11/07 Journal of - SBCC Accounting

advertisement

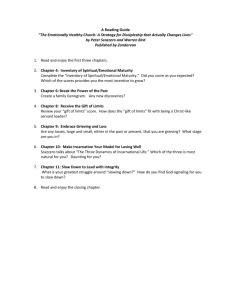

Accounting for Gift Cards An emerging issue for retailers and auditors BY CHARLES OWEN KILE JR. NOVEMBER 2007 EXECUTIVE SUMMARY The accounting for gift card sales presents an emerging reporting dilemma for retailers. Unresolved reporting issues stemming from the reporting treatment of gift card sales and “breakage” (gift cards that consumers fail to redeem) potentially involve several accounting regulations, including standards for revenue recognition and the recognition of special items. This consumer-merchant trade-off provides plenty of economic justification for retailers to offer and even to promote gift card sales because retailers stand to derive several economic benefits from such sales. Benefits from gift cards can include increased sales, marketing opportunities, improved cash flow and inventory management and a stronger bottom line as the result of unredeemed gift cards. The accounting for the initial sales transaction for a gift card does not reflect any presumed value but rather a liability for deferred revenue, which presents challenges for analysts. The author’s analysis suggests that while certain trends in the reporting of gift card transactions are emerging, practices are far from uniform. The apparently material percentage of gift card value that goes unused creates additional accounting complications. Trends in the redemption patterns of previously sold gift cards allow retailers to create an estimate of future breakage. Once a reliable estimate is established, the retailer may claim to have a basis for removing the gift card liability from its books. The placement of gift card breakage in the financial statements causes additional uncertainty and variation in financial reporting. The SEC has not taken a public position on gift card accounting, except to advise that the staff does not view immediate recognition of any amount of revenue at the point of sale as consistent with the staff’s view of GAAP. Charles Owen Kile Jr., Ph.D., is a professor of accounting at Middle Tennessee State University. His e-mail address is ckile@mtsu.edu. B lack Friday, so called because it kicks off the holiday shopping season that retailers hope will bring the $4.7 trillion industry into the black, is just weeks away. But last year, continuing a growing trend, more shoppers chose to purchase gift cards rather than merchandise, skewing some sales reports. This article examines the varying accounting treatments for gift card sales and their subsequent redemption patterns. The National Retail Federation said 2006 holiday sales (those occurring in November and December) of gift cards were $27.8 billion. Overall holiday sales were $663 billion, according to the U.S. Commerce Department. Independent financial services research firms have estimated holiday gift card sales were as much as $75 billion. In fact, no one really knows the aggregate effect of gift card transactions because retailers rarely provide separate information on gift card sales and redemptions. The accounting for gift card sales presents an emerging reporting dilemma for retailers. Unresolved issues stemming from the reporting treatment of gift card sales and “breakage” (gift cards that consumers fail to redeem) potentially encroach upon several accounting regulations, including standards for revenue recognition and the recognition of special items. In practice, the reporting of gift card sales and breakage among retailers varies significantly and it is unclear what future action, if any, standard-setters and regulators will take toward unifying the range of practices. ADVANTAGES TO SELLERS Gift cards offer buyers and gift recipients a variety of product choices but restrict those choices to a single or limited number of retail service providers. This consumer-merchant trade-off provides plenty of economic justification for retailers to offer, and even to promote, gift card sales, because retailers stand to derive several potential economic benefits. Increased sales. The gift card’s product selection option can persuade indecisive buyers to make purchases they might not otherwise make. Moreover, a gift card may induce additional sales when the card is redeemed. The predetermined, fixed gift card value essentially translates into a minimum purchase guarantee upon redemption. However, the lumpiness of the pricing of retail items makes it likely that the recipient will spend additional money to buy an item of greater value, as opposed to leaving a balance on the card. Marketing opportunities. When gift cards are used as a gift, they generate marketing benefits by offering the retailer two customer contacts and two sales opportunities, as opposed to only one. Gift card transactions also generate incremental information that the company may be able to translate into additional future period sales through marketing and promotional efforts. Cash flow and inventory management. Benefits to retailers are not limited to customer effects. They are realized through other aspects of the retail operation. For example, the delay in the transfer of goods and services provides significant and obvious operating cash flow benefits to the business. This delay also provides inventory management benefits. Since gift cards are sold during the holiday shopping season and frequently redeemed during off-seasonal periods, businesses may then provide greater inventory smoothing than would otherwise be possible. Gift cards can also reduce general operating expenses. Bottom line. Perhaps the greatest benefit to retailers—and one that has distinct accounting implications—is that historical consumer behavior trends show that a portion of many gift card purchases will never be redeemed. The retail and banking industries recognize the tendency of consumers to leave gift card balances unused and refer to the unspent balance of a gift card as breakage . Reported estimates of breakage by consumer research groups vary from 10% to 19%. Even by conservative estimates, gift card breakage has the potential to significantly influence many companies’ bottom lines. FINANCIAL REPORTING PRACTICES The author analyzed the 2006 fiscal year 10-Ks of 167 companies—from selected retailers and eateries—in an attempt to evaluate the gift card reporting practices of potentially affected issuers. The results of this analysis, summarized in Exhibit 1, suggest that gift card reporting is a significant consideration for many firms and that reporting patterns are emerging. Most notably, more than two-thirds of selected companies provide some level of information about their gift card reporting practices (see Exhibit 1, Panel A). Of the companies that do not, most are small, over-the-counter franchise companies. DELAY IN RECOGNITION OF SALE SEC Staff Accounting Bulletin no. 101 generally requires the transfer of product (merchandise) as a necessary condition for revenue to be recognized. SEC Staff Accounting Bulletin no. 104 provides additional guidance. When a retailer sells a gift card to a customer, the payment for a future purchase is received upfront, but transfer of merchandise is delayed at the consumer’s discretion. So, instead of recognizing actual revenue on the sale of gift cards, retailers record a deferred revenue liability on the balance sheet for the cash exchange until the gift card is redeemed. This deferred revenue approach not only fails to reflect any of the benefits previously cited but also presents challenges for analysts. A survey by Marketing Workshop Inc. found that only 30% of recipients use a gift card within a month. The increasing use of gift cards and the time lag between purchase of the cards and when the recipient redeems them for merchandise, allowing retailers to recognize the sale, apparently caused analysts to misgauge 2006 holiday sales as being weaker than expected. The unexpectedly strong January sales, when counted toward the 2006 holiday season, ultimately made retail sales for the year strong for most retailers. In the author’s analysis, most companies provided a revenue recognition policy statement explaining that revenue from gift cards is delayed until redemption and roughly one-third provide a policy statement on the recognition of breakage. A similar number of companies provided the amount of the current gift card liability (usually in a footnote). Only one company, Ruth’s Chris, disclosed the amount of gift card sales for the current year. Of the 113 companies that provided gift card information, 80 provided at least some indication as to where the liability can be found on the balance sheet (Exhibit 1, Panel B). The most common practice was to lump the liability into an “accrued expense or other liability.” Others included gift cards in a “deferred revenue” account. However, nine companies viewed the gift card liability significantly enough to create a separate line item on the balance sheet. GIFT CARD BREAKAGE The apparently material percentage of gift card value that goes unused creates additional accounting complications. (Consumer Reports estimated that 19% of the people who received a gift card in 2005 never used it.) For example, when does the non-event of the failure to redeem a gift card occur? For some gift cards, an expiration date may serve as an event for removing any unused amount from the lingering gift card liability. Some states have laws governing unclaimed property that regulate gift card breakage. However, as a result of consumer advocacy efforts, in many cases gift cards have no expiration date and, when unredeemed, represent an indefinite obligation of the retailer (see sidebar “Consumers Fight Gift Card Restrictions”). In such instances, trends in the redemption patterns of previously sold gift cards allow retailers to create an estimate of future breakage. As each day passes, the likelihood of redemption declines based upon historical redemption patterns. These patterns allow retailers to compute a weighted average gift card breakage estimate. Once a reliable estimate is established, the retailer may claim to have a basis for removing the gift card liability from the books. Estimating the trend to establish reliable gift card breakage patterns requires the passage of a sufficient number of years. As a result, in practice, retailers recognize two phases of gift card breakage adjustments. The initial adjustment is a one-time recognition to cover the multiyear estimation period needed for the retailer to establish a gift card redemption and breakage pattern. Ensuing adjustments occur in subsequent periods to keep the estimates of future unredeemed gift cards current. The initial adjustment is potentially dangerous because it causes a nonrecurring one-time shock to the reporting process. Moreover, the timing of this adjustment is subject to manipulation and the amount can be substantial because it represents the accumulation of multiple years of breakage, rather than just one. For example, during the first quarter of 2005, Home Depot recognized a $43 million adjustment for gift card breakage covering all preceding periods from “the inception of [its] gift card program.” However, the ensuing gift card breakage adjustments for the remainder of 2005 were $9 million, a material amount, yet small relative to the initial one-time adjustment. PLACEMENT OF CARD BREAKAGE The placement of gift card breakage in financial statements causes additional uncertainty and variation in financial reporting. Best Buy Inc. added $43 million of unredeemed gift card proceeds directly to February 2006 sales revenue, including $27 million from prior periods. In contrast, Home Depot applied both its one-time and period unredeemed gift card proceeds to reduce “selling and general administrative expense.” Best Buy and Home Depot were given an opportunity to explain their gift card accounting for this article. Both declined to do so. In the author’s analysis, although 53 companies provided a policy statement about breakage, only 39 identify where breakage is or could be found on the income statement (see Exhibit 1, Panel C). The trend clearly tends toward “net sales,” although “other income” has some support as well. In summary, the analysis suggested that while an increasing number of companies are providing gift card information, useful quantitative disclosures indicating amounts of annual gift card sales and breakage are rarely provided. The analysis also suggested that while certain reporting trends are emerging, practices are far from uniform. Conceptually, the practices of including unredeemed gift card amounts in sales or as a reduction in cost of goods sold lead to misleading, overstated gross margins, given that unredeemed gift card proceeds have no accompanying inventory costs. For example, some analysts of Best Buy initially misread investor-sensitive sales and gross margin trends. Reducing SG&A expenses with gift card write-offs represents a more conservative approach, but seems conceptually flawed and potentially misleading, since the economic benefit does not originate from expense reduction measures. Alternatively, recurring period gift card breakage could be included in “other revenue” and the amount separately disclosed in a footnote, if material. This would at least allow analysts to segregate it from “sales.” However, non-recurring gift card breakage from multiple periods is an unsustainable element of operations and meets the definition of a special item. At a minimum, companies offering gift cards should disclose their treatment of gift card transactions and breakage in the footnotes. Also, MD&A requirements likely oblige companies to disclose whether they offer such programs and, if so, the amounts from gift card proceeds and unredeemed balances, if material. Exhibit 1 Analysis of Gift Card Accounting (167 Companies)* Panel A: How Many Companies Provide Gift Card Disclosures? Information Availability No. Pct. (of 167) Companies analyzed 167 100% No mention of gift cards 44 26% Gift card sales immaterial 10 6% 113 68% Provided revenue recognition policy 99 59% Provided gift card liability separately 51 31% Provided gift card breakage policy 53 32% 8 5% Provided gift card information Provided amount of breakage separately Panel B: How Is the Gift Card Liability Classified on the Balance Sheet? Out of 113 companies providing gift card information, 80 indicated the classification of the liability. Those 80 companies classified the liability as: Balance Sheet Account Separate gift card line item No. Pct. (of 80) 9 11% Accrued expense or other liability 52 65% Deferred revenue 17 21% Accounts payable 2 3% Panel C: How Is Gift Card Breakage Recognized in Income? Out of 53 companies that provided a gift card breakage policy, 39 stated where breakage is recognized. Those 39 companies indicated the breakage as part of : Income Statement Account Net sales No. Pct. (of 39) 25 64% Other income 8 21% Reduction of cost of goods sold 2 5% Reduction of SG&A 1 3% Breakage not recognized in income 3 8% * Selection of companies for analysis included all 172 companies from the following industries listed on the Yahoo Finance Web site at the time of the analysis: Apparel Stores, Discount Variety Stores, Electronics Stores, Restaurants, Specialty Eateries, Sporting Goods Stores, Toy & Hobby Stores. Analysis includes the 167 companies with available 10-Ks. Source: 2006 SEC 10-K Filings. THE SEC VIEW The SEC has not taken a public position on gift card accounting (the SEC staff declined to be interviewed for this article), except to advise that the staff does not view immediate recognition of any amount of revenue at the point of sale as consistent with the staff’s view of GAAP. However, the mere making of such a statement likely indicates that gift card accounting issues are on the SEC’s “radar” and that the Division of Corporation Finance staff is already monitoring applicable issuers’ treatment of gift card sales when reviewing filings. Given the staff’s history on previous emerging issues, it appears likely that the staff will follow up its reviews with comments on this issue in an attempt to narrow the range of practices retailers are now following and to provide some degree of consistency to the reporting. If so, retailers may risk filing amended 10-Ks, delaying registrations of new securities and even restating financial results. Regardless, past SEC behavior suggests that the staff will at least encourage retailers to be more open about their treatment of gift card transactions.