Appendix I: Mock-up of Help Page for Withholding Allowance

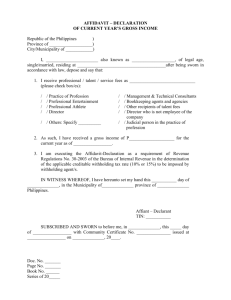

advertisement