postfile_3569

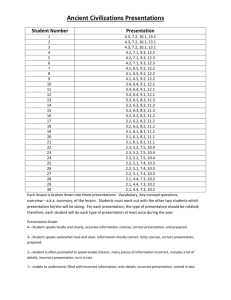

advertisement

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

科目:葉兆輝 TEST

※

1

請填入學號:

注意:答對題數每題得 10 分,答錯題數每題扣 10 分。

答案欄:考生請在「答案欄」上作答,謝謝合作。

姓名:

答對題數:答錯題數:

Q1.

Q6.

Q2.

Q7.

Q3.

Q8.

Q4.

Q9.

得分:

Q5.

Q10.

Q1. If we compare the prices of two options that are identical in every way except that one is American and one is European,

the price of the European should be at least as high the American.

A. True

B. False

Q2. When the price of a stock moves, the dollar change of the stock is generally less than the dollar change of option price.

A. True

B. False

Q3. Options are a zero-sum game, meaning that profits on the long position represent losses on the short side, and vice

versa.

A. True

B.

False

Q4. Call and put option princess decrease as the volatility of the underlying stock increases.

A. True

B. False

Q5. Under the binomial option-pricing model, once the possible stock prices at expiration have been determined, it is not

necessary to make an assumption as to the probability of reaching each ending stock price.

A. True

B. False

Q6. When using put-call party relationships, all of the following conditions must be met in order to be certain that the cash

flows of the portfolios will be identical at the options expiration date, except:

A . The call and put options must have the same exercise price.

B . The call and put options must share the same expiration date.

C . The underlying stock must not pay a dividend during the life of the options.

D . The call and put options must be American options.

Q7. Using the binomial option-pricing model, what is the appropriate hedge ratio for the following scenario: current

stock price = $24; possible stock prices at expiration = $36, or $16; exercise price of a call option = $30?

a. 0.3

b. 0.4

c. 0.6

d. 0.5

Q8. In order to price an option using the binomial option-pricing model, which of the following prices of information is not

necessary?

A. the current price of the underlying stock.

Incorrect. This is required information.

B. an estimate of the company’s current beta.

Correct. This isn’t required information.

C. the amount of time remaining before the option expires.

Incorrect. This is required information.

D. the market’s current risk-free rate.

Incorrect. This is required information.

Q9. Which of the following portfolios represents a synthetic position equivalent to a short bond PV(x)?

A. long call, short stock, and short put.

Correct

B. short call, short stock, and short put.

Incorrect.-B=C-S-P.

C. short call, long stock, and long put

Incorrect.-B=C-S-P.

D. long call, short stock, and long put.

Incorrect.-B=C-S-P.

Q10. Consider the following scenario. The stock of ABC company is currently trading at$18.in 6 mouths, the stock will

either be worth $27, or$9. The risk-free rate is 20%.using the risk-neutral method, what is the probability of an upward move

(to $27)?

a. 0.3

b. 0.4

c. 0.5

d. 0.6

1. If we compare the prices of two

options that are identical in every way

except that one is American and one is

第 1 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

European, the price of the European

should be at least as high as the

American.

a. True

Incorrect. The American call should be

worth at least as much as the European

call due to the American call’s greater

flexibility.

b. False

Correct.

2. When the price of a stock moves, the

dollar change of the stock is generally

less than the dollar change of the option

price.

a. True

Incorrect. The dollar change of the stock

is greater than the dollar change of the

option. It is the percentage change in the

option price which is greater than the

percentage change in the stock price.

b. False

Correct.

3. Options are a zero-sum game,

meaning that profits on the long position

第 2 頁,共 69 頁

2

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

represent losses on the short side, and

vice versa.

a. True

Correct.

b. False

Incorrect. Options are in fact a zero-sum

game.

4. Call and put option prices decrease as

the volatility of the underlying stock

increases.

a. True

Incorrect. Due to the asymmetry of

option payoffs, call and put option prices

increase as the volatility of the

underlying assets increases.

b. False

Correct.

5. Under the binomial option-pricing

model, once the possible stock prices at

expiration have been determined, it is

not necessary to make an assumption as

to the probability of reaching each

ending stock price.

第 3 頁,共 69 頁

3

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

a. True

Correct.

b. False

Incorrect. This is due to the fact that the

market already prices these probabilities

into the stock price, and the fact that

binomial model prices an option through

the principle of “no arbitrage”.

6. When using put-call parity

relationships, all of the following

conditions must be met in order to be

certain that the cash flows of the

portfolios will be identical at the options’

expiration date, except:

a. The call and put options must have the

same exercise price.

Incorrect. This is a necessary condition.

b. The call and put options must share the

same expiration date.

Incorrect. This is a necessary condition.

c. The underlying stock must not pay a

dividend during the life of the options.

Incorrect. This is a necessary condition.

d. The call and put options must be

第 4 頁,共 69 頁

4

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

5

American options.

Correct. The call and put options must

be European options.

7. Using the binomial option-pricing

model, what is the appropriate hedge

ratio for the following scenario: current

stock price 大盤 7700 = $24; possible stock

prices at expiration = $36, or $16 $7800,

or $7600; exercise price of a call option

= $30? 買 權

月份: 2009/12

履約價 4400

a. 0.3

b. 0.4

c. 0.6

d. 0.5

correct. (6-0)/(36-16); h

=0.3

C MAX 36 30,0 MAX 16 30,0

6

S

S

36

7.1 Using the binomial option-pricing model, what is the appropriate hedge ratio for the

following scenario: current stock price 大盤 7700 = $24; possible stock prices at

expiration = $7800, or $7600; exercise price of a call option = $4400? 買 權履約價

4400 月份:

2009/12

C MAX 7800 4400,0 MAX 7600 4400

S

S

第 5 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

6

current stock price=$35;possible stoc

at expiration=$45,or$33;exercise pric

option=$27?

C 45 27 33 27 45 33

S

45 33

45 33 ;h=1

C MAX 45 27 ,0 MAX 33 27 ,0 18 6

S

S

45 33

http://www.investorwords.com/5602

atio.html

An options strategy that aims to reduce (hedge) the ris

movements in the underlying asset by offsetting long

example, a long call position may be delta hedged by

stock. This strategy is based on the change in premium

caused by a change in the price of the underlying secu

premium for each basis-point change in price of the u

and the relationship between the two movements is th

Investopedia Says:

For example, the price of a call option with a hedge ra

(of the stock-price move) if the price of the underlyin

opposite is true for options with a low hedge ratio.

第 6 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

7

(35-27)/(45-33);h=.67

45 =possible stock prices at expiratio

27=exercise price of a call option

8. In order to price an option using the

binomial option-pricing model, which of

the following pieces of information is not

necessary?

a. The current price of the underlying

stock.

Incorrect. This is required information.

b. An estimate of the company’s current

beta.

Correct. This isn’t required information.

c. The amount of time remaining before the

option expires.

Incorrect. This is required information.

d. The market’s current risk-free rate.

Incorrect. This is required information.

9. Which of the following portfolios

represents a synthetic position

equivalent to a short bond PV(X)?

第 7 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

a. Long call, short stock, and short put.

Correct.

b. Short call, short stock, and short put.

Incorrect. –B = C – S – P.

c. Short call, long stock, and long put.

Incorrect. –B = C – S – P.

d. Long call, short stock, and long put.

Incorrect. –B = C – S – P.

10. Consider the following scenario. The

stock of ABC Company is currently

trading at $18. In 6 months, the stock

will either be worth $27, or $9. The

risk-free rate is 20%. Using the

risk-neutral method, what is the

probability of an upward move (to $27)?

a. 0.3

b. 0.4

c. 0.5

d. 0.6

correct. (27*p) + [9*(1-p)] = 18*1.1; p =

0.6

27

9

R d 1.1 0.5 0.6

R 1.1 , u

d 。

Pr o

,

,

18

18

u d (27 9)

1

18

第 8 頁,共 69 頁

8

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

9

C 27 18 9

.5

S

27 9 18

科目: 期貨、選擇權理論與實務

請填入學號:

※ 注意:考生請在「答案欄」上作答,單一選擇題,共

題,每題

分。

答案欄:請將您的答案依題號放入下列答案欄,謝謝合作。

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

班級:

學號:

姓名:

答對題數:

得分:

1. If we compare the prices of two options that are identical in every way except that one is American

and one is European, the price of the European should be at least as high as the American.

a. True

b. False

2. When the price of a stock moves, the dollar change of the stock is generally less than the dollar change

of the option price.

a. True

b. False

3. Options are a zero-sum game, meaning that profits on the long position represent losses on the short

side, and vice versa.

a. True

b. False

4. Call and put option prices decrease as the volatility of the underlying stock increases.

a. True

b. False

5. Under the binomial option-pricing model, once the possible stock prices at expiration have been

第 9 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

10

determined, it is not necessary to make an assumption as to the probability of reaching each ending stock

price.

a. True

b. False

6. When using put-call parity relationships, all of the following conditions must be met in order to be

certain that the cash flows of the portfolios will be identical at the options’ expiration date, except:

a. The call and put options must have the same exercise price.

b. The call and put options must share the same expiration date.

c. The underlying stock must not pay a dividend during the life of the options.

d. The call and put options must be American options.

7. Using the binomial option-pricing model, what is the appropriate hedge ratio for the following scenario:

current stock price = $24; possible stock prices at expiration = $36, or $16; exercise price of a call option

= $30?

a. 0.3

b. 0.4

c. 0.6

d. 0.5

8. In order to price an option using the binomial option-pricing model, which of the following pieces of

information is not necessary?

a. The current price of the underlying stock.

b. An estimate of the company’s current beta.

c. The amount of time remaining before the option expires.

d. The market’s current risk-free rate.

9. Which of the following portfolios represents a synthetic position equivalent to a short bond PV(X)?

a. Long call, short stock, and short put.

b. Short call, short stock, and short put.

c. Short call, long stock, and long put.

d. Long call, short stock, and long put.

10. Consider the following scenario. The stock of ABC Company is currently trading at $18. In 6 months,

the stock will either be worth $27, or $9. The risk-free rate is 20%. Using the risk-neutral method, what is

the probability of an upward move (to $27)?

a.

0.3

b. 0.4

c. 0.5

d. 0.6

36. 下列敘述何者不正確?

(A)避險者利用期貨契約將風險轉移至投機者

(B)投機者通常對於市場未來走勢有個人

第 10 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

11

主觀預期 (C)投機者一定可以賺取期貨價差做為風險貼水

(D)投機者提高市場流動性

46. 其他條件不變時,黃金期貨買權的時間價值一般會隨著到期日的接近:

(A)呈比例遞增 (B)呈比例遞減 (C)呈加速遞增 (D)呈加速遞減

50. 某甲以 52 元買進 A 股票後,又買進同量的 A 股賣權,其履約價格為 50 元,權利金為

1.2 元,則某甲在權利期間結束時之每單位,最大可能虧損為:

(A)53.2 元 (B)51.2 元 (C)1.2 元 (D)3.2 元

51. 預期未來標的期貨價格走勢將大幅波動,但不確定上漲或下跌時,應採何應策略?

(A)買入跨式交易(Long Straddle)

(B)賣出跨式交易(Short Straddle)

(C)兀鷹價差交易(Condor Spread)

(D)盒狀價差交易(Box Spread)

52. 買進一口 9 月份 S&P500 期貨買權、履約價格為 1,400,請問上述動作與下列何者可組成

多頭價差策略? (A)買進 1 口 9 月份 S&P500 期貨買權、履約價格為 1,410 (B)賣出 1

口 9 月份 S&P500 期貨買權、履約價格為 1,410 (C)賣出 1 口 9 月份 S&P500 期貨買權、

履約價格為 1,390 (D)買進 1 口 9 月份 S&P500 期貨賣權、履約價格為 1,410

57. 下列何者不是期貨契約應符合之標準?

(A)結算所對買賣負責 (B)價格發現 (C)競價公開

(D)契約標準化

92. 若交易人同時買一個履約價為 100 的現貨買權,賣一個履約價為 140 的現貨買權,若現

在現貨價格為 120,不考慮權利金下,則該交易人每單位之損益為:

(A)0 (B)賠 20 (C)賺 20 (D)以上皆非

93. 當賣出期貨賣權(put)且被執行時,其結果如何?

(A)取得多頭期貨契約 (B)取得空頭期貨契約 (C)取得相等數量之現貨

(D)取得現金

94. 現貨賣權(put)履約價格為 K,選擇權標的現貨市價 F,若 F<K,則其內含價值等於:

(A) 0

(B) K-F

(C) K+F

(D) F

95. 設現貨買權(call)履約價格為 K,選擇權標的現貨市價 F,若 F<K,則其內含價值等於:

(A) K-F

(B) 0

(C) F-K

(D)K

100. 新到期月份契約掛牌時,以前一營業日標的指數收盤價為基準,向下取最接近之一百點

倍數推出一個序列,另再依履約價格間距上下各推出二個序列,共計五個序列,如果

3/19(星期三)現貨收盤 6,092 點,則四月履約價格何者不可能:

(A) 5,700

(B) 5,800

(C) 5,900

(D)6,000

CDDABBCABBA

1 C 11 C

21 C

31 D

41 D 51 A

61

D

71

D

81 D

91

A

2 C 12 C

22 A

32 D

42 C 52 B

62

C

72

B

82 C

92

C

3 A 13 C

23 D

33 D

43 B 53 B

63

A

73

C

83 D

93

A

4 D 14 C

24 A

34 D

44 B 54 B

64

C

74

A

84 A

94

B

5 C 15 C

25 A

35 D

45 A 55 B

65

A

75

D

85 B

95

B

第 11 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

12

6 A 16 B

26 C

36 C

46 D 56 D

66

A

76

B

86 C

96

B

7 A 17 A

27 B

37 B

47 A 57 B

67

B

77

C

87 D

97

A

8 A 18 B

28 D

38 B

48 D 58 D

68

C

78 均給分

88 D

98

A

9 C 19 D

29 D

39 C

49 C 59 D

69

B

79

A

89 B

99

C

10 B 20 D

30 C

40 C

50 D 60 C

70

A

80

A

90 B 100

A

1.

下列何者不是期貨契約所規範的項目:

割方式

3.

期貨市場在買賣手續確定後,買方之對手為:

期貨商

7.

期貨交易比遠期交易具有「安全與效率」之優勢主要因那一單位之建立?

(A)主管機關 (B)期交所 (C)公會 (D)結算所

9.

下列何者不屬於期貨市場之功能?

(A)品質等級

(B)數量

(A)結算所

(A)募集資金

(B)投機

(C)下單方式

(B)賣方

(C)避險

(D)交

(C)期交所

(D)

(D)價格發現

13. 期貨契約不同於遠期契約的最大差異在於: (A)定型化 (B)電腦化 (C)透明化 (D)以

上皆是

21. 期貨商向交易人發出追繳保證金通知為當交易人帳戶餘額低於:

(A)交易保證金 (B)結算保證金 (C)維持保證金 (D)原始保證金

81. 同時買進到期日期和履約價格相同的買權和賣權(買進跨式部位)可用於:

A.看空標的物價格;B.看多標的物價格;C.標的物價格持平

(A)A. C.

(B)A. B. C.

(C)B. C.

(D)A. B.

82. 三月黃金期貨市價為 290,則下列何種黃金期貨買權有較高之時間價值?

(A)履約價格為 270

(B)履約價格為 280

(C)履約價格為 290

(D)履約價格為 300

83. 某一投資持有公債期貨空頭部位,其應如何應用選擇權來保護其投資?

(A)買入公債期貨買權

(B)買入公債期貨賣權

(C)賣出公債期貨買權

(D)賣出公債期

貨賣權

84. 其他條件不考慮,利率上揚,則期貨賣權價格應: (A)越高 (B)越低 (C)無關 (D)不一

定

85. 價平(at-the-money)原油期貨買權指原油期貨價格:

(A)等於履約價格 (B)大於履約價格 (C)小於履約價格

(D)大於或小於履約價格

86. 期貨買權之內含價值(Intrinsic Value)與時間價值之關係為何?

(A)成正向關係 (B)成反向關係 (C)不一定 (D)無關

87. 買入黃金期貨賣權一般是:

(A)看多黃金市場 (B)看空黃金市場 (C)預期黃金市場平穩

(D)預期黃金市場大波動

90. 下列何者是上跨式(Top Straddle)策略?

(A)賣出 2 月期貨買權履約價格$575,並買進 2 月期貨賣權履約價格$575

(B)賣出 2 月期貨買權履約價格$575,並賣出 2 月期貨賣權履約價格$575

(C)買入 2 月期貨買權履約價格$575,並賣出 2 月期貨賣權履約價格$600

第 12 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

13

(D)買入 2 月期貨買權履約價格$575,並買進 2 月期貨賣權履約價格$575

91. 買進一口 9 月份 S&P500 期貨買權、履約價格為 1,400,請問上述動作與下何者可組成多

頭價差策略?

(A)買進 1 口 9 月份 S&P500 期貨買權、履約價格為 1,410

(B)賣出 1 口 9 月份 S&P500 期貨買權、履約價格為 1,410

(C)賣出 1 口 9 月份 S&P500 期貨買權、履約價格為 1,390

(D)買進 1 口 9 月份 S&P500 期貨賣權、履約價格為 1,410

92. 臺指選擇權市場造市者之資格限定為:

A.期貨自營商;B.證券商 (A)限 A. (B)限 B.

93. 指數選擇權到期月份為:

(A)四個

(B)五個

(C)A. B.皆可

(C)六個

(D)A. B.皆不可

(D)以上皆非

CA D A ACDCABABBBBAB

1 C

11 B

21

C

81 D

91

B

2 B

12 D

22

C

82 C

92

A

3 A

13 A

23

A

83 A

93

B

4 A

14 C

24

B

84 B

94

B

5 B

15 B

25

A

85 A

95

D

6 B

16 A

26

A

86 B

96

A

7 D

17 A

27

B

87 B

97

D

8 A

18 A

28

C

88 D

98

A

9 A

19 D

29

A

89 A

99

C

10 A

20 B

30

B

90 B

100

D

科目:

※

請填入學號:

注意:單一選擇題,答對題數每題得 2 分,答錯題數每題扣 2 分。

答案欄:考生請在「答案欄」上作答,謝謝合作。

姓名:

班級:

答對題數:

答錯題數:

得分:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

32.

33.

34.

35.

36.

37.

38.

39.

40.

41.

42.

43.

44.

45.

46.

47.

48.

49.

50.

51.

52.

53.

54.

55.

56.

57.

58.

59.

60.

61.

62.

63.

64.

65.

66.

67.

68.

69.

70.

71.

72.

73.

74.

75.

76.

77.

78.

79.

80.

81.

82.

83.

84.

85.

86.

87.

88.

89.

90.

第 13 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

91.

92.

93.

94.

95.

96.

97.

14

98.

99.

100.

1. If we compare the prices of two options that are identical in every way except that one is

American and one is European, the price of the European should be at least as high as the

American.

a. True

Incorrect. The American call should be worth at least as much as the European call due to the

American call’s greater flexibility.

b. False

Correct.

2. When the price of a stock moves, the dollar change of the stock is generally less than the

dollar change of the option price.

a. True

Incorrect. The dollar change of the stock is greater than the dollar change of the option. It is

the percentage change in the option price which is greater than the percentage change in the

stock price.

b. False

Correct.

3. Options are a zero-sum game, meaning that profits on the long position represent losses on

the short side, and vice versa.

a. True

Correct.

b. False

Incorrect. Options are in fact a zero-sum game.

4. Call and put option prices decrease as the volatility of the underlying stock increases.

a. True

Incorrect. Due to the asymmetry of option payoffs, call and put option prices increase as the

volatility of the underlying assets increases.

b. False

Correct.

5. Under the binomial option-pricing model, once the possible stock prices at expiration have

been determined, it is not necessary to make an assumption as to the probability of reaching

each ending stock price.

a. True

Correct.

第 14 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

15

b. False

Incorrect. This is due to the fact that the market already prices these probabilities into the

stock price, and the fact that binomial model prices an option through the principle of “no

arbitrage”.

6. When using put-call parity relationships, all of the following conditions must be met in

order to be certain that the cash flows of the portfolios will be identical at the options’

expiration date, except:

a. The call and put options must have the same exercise price.

Incorrect. This is a necessary condition.

b. The call and put options must share the same expiration date.

Incorrect. This is a necessary condition.

c. The underlying stock must not pay a dividend during the life of the options.

Incorrect. This is a necessary condition.

d. The call and put options must be American options.

Correct. The call and put options must be European options.

7. Using the binomial option-pricing model, what is the appropriate hedge ratio for the

following scenario: current stock price = $24; possible stock prices at expiration = $36, or $16;

exercise price of a call option = $30?

a. 0.3

b. 0.4

c. 0.6

d. 0.5

correct. (6-0)/(36-16); h =0.3

8. In order to price an option using the binomial option-pricing model, which of the following

pieces of information is not necessary?

a. The current price of the underlying stock.

Incorrect. This is required information.

b. An estimate of the company’s current beta.

Correct. This isn’t required information.

c. The amount of time remaining before the option expires.

Incorrect. This is required information.

d. The market’s current risk-free rate.

Incorrect. This is required information.

9. Which of the following portfolios represents a synthetic position equivalent to a short bond

PV(X)?

第 15 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

a. Long call, short stock, and short put.

Correct.

b. Short call, short stock, and short put.

Incorrect. –B = C – S – P.

c. Short call, long stock, and long put.

Incorrect. –B = C – S – P.

d. Long call, short stock, and long put.

Incorrect. –B = C – S – P.

10. Consider the following scenario. The stock of ABC Company is currently trading at $18.

In 6 months, the stock will either be worth $27, or $9. The risk-free rate is 20%. Using the

risk-neutral method, what is the probability of an upward move (to $27)?

a.

0.3

b. 0.4

c. 0.5

d. 0.6

correct. (27*p) + [9*(1-p)] = 18*1.1; p = 0.6

Pr o

27

9

R d 1.1 0.5 0.6

, R 1.1 , u

,d 。

18

18

u d (27 9)

1

18

Section :

INCORRECT

1 : An option can be exercised after its expiration date.

a. True

b. False

The correct answer is b

Your answer is a

Feedback : This is not correct; an option can be exercised up to and including its expiration date.

CORRECT

2 : It is not possible for a call option to sell for more than the underlying stock.

a. True

b. False

The correct answer is a

Your answer is a

Feedback : You are correct!

第 16 頁,共 69 頁

16

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

17

INCORRECT

3 : The first stock index options were contracts on the S<![CDATA[&]]>P 500.

a. True

b. False

The correct answer is b

Your answer is a

Feedback : This is not correct; it was the S&P 100.

CORRECT

4 : All stock index options use a cash settlement procedure when they are exercised.

a. True

b. False

The correct answer is a

Your answer is a

Feedback : You are correct!

INCORRECT

5 : A _____ option on a stock gives the holder the right to buy the underlying stock at a given price

before the option expiration date.

a. hedge

b. call

c. put

d. protective put

The correct answer is b

Your answer is a

Feedback : This is not correct; calls-buy, puts-sell.

INCORRECT

6 : Buying a baseball ticket to see a Mets game is similar to:

a. put option

b. call option

c. covered option

d. writing an option

The correct answer is b

Your answer is a

Feedback : This is not correct; a call option gives you rights, but not an obligation to exercise the option.

A baseball ticket gives you a right to a seat, but you are obliged to go. In both cases if you do not exercise

your rights, you lose your money.

第 17 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

18

CORRECT

7 : An option is said to be <![CDATA[&quot;]]>in-the-money<![CDATA[&quot;]]> if it has

a. a positive intrinsic value.

b. a zero intrinsic value.

c. an exercise price greater than the intrinsic value.

d. an exercise price less than the intrinsic value.

The correct answer is a

Your answer is a

Feedback : You are correct!

INCORRECT

8 : A call option sells for $15, has a strike price of $60 and expires in 6 months. If the stock price is $50

per share and the risk-free interest rate is 5 percent, what is the price of a put option with a strike price of

$60 and 6 months to maturity?

a. $18.77

b. $21.87

c. $23.52

d. $26.52

The correct answer is c

Your answer is a

Feedback : This is not correct; the put-call parity relationship is expressed algebraically as C ? P = S ?

Ke<sup>?rT</sup>, where:<blockquote>C = the value of the call, P = the value of the put,<br></br>

S = the value of the stock, K = the strike price of the options,<br></br>

r = the risk?free rate, and T = the time to expiration</blockquote>

INCORRECT

9 : At what stock price does the owner of a call option break even?

a. When the stock price is equal to the strike price.

b. When the stock price is below the strike price by the amount of the premium.

c. When the stock price is above the strike price by the amount of the premium.

d. Whenever the option expires in-the-money.

The correct answer is c

Your answer is a

Feedback : This is not correct; a call owner breaks even when the stock price is equal to the strike price

plus the option premium paid.

CORRECT

10 : A protective put

第 18 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

a. acts as insurance against the decline of the underlying stock.

b. represents a short position in both the stock and the put.

c. has a linear payoff.

d. guarantees a maximum profit potential.

The correct answer is a

Your answer is a

Feedback : You are correct!

Section :

INCORRECT

1 : "In the money options" are usually sold rather than exercised.

a. True

b. False

The correct answer is a

Your answer is b

Feedback : This is not correct; the statement is true

INCORRECT

2 : The premium imbedded in a call option will generally increase with the interest rate.

a. True

b. False

The correct answer is a

Your answer is b

Feedback : This is not correct; the statement is correct.

INCORRECT

3 : Interest rates and call prices are positively related.

a. True

b. False

The correct answer is a

Your answer is b

Feedback : This is not correct; interest rates and call prices are positively related.

CORRECT

4 : In the Black-Scholes-Merton option pricing model, a put option eta is greater than or equal to 1.

a. True

b. False

The correct answer is b

第 19 頁,共 69 頁

19

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

20

Your answer is b

Feedback : You are correct!

CORRECT

5 : When examining volatility skews, it is generally found that for a _____ strike price the implied

standard deviation is ______.

a. lower; lower

b. lower; higher

c. higher; higher

d. There is no general relationship.

The correct answer is b

Your answer is b

Feedback : You are correct!

INCORRECT

6 : As a stock's dividend yield decreases, put prices _____ and call prices _____.

a. increase...increase

b. increase...decrease

c. decrease...decrease

d. decrease...increase

The correct answer is d

Your answer is b

Feedback : This is not correct; dividends ultimately lower stock

prices.<br></br>&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;Recall that the minimum value of an

option is:<br></br>&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;C = max[0, S -K] and P = max[0,

K - S]

CORRECT

7 : Vega is

a. positive for a call option and negative for a put option.

b. positive for both a put and call option.

c. negative for a call option and positive for a put option.

d. negative for both a put and call option.

The correct answer is b

Your answer is b

Feedback : You are correct!

INCORRECT

第 20 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

8 : Calculating an implied volatility requires that all input values be known except for

a. call price.

b. put price.

c. dividend yield.

d. sigma.

The correct answer is d

Your answer is b

Feedback : This is not correct; sigma is volatility.

INCORRECT

9 : If the S<![CDATA[&]]>P 500 index has a value of 996.33, an SPX option contact has a value of

a. $99,633

b. $49,816

c. $996,330

d. $498,165

The correct answer is a

Your answer is b

Feedback : This is not correct; S&P 500 index option contracts have a value equal to $100 times the

index.

CORRECT

10 : Which of the following would decrease the price of a call option?

a. The underlying stock price increases.

b. The volatility of the underlying stock decreases.

c. The risk-free rate of interest increases.

d. The dividend yield of the underlying stock decreases.

The correct answer is b

Your answer is b

Feedback : You are correct!

Author Name : Corrado

Site Name : Fundamentals of Investments

Chapter : Chapter 16 : Futures Contracts

Quiz : Multiple Choice Quiz

Student Name: CHY

Section ID:

Results Reporter

================

第 21 頁,共 69 頁

21

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

22

Out of 10 questions, you answered 4 correctly.

4 correct (40%)

6 incorrect (60%)

0 unanswered (0%)

===========================================================================

=================

===========================================================================

=================

Your Results :

===========================================================================

=================

Section :

INCORRECT

1 : Commodity futures date back to ancient times, but financial futures have only been in existence since

the roaring 20's.

a. True

b. False

The correct answer is b

Your answer is a

Feedback : This is not correct; the first financial futures were traded in 1972 on the International Money

Market (IMM), a division of the Chicago Mercantile Exchange.

INCORRECT

2 : Traders at the Chicago Board of Trade (CME) must all wear the same color jackets.

a. True

b. False

The correct answer is b

Your answer is a

Feedback : This is not correct; traders make a fashion statement by wearing bold color (or print) jackets

to make them easily identified.

INCORRECT

3 : American futures exchanges devote their activities exclusively to commodity futures.

a. True

b. False

第 22 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

23

The correct answer is b

Your answer is a

Feedback : This is not correct; various types of futures contracts are traded on American futures

exchanges.

CORRECT

4 : Standardized futures contracts have a specified contract size.

a. True

b. False

The correct answer is a

Your answer is a

Feedback : You are correct!

INCORRECT

5 : A _____ contract is a unique formal agreement between a buyer and a seller who both commit to a

transaction at a future date at a price set by negotiation today.

a. futures

b. forward

c. long position

d. short position

The correct answer is b

Your answer is a

Feedback : This is not correct; an investor can be either long or short with either futures or forwards but

futures are standardized.

INCORRECT

6 : Delivery of financial futures is usually accompanied by

a. a signed release.

b. the par value of the security.

c. registered ownership.

d. settlement procedures.

The correct answer is c

Your answer is a

Feedback : This is not correct; delivery of financial futures is often accompanied by a transfer of

registered ownership. US Treasury bills are registered at the FED.

CORRECT

7 : If you wish to hedge the future purchase of 2,100,000 gallons of gasoline, and the standard size of

第 23 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

24

gasoline futures contracts is 42,000 gallons, how many contracts will you need to buy or sell?

a. buy 50 contracts

b. sell 50 contracts

c. buy 200 contracts

d. sell 200 contracts

The correct answer is a

Your answer is a

Feedback : You are correct! 2,100,000 &#247; 42,000 = 50 contracts.

CORRECT

8 : Initial margin ranges between _____ percent of total contract value.

a. 5-15

b. 10-20

c. 15-25

d. 20-30

The correct answer is a

Your answer is a

Feedback : You are correct!

CORRECT

9 : On the maturity date, stock index futures require delivery of

a. cash.

b. Treasury bills.

c. common stock.

d. common stock plus accrued dividends.

The correct answer is a

Your answer is a

Feedback : You are correct!

INCORRECT

10 : To protect the value of a bond portfolio against a rise in interest rates using interest rate futures, the

portfolio owner could execute a __________ hedge.

a. long

b. cross

c. reverse

d. short

The correct answer is d

Your answer is a

第 24 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

25

Feedback : This is not correct; if interest rates rise, the portfolio value will decline. The hedger wants to

be able lock into a selling price by selling (shorting) futures.

Name : Corrado

Site Name : Fundamentals of Investments

Chapter : Chapter 17 : Corporate Bonds

Quiz : Multiple Choice Quiz

Student Name: CHY

Section ID:

Results Reporter

================

Out of 10 questions, you answered 3 correctly.

3 correct (30%)

7 incorrect (70%)

0 unanswered (0%)

===========================================================================

=================

===========================================================================

=================

Your Results :

===========================================================================

=================

Section :

CORRECT

1 : Senior debentures have a higher claim on the firm's assets than subordinated debentures.

a. True

b. False

The correct answer is a

Your answer is a

Feedback : You are correct!

INCORRECT

2 : Convertible bonds grant bondholders the right to exchange their bonds for shares of preferred stock.

a. True

第 25 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

b. False

The correct answer is b

Your answer is a

Feedback : This is not correct; convertible bonds can be converted into common stock.

CORRECT

3 : When a redemption is due, a sinking fund trustee will randomly select the bonds to be called.

a. True

b. False

The correct answer is a

Your answer is a

Feedback : You are correct!

CORRECT

4 : Floaters are often putable at par value.

a. True

b. False

The correct answer is a

Your answer is a

Feedback : You are correct!

INCORRECT

5 : Most corporate bond trading takes place in/on the

a. primary market.

b. NYSE.

c. Amex.

d. OTC market.

The correct answer is d

Your answer is a

Feedback : This is not correct; the corporate bond market is primarily a dealer market.

INCORRECT

6 : Relative to bonds that do not have call or put provisions, a callable bond will have a __________

coupon rate and a putable bond will have a __________ coupon rate.

a. higher...higher

b. higher...lower

c. lower...higher

d. Call or put provisions do not affect the coupon rate of a bond.

第 26 頁,共 69 頁

26

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

27

The correct answer is b

Your answer is a

Feedback : This is not correct. Ceteris paribus, bondholders do not like call features and will want

compensation for accepting them while issuers don't like put features and will be willing to pay less for

bonds with them.

INCORRECT

7 : Calculate the conversion value for a bond with a par value of $1,000 that can be converted into 40

shares of the issuing firm's common stock. The stock is currently selling at $50 per share.

a. $1,000

b. $1,250

c. $2,000

d. $1,600

The correct answer is c

Your answer is a

Feedback : This is not correct.<br></br>&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;Conversion Value =

Conversion Ratio &times; Market Price

INCORRECT

8 : A protective covenant is designed to:

a. restrict a corporation from offering a negative pledge clause.

b. restrict corporations from causing a deterioration in credit rating on bonds.

c. prevent corporations from suspending coupon payments on bonds.

d. require a indenture when make a private placement.

The correct answer is b

Your answer is a

Feedback : This is not correct; a protective covenant specifies restrictions in a bond indenture in order to

protect bondholders from causing a deterioration in credit ratings.

INCORRECT

9 : When the price/yield curve is bowed toward the origin, this is called

a. affirmative convexity.

b. definite convexity.

c. positive convexity.

d. negative convexity.

The correct answer is c

Your answer is a

Feedback : This is not correct; negative convexity exists when the price/yield relationship is bowed away

from the origin.

第 27 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

28

INCORRECT

10 : Generally, notes have maturities

a. greater than 5 years.

b. less than 5 years.

c. greater than 10 years.

d. less than 10 years.

The correct answer is d

Your answer is a

Feedback : This is not correct. Bills mature in one year or less and bonds have maturities greater than 10

years.

Author Name : Corrado

Site Name : Fundamentals of Investments

Chapter : Chapter 10 : Bond Prices and Yields

Quiz : Multiple Choice Quiz

Student Name: CHY

Section ID:

Results Reporter

================

Out of 10 questions, you answered 2 correctly.

2 correct (20%)

8 incorrect (80%)

0 unanswered (0%)

===========================================================================

=================

===========================================================================

=================

Your Results :

===========================================================================

=================

Section :

INCORRECT

1 : According to Malkiel's theorems, shorter term bonds are more sensitive to changes in yields than

第 28 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

29

longer term bonds.

a. True

b. False

The correct answer is b

Your answer is a

Feedback : This is not correct; Malkiel's second theorem states that "for a given change in a bond's yield

to maturity, the longer the term of a bond, the greater will be the magnitude of a change in price."

CORRECT

2 : The yield to maturity for a premium bond is less than its coupon rate.

a. True

b. False

The correct answer is a

Your answer is a

Feedback : You are correct!

CORRECT

3 : Unless a bond is selling at par, the current yield is always between the coupon rate and the yield to

maturity.

a. True

b. False

The correct answer is a

Your answer is a

Feedback : You are correct!

INCORRECT

4 : A bond is usually called after a rise in interest rates.

a. True

b. False

The correct answer is b

Your answer is a

Feedback : This is not correct; a bond is usually called after a decline in interest rates.

INCORRECT

5 : The two components of the bond pricing formula are

a. present value of coupon payments and yield to maturity.

b. present value of coupon payments and present value of principal payment at maturity.

c. yield to maturity and future value of coupon payment.

第 29 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

30

d. yield to maturity and current yield.

The correct answer is b

Your answer is a

Feedback : This is not correct; the price of a bond is the present value of all cash flows associated with it.

INCORRECT

6 : Which of the following statements about duration is FALSE?

a. Ceteris paribus, the longer a bond's maturity, the longer its duration.

b. Ceteris paribus, a bond's duration decreases at an increasing rate as maturity lengthens.

c. Ceteris paribus, the higher a bond's coupon, the shorter its duration.

d. Ceteris paribus, the duration on a bond with coupons is always less than its maturity.

The correct answer is b

Your answer is a

Feedback : This is not correct; this is a true statement.

INCORRECT

7 : The risk that arises in dedicated portfolios when the target date value (ending value) of a bond or bond

portfolio is not known with certainty is known as __________ risk.

a. reinvestment rate

b. price

c. interest rate

d. value

The correct answer is b

Your answer is a

Feedback : This is not correct. Value and price are the same in equilibrium.

INCORRECT

8 : The yield to maturity for a 10 percent annual coupon bond with 10 years to maturity, selling for

$885.30 is

a. 6%

b. 10%

c. 12%

d. 15%

The correct answer is c

Your answer is a

Feedback : This is not correct.<blockquote>

PV = ?Price<br></br>

FV = Par<br></br>

PMT = Coupon payment per compounding period<br></br>

第 30 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

31

N = Number of compounding periods<br></br>

I/Y = Interest per compounding period</blockquote>

INCORRECT

9 : Calculate the price of a 15 year bond with a face value of $1,000 and an annual coupon of $120, when

the yield to maturity is 10 percent.

a. $1,152.12

b. $1,726.58

c. $1,000.00

d. $695.76

The correct answer is d

Your answer is a

Feedback : This is not correct.<blockquote>

PV = ??? = ?$1152.12<br></br>

FV = 1000<br></br>

PMT = 120<br></br>

N = 15<br></br>

I/Y = 10</blockquote>

INCORRECT

10 : Sarah Clark needs to purchase a dedicated bond portfolio with a five year maturity to match

$200,000 in estimated outlays for her company "Hopefully Insured". Coupons are paid semiannually and

currently yielding 6%. The present value that must be invested is ______.

a. $172,522

b. $111,679

c. $200,000

d. $148,819

The correct answer is d

Your answer is a

Feedback : This is not correct; the present value of $200,000 is [$200,000/(1 + .03)<sup>10</sup>]

&#187; $148,819.]

Author Name : Corrado

Site Name : Fundamentals of Investments

Chapter : Chapter 6 : Common Stock Valuation

Quiz : Multiple Choice Quiz

Student Name: CHY

Section ID:

Results Reporter

第 31 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

32

================

Out of 10 questions, you answered 0 correctly.

0 correct (0%)

10 incorrect (100%)

0 unanswered (0%)

===========================================================================

=================

===========================================================================

=================

Your Results :

===========================================================================

=================

Section :

INCORRECT

1 : Due to its simplicity, the constant perpetual growth model can be usefully applied to any company.

a. True

b. False

The correct answer is b

Your answer is a

Feedback : This is not correct; this model is only usefully applied to companies with a history of

relatively stable earnings and dividend growth expected to continue into the distant future.

INCORRECT

2 : The substantive growth rate refers to dividend growth that can be sustained by a company's earnings.

a. True

b. False

The correct answer is b

Your answer is a

Feedback : This is not correct; the sustainable growth rate refers to dividend growth that can be sustained

by a company's earnings.

INCORRECT

3 : A firm's growth rate equals the retention ratio divided by its return on equity.

a. True

第 32 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

33

b. False

The correct answer is b

Your answer is a

Feedback : This is not correct; a firm's growth rate equals the retention ratio multiplied by its return on

equity

INCORRECT

4 : Unlike the constant growth rate model, the two-stage dividend discount model is suitable for

companies that don't pay dividends.

a. True

b. False

The correct answer is b

Your answer is a

Feedback : This is not correct. Normally, the two-stage dividend discount model is for companies that

have a period of high growth followed by an infinite period of constant growth.

INCORRECT

5 : Suppose a risky security has an equal probability of paying either $400 or $500 in one year. What is

the present value of the expected future cash flow if the discount rate is equal to 5%?

a. $380.95

b. $428.57

c. $476.19

d. $452.38

The correct answer is b

Your answer is a

Feedback : This is not correct; expected value is the sum of the probability-weighted values of each of the

individual payoffs. Present value is simply the discount value of the expected future value.

INCORRECT

6 : An analyst would expect Starbucks to have a

a. low price/earnings ratio

b. high price/earnings ratio

c. low price/book ratio

d. high price/book ratio

The correct answer is b

Your answer is a

Feedback : This is not correct; growth stocks generally have high P/E ratios.

第 33 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

34

INCORRECT

7 : A firm has a per share dividend of $4 and is expected to decrease by 15% per year for the next five

years and then grow at a rate of 10%. Using the two stage model, determine the value of the stock. The

discount rate is 8%.

a. $42.28

b. $10.35

c. $61.71

d. $52.35

The correct answer is d

Your answer is a

Feedback : This is not correct; PV = $4(.85)/.08 &#8722; (&#8722;.15) [1 &#8722;

(.85/1.08)<sup>5</sup>] + (.85/1.08)<sup>5</sup> ($4(1.05)/.08 &#8722; .05) = $52.35

INCORRECT

8 : Suppose that the dividend growth rate is 12 percent, the discount rate is 8 percent, there are 30 years

of dividends to be paid, and the current dividend is $14. What is the value of the stock based on the

constant growth model?

a. $558.23

b. $626.84

c. $708.93

d. $775.12

The correct answer is d

Your answer is a

Feedback : This is not correct. The formula for the value of a stock that pays a dividend that grows at a

constant rate over a finite period is:<br></br><blockquote>V(0) = D(0)(1 + g)/(k ? g) &times; {1 ? [(1 +

g)/(1 + k)]<sup>T</sup>}]<br></br>where; V(0) = the value at time t = 0<br></br>D(0) = the current

dividend<br></br>g = the constant growth rate<br></br>k = the appropriate discount rate<br></br>T =

the number of dividend paying periods</blockquote>

INCORRECT

9 : If the U.S T-bill rate is 4 percent and the stock market risk premium is 8 percent, then the CAPM

discount rate for a security with a beta of 1.4 is

a. 12%.

b. 15.2%.

c. 5.6%.

d. 13.4%.

The correct answer is b

Your answer is a

Feedback : This is not

correct.<br></br>&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;&nbsp;Discount Rate

第 34 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

35

= T-bill Rate + &#946;(Market Risk Premium)

INCORRECT

10 : Under the constant growth version of the DDM,

a. D<sub>5</sub> = D<sub>0</sub>(1 + g)

b. D<sub>5</sub> =D<sub>0</sub>(1 + g)<sup>4</sup>

c. D<sub>5</sub> = D<sub>3</sub>(1 + g)<sup>2</sup>

d. D<sub>5</sub> = D<sub>4</sub>(1 + g)<sup>2</sup>

The correct answer is c

Your answer is a

Feedback : This is not correct. D<sub>3</sub> = D<sub>0</sub>(1 + g)<sup>3</sup> and

D<sub>5</sub> = D<sub>3</sub>(1+g)<sup>2</sup>

Options

24.1 Calls and Puts

Selling Calls and Puts

Financial Alchemy with Options

24.2 What Determines Option Values?

Upper and Lower Limits on Option Values

The Determinants of Option Value

Option-Valuation Models

24.3 Spotting the Option

Options on Real Assets

Options on Financial Assets

24.4 Summary

Author Name : Brealey

Site Name

: Fundamentals of Corporate Finance

Chapter

: Chapter 24 : Options

Quiz

: Multiple Choice Quiz

Student Name: CHY

Section ID:

Results Reporter

================

Out of 15 questions, you answered 2 correctly.

2 correct (13%)

13 incorrect (87%)

0 unanswered (0%)

=======================================================================

=====================

第 35 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

36

=======================================================================

=====================

Your Results :

=======================================================================

=====================

Section :

INCORRECT

1 : The seller of a put option is betting that the market value of the stock will decrease.

a. True

b. False

The correct answer is b

Your answer is a

Feedback :

CORRECT

2 : At expiration a call option will have no value if the stock price is less than exercise price.

a. True

b. False

The correct answer is a

Your answer is a

Feedback :

INCORRECT

3 : If the owner of a call option with a strike price of $35 finds the stock to be trading for $42 at

expiration, then the option:

a. expires worthless.

b. will not be exercised.

c. is worth $7 per share.

d. cost too much initially.

The correct answer is c

Your answer is a

Feedback :

INCORRECT

4 : Which of the following is true for the owner of a call option?

a. The loss potential is unlimited.

b. The profit potential is unlimited.

c. The premium exceeds the strike price.

d. There is no expiration date, unless the option is a European call.

The correct answer is b

Your answer is a

Feedback :

INCORRECT

5 : What is the option buyer's total profit or loss per share if a call option is purchased for a $5

premium, has a $50 exercise price, and the stock is valued at $53 at expiration?

a. ($5)

b. ($2)

第 36 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

37

c. $3

d. $8

The correct answer is b

Your answer is a

Feedback :

CORRECT

6 : Which of the following option traders <i>receive</i>, rather than pay, a premium?

a. Option sellers

b. Option buyers

c. Both option sellers and buyers

d. Neither buyers nor sellers receive premiums

The correct answer is a

Your answer is a

Feedback :

INCORRECT

7 : Which of the following is true for an investor that owns a share of stock and has purchased a put

option on the stock?

a. The investor profits when the stock decreases in value.

b. Maximum loss is the price of the option premium.

c. The investor is protected against upside potential.

d. Increases in stock value go to the seller of the put.

The correct answer is b

Your answer is a

Feedback :

INCORRECT

8 : Which combination of positions will tend to protect the owner from downside risk?

a. Buy the stock and buy a call option.

b. Sell the stock and buy a call option.

c. Buy the stock and buy a put option.

d. Buy the stock and sell a put option.

The correct answer is c

Your answer is a

Feedback :

INCORRECT

9 : What is the worst-case profitability scenario for an investor who sold a call on the firm's stock

for a premium of $10 and a strike price of $100?

a. $90 per share profit

b. $10 per share profit

c. $0 per share profit (break-even)

d. Unlimited losses

The correct answer is d

Your answer is a

Feedback :

INCORRECT

10 : Which of the following call options would command the higher premium in September, 2002,

第 37 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

38

other things equal?

a. October 2002 expiration, $45 strike price

b. December 2002 expiration, $40 strike price

c. March 2003 expiration, $45 strike price

d. June 2003 expiration, $40 strike price

The correct answer is d

Your answer is a

Feedback :

INCORRECT

11 : The option to abandon a project investing in real assets can be considered to have a strike price

equal to the:

a. historical cost of the asset.

b. market value of the asset at abandonment.

c. forgone revenues anticipated from the project.

d. forgone interest on the bonds used to finance the real assets.

The correct answer is b

Your answer is a

Feedback :

INCORRECT

12 : The conversion ratio for a convertible bond equals the:

a. ratio of bond value to stock price at conversion.

b. number of bonds necessary to convert into one share of stock.

c. number of shares of stock that can be exchanged for one bond.

d. floor value beneath which the bond price cannot fall.

The correct answer is c

Your answer is a

Feedback :

INCORRECT

13 : If a $1,000 convertible bond with a market value of $950 has a conversion ratio of 25 when the

firm's stock is selling for $36 per share, then:

a. the bond will be converted immediately.

b. the bond is violating its "price floor."

c. conversion now would give the investor a profit of $900.

d. the conversion value of the bond is $900.

The correct answer is d

Your answer is a

Feedback :

INCORRECT

14 : Option buyers can have a(n) _____ of exercising their options. Options sellers can have a(n)

_____ of exercising their options.

a. obligation; obligation

b. obligation; right

c. right; right

d. right; obligation

The correct answer is d

Your answer is a

Feedback :

第 38 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

39

INCORRECT

15 : The value of a call option increases as the time to expiration increases because:

a. the exercise price continually decreases.

b. opportunity increases to surpass exercise price.

c. dividends accumulate while waiting to be paid.

d. the option can be repeatedly exercised.

The correct answer is b

Your answer is a

Feedback :

Author Name : Brealey

Site Name

: Fundamentals of Corporate Finance

Chapter

: Chapter 4 : The Time Value of Money

Quiz

: Multiple Choice Quiz

Student Name: CHY

Section ID:

Results Reporter

================

Out of 15 questions, you answered 3 correctly.

3 correct (20%)

12 incorrect (80%)

0 unanswered (0%)

=======================================================================

=====================

=======================================================================

=====================

Your Results :

=======================================================================

=====================

Section :

CORRECT

1 : The more frequent the compounding, the higher the future value, other things equal.

a. True

b. False

The correct answer is a

Your answer is a

Feedback :

INCORRECT

2 : For a given amount, the lower the discount rate, the less the present value.

a. True

b. False

The correct answer is b

Your answer is a

Feedback :

第 39 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

INCORRECT

3 : Converting an annuity to an annuity due decreases the present value.

a. True

b. False

The correct answer is b

Your answer is a

Feedback :

INCORRECT

4 : How much will accumulate in an account with an initial deposit of $100, and which earns 10%

interest compounded quarterly for three years?

a. $107.69

b. $133.10

c. $134.49

d. $313.84

The correct answer is c

Your answer is a

Feedback :

INCORRECT

5 : How much can be accumulated for retirement if $2,000 is deposited annually, beginning one

year from today, and the account earns 9% interest compounded annually for 40 years?

a. $ 87,200.00

b. $675,764.89

c. $736,583.73

d. $802,876.27

The correct answer is b

Your answer is a

Feedback :

INCORRECT

6 : Under which of the following conditions will a future value calculated with simple interest

exceed a future value calculated with compound interest at the same rate?

a. The interest rate is very high.

b. The investment period is very long.

c. The compounding is annually.

d. This is not possible with positive interest rates.

The correct answer is d

Your answer is a

Feedback :

INCORRECT

7 : How much interest is earned in the third year on a $1,000 deposit that earns 7% interest

compounded annually?

a. $ 70.00

b. $ 80.14

c. $105.62

d. $140.00

The correct answer is b

Your answer is a

第 40 頁,共 69 頁

40

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

41

Feedback :

INCORRECT

8 : How long must one wait (to the nearest year) for an initial investment of $1,000 to triple in value

if the investment earns 8% compounded annually?

a. 9

b. 14

c. 22

d. 25

The correct answer is b

Your answer is a

Feedback :

CORRECT

9 : A credit card account that charges interest at the rate of 1.25% per month would have an

annually compounded rate of _______ and an APR of _______.

a. 16.08%; 15.00%

b. 14.55%; 16.08%

c. 12.68%; 15.00%

d. 15.00%; 14.55%

The correct answer is a

Your answer is a

Feedback :

INCORRECT

10 : What is the APR on a loan that charges interest at the rate of 1.4% per month?

a. 10.20%

b. 14.00%

c. 16.80%

d. 18.16%

The correct answer is c

Your answer is a

Feedback :

INCORRECT

11 : If the effective annual rate of interest is known to be 16.08% on a debt that has quarterly

payments, what is the annual percentage rate?

a. 4.02%

b. 10.02%

c. 14.50%

d. 15.19%

The correct answer is d

Your answer is a

Feedback :

INCORRECT

12 : If a borrower promises to pay you $1,900 nine years from now in return for a loan of $1,000

today, what effective annual interest rate is being offered?

a. 5.26%

b. 7.39%

第 41 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

42

c. 9.00%

d. 10.00%

The correct answer is b

Your answer is a

Feedback :

INCORRECT

13 : What is the present value of your trust fund if it promises to pay you $50,000 on your 30th

birthday (7 years from today) and earns 10% compounded annually?

a. $25,000.00

b. $25,657.91

c. $28,223.70

d. $29,411.76

The correct answer is b

Your answer is a

Feedback :

CORRECT

14 : What is the present value of the following payment stream, discounted at 8% annually: $1,000

at the end of year 1, $2,000 at the end of year 2, and $3,000 at the end of year 3?

a. $5,022.11

b. $5,144.03

c. $5,423.87

d. $5,520.00

The correct answer is a

Your answer is a

Feedback :

INCORRECT

15 : The present value of a perpetuity can be determined by:

a. Multiplying the payment by the interest rate.

b. Dividing the interest rate by the payment.

c. Multiplying the payment by the number of payments to be made.

d. Dividing the payment by the interest rate.

The correct answer is d

Your answer is a

Feedback :

Author Name : Brealey

Site Name

: Fundamentals of Corporate Finance

Chapter

: Chapter 5 : Valuing Bonds

Quiz

: Multiple Choice Quiz

Student Name: CHY

Section ID:

Results Reporter

================

Out of 15 questions, you answered 6 correctly.

6 correct (40%)

9 incorrect (60%)

0 unanswered (0%)

第 42 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

43

=======================================================================

=====================

=======================================================================

=====================

Your Results :

=======================================================================

=====================

Section :

CORRECT

1 : Longer-term bond prices are more sensitive to changes in interest rates than are short-term bond

prices.

a. True

b. False

The correct answer is a

Your answer is a

Feedback :

CORRECT

2 : A Treasury bond's bid price will be lower than the ask price.

a. True

b. False

The correct answer is a

Your answer is a

Feedback :

INCORRECT

3 : Which of the following presents the correct relationship? As the coupon rate of a bond

increases, the bond's:

a. face value increases.

b. current price decreases.

c. interest payments increase.

d. maturity date is extended.

The correct answer is c

Your answer is a

Feedback :

CORRECT

4 : What happens when a bond's expected cash flows are discounted at a rate lower than the bond's

coupon rate?

a. The price of the bond increases.

b. The coupon rate of the bond increases.

c. The par value of the bond decreases.

d. The coupon payments will be adjusted to the new discount rate.

The correct answer is a

Your answer is a

Feedback :

第 43 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

44

INCORRECT

5 : When an investor purchases a $1,000 par value U.S. Treasury bond that was quoted at 97.16, the

investor:

a. receives 97.5% of the stated coupon payments.

b. receives $975 upon the maturity date of the bond.

c. pays 97.5% of face value for the bond.

d. pays $1,025 for the bond.

The correct answer is c

Your answer is a

Feedback :

CORRECT

6 : How much should you pay for a $1,000 bond with 10% coupon, annual payments, and five years

to maturity if the interest rate is 12%?

a. $ 927.90

b. $ 981.40

c. $1,000.00

d. $1,075.82

The correct answer is a

Your answer is a

Feedback :

INCORRECT

7 : The current yield of a bond can be calculated by:

a. multiplying the price by the coupon rate.

b. dividing the price by the annual coupon payments.

c. dividing the price by the par value.

d. dividing the annual coupon payments by the price.

The correct answer is d

Your answer is a

Feedback :

INCORRECT

8 : The discount rate that makes the present value of a bond's payments equal to its price is termed

the:

a. rate of return.

b. yield to maturity.

c. current yield.

d. coupon rate.

The correct answer is b

Your answer is a

Feedback :

INCORRECT

9 : What is the coupon rate for a bond with three years until maturity, a price of $1,053.46, and a

yield to maturity of 6%?

a. 6%

b. 8%

c. 10%

d. 11%

The correct answer is b

第 44 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

45

Your answer is a

Feedback :

INCORRECT

10 : Which of the following factors will change when interest rates change?

a. The expected cash flows from a bond

b. The present value of a bond's payments

c. The coupon payment of a bond

d. The maturity value of a bond

The correct answer is b

Your answer is a

Feedback :

CORRECT

11 : What is the rate of return for an investor who pays $1,054.47 for a three-year bond with a 7%

coupon and sells the bond one year later for $1,037.19?

a. 5.00%

b. 5.33%

c. 6.46%

d. 7.00%

The correct answer is a

Your answer is a

Feedback :

CORRECT

12 : How does a bond dealer generate profits when trading bonds?

a. By maintaining bid prices lower than ask prices

b. By maintaining bid prices higher than ask prices

c. By retaining the bond's next coupon payment

d. By lowering the bond's coupon rate

The correct answer is a

Your answer is a

Feedback :

INCORRECT

13 : The yield curve depicts the current relationship between:

a. bond yields and default risk.

b. bond maturity and bond ratings.

c. bond yields and maturity.

d. promised yields and default premiums.

The correct answer is c

Your answer is a

Feedback :

INCORRECT

14 : Which of the following bonds would be likely to exhibit a <i>greater degree</i> of interest-rate

risk?

a. A coupon-paying bond with 5 years until maturity.

b. A coupon-paying bond with 20 years until maturity.

c. A floating-rate bond with 20 years until maturity.

第 45 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

46

d. A zero-coupon bond with 30 years until maturity.

The correct answer is d

Your answer is a

Feedback :

INCORRECT

15 : What is the yield to maturity (APR) of a bond with the following characteristics? Coupon rate

is 8% with semi-annual payments, current price is $960, three years until maturity.

a. 4.78%

b. 5.48%

c. 9.57%

d. 12.17%

The correct answer is c

Your answer is a

Feedback :

Author Name : Brealey

Site Name

: Fundamentals of Corporate Finance

Chapter

: Chapter 6 : Valuing Stocks

Quiz

: Multiple Choice Quiz

Student Name: CHY

Section ID:

Results Reporter

================

Out of 15 questions, you answered 0 correctly.

0 correct (0%)

15 incorrect (100%)

0 unanswered (0%)

=======================================================================

=====================Author Name : Brealey

Site Name

: Fundamentals of Corporate Finance

Chapter

: Chapter 25 : Risk Management

Quiz

: Multiple Choice Quiz

Student Name: CHY

Section ID:

Results Reporter

================

Out of 15 questions, you answered 4 correctly.

4 correct (27%)

11 incorrect (73%)

0 unanswered (0%)

=======================================================================

=====================

=======================================================================

=====================

Your Results :

=======================================================================

=====================

第 46 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

47

Section :

CORRECT

1 : Put options can be thought of as insurance policies for commodity producers.

a. True

b. False

The correct answer is a

Your answer is a

Feedback :

CORRECT

2 : Hedging reduces risk, but it is seldom cost free.

a. True

b. False

The correct answer is a

Your answer is a

Feedback :

INCORRECT

3 : Which of the following is <i>not</i> generally considered a benefit of hedging?

a. It reduces one or more aspects of business risk.

b. It allows prices to be locked in advance.

c. The costs of hedging are paid by the speculators.

d. It can stabilize profits.

The correct answer is c

Your answer is a

Feedback :

CORRECT

4 : How might a firm such as General Mills use options to control raw material prices for breakfast

cereals?

a. Buy call options on commodities.

b. Sell call options on commodities.

c. Buy put options on commodities.

d. Sell put options on commodities.

The correct answer is a

Your answer is a

Feedback :

CORRECT

5 : The spot price of silver closes at $7 per ounce at the expiration of an option contract. Which

one of the following option positions will have value?

a. The buyer of a call with $5 strike price.

b. The seller of a call with $5 strike price.

c. The buyer of a put with $5 strike price.

d. The seller of a put with $5 strike price.

The correct answer is a

Your answer is a

Feedback :

第 47 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

48

INCORRECT

6 : Which of the following is <i>not</i> correct concerning futures contracts?

a. Entails an obligation rather than an option.

b. Contract price is set at the beginning of the contract.

c. Contracts are exchange-traded.

d. Gains or losses are recorded at contract expiration.

The correct answer is d

Your answer is a

Feedback :

INCORRECT

7 : What happens to the price of a futures contract as expiration draws closer?

a. It exceeds the spot price of the asset.

b. It is exceeded by the spot price of the asset.

c. It approaches the spot price of the asset.

d. There is no relationship between futures price and spot price as the contract approaches

expiration.

The correct answer is c

Your answer is a

Feedback :

INCORRECT

8 : The process of marking a futures contract to market means that:

a. the profitability of the contract is locked in from the onset of the contract.

b. the amount of commodity to be delivered changes as prices change.

c. contracts are closed out as soon as they become unprofitable.

d. profits or losses are posted to the contract daily.

The correct answer is d

Your answer is a

Feedback :

INCORRECT

9 : The basic difference between speculators and hedgers in futures contracts is that speculators:

a. will profit regardless of the direction of price change.

b. are not protecting their commodity holdings.

c. are concerned only with long-term price movements.

d. take a position in more than one commodity at a time.

The correct answer is b

Your answer is a

Feedback :

INCORRECT

10 : You enter into a forward contract to take delivery of one million Deutsche marks three months

from now. What happens to the price you will pay at expiration if marks depreciate during the

contract?

a. Your price will increase.

b. Your price will decrease.

c. Your price was fixed at the onset of the contract.

d. Your price was fixed, and you will receive correspondingly more marks due to the

第 48 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

49

depreciation.

The correct answer is c

Your answer is a

Feedback :

INCORRECT

11 : When two borrowers engage in a currency swap, they agree to:

a. trade one currency for another, thus avoiding the foreign exchange market.

b. make payments on each other's borrowings in a different currency.

c. pay to each other any depreciation or appreciation of the currency.

d. exchange fixed-rate interest payments for variable-rate interest payments.

The correct answer is b

Your answer is a

Feedback :

INCORRECT

12 : Because most hedging acts to reduce risk, managers should expect that hedging will:

a. increase profits.

b. decrease profits.

c. increase the firm's stock price.

d. stabilize the firm's dividend payout.

The correct answer is b

Your answer is a

Feedback :

INCORRECT

13 : If managers are rational, they will only hedge when they perceive that:

a. prices are headed in an adverse direction.

b. derivative instruments are priced lower than actual value.

c. risk reduction is preferable to higher potential profits.

d. they can increase their profitability by doing so.

The correct answer is c

Your answer is a

Feedback :

INCORRECT

14 : Hershey's Chocolate is concerned about cocoa prices prior to building inventory for Halloween

sales. Analysts project that price per ton could vary from $1,250 to $1,500. A September call

option can be purchased with a $1,300 strike price for a premium of $145. What is Hershey's

worst-case scenario if it purchases these options?

a. Cocoa prices will rise to $1,500 and Hershey is only protected to a price of $1,300.

b. Cocoa prices will decline to $1,250 and Hershey must pay an extra $50 per ton.

c. Cocoa prices will not rise above Hershey's break-even price of $1,445, which equals the sum

of the strike price plus the option premium.

d. Cocoa Prices will remain below $1,300 and Hershey will lose $145 per option contract.

The correct answer is d

Your answer is a

Feedback :

INCORRECT

第 49 頁,共 69 頁

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三

50

15 : Why are most futures contracts not settled through delivery of the product?

a. Most contracts are settled through the margin account.

b. Most contracts expire with neither party having an obligation to the other party.

c. Most participants cancel their futures contracts through purchase of an option contract.

d. It is easier and cheaper to settle in cash or by offset.

The correct answer is d

Your answer is a

Feedback :

1. If we compare the prices of two options that are identical in every way except that one is

American and one is European, the price of the European should be at least as high as the

American.歐式選擇權與美式選擇權有許多方面事一樣的,唯一的不同點是歐式選擇權的

價格大於等於美式選擇權的價格。

2. When the price of a stock moves, the dollar change of the stock is generally less than the