chapter one

advertisement

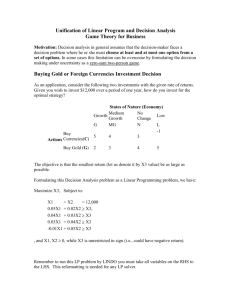

Carry Over Trade Boom or a Bust ? Msc Mathematical Trading and Finance Project Semester B By AMIT PATEL Student No. 070026966 CASS BUSINESS SCHOOL SMM522 PROJECT ASSESSMENT TRANSCRIPT Student Name: Session: Amit Patel Student Number: 070026966 Project Title: CARRY OVER TRADE BOOM OR A BUST ? Project Tutor: Professor John Hatgioannides Semester Start: B Course: MSC MTF AKNOWLEDGEMENT This study would not have been possible without the support and assistance of a number of people and organizations as well as my family. Mr Babulal Patel, father to me, was the source of the inspiration and incentive to begin the research effort. He provided critical assistance along the way. His help was invaluable as he is a FX trader and conducts research in FX and Commodity market since 15 years. Members of my staff assisted with this study in myriad ways. Especially I am grateful to Professor John Hatgioannides who allowed me to do this project and who was all the way helpful towards my successful completion of project. No study of this size can be completed without disruption of one’s normal family and work routine. This project could not have been completed without the support, encouragement, and love and caring of my family and work mates due to their exceptional support. The Precious knowledge attributes of this report are derived from those mentioned above, from my 4 years of trading experience and many other internet sources. The conclusions and any errors, omissions or mistakes within this report are attributable only to the author. Best regards, Amit Patel Cass Business School TABLE OF CONTENTS CHAPTER ONE ................................................................................................................. 5 WORLDWIDE EMERGENCE OF CARRY OVER TRADES ......................................... 5 1.0 INTRODUCTION .................................................................................................. 5 1.1 CARRY TRADE CURRENCIES............................................................................. 5 1.2 EQUITY INDICES AND CARRY TRADE ............................................................ 7 1.3 CONCLUSION ......................................................................................................... 9 CHAPTER TWO .............................................................................................................. 10 CARRY OVER TRADES AND RETURNS ................................................................... 10 2.0 INTRODUCTION ................................................................................................ 10 2.1 CARRY TRADE PERFORMANCE ...................................................................... 10 2.2 CONCLUSION ....................................................................................................... 16 CHAPTER THREE .......................................................................................................... 17 CARRY OVER TRADE BUBBLE .................................................................................. 17 3.0 INTRODUCTION ................................................................................................ 17 3.1 CARRY TRADE BUBBLE .................................................................................... 17 3.2 JAPANESE MONETARY POLICY ...................................................................... 18 3.3 CONCLUSION ....................................................................................................... 18 CHAPTER ONE WORLDWIDE EMERGENCE OF CARRY OVER TRADES 1.0 INTRODUCTION Carry over trade is a term associated with the interest rate differential between high and low yield currencies. As for example borrowing Japanese yen (JPY) at 0.50% LIBOR and investing in high yield currencies like Turkish Lira (TRL) at 15.75% LIBOR. (Libor rates as per Feb 11 2008). The exceptionally low borrowing rates attract a lot of institutional and private investors to borrow currencies like Japanese Yen(JPY), Swiss Franc (CHF) primarily. Carry over trade doesn’t simply mean funding low yield currencies to buy high yield but its has a bit more broader prospectus. Such low rate borrowings can be used to create a portfolio or Investment fund having a wide variety of assets like Equities, Stock Indices, Commodities, High yield currencies and Bonds. The extent to which carry over trades progress tend to reflect investors risk appetite. The benefits of carry over trades are not limited to capital gains but also the interest rate differential between two assets like currencies. However there is a drawback associated which is very vulnerable and can erode the capital gains which is known as exchange rate fluctuation. Below are the some aspects of carry over trade fundamentals. 1.1 CARRY TRADE CURRENCIES Over the past decade we have seen a surge in carry trades which have been funded by Japanese Yen. In order to understand the fundamentals of carry trades it is equally important to analyse the contribution of Yen and other funding currencies to the surge and possible downfall of carry trades. Due to the monetary policy of Bank of Japan(BOJ) the borrowing rate on Japanese Yen has been at historical lows.( 0.50%). Similarly other funding currencies like the Swiss Franc(CHF) , Euro (EUR), U.S.Dollar(USD) have been also used to diversity borrowing exchange rate risk. On the other hand Currencies like Australian Dollar (AUD), Turkish Lira (TRL), New Zealand Dollar (NZD), Brazilian Real ( BRL) etc have been target high yield currencies. It is true that the recent appreciation of high yield currencies has been spurred due to solid growth in their respective economies but at the same time we cannot ignore the fact that carry trade has added a factor to the appreciation of high yield currencies as well. Below are the few Currency interest rates guide as per 12 -02-2008. [FXCO08] Low Yield Currencies High Yield Currencies Japanese Yen (JPY)- 0.50% Turkish Lira (TRY)- 15.75% Swiss France (CHF)- 2.75% Brazilian Real (BRL)- 11.25% U.S.Dollar (USD)- 3.00% New Zealand Dollar (NZD)- 8.25% Australian Dollar (AUD)- 7.00% Iceland Koruna (ISK)- 13.75% In the world of carry over trades the low yield and high yield currencies have significantly developed a correlation among themselves. As for example if we look at the chart below of low yield or funded currencies like Jpy and Chf their movements have been closely associated with each other. Source : [ SaxoBank Trader] In a similar fashion the high yielding currencies like Turkish Lira(TRY), South African Rand(ZAR), Polish Zloty (PLN) and Brazilian Real have highly correlated movements. The huge move of ZAR at the end of chart which is indicated as orange is due to instability in South African politics and is a medium term shock. Source: [Bloomberg] 1.2 EQUITY INDICES AND CARRY TRADE There is a high degree of correlation between Equity Indices , High Yield Currencies and funding currencies like JPY. JPY has negative correlation with the movements of equity indices like Dow Jones Industrial Average(DOW 30) . This is due to the fact that a lot of investors fund their borrowings by Yen and invest in risky assets like Dow Jones. Hence any event which triggers a steep fall or rise of Dow will trigger a opposite move in Jpy. This is due to unwinding or carry trades. Unwinding is described as a process in which Institutional or private investors would liquidate the positions to payoff the loan borrowed in funded currency (Jpy). When a massive unwinding takes place, funding currencies like Jpy and Chf can experience a sudden gain against Usd. As for example during credit crisis July 07’ Source: [Bloomberg] The above chart explains the correlation between a stock indice (Dow 30) indicated yellow, High yield currency (TRY) indicated white and a low yield funding currency (JPY) indicated orange with all the price levels on the right side of picture. If we take any time frame we will see a positive correlation between Dow and Try and negative correlation between Jpy and Dow. Similarly a negative correlation or price movements can be seen between Jpy and Try. For example on Feb 28 time scale indicative Usd/Jpy rate on chart is 117 , Usd/Try is 1.45 and Dow Jones at 12,000 area. If we move three time frames ahead to May 31 we can see weakening Usd/Jpy (approx 121) , strengthening Usd/Try (1.33) and Dow at 13,500 area. This effect can be seen on analysing any particular time frame. 1.3 CONCLUSION Thus in the above chapter we can conclude that most of the high yield or risky assets are funded by low cost borrowings. This has lead to a new era of carry over trade where the returns on them are exceptionally high. However in my theory above I have couple of drawbacks that can erode the earnings of such risky assets. This can result due to factors like major event risk like Credit Crisis 07’, Asian Currency Crisis 97’ and other shocks when there is uncertainty in financial markets. This uncertainty can lead to massive sell off of risky assets like Equity indices, Equities, High yield currencies due to risk averseness or safe heaven buying. Risk averseness leads to further huge fluctuations in exchange rates of currencies and volatility of risky assets tend to increase. Situations like Credit Crisis 07’ which can be classified as major event risk created a lot of financial imbalances which resulted in downfall of major Stock Indices and Currencies against Jpy and Chf . CHAPTER TWO CARRY OVER TRADES AND RETURNS 2.0 INTRODUCTION In this chapter, I will discuss about exceptional amount of carry interest and carry returns. This chapter will also investigate on net long positions of some carry trades as well as carry index performances with the help of charts and statistics sourced from Bloomberg. Further a critical analysis on carry trade boom will be provided and whether such high level appreciated reflects the fundamentals of respective economies. 2.1 CARRY TRADE PERFORMANCE Statistical evidence suggests that there was a rapid growth of carry over trades since 2003. If we compare the net long positions of Brl/Jpy and Try/Jpy between 2003 and 2008 we can see 250% increase in Brl/Jpy longs and approximately 260% increase in Try/Jpy longs. Below are the charts sourced from Bloomberg. Chart-4 Net Long Positions in Brl/Jpy. Source:[ Bloomberg] Chart-5 Net Long positions in Try/Jpy Similarly charts of other high yields will also depict similar increments in terms of net long positions. Not only high yields but also Carry trade index has exceptional returns as for example Bear Stearns Smart Carry Index shown has provided a return of 180% in 5 years time period. In a similar fashion if we just take into account carry returns or capital gains on high yield currencies such as Brl/Jpy longs have fetched 189% as top performing pair in Latin America and Argentinean peso/Japanese yen (Ars/Jpy) having fetched 26.56% in 5 year Time period. Source:[ Bloomberg] Carry Returns on Exotic High Yield Currencies of South America Further Charts 7 and 8 depict the interest return on high yielding exotic currencies. This carry trades have benefited a lot from leverage finance and thus the returns are in double digits. Turkish Lira (Try) tops the chart with exceptional 112.39% interest return following Brazilian Real (Brl) with 78.83%. Similar patterns of returns can be seen in Mexico, Iceland, Poland, Hungary, South Africa etc Source:[ Bloomberg] Chart -7 Carry Returns on Exotic High Yield Currencies Source:[ Bloomberg] Chart- 8 Interest Rate Returns on Exotic High Yield Currencies Source:[ Bloomberg] Chart- 9 Interest Rate Returns on Exotic High Yield Currencies 2.2 CONCLUSION In the above chapter, I have put forward the theory of carry over trades along with statistics supporting the boom of carry trades. However it is not appropriate to conclude that capital gains in high yield currencies are due to carry over trades and interest rate differentials. There is a lot of fundamental factors which support such currency appreciation. As a majority of high yield currencies like South African Rand(ZAR), Turkish Lira(TRY), Brazilian Real( BRL) are emerging markets. The world economy has seen solid growth since 2003 which seems the inception period of carry over trades as well. Almost every emerging markets have seen huge capital inflows from investors in terms of Infrastructure development. Further Emerging markets like China, Brazil, India, Poland, Hungary etc have seen remarkable increase in foreign exchange reserves brought as export revenues. These increases the demand of local currency as exporters then tend to convert the U.S. Dollar revenue to local currencies on OTC or freely floated markets. Thus globalization and foreign direct investments have also contributed to the appreciation of such currencies which fall in the emerging markets criteria. On the other hand high yield currencies of Industrialised nations like Canada, Australia, New Zealand etc have been supported by rising commodity prices. Other riskier assets like bonds, stocks and indices have also appreciated due to much more healthier state world economy compared to the era before 2003. Further the Federal Reserves Money supply which according to economist survey is increasing at the rate of 11% has lead to weakening of U.S Dollar overall and fuelling to further appreciation of world wide currencies. [PAGA] Thus such capital gains on currencies, stocks and bonds cannot be solely attributed to carry over trades and interest rate differentials. Carry over trades are just one of the driving forces behind the boom and interest rate differentials is just one of the benefits. CHAPTER THREE CARRY OVER TRADE BUBBLE 3.0 INTRODUCTION In this chapter, I will put forward facts and figures to what extent Yen carry over trade and induced a bubble factor in global financial markets. I will primarily investigate Japanese Yen due to its high contribution in carry trades compared to other low yields like Swiss Franc. Further research on Japanese household’s contribution to the creation of such carry trade bubbles will also be included. Finally I will conclude whether the carry over trade era has ended or if there is any sign of carry trade bubble collapse. 3.1 CARRY TRADE BUBBLE There is no official statistics to show the extent to which Yen carry trade has taken place in financial markets but economists believe the size to be in range between $200 billion to $1 trillion. [FOCO07] The Yen carry trade in currency markets is at 97% of its highest volume ever and $ 250 billion worth yen is borrowed from Japanese banks for speculative purposes. [PAGA07] The default Long-Term Capital Management(LTCM) due to Russian debt crisis in 1998 caused panic selling and Yen rose 20% in just 2 months. Today the number of hedge funds have also increased and their exposure to such carry trades as well which might give an indication of next major unwinding will be more devastating than 98’. [WIPE07] A huge carry trade bubble is developing in Eastern European countries where the debt has almost surpassed the foreign reserves of countries like Poland, Hungary and Latvia. In Poland 33 % and in Hungary 50% of mortgages have been propelled through cheap borrowing due to high local borrowing rates. This seems to be identical to Asian Crisis 98’ where the corporate debt was funded by foreign currency and huge devaluations resulted in crisis. The only difference here is the debt is in the form of house mortgage. [HOCO07] Such carry trade funding is poured into various financial assets like high yield bonds, Currencies, Credit derivatives, Corporate loans, Real Estate and Mortgages. 3.2 JAPANESE MONETARY POLICY Since 1998, Bank of Japan’s official lending rates have been almost 0% which has triggered carry trades and fuelled a possible bubble factor in financial industry. Due to extremely low interest rates Japanese household are unable to save their saving or unable to procure returns on their savings. Japanese investors have invested a whopping 1,500 trillion Yen in financial assets, which is thrice the size of Japan’s GDP. The major concern here would be when Bank of Japan would start tightening its monetary policy which may trigger unwinding of carry trades provided the yen carry trades do not seem to be appealing. In chapter one, I discussed about Credit Crisis 07’ which triggered massive unwinding of carry trades. Such an event was just a small example the extent to which carry trade can have devastating affects. [TANA07] 3.3 CONCLUSION The above chapter gives a glimpse of astonishing facts which haunt the future of carry over trade. No doubt the statistics mentioned earlier prove that the carry over trade bubble is building, but it is difficult to conclude whether it is going to bust in the near term. This is due to lack of evidence of whether long term investors have really started unwinding the carry trades. The triggering point may be huge fluctuations in Usd/Jpy exchange rate that will probably force investors to scale their positions. Similarly mortgages and corporate debt funded by Yen will have to pay a hefty price for such a carry trade strategy. When I started writing this particular research report Yen was trading at 108.80 against the U.S. Dollar (18-02-08) and by the time I finished the conclusion Yen hit a multi year low of 101.30 (07-03-08) on U.S recession concerns. Indeed this gives an example of devastating affects when unwinding is taking place. Hence in order to get a confirmation of carry over trade bubble has bust a triggering point is essential which may be in the form of rising housing defaults or corporate debt due to exchange rate fluctuations. But, for now its way to early to conclude and difficult to predict the bubble is going to bust. REFERENCES Jeffrey Frankel, 2007, “Getting Carried Away: How the Carry Trade and Its Potential Unwinding Can Explain Movements in International Financial Markets” Milken Institute Review Paper, Harvard University. “Is There A Yen Carry Trade?” Lazard Asset Management LLC, 2007. Bank for International Settlements (2007): “Evidence of carry trade activity ”, BIS Papers, no 14, February. [FXCO08] Fxstreet.com,2008, “World Interest Rates Table”[Online]. Available at http://www.fxstreet.com/fundamental/interest-rates-table/ . Access date [12-02-08] [ FOCO07] Forex.com,2007, “Carry trade unwinding roils currency markets”[online]. Available at http://www.forex.com/07-02-27.html . Access date [ 15-02-08] [PAGA07]- Paul.G, 2007, “ BOE, Not BOJ, May Pop the Carry- Trade” [online]. Available at http://www.larouchepub.com/eiw/public/2007/2007_1-9/2007_1-9/20079/pdf/49_709_paul.pdf . Access date [ 15-02-08] [WIPE07]- William.P,2007, “ Viewpoint, A Currency bubble risis in Japan”[online]. Available at http://www.iht.com/articles/2007/01/21/bloomberg/sxpesek.php Access date[06-03-08]. [HOCO07]- Howiecopywriter.com,2007, “ The carry trade and real estate bubble”[online]. Available at http://howiecopywriter.blogspot.com/2007/06/carry-tradeand-real-estate-bubble.html . Access date[06-03-08] [TANA07]- Tadashi.N,2007, “ Weak Yen Conundrum”[Online]. Available at http://www.international-economy.com/TIE_W07_Nakamae.pdf. Access date[15-02-08] [SAXOBANKTRADER]- Saxobank.com, Online Trading Software.