options on foreign exchange

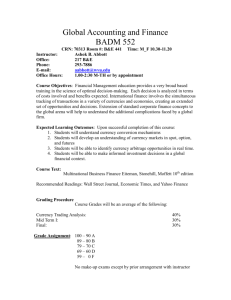

advertisement

FOREIGN CURRENCY OPTIONS “In the mid 1990s, trading in exotic options began to develop at a rapid pace. Today, dealers routinely supply two-way bid-ask prices for a wide spectrum of exotic currency options.”1 I. Definitions Currency Options – provide payoffs that depend on the difference between the exercise price and the exchange rate at maturity. Currency Futures Options – provide payoffs that depend on the difference between the exercise price and the exchange rate futures price at maturity. “Because exchange rates and exchange rate futures prices generally are not equal, the options and futures-options contracts will have different values, even with identical expiration dates and exercise prices. Today, trading volume in currency futures options dominates by far trading in currency options.”2 Definition of Derivatives – “any apparently complex financial instrument in which someone has suffered a loss.”3 II. Spot Foreign Exchange and Market Conventions “There is no organisation that decides what market convention should be for any aspect of foreign exchange trading.”4 The most important locations for foreign exchange are London, New York, and Tokyo, although foreign exchange trading takes place in every major city around the world. The major exchange for trading foreign currency options in the United States is the Philadelphia Stock Exchange. (www.phlx.com) Spot Rate (S) – a quotation for currency to be delivered in two bank business days. One exception is the USD/CAD which is delivered in one bank business day. Pip – the smallest unit of quotation for a currency. Value Date – foreign exchange settlement date (cannot be a bank holiday in either currency’s country and it must not be a bank holiday in the United States). 1 Source: Options on Foreign Exchange, 2nd Edition by David F. DeRosa. Source: Investments, by Zvi Bodie, Alex Kane, and Alan J. Marcus (Chapter 20) p.656 3 http://www.vtmagazine.vt.edu/sum96/derivatives.html. 4 Source: http://www.londonfx.co.uk/quoting.html 2 1 Source: http://www.coppclark.com/EDF_InteriorSpread.aspx Bid/Ask - 125.00/125.10 means the dealer is willing to sell dollars (buy yen) at 125.10 and buy dollars (sell yen) at 125.00. Trading Rules: The first currency in an exchange rate pair is the direct object of the trade. o Example: To buy $10M euro/dollar is to buy $10M euros against dollars. If S = 1.17 then you will receive 10M euros and you will pay 1.17M dollars. The rule in the professional currency market is that the higher currency on the list is the one that deals against all currencies. See Table 1 below. Table 1: Currency Hierarchy Symbol* Name Conversion Factor** EUR Euro (6 significant digits) GBP British Pound (6 significant digits) MTL Maltese Lira (6 significant digits) AUD Australian Dollar (6 significant digits) NZD New Zealand Dollar (6 significant digits) FJD Fiji Dollar (4 significant digits) PYG Paraguay Guarani (5 significant digits) USD United States Dollar (6 significant digits) JPY Japanese Yen5 (6 significant digits) * Source: http://www.londonfx.co.uk/quoting.html **Source: http://coinmill.com/sources.html 5 Source: Options on Foreign Exchange, 2nd Edition by David F. DeRosa, p. 14. 2 American terms – U.S. dollars per unit of foreign currency. The pound, Australian dollar, New Zealand dollar, and the euro are quoted using the American convention. For example: $1.7/£. European terms – The number of units of foreign currency per dollar. The Japanese yen is quoted using the European convention. For example ¥120/$. Note: Most exchange-traded currency futures and options quote currencies American, even for currencies that are quoted European in the spot market! III. Pricing Options C = value of a call option P = value of a put option S = spot rate (d/f) K = strike price (d/f) rf = foreign interest rate rd = domestic interest rate t = t0 T = t1 T – t = τ = time to expiration Value of a call at expiration: Value of a put at expiration: CT = Max[0, ST – K] PT = Max[0, K – ST] Max value of a call is the spot price:6 Max value of a put is the strike price C≤S P≤K Min value of a call option: C ≥ S0e Min value of a put option: r P ≥ Ke d S0e rf Ke rd rf where, τ = T – t Assume: European options No – arbitrage Price cannot be < 0 (i.e. C ≥ 0, P ≥ 0) USD put = JPY call USD call = JPY put Long USD call = Long JPY put Short USD call = Short JPY put Long USD put = Long JPY call Short USD put = Short JPY call 6 If this were not true an arbitrage profit would exist by selling the option and buying the currency. 3 Put-Call Parity C Kerd P S0e rf Portfolio 1 Long put Short call Total Value Portfolio 2 Long domestic bond Short foreign bond ST ≤ K ST > K K - ST 0 K - ST 0 -(ST – K) K - ST K -ST K - ST K -ST K - ST Figure 1a:Put-Call Parity Profit Profit Payoff Call Holder Put Writer Combined = Leveraged Equity Long Call 0 0 Exchange Rate Call Writer Put Holder Short Put Exchange Rate Exchange Rate Figure 1b:Put-Call Parity Long £ Buy an ATM $/£ put Profit Profit 0 Exchange rate, $/£ 0 Exchange rate, $/£ K Profit Sell an ATM $/£ call Value of the Portfolio = Exchange rate, $/£ E 0 K Exchange rate, $/£ 0 K 4 Formulas r r C = S0e f N (d1 ) Ke d N (d2 ) P = Ker N (d2 ) S0er N (d1 ) f d where, 2 S ln 0 rd rf 2 K d1 2 S ln 0 rd rf 2 K d2 d1 Example:7 Currencies: Type: S= K= Rf = Rd = τ= USD/GBP GBP call (USD put) 1.6000 1.6000 11% 8% 4 months = 120/360 σ= 14.1% volatility Steps 1 & 2 calculate d1 & d2: 0.1412 120 1.6000 ln 0.08 0.11 360 2 1.6000 d1 0.141 120 360 0 0.02006 .33 0.141 x 0.57735 0.00669 0.081406 0.08214 d 2 d1 0.08241 0.141 120 360 0.08241 0.081406 0.16382 7 Example 14.2, p. 322 from Options, Futures, & Other Derivatives, by John C. Hull. 5 Steps 3 & 4 calculate N(d1) & N(d2): N(d1) = N(-0.0821) = N(-0.08) - 0.21[N(-0.08) – N(-0.09)] = 0.4681 - 0.21 x (0.4681-0.4641) = 0.4681 - 0.0008 = 0.4673 N(d2) = N(-0.1638) = N(-0.16) - 0.38[N(-0.16) – N(-0.17)] = 0.4364 - 0.38 x (0.4364-0.4325) = 0.4364 - 0.0015 = 0.4349 Step 5 calculate C: r C S0 e f N (d1 ) Ke rd N (d 2 ) 1.6e 0.11 120 360 0.4673 1.6e0.08120 360 0.4349 1.6e 0.0366 0.4673 1.6e 0.266 0.4349 0.7207 0.6776 0.0431 or 4.3 ¢ 6 Figure 2: USD/JPY Options Source: ft.com Figure 3: USD/EUR Options Source: ft.com Figure 4: USD/GBP Options 7 Black-Scholes-Merton8 Three Assumptions: 1. Frictionless Markets - No taxes, transaction costs, no restrictions on taking long or short positions, and no market control. 2. Interest rates are riskless, continuously compounded, and constant. 3. Spot rates change instantaneously and they have a normal distribution. Options Calculators Chicago Board Options Exchange http://www.cboe.com/LearnCenter/OptionCalculator.aspx Currency Options Calculators CFO.com http://tools.cfo.com/calc/BSCurrency/input.jsp OZForex http://www.ozforex.com.au/cgi-bin/optionsCalc.asp IV: LEGO® Hedging9 LEGO® hedging requires: 1. Identification of the amount of foreign currency at risk and relevant future dates. 2. The value of the FX instrument selected (forwards, options or futures) must change (∆F) so as to offset any change in the identified exposure (∆S). ∆V = ∆S - ∆F (where the change in value of the firm (∆V) is expected to equal zero) Example: A U.S. based firm with domestic dollar denominated sourcing costs and euro export earnings may want to hedge adverse movements in the value of the dollar vs. euro. – In other words, a fear that the dollar will appreciate vs. the euro. – The firm could purchase a series of long maturity put options on the euro. 8 The Black-Scholes (1973) model was extended by Merton (1973) to include the theoretical case of an option on shares of a stock that pays dividends continuously, Garman and Kohlhagen (1983) adapted the model to work for European options on foreign currencies. 9 Charles W. Smithson, “A LEGO Approach to Financial Engineering: An Introduction to Forwards, Futures, Swaps, and Options,” Midland Corporate Finance Journal vol.4 (no.4, 1987), pp. 16-28. Michael H. Moffett, Jan Karl Karlsen (1994) “Managing Foreign Exchange Rate Economic Exposure” Journal of International Financial Management & Accounting 5 (2), 157–175. Joseph K. Cheung and Richard Chung (1996) “Valuation of complex financial instruments via basic components,” Review of Quantitative Finance and Accounting, Volume 7, Number 2 / September, 1996, p. 163-176. http://pages.stern.nyu.edu/~adamodar/pdfiles/eqnotes/valclose.pdf 8 Challenges with LEGO® Hedging 1. Even with relatively predictable cash flows total exposure may be greater than the straight-forward currency loss. – Example: If export sales are reduced due to FX risk, the total exposure might include lost economies of scale or market share. 2. While the foreign currency option will protect the firm from FX liabilities, the actual upfront cost of the option may be prohibitive. 3. Tax laws may require the company to mark-to-market options at the end of the fiscal year. – In the U.S. companies can apply for “Hedge Accounting” to avoid marking-tomarket a financial hedge instrument. – Hedge Accounting means both the instrument and the underlying exposure are treated as if they were one single account. 4. The actual exposure of a firm will likely change over time. V. Exotic Currency Options Exotic currency option - an option with a nonstandard feature that sets it apart from an ordinary vanilla currency option. Barrier option – pays (or doesn’t pay) once the spot price hit a predetermined price. Barrier options are the most popular exotic options. Types of Barrier Options: Knock-out option Double-barrier currency option Binary option – pays a lump sum if the option is in the money at expiration. Types of Binary Options: One touch Double-barrier range binary Other Types of Options Basket option Compound option Average rate currency options Quantos options 9 VI. Final Comments All varieties of barrier options depend on knowing whether the barrier has been struck and the industry standard is to have the option-dealing bank assume the role of the determination agent (despite the obvious conflict of interest). Transparency Foreign exchange transactions are private conversations between two parties (no public record of trades exist). Thin Markets Trading done during the early Monday morning hours in Australia and New Zealand might not be counted. Cross rates A number of disputes have arisen asking whether a cross-rate implies a barrier event. www.isda.org International Swaps and Derivatives Association 10