postfile_3593

advertisement

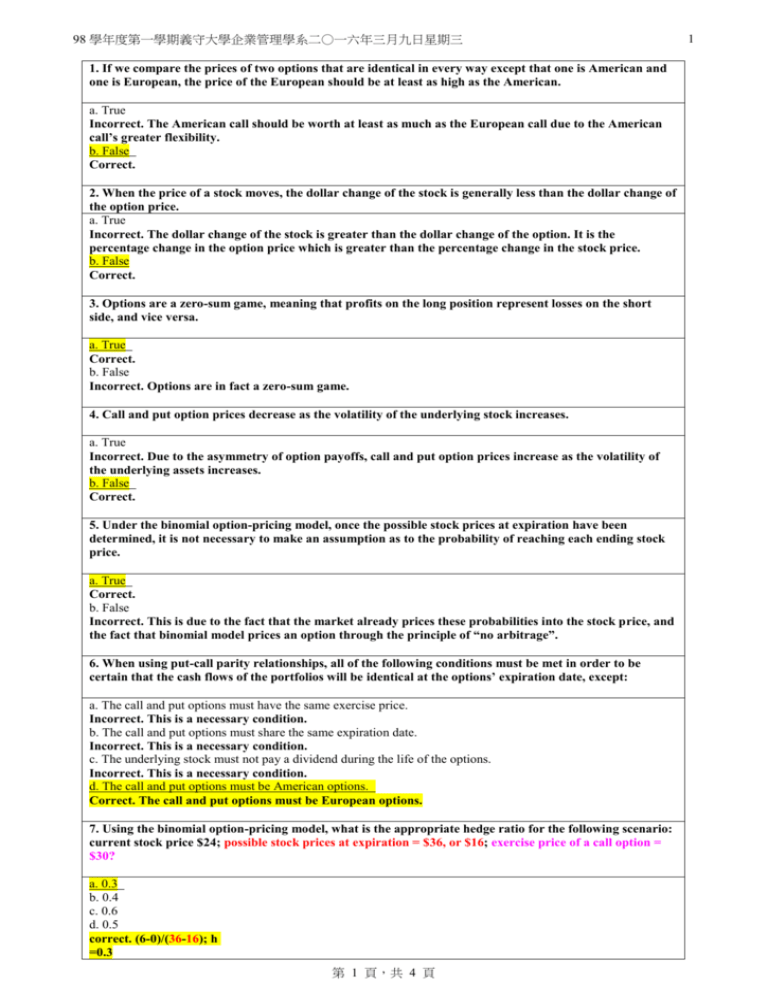

98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三 1. If we compare the prices of two options that are identical in every way except that one is American and one is European, the price of the European should be at least as high as the American. a. True Incorrect. The American call should be worth at least as much as the European call due to the American call’s greater flexibility. b. False Correct. 2. When the price of a stock moves, the dollar change of the stock is generally less than the dollar change of the option price. a. True Incorrect. The dollar change of the stock is greater than the dollar change of the option. It is the percentage change in the option price which is greater than the percentage change in the stock price. b. False Correct. 3. Options are a zero-sum game, meaning that profits on the long position represent losses on the short side, and vice versa. a. True Correct. b. False Incorrect. Options are in fact a zero-sum game. 4. Call and put option prices decrease as the volatility of the underlying stock increases. a. True Incorrect. Due to the asymmetry of option payoffs, call and put option prices increase as the volatility of the underlying assets increases. b. False Correct. 5. Under the binomial option-pricing model, once the possible stock prices at expiration have been determined, it is not necessary to make an assumption as to the probability of reaching each ending stock price. a. True Correct. b. False Incorrect. This is due to the fact that the market already prices these probabilities into the stock price, and the fact that binomial model prices an option through the principle of “no arbitrage”. 6. When using put-call parity relationships, all of the following conditions must be met in order to be certain that the cash flows of the portfolios will be identical at the options’ expiration date, except: a. The call and put options must have the same exercise price. Incorrect. This is a necessary condition. b. The call and put options must share the same expiration date. Incorrect. This is a necessary condition. c. The underlying stock must not pay a dividend during the life of the options. Incorrect. This is a necessary condition. d. The call and put options must be American options. Correct. The call and put options must be European options. 7. Using the binomial option-pricing model, what is the appropriate hedge ratio for the following scenario: current stock price $24; possible stock prices at expiration = $36, or $16; exercise price of a call option = $30? a. 0.3 b. 0.4 c. 0.6 d. 0.5 correct. (6-0)/(36-16); h =0.3 第 1 頁,共 4 頁 1 98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三 2 C MAX 36 30,0 MAX 16 30,0 6 S S 36 7.1 Using the binomial option-pricing model, what is the appropriate hedge ratio for the following scenario: current stock price 大盤 7700; possible stock prices at expiration = $7800, or $7600; exercise price of a call option = $4400? 買 權履約價 4400 月份: 2009/12 C MAX 7800 4400,0 MAX 7600 440 S S current stock price=$35;possible stock prices at expiration=$45,or$33;exercise price of a call option=$27? C 45 27 33 27 45 33 S 45 33 45 33 ;h=1 C MAX 45 27 ,0 MAX 33 27 ,0 18 6 S S 45 33 http://www.investorwords.com/5602/hedge_ratio.html An options strategy that aims to reduce (hedge) the risk associated with price movements in the underlying asset by offsetting long and hedged by shorting the underlying stock. This strategy is based on the change in premium (price of option) caused by a change in the pr basis-point change in price of the underlying is the delta and the relationship between the two movements is the hedge ratio. Investopedia Says: For example, the price of a call option with a hedge ratio of 40 will rise 40% (of the stock-price move) if the price of the underlying sto ratio. (35-27)/(45-33);h=.67 45 =possible stock prices at expiration ,or $33 27=exercise price of a call option 8. In order to price an option using the binomial option-pricing model, which of the following pieces of information is not necessary? a. The current price of the underlying stock. Incorrect. This is required information. b. An estimate of the company’s current beta. Correct. This isn’t required information. c. The amount of time remaining before the option expires. Incorrect. This is required information. d. The market’s current risk-free rate. Incorrect. This is required information. 9. Which of the following portfolios represents a synthetic position equivalent to a short bond PV(X)? a. Long call, short stock, and short put. Correct. P+ S = C + B. short bond PV(X)= –B b. Short call, short stock, and short put. Incorrect. –B = C – S – P. c. Short call, long stock, and long put. Incorrect. –B = C – S – P. d. Long call, short stock, and long put. Incorrect. –B = C – S – P. 10. Consider the following scenario. The stock of ABC Company is currently trading at $18. In 6 months, 第 2 頁,共 4 頁 98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三 the stock will either be worth $27, or $9. The risk-free rate is 20%. Using the risk-neutral method, what is the probability of an upward move (to $27)? a. 0.3 b. 0.4 c. 0.5 d. 0.6 correct. (27*p) + [9*(1-p)] = 18*1.1; p = 0.6 Pr o 27 9 R d 1.1 0.5 0.6 , R 1.1 , u ,d 。 18 18 u d (27 9) 1 18 C 27 18 9 .5 S 27 9 18 1. If we compare the prices of two options that are identical in every way except that one is American and one is European, the price of the European should be at least as high as the American.歐式選擇權與美式選擇權有許多方面事一樣的,唯一的不同點 是歐式選擇權的價格大於等於美式選擇權的價格。 2. When the price of a stock moves, the dollar change of the stock is generally less than the dollar change of the option price.當現貨(股票)的成交價變動時,現貨(股票)的價格變 動絕對量通常小於股票選擇權的價格變動絕對量(非相對量)。 3. Options are a zero-sum game, meaning that profits on the long position represent losses on the short side, and vice versa. 選擇權是一種零和遊戲,「做多」一方的利益來 自於「做空」一方的損失,反之亦然。 4. Call and put option prices decrease as the volatility of the underlying stock increases. 選擇權價格(權利金)與現貨(股票)的變異數成反比,即一個增加一個減少。 5. Under the binomial option-pricing model, once the possible stock prices at expiration have been determined, it is not necessary to make an assumption as to the probability of reaching each ending stock price.在二項式選擇權定價模型下,一旦現貨(股票)的到期日 成交價已被決定時,那麼就不需要再對每天股票的成交價上漲或下跌的機率做任何假設。 6. When using put-call parity relationships, all of the following conditions must be met in order to be certain that the cash flows of the portfolios will be identical at the options’ expiration date, except:當在使用買權賣權評價關係式時,為了確保兩種投資組合的現金 流量在期初是一樣,在期末也是一樣。則有一些條件須被吻合,請在 a、b、c、d 中挑出 不須被吻合的條件。 7. Using the binomial option-pricing model, what is the appropriate hedge ratio for the following scenario: current stock price = $35; possible stock prices at expiration = $45, or $33; exercise price of a call option = $27?使用二項式選擇權定價模型來避險時,當目前股 票價格為$35(S),在到期日時,股票價格有可能變成$45(Su)或是$33(Sd),而買權的履約 第 3 頁,共 4 頁 3 98 學年度第一學期義守大學企業管理學系二○一六年三月九日星期三 價格為$27(K),(Cu=Su-K=45-27=18,Cd=6),試求應買進幾單位的標的物(股票),才是最佳避 險比率? 8. In order to price an option using the binomial option-pricing model, which of the following pieces of information is not necessary?為了要使用二項式選擇權定價模型,我 們需要一些資訊,但下列哪一個資訊是我們不需要的? 9. Which of the following portfolios represents a synthetic position equivalent to a short bond PV(X)?下列哪一組投資組合的部位等於放空債券? 10. Consider the following scenario. The stock of ABC Company is currently trading at $18. In 6 months, the stock will either be worth $27, or $9. The risk-free rate is 20%. Using the risk-neutral method, what is the probability of an upward move (to $27)?考慮 下列情形。ABC 公司所發行的股票在今日的價格為$18,而在六個月後,它的價格有可 能變成$27 或者是$9,其無風險利率為 20%,使用風險中立者方法,求算出股票價格上 漲的機率。 第 4 頁,共 4 頁 4