Business course

advertisement

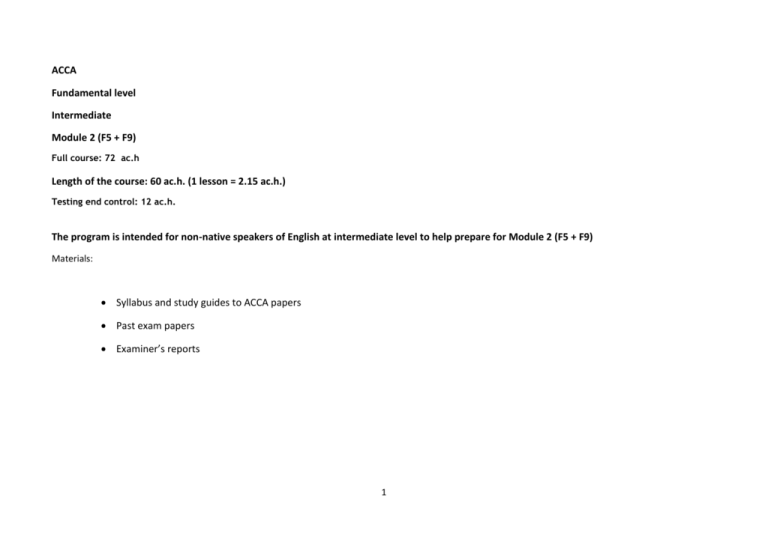

ACCA Fundamental level Intermediate Module 2 (F5 + F9) Full course: 72 ac.h Length of the course: 60 ac.h. (1 lesson = 2.15 ac.h.) Testing end control: 12 ac.h. The program is intended for non-native speakers of English at intermediate level to help prepare for Module 2 (F5 + F9) Materials: Syllabus and study guides to ACCA papers Past exam papers Examiner’s reports 1 Dates Lesson (Each lesson = 2.15 ac.h.) Vocabulary to focus on Grammar to focus on Business skills obtained Lesson 1 Target costing and lifecycle costing and activity-based costing Present tenses Explain and apply cost accounting techniques Lesson 2 Lesson 3 Lesson 4 Lesson 5 Lesson 6 Throughput accounting and backflush accounting Cost-volume-profit-analysis Transfer pricing The risks of uncertainty and linear programming Quantitative aspects of budgeting (affirmative, negative sentences and questions) Time: 19.00-21.15 25 February Giving definitions Describing Giving opinions 27 February Agreeing and disagreeing Means of comparing and speaking about the difference Making conclusions 3 March Select and appropriately apply decision-making techniques to facilitate business decisions and promote efficient and effective use of scarce business resources, appreciating the risks and uncertainty inherent in business and controlling those risks Commenting 5 March 7 March Writing Making suggestions Making recommendations 2 Identify and apply appropriate budgeting techniques and methods for planning and control 11 March Lesson 7 Budgeting techniques Expressing ideas in a structured way Lesson 8 Behavioral aspects of budgeting Assessing the advantages and disadvantages of the situation Linking words Lesson 9 Materials mix and variance analysis Lesson 10 Measuring planning variances Lesson 11 Interpreting financial data Lesson 12 Performance measurement Lesson 14 17 March Analyzing Assessing Writing in a structured way Making suggestions Figures Presenting information using graphs, charts and tables (bar charts, line graphs, pie charts and scatter graphs) Using passive Interpreting information (including the above tables, graphs and charts) presented in management reports Lesson 13 13 March Financial management and its function Verbs +Infinitives Verbs + gerunds Using gerunds Financial management environment Means of critical discussing 3 19 March 21 March Use standard costing systems to measure and control business performance and to identify remedial action Formulate and solve multiple scarce resource problems both graphically and using simultaneous equations as appropriate Assess the performance of a business from both a financial and non-financial viewpoint, appreciating the problems of controlling divisionalised businesses and the importance of allowing for external aspects Discuss the role and purpose of the financial management function Assess and discuss the impact of the economic environment on financial management 25 March 27 March 31 March 2 April Lesson 15 Lesson 16 Working capital management Investment appraisal Critical discussing Speaking about the advantages and disadvantages Discuss and apply working capital management techniques Means of speaking about possibility and probability Carry out effective investment appraisal Identify and evaluate alternative sources of business finance Explain and calculate the cost of capital and the factors which affect it Lesson 17 Business finance Conditionals 0, 1 Lesson 18 Cost of capital Conditionals 2 Lesson 19 Business valuations Lesson 20 Risk management Conditionals 3 Conditionals (revision) 4 4 April 8 April 10 April 14 April Discuss and apply principles of business and asset valuations 16 April Explain and apply risk management techniques in business 18 April