【KCS Form 4】Korean Verification of Origin Questionnaire for

advertisement

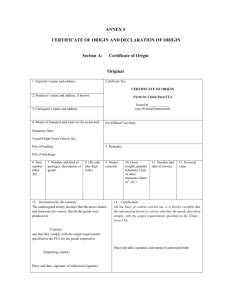

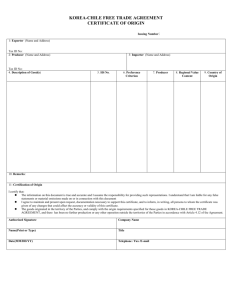

【KCS Form 4】Korean Verification of Origin Questionnaire for Exporter or Producer KOREA CUSTOMS SERVICE VERIFICATION OF ORIGIN QUESTIONNAIRE (FOR EXPORTER OR PRODUCER) This questionnaire is sent to you pursuant to Article O.OO of Korea-OO FTA and Article 13 of the Special Law on Customs Act for the implementation of Free Trade Agreement. It will be used in determining the preferential tariff treatment for imported good(s). If necessary, additional information may be requested at a later date. Attached continuation pages may be used if additional space is needed for your response. Please return the completed sheets within ___ days after you receive this questionnaire. Regulatory measures such as denial of preferential tariff treatment may be provided if the due period is not met. For an extension of the submission date, you may have a single opportunity to make a written request to the Customs Authority sending this questionnaire (Korea-Peru FTA excluded). SECTIONⅠ ▶ TRADER INFORMATION Exporter or producer mark √ where applicable and complete the following questionnaire. Trader Status Description Exporter You are the exporter of the good(s) subject to verification. Exporter/Producer You are the exporter and also the producer of the good(s) subject to verification. Producer of Good(s) You are the producer of the good(s) subject to verification. Producer Material(s) of You are the producer of the materials used in the production of the good(s) subject to verification. Overseas Supplier's No. Business Type/Condition Company Name Name of CEO Country (Head office) Tel Fax Physical Address Personnel Consultants and Staffs in Origin Management Website (Factory 1) Tel (Factory 2) Tel (Total) (Managers) persons persons (Board of Directors) (Production) persons persons (Others) persons Third Party Consultants(Customs Broker, Consulting Firm, and/or Origin Specialist) Name: /☎: Origin Staff (Name: /☎: ), experienced for ____ yr(s) Please provide information about human resources in charge of origin management (※ Attached continuation pages may be used if additional space is needed for your response.) Origin Management System Production Facilities for goods subject to verification Do you have an origin management manual? Yes No Yes No If yes, please provide (a copy of) the manual Do you operate a system for origin management? Description of Equipment Quantity Use Location Manager in charge of Origin Management (※ Attached continuation pages may be used if additional space is needed for your response) (Department) (Position) (Name) (Tel) (E-mail) SECTION Ⅱ ▶ GENERAL INFORMATION (based on each export declaration) Korea-Chile Applied FTA or Agreement Korea-Singapore Korea-EFTA Korea-ASEAN Korea- India (Mark √ where applicable) Korea-EU Korea-Peru Korea-US APTA GSP 1. DETAILS OF GOOD(S) SUBJECT TO VERIFICATION Export Declaration No. Date of Exportation Description of good(s) Specification of good(s) HS Code Price Weight/Quantity Exporter's determination Advance Rulings specify: ) Consulting broker Others (please 2-1. How did you determine HS code of the exported good(s)? 2-2. For tariff classification, please mark √ where applicable and provide a copy of the documents Transaction Contract Information of use Information of Production Process Advance Rulings on Tariff Classification analysis) Bill of Material (BOM) Sample (※Your sample will not return if it is used for 2. CERTIFICATE OF ORIGIN (C/O) Government agency Importer specify: ) Exporter Producer Others (please 2-1. Issuer of the Certificate of Origin (C/O). 2-2. Does the exporter keep C/O log book(s)? Yes No Unknown 2-3. Does the producer keep C/O log book(s)? Yes No Unknown 2-4. Which document is your determination of the preference rules of origin based on? Please mark √ where applicable and submit copy of supporting documents Origin Certificate of Invoice with certified origin (including C/Os issued by countries) third Origin certifying document (※Supplier's Declaration (including blanket-exportations), domestic manufacturing confirmation, Import Declaration etc.) Cost and Production Statement Others ( ) 3. TRANSIT AND TRANSSHIPMENT 3-1. Please mark √ where the transportation modes are indicated. Bill of Lading (B/L) Airway Bill (AWB) Cargo Manifest specify: Others ) Yes (please No 3-2. Did the exported good(s), on which a claim for preferential treatment was made, transit or transship a non-originating party while transported? 3-3. If you marked 'yes' to question 3-2, please provide supporting details proving that the good(s) remained under the control of Customs Authority of the non-originating party, and submit documentary evidences. (※ Supporting details. Attached continuation pages may be used if additional space is needed for your response.) 3-4. Did the exported good(s) undergo further production or any other operation outside the territories of the Parties, other than unloading, reloading, or any other operation necessary to preserve the goods in good condition? Yes No 3-5. If you marked 'No' to question 3-4, please explain the detailed operation under the control of Customs Authority, and submit documentary evidences. (※ Explanation of the operation. Attached continuation pages may be used if additional space is needed for your response.) SECTION Ⅲ ▶ PREFERENCIAL RULES OF ORIGIN (based on each export declaration) 4. COMMON CRITERIA 4-1. Does your company have manufacturing plant(s) and/or equipments involved in the production of the exported good(s) entitled to the preferential tariff treatment? Yes No 4-2. Did you carry out the production operations beyond the non-qualifying operations stipulated in the relevant Agreement? Yes No 4-3. Please state the country of production. 4-4. Please provide physical address of the production facilities. 4-5. If you have marked 'Yes' to question 4-2, provide copies of the documents proving the production. 4-6. Please explain the manufacturing processes of the good(s) subject to verification. (※ Explanation of manufacturing process. Attached continuation pages may be used if additional space is needed for your response.) Please mark √ indicating the appropriate preference rules applied to the good(s) being verified, and complete the question(s) below. Preferenc e Please mark all the applicable rules you applied. Complete the question Criterion corresponding to the rule that apply. Wholly obtained Change classification Complete Question No. 5 in tariff Complete Question No. 6 Regional value content Complete Question No. 7 Manufacturing process Complete Question No. 8 5. WHOLLY OBTAINED CRITERION 5-1 Please describe the production operation for the good(s) subject to verification (※ Production Operation. Attached continuation pages may be used if additional space is needed for your response.) 5-2. Provide the details of raw materials used in the production of the good(s) in the table below. S/N Description of Material Type HS Code Name/Address of Supplier Country of Origin ※ HS code: 6 or 8 digit code to be indicated according to the relevant Agreement. Type: please refer to #7 of the attached 'Completion Instruction' and indicate one out of a through h. Attached continuation pages may be used if additional space is needed for your response. 6. A CHANGE IN TARIFF CLASSIFICATION CRITERION 6-1. Provide the details of raw materials used in the production of good(s) in the table below and provide supporting documents. S/N Description of Material HS Code Name of Supplier Address/Contact Details of Supplier Country of Origin (※ Attached continuation pages may be used if additional space is needed for your response.) Provide the details of non-originating materials in the table below, which did not undergo a change in tariff classification. Provide supporting documents to substantiate a claim for the preferential treatment, e.g. based on De-minimis rule. 6-2. ※ For application of De-minimis rule, please check if De-minimis calculation is based on value or weight. Complete only one of the two columns applicable. S/N Description of Material HS Code Country of Origin Total Value Weight (※ Attached continuation pages may be used if additional space is needed for your response.) Calculation based on Value Total value of Nonoriginating materials which did not undergo applicable tariff classification change Total transaction value adjusted to FOB basis Value ① Total weight of Nonoriginating materials which did not undergo applicable tariff classification change ① ② Total weight components ② ③ De Minimis percentage = ①/②×100(%) or Total cost of the good De Minimis percentage = ①/②×100(%) Calculation based on Weight of the Weight ③ ㅣㅏㅓ 8. REGIONAL VALUE CONTENT (RVC) CRITERION 8-1. Fiscal year for calculating RVC. 8-2. Provide details of raw materials used in the production of good in the table below, and submit cost accounting statement. Value of Materials S/N Material Description HS Code Supplier Country of Origin Unit Quantity Unit Value Originating Material Total (※ Attached continuation pages may be used if additional space is needed for your response.) 8. MANUFACTURING PROCESS CRITERION 8-1. Explain how this criterion is met and submit supporting documents. Nonoriginating Material (※ Explanation on manufacturing process undertaken. Attached continuation pages may be used if additional space is needed for your response.) 9. FUNGIBLE GOODS/MATERIALS 9-1. Does the good(s) subject to verification contain fungible goods? 9-2. If yes, select the inventory management method used. 9-3. Provide the fungible good(s) used in the space below Yes No FIFO LIFO Averaging Other acceptable method (※ Description of fungible goods. Attached continuation pages may be used if additional space is needed for your response.) 9-4. Does the good(s) subject to verification contain fungible materials? If yes, select the method applied for inventory management. Yes No FIFO LIFO Averaging Other acceptable method Provide description of the fungible material(s) used in the space below. (※ Description of fungible materials. Attached continuation pages may be used if additional space is needed for your response.) SECTION Ⅳ ▶ CERTIFICATION We certify that the information on this document is true and accurate and we assume the responsibility for proving such representations. We understand that we are liable for any false statements or material omissions made on or in connection with this document. Company Name Date Name of Representative Title Authorized Signature/Seal Name of Person who Completed this Form Title Authorized Signature/Seal Customs Use Only Name of Customs Division Title Name of person in charge 【Additional question or information】 ※ If you have any questions or comments please state below. If further space is needed use the continuation pages. . List of Documents Submitted S/N 1 2 3 4 5 6 7 Description of Documents Question No. 8 9 10 11 12 13 14 15 16 17 18 19 20 Completion Instruction 1. The confidential business information collected on the questionnaire may only be disclosed to those authorities responsible for the administration and enforcement of determination of preference rules of origin, and of customs, and revenue regulations. If necessary, additional information may be requested at a later date. 2. You will have to return the completed and signed questionnaire to the requesting Customs office. Regulatory measures such as denial of preferential tariff treatment may be provided if the due period is not met. 3. Exporter and/or producer is required to keep all export/production-related documents relevant to exportation for 5 years from the acceptance date of export declaration. The documents stated as below shall be submitted if requested by Customs. ※ Record keeping requirements are stipulated in the FTA and Enforcement Decree under the Special Law on Customs Act for the implementation of Free Trade Agreement FTA Regulatory Basis Documents entitled to Record Keeping Enforcement Decree Paragraph 1 of Article 12 the Special Law on Customs Act Paragraph 1.2 of Article 13 ● A copy of the Certificate of Origin (including electronic records) ● A copy of Documents claiming for Origin Certification ● Certificate of Export Declaration ● Contract of Export Transaction ● Certificate of Export Declaration of materials used within the production of the good in question ● Documentary evidences proving production or purchase of the raw materials and the good in question ● Cost Statement ● Bill of Material ● Production Process Instruction ● Log books of the good(s) and materials ● Origin certifying documents completed by the producer and submitted to the exporter in order to prove the origin of the good in question ● Origin confirmation or declaration completed by the producer in case where the local producer exists separately. Paragraph 5 of Article 5.4 ● All records relating to the origin of the good(s) for which preferential tariff treatment was claimed ● Records relevant to purchase, cost and value of and payment for the exported good(s) ● Records relevant to purchase, cost and value of, and payment for all materials used in production of the exported good(s) ● Records regarding the production of the good(s) in the form in which the good is exported from its territory ● Certificate of Origin or Origin Declaration KoreaSingapore Paragraph 1 of Article 5.5 ● All records relating to the origin of the good(s) for which preferential tariff treatment was claimed ● Records relevant to purchase, cost, shipping and value of and payment for the exported good(s) ● Records relevant to sourcing, purchase, cost and value of, and payment for all materials used in production of the exported good(s) ● Records regarding the production of the good(s) in the form in which the good is exported from its territory Korea-EFTA Paragraph 1 and 3 of Article 21 of Annex I ● Copy of the Origin Declaration, and of all documents supporting the originating status ● The records shall include electronic records KoreaASEAN Paragraph 1 of Article 13, Appendix I ● Records relevant to applying for issuance of Certificate of Origin pursuant to domestic laws and regulations of the exporting country Paragraph 1 and 3 of Article 4.10 ● the application for Certificate of Origin and all documents related to origin ● Exporter or producer may choose to maintain records specified in any medium that allows for prompt retrieval, including, but not limited to, digital, electronic, optical, magnetic or hard copy Korea-Chile Korea-India FTA(Law) Korea-EU Korea-Peru Article Record keeping data Paragraph 1 and 3 of Article 23 Paragraph 3 of Article 16 ● Copy of Origin Declaration as well as documents stated in Article 16.3 ● All appropriate documents proving the originating status of the product(s) concerned including statements from the suppliers or producers in accordance with domestic legislation as well as the fulfillment of the other requirements of the protocol ● The records may include electronic records Paragraph 1, 2 and 4 of Article 4.6 ● Documents related to the purchase, cost, value of and payment for the exported good(s) ● documents related to the purchase, cost, value of and payment for all materials including indirect materials used on the production of the exported good(s) ● Records regarding the production of the good(s) in the form in which the good is exported from its territory ● Other documents agreed by both parties ● Exporter or producer may choose to maintain records specified in any medium that allows for prompt retrieval, including, but not limited to, digital, electronic, optical, magnetic or hard copy Korea-US Paragraph 1 and 4 of Article 6.17 ● All records necessary to demonstrate that the good for which the producer or exporter provided a certification was an originating good, including records concerning; ● the purchase, cost, value of and payment for the exported good(s) ● the purchase, cost, value of and payment for all materials including indirect materials used in the production of the exported good(s) ● Records regarding the production of the good(s) in the form in which the good is exported from its territory ● Other documents agreed by both parties ● Exporter or producer may choose to maintain records specified in any medium that allows for prompt retrieval, including, but not limited to, digital, electronic, optical, magnetic or hard copy 4. 6-digit or 8-digit HS Code shall be provided in accordance with the relevant FTA. 5. In terms of the value (price) of the goods and/or materials, please convert the value(price) of FOB, EXW, adjusted price, net cost etc. into the US dollars. 6. Please describe the unit of quantity of the good set out in the harmonized commodity description and coding system. e.g. ㎏, u ㎏, 2u, m ㎏, ㎡ ㎏, ㎥ ㎏, ℓ ㎏, MW, etc. 7. For question 5-2, please complete the type of materials with reference to the below chart. Classification Type Detailed Context Mineral products a mineral goods extracted from in territory of party Vegetable products b vegetable products grown and harvested there Live animals or goods taken from them c live animals born and raised there, products from live animals raised there Goods obtained by hunting or fishing d goods obtained by hunting, trapping, fishing, aquaculture conducted there Marine products e products of sea fishing taken by vessels registered with the party and entitled to fly its flag from the sea outside the sea territorial sea Goods from universe f goods taken from outer space provided that they are obtained by the party or a person of the party Waste, recycling goods g used articles collected there fit only for the recovery of raw materials or for use as waste derived products h goods obtained or produced in the territory of party solely from goods referred to as above ※ Detailed classification of territory and product depends on the applied FTA. 8. For goods entitled to preference under Korea-US FTA, the importer may arrange for the exporter or producer to provide information proving that the good is originating directly to the Party.