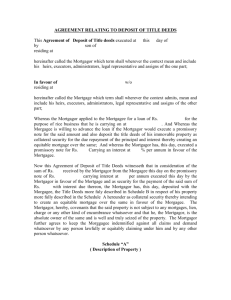

Word format

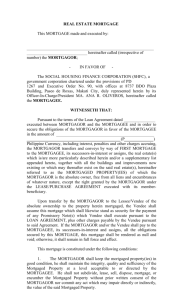

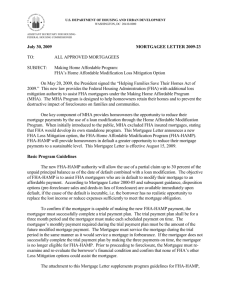

advertisement