Taxation (FBT, SSCWT and Remedial Matters) Bill

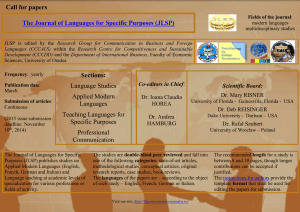

advertisement