August 25, 2008

LARGE STOCK FOCUS

Bond Market Flashes

Caution Signals for Stocks

By E.S. BROWNING

August 25, 2008; Page C1

Stock investors trying to see the market's future have begun monitoring indicators

from the bond market -- and they don't like what they are seeing.

Until the current bear market, stock investors often paid little attention to credit

markets. But as troubled financial companies and bad mortgages have pulled the

stock market down over the past year, stock investors have begun looking for

signals from the

mortgage market, the

corporate bond market

and even the interbank

market. And lately, the

signals have been

flashing yellow and red.

John Kattar, a Boston

money manager, has

been dismayed by those

signals, so he is

shrinking his stock

exposure.

Mr. Kattar is one of

many investors who

have concluded that

stocks can't stabilize until the lending markets improve, and if anything, lending

market indicators have recently been worsening. That helps explain why this

summer's stock rally has proved so puny. Although the Dow Jones Industrial

Average rose 197.85 points on Friday to 11628.06, it is up just 6% from its July 15

closing low and still is 18% off last October's record high.

Mr. Kattar, chief investment officer at Eastern Investment Advisors, hoped creditmarket conditions would be improving by now, permitting him to jump back into

stocks. Instead, he has pulled back from both stocks and bonds, increasing his

typical client's cash position to roughly 10% -- an exceptionally high level for him.

"We have lightened up during the recent stock rally," Mr. Kattar said. "We believe

that we are in a bear market that will end some time in the second half of the year.

Our target is for stocks to fall about 8% below where they are now" -- which would

take major indexes to new lows since the bear market began last October.

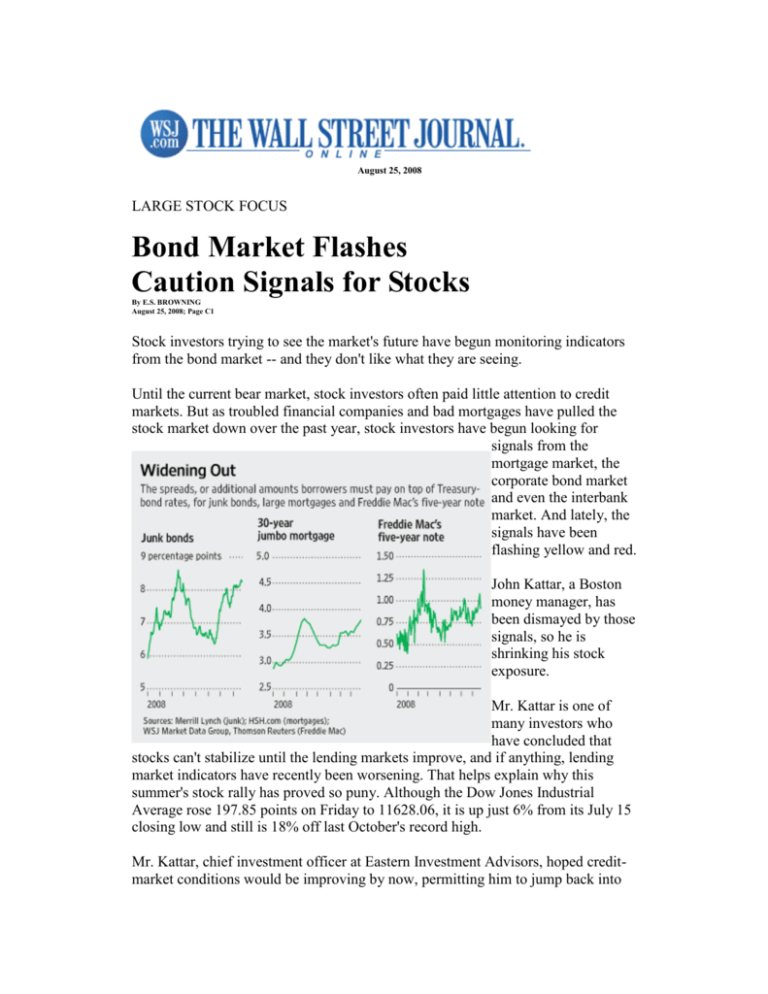

Mr. Kattar and other stock-portfolio managers are focused on spreads. These are

classic bond indicators that measure the difference between the yields of low-risk

U.S. Treasurys and those of other debt instruments. In particular, the managers

home in on spreads for junk bonds, interbank loans, mortgage-backed securities and

the bonds of government-sponsored mortgage companies Fannie Mae and Freddie

Mac.

Broadly speaking, spreads lately have been at their widest since Bear Stearns was

rescued in March, and in some cases at their widest in a decade.

Investors worry about widening spreads for two reasons. First, they reflect a lack of

trust in the financial system -- a fear about borrowers' ability to repay. Spreads

involving interbank loans suggest that banks sometimes even are nervous about

lending to one another.

Second, higher spreads typically mean higher borrowing costs for businesses and

consumers, potentially damaging earnings. That makes economic recovery harder.

A recently released Federal Reserve survey of big banks reported that banks have

"tightened their lending standards and terms on all major loan categories over the

previous three months."

"We view higher spreads as a sign of stress in the financial markets, and we are

worried about that," Mr. Kattar said. He and others worry that more banks,

mortgage investors and brokerage firms might need government support in order to

survive.

On top of that, applications from people seeking new mortgages have continued to

fall, suggesting that the consumers are still pulling back.

Fannie and Freddie bonds are a special case because of uncertainty about a possible

government rescue. It is possible that, if that crisis is resolved, lending markets will

settle down and stocks will bottom out. Some investors have bought stocks in that

hope, or in the hope that falling oil prices will help keep the economy out of

recession. But those tracking spreads in bond markets have their doubts.

Back in spring, Jason Trennert, founder of New York research firm Strategas,

devised a checklist of things that had to improve for the stock market to recover.

The list included items such as oil prices, the dollar, gold prices and lending

markets.

"A lot of those things have happened," including cheaper oil and a stronger dollar,

Mr. Trennert said. But credit conditions have stayed so bad that Mr. Trennert has

remained skeptical of the market's prospects.

Mr. Trennert pointed in particular to the spread between rates for jumbo mortgages

-- mortgages too big to be guaranteed by a government-sponsored company -- and

Treasury bonds. If the housing market and lending markets were settling down, Mr.

Trennert said, jumbo-mortgage spreads would be coming down. This is a profitable

business that banks normally seek out, because borrowers tend to be high-quality

and, because the loans aren't guaranteed, rates can be relatively high.

But jumbo spreads have been widening in recent weeks, at or near their highest

levels in a decade. "That suggests that banks are more focused on mending their

own fences than on expanding the business," Mr. Trennert said.

His conclusion: "The rally that we have seen since the July 15 low is not

sustainable." He is urging clients to look at stocks of conservative companies with

low debt and strong cash flow and that have been building market share. "Investors

should pursue a very, very defensive kind of approach, really keeping powder dry,"

Mr. Trennert said.

Michael Darda, chief economist at brokerage firm MKM Partners in Greenwich,

Conn., keeps charts tracking spreads for mortgages, investment-grade bonds, junk

bonds and interbank loans in London.

"The most action has been in mortgage spreads," because of the threat to Fannie

and Freddie, Mr. Darda said, but he is seeing wider spreads virtually across the

board since May. He is concerned because credit markets have reacted negatively

in the weeks since the Treasury Department and the Federal Reserve announced

their willingness to support Fannie and Freddie, if needed.

"The conclusion is that things are going to get worse before they get better," Mr.

Darda said. "There is a period of weakness ahead."

Write to E.S. Browning at jim.browning@wsj.com1

URL for this article:

http://online.wsj.com/article/SB121960885525067165.html

Hyperlinks in this Article:

(1) mailto:jim.browning@wsj.com

Copyright 2008 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this

material are governed by our Subscriber Agreement and by copyright law. For nonpersonal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-8430008 or visit www.djreprints.com.

RELATED ARTICLES FROM ACROSS THE WEB

Related Articles from WSJ.com

•

•

•

•

Stocks Rally on Oil, Fed Signals Aug. 06, 2008

Banks Act to Aid Mortgage Lending Jul. 29, 2008

Reasons Not to Invest In Russia Are Growing Jul. 28, 2008

Market Likes Alpharma’s Rejection of King’s Rich Offer

Aug. 22, 2008

Related Web News

• Fannie Mae, Freddie Mac shares plummet Aug. 20, 2008 news.aol.com

• Credit spreads foreshadow end of equity rally, Merrill says Aug. 19, 2008

• Bond market jitters return Aug. 18, 2008 money.cnn.com

• Securities Market Remains Jammed, a Year Later - NYTimes.com

More related content Powered by Sphere

marketwatch.com

Aug. 13, 2008

nytimes.com