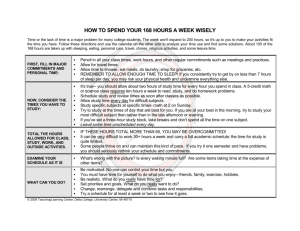

advertisement