Internal Audit Programs

advertisement

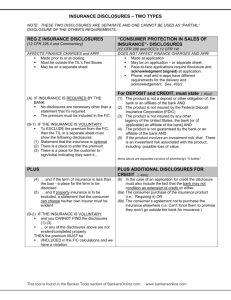

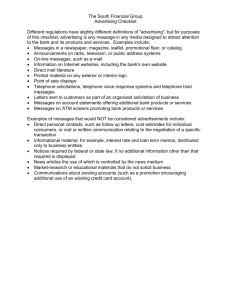

Retail Nondeposit Investment Products Compliance Audit The following items, as applicable, should be reviewed for compliance with the federal agencies joint policy statement on the sale of nondeposit investment products: • Written statement on the investment sales program • Evidence of board of director review of the statement and compliance reviews • Written policies and procedures governing the sale of nondeposit investment products • Copy of the minimum disclosure for nondeposit investment products • Samples of signed customer statements • Samples of confirmations, account statements, and periodic statements • Samples of advertisements • Evidence of training • Copy of any incentive compensation programs In addition, actual procedures should be checked against the formal program and procedures to ensure compliance. Interviews should be conducted with the personnel responsible for complying with the joint policy statement on the sale of nondeposit investment products to ensure adequate knowledge of responsibilities and appropriate conduct. The following checklist should be modified to fit the specifics of your institution. NONDEPOSIT INVESTMENT PRODUCTS Yes, No N/A 1. Has the institution’s board of directors adopted a written statement that addresses the risks associated with the investment sales program and that contains a summary of policies and procedures outlining the features of the institution’s program and addressing the issues contained in the federal agencies’ joint policy statement dated February 15, 1994, and the Consumer Insurance Rule of 2001? Work Paper Reference Comments 2. Is the institution’s statement reviewed periodically by the board of directors? 3. Does the statement address the scope of activities of any third party involved, as well as the procedures for monitoring compliance by third parties? 4. Do the institution’s written policies and procedures include: • Compliance procedures? • Supervision of personnel involved in sales? • Criteria governing the selection and review of each type of product sold or recommended? • Permissible use, reuse, and confidentiality of customer information? • Designation of employees to sell investment products, including descriptions of responsibilities, appropriate referral activities, training requirements, and compensation arrangements? • Arrangements with third parties, including written agreements and review of the third party? 5. Do compliance procedures: • Identify any potential conflicts of interest and how such conflicts should be addressed? • Provide for a system to monitor customer complaints and their resolution? • Provide for verification that third-party sales are being conducted consistent with the written agreement, if applicable? 6. Are the results of reviews conducted by the compliance personnel, as well as the audit function, reported to the board of directors? 7. Does the institution, when recommending or selling nondeposit investment products to retail customers, ensure that customers are fully informed that the products: • Are not insured by the Federal Deposit Insurance Corporation (FDIC) or any other agency of the United States, the bank, or any of its affiliates? • Are not deposits or other obligations of the institution and are not guaranteed by the institution? • Are subject to investment risks, including possible loss of principal? 8. Is such disclosure provided: • Orally during any sales presentation? • Orally when investment advice concerning nondeposit investment products is provided? • Orally and in writing prior to or at the time an investment account is opened to purchase these products? • In advertisements material? and other promotional 9. Does the institution obtain a signed statement when a customer opens an investment account acknowledging that the customer has received and understands the disclosures? 10. Do confirmations and account statements for such products contain at least the minimum disclosures if they contain the name or the logo of the institution or an affiliate? 11. If a customer’s periodic deposit account statement includes account information concerning the customer’s nondeposit investment products, is such information clearly separate from the information concerning the deposit account, and is it introduced with the minimum disclosures and the identity of the entity conducting the nondeposit transaction? 12. Is information about nondeposit investment products advertised and disclosed in a manner that clearly differentiates these products from insured deposits? 13. Do advertisements for nondeposit investment products conspicuously include at least the minimum disclosures? 14. Do such advertisements refrain from suggesting or conveying any inaccurate or misleading impression about the nature of the product or its lack of FDIC insurance? 15. Does the institution refrain from recommending or selling a nondeposit investment product with a name similar to that of the institution? 16. If the institution conducts investment sales programs on bank premises, does it do so in a physical location distinct from the area where retail deposits are taken? 17. Has the institution taken steps to ensure that tellers and other personnel located in the routine deposittaking area do not: • Make general or specific recommendations regarding nondeposit investment products? • Qualify customers as eligible to purchase such products? • Accept orders for such products, even if unsolicited? 18. Has the institution taken steps to ensure that investment sales personnel are properly qualified and trained? 19. Has the institution taken steps to ensure that investment sales personnel recommend investments that are suitable for the particular customer? 20. Has the institution taken steps to ensure that incentive compensation programs are properly structured to protect customers and are in compliance with the calculations in Regulation R (12 CFR 218.700(c))? Note: Regulation R will consider a referral fee of not more than $25 a nominal fee. Fees for referrals of high net worth individuals may be higher if certain disclosures are given. ? 21. Do bank officers and employees who make investment recommendations or decisions for customers report their personal transactions in securities to the bank within [10] [30] days after the end of the quarter in which they are purchased? Note: FDIC and OTS regulated banks use 30 days (12 CFR 344.9 and 12 CFR 551.150) — OCC and Fed regulated banks use 10 days (12 CFR 12.7(4) and 12 CFR 208.34(g)(4)).