fiscal federalism and regional inequality: the spanish case

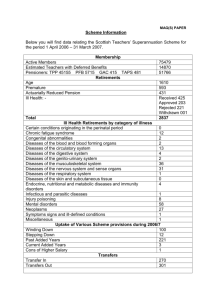

advertisement

FISCAL FEDERALISM AND REGIONAL INEQUALITY: THE SPANISH CASE (1986-2007) Montero-Granados, Roberto Jiménez-Aguilera, Juan de Dios Barrilao-González, Pedro E. Villar-Rubio, Elena University of Granada Abstract From the perspective of fiscal decentralisation, the decentralization of public services must be accompanied by the decentralisation of taxation because, otherwise, the amounts offered by the sub-central units may be inefficient. So if there are regional inequity in tax revenue (i.e. in per capita terms) and the decentralization level is high, horizontal transfers may be needed. If we assume that horizontal transfers are very difficult then we have a limit for fiscal decentralization. Moreover, horizontal transfers have two faces: a equality face, very known, but a significant efficiency face too. As some regions can collect more taxes than would correspond to them in terms of their actual economic situation, then the difference between real revenue (what is actually collected in the territory) and potential revenue (the taxable transactions taking place in the territory) will place limits on the capacity of economic decentralisation in terms of efficiency. We draw up an index to measure the intensity of this taxation shift from the perspective of both direct and indirect taxes and illustrate the problem within the framework of the Spanish case. Keywords: decentralisation, interregional tax displacement, concentration indices, equity and efficiency in tax collection. JEL Codes: H72, H73. 1. Introduction The theory of decentralisation (Oates 1972, 1999) predicts that fiscal decentralisation processes can increase the efficiency of public management. However, it has been detected (Brandforf and Oates, 1971; Quigley and Smolnensky, 1993; Hines and Thaller, 1995; Rodden, 2002, etc.) that local governments tend to overspend when they are financed by transfers from the central unit of government and are not directly responsible for collecting taxes. This phenomenon, commonly known as the "flypaper effect", is intended to be corrected by the transfer of tax-collecting competences to the sub-central governments in order to cover necessary expenditures. Hence, processes to decentralise expenditure should be accompanied by parallel processes to decentralise tax revenue. However, in many times, i.e. when there is great economic disparity between regions, it is necessary transfers resources from one region to another (horizontal transfers) or from a central government level to a sub-central level (vertical transfers). Oates (2008) states that the literature justifies such transfers for two reasons: 1 a) The existence of spillover or external profits in public investment. These transfers are referred to as "pro-efficiency" transfers. b) The existence of poorer regions that require greater resources. These transfers are referred to as "pro-equity" transfers. According to Oates (2008), pro-equity transfers should be transparent, while Padovano (2007) and Rodden et al. (2003) state that they must be limited so as not to affect convergence. We detect yet another reason for making transfers that is also based on efficiency grounds. Some regions can collect more taxes than correspond to them by their economic activity, in example because some taxpayers established their tax residence (but not their activity) and pay their taxes in political capitals and wealthy regions, the revenue of these regions exceeds their economic capacity. Taxpayers can have different reasons for domiciling their firms in important economic or administrative centres such as increased promotion, more professional contacts and easier tax evasion, among others. Then, transfers also serve as to return each region its authentic tax resources. We believe that these transfers are also pro-efficiency transfers because their absence would lead to inefficient tax competition between regions and thus multiply the cost of tax compliance by firms. For example, if the firms are required to pay income or consumption tax in each region and not in the region where they have established their tax domicile). Moreover, in practice and whatever their motives, regions with higher levels of revenue have incentives and often have budgetary resources to prevent or limit horizontal transfers. This issue is evident in the case of Spain regarding the fiscal competition of the Basque country, the claims of contour regions and the vast literature on regional fiscal balances (Barberán, 2004, Castells et al., 2000, De la Fuente, 2001, Uriel, 2001, among others) The aim of this paper is to quantify economic inequalities between regions and their tax collection capacity with a view to arguing, ceteris paribus, that greater economic inequality between regions allow a lower level of fiscal decentralisation and vice versa because regions with higher tax revenues do not promote horizontal transfers. Data on the Spanish case is used as Spain is an example of an economy with marked regional differences that has embarked on a far-reaching fiscal decentralisation process in recent years. 2. Methodology We use a panel of data on the Spanish Autonomous Communities (AACC) that reflects the dynamic evolution of revenue collected from the three taxes with highest potential revenue: personal income tax (PIT), value added tax (VAT) and other consumption taxes; the so-called excise duties (ED). We analyse these three taxes because they are the most important taxes established under the Spanish regional financial agreement. We use relevant macroeconomic variables from the 1986-2007 period for PIT and VAT, and from the 2000-2005 period for ED. The beginning and end of the period are determined by the availability of both revenue and macroeconomic 2 data. Data on revenue were obtained from AEAT1 Annual Reports on Tax Revenue, while the macroeconomic data were obtained from the Spanish Regional Accounts (CRE) databases, specifically the databases of 1986 (CRE-86), 1995 (CRE-95) and 2000 (CRE-00) (available at www.ine.es). Due to their special fiscal regulations, we have excluded the Canary Islands, the Basque Country and Navarre. The independent variables (regional macroeconomic data) were selected according to strictly normative criteria derived from the legislation on each tax. Of the different alternative models, (state, logarithms, aggregates, per capita, etc.) the best fit was obtained with the elasticity ratio. The variables forming the panel are shown below. All the variables have been transformed into their corresponding natural logarithms: pit: Territorialised revenue (by AACC) for personal income tax (residents and nonresidents) vat: Territorialised revenue for value added tax ed: Territorialised revenue for excise duties wages: Wages and salaries income: Income from fixed and mobile property profits: Gross operating surplus and gross mixed income. Company profits and the profits of family businesses. ct: Territorialised revenue for the tax on capital transfers. This tax is levied on transfers of assets between individuals cons_terr: End consumption, including public consumption, in the territory dummy: A dichotomised variable for the PIT econometric model. This variable is used due to changes in heterogeneity between the macroeconomic data drawn from CRE-86 and CRE-2000, but has not been included in the econometric model as it is not stastically significant. For the purposes of this article, we refer to the effective revenue obtained in each region as ‘real revenue’ and the revenue that should be obtained according to the macroeconomic indicators of each region as ‘potential revenue’. Since one of the objectives of this study is to detect differences between potential revenue and real revenue, the former must be estimated. To do so, we use the predictions of a regression analysis that is performed according to the following linear2 models: pitit = βo + β1 wagesit + β2 incomeit + β3 profitsit + β4ctit + β5 dummyit + ui + eit [1] vatit = β’’o+ β’’1cons_territ + u’i + e’it [2] In the case of ED, it is not possible to use regression analysis due to the lack of degrees of freedom (five years). Hence, we estimate the potential revenue for each region as a ratio of the territorialised consumption of the assets which form the basis on which to assess this tax (tobacco, wine, beer, gasoline and fuel, etc.). 1 AEAT stands for Agencia Estatal de la Administración Tributaria. It is the Spanish tax authority and is in charge of collecting centralised state taxes. 2 The linear specification is correct even in the case of the PIT, which is a progressive tax. This is because the estimation is not individual, but aggregated by AACC. 3 To measure the differences between real and potential revenue, we adapted the granted methodology developed in the Health Economics field by Kakwani, Wagstaff and van Doorslaer (Kakwani et al. 1997; Wagstaff et al 1999 and van Doorsaler et al. 2000a and 2000b). An index of tax inequality (TI) was then estimated for each tax and for each year of the sample. One way to measure the degree of inequality in regional revenue is by means of the Lorenz curve which represents the cumulative percentage of real revenue as Lr. A greater gap between the Lr curve and the line of equiproportionality (diagonal) will indicate greater inequality and vice versa. The concentration index (CI) doubles this gap so it is constrained between 0 (minimum inequality) and 1 (maximum inequality). There are many ways of measuring this index. One of the simplest (Kakwani et al, 1997) is: 2 n 1 CI r fi ( r ,i r )(Ri ) r i 1 2 Where fi is the relative population of each region i, τe.i is the real revenue (r) per n capita; r fi r ,i is the weighted average of income per capita of all regions, i 1 Ri i 1 f i i 0 1 f i is the fractional relative order of each region i (0 ≤ Ri ≤ 1) (i.e. the 2 accumulated percentage of population that is over the median of each interval after the regions are sorted by revenue per capita) and R2 is the variance of Ri. In a similar manner, we obtained a concentration index of potential revenue (CIp) for each tax. CIr measures the area between Lr and the equidistribution line twice and is an indicator of inequality that indicates the degree of difference in the real revenues of different regions. CIp measures the area between Lp and the equidistribution line twice and is an indicator of the inequality in the distribution of regional revenue relative to the macroeconomic potential of each region. The difference between both indices (CIr-CIp), what we call the index of tax inequality (TI), can also be seen as a measure of the amount of compensatory transfers required to match the actual collection of each region to its potential revenue. 3. Results 3.1. Regression analysis The functional econometric model reflected in expression [1] underwent successive Breuch-Pagan and Hausman tests (Table 6). The results show that the ideal estimator is the most consistent (the fixed effects estimator). The cointegration test is also positive. The general results are shown in Table 1. The general fit of the model is very high, while the general determination coefficient exceeds 90% of the fit. The significance of the variables included in the model is also high except for ct. Since an elasticity ratio was constructed, the regression model shows that, in Spain, a 100% increase in wages and salaries increases PIT tax 4 revenue by 52.7%. On the other hand, a 100% increase in the profits of professionals and business owners leads to a 34.1% increase in revenue. TABLE 1. ESTIMATED PARAMETERS OF REVENUE FROM PIT Variable wages income ct profits dummy constant fit R2: Wald χ2 N: groups: estimation 0.527 0.386 0.045 0.341 -0.137 -3.625 intra: 94.36 % between: 91.60% overall: 91.90% 753.64 308 14 p-value 0.000 0.000 0.375 0.000 0.000 0.000 0.000 In light of the results of the Hausman test, we use the random effect estimator for the econometric model for the VAT potential revenue estimation. The cointegration tests are also positive. The general results are shown in Table 2 below. TABLE 2. ESTIMATED PARAMETERS OF REVENUE FROM VAT Variable cons_territ constant fit R2: Wald χ2 N: groups: estimation 0.976 -2.826 intra: 82.3 % between: 82.7% overall: 81.8% 1273.46 280 14 p-value 0.000 0.000 0.000 3.2. The tax inequality index This section presents the results obtained for the tax inequality index. While CIr should be the entire revenue inequality, CIp can be interpreted as the need by equity redistribution and IT can be interpreted as the need by efficiency redistribution. Table 3 shows the data estimated for the last year of the sample. These results are similar across the study period, and also for other taxes and methodological alternatives not considered in this study. The results indicate that revenue from PIT is the most stable and behaves homogeneously. Inequality varies from 12.85% in 2002 to 15.26% in 2000. VAT revenue, on the other hand, shows a greater disparity between the concentration index for real and potential revenue. The inequality index reaches a minimum in 2004 at 37.69% and a maximum in 2000 at 41.87%. The ED revenues show the greatest inequality. The concentration index of the real revenue shows more than 70% inequality in all cases, while the concentration index of potential collection, with a slight downward trend, is about 10%. 5 TABLE 3. TAX REVENUE INEQUALITY INDEX IN SPAIN (2000-2007) CIr PIT CIp PIT TIPIT 2000 38.05 22.79 15.26 2001 35.45 21.92 13.54 2002 34.34 21.49 12.85 2003 34.76 21.24 13.53 2004 36.37 21.44 14.93 2005 33.80 21.26 12.54 2006 33.89 21.47 12.42 2007 33.67 20.59 13.09 Meanpit 35.04 21.53 13.52 CIr VAT CIp VAT TIVAT 2000 49.28 7.41 41.87 2001 47.21 7.02 40.19 2002 46.33 6.81 39.52 2003 44.91 6.49 38.42 2004 44.06 6.37 37.69 2005 44.36 6.32 38.05 Meanvat 46.03 6.74 39.29 CIr ED CIp ED TIED 2000 70.84 11.53 59.31 2001 71.98 11.19 60.78 2002 76.90 11.18 65.72 2003 77.46 10.52 66.94 2004 76.01 9.69 66.32 2005 75.21 9.21 66.01 Meaned 74.73 10.55 64.18 In the case of PIT (00-07 mean), 35% of total tax revenue would be redistributed. Specifically 13.5% due to a tax shift by tax residence of taxpayers and 21.5% due to economic inequality. In the case of VAT and ED, the shift in tax revenue due to taxpayer residence is 39.2% and 64.18%, respectively. These results suggest that taxpayer fiscal residence may be a significative influence on regional revenue and the horizontal or vertical transfers required to correct such revenue must also be large. If fiscal decentralisation must be joined by tax decentralisation, assuming that the application of horizontal transfers are difficult, then the concentration index of real revenue places constraints on tax decentralisation. Moreover, if transfers do not match, at least, the amount of the tax inequality index (TI=CIr-CIp), fiscal decentralisation may adversely affect efficiency. 6 4. Conclusions The decentralisation of tax resources is a controversial matter. The most important practical problem involved in decentralising taxes is transfers. According to the literature, this is due to two reasons: to guarantee the efficiency of an investment that provides externalities or spillovers to other regions and to ensure equal access to essential public services by residents in the poorest regions. In this paper we have argued that there is another reason for making regional transfers consisting in returning to each region taxes that should have been collected according to their economic potential, but were not collected, among other reasons, because the taxpayers may set up their tax residence in a region and all or some economic activity in other. For various reasons, taxpayers tend to established their tax residence in the richest regions. As such, the above transfers are mixed and confused with transfers for equalization. These transfers must be applied prior and separately to transfers for equalization or the equity transfers will otherwise appear to be greater than they actually are. In Spain, the amount of these transfers is significant. There is evidence that in the case of income tax, 38.6% of transfers for equalization are taxes that should be levied in poorer regions. This percentage jumps to 85% in the case of VAT and ED. We also argue that since rich regions are reluctant to provide horizontal transfers, it is more difficult to efficiently decentralise public services in an economy in which regional inequality is greater. The tax revenue inequality index can be understood as a proxy of the inverse of an economy’s capacity for fiscal decentralisation. 5. References Barberán, R. (2004): “Las balanzas fiscales regionales: inventario de divergencias”. Papeles de Economía Española, 99, págs. 40-76 Brandfort, DF. Oates, WE., (1971) “The analysis of revenue sharing in a new approach to collective fiscal decisions”. Quarterly journal of economics. 85. 416439. Castells, A.; Barberán, R.; Bosch, N.; Espasa, M., Rodrigo, F. Y Ruiz-Huerta, J. (2000): “Las balanzas fiscales de las Comunidades Autónomas (1991-1996). Análisis de los flujos fiscales de las Comunidades Autónomas con la Administración Central”. Ariel. Barcelona. De La Fuente, A. (2001): «Un poco de aritmética territorial: Anatomía de una balanza fiscal para las regiones españolas». Estudios de Economía Española, 91. FEDEA. Madrid. Dickey, GEP. Fuller, WA. (1979): “Distribution of the estimators for autoregressive time series with a unit root”. Journal of the American Statistical Association. 74. 427-431. Elliot, G. Rothenberg, T. Stock, JH. (1996): “Efficient test for an autoregressive unit root”. Econometrica. 64. 813-836. Engle, RF. Granger, CWJ.(1987): “Co-integration and error-correction: Representation, estimation and testing”. Econometrica. 55. 251-276. 7 Hines, J.R. y Thaller, R.H. (1995): “The flypaper effect”, Journal of economics perspectives. vol 9. nº 4, págs. 217-226 Kakwani, N. Wagstaff, A., van Doorslaer, E., 1997. Socioeconomic inequalities in health: Measurement, computation an statistical inference. Journal of econometrics. 77. 87-103. Oates, WE., 1972. Fiscal Federalism. Harcourt Brace Jovanovich. Oates, WE., 1999. An Essay on Fiscal Federalism. Journal of economic literature, 37. 1120-1149. Oates. W.E. (2008): “On The Evolution of Fiscal Federalism: Theory and Institutions”. National Tax Journal, vol. LXI, 2. 313-334. Padovano, F. (2007) The Politics and Economics of Regional Transfers: Decentralization, Interregional Redistribution, and Income Convergence. Cheltenham, U.K.: Edward Elgar. Quigley, JM. Smolensky, E (1993). “Conflicts among levels of government in a Federal System: The flypaper Effect”. Public finance. (sup). 202-215. Rodden J. (2002): “The Dilemma of Fiscal Federalism: Grants and Fiscal Performance around the World”. American Journal of Political Science, Vol. 46, No. 3, pp. 670-687 Rodden, J., Gunnar, A. Eskeland, S. Litvack. J (2003): Fiscal Decentralization and the Challenge of Hard Budget Constraints. Cambridge, MA: MIT Press. Uriel, E. (2001): “Análisis de la incidencia regional de los ingresos y gastos de la Administración Pública Central”, en González-Páramo (ed.): Bases para un sistema estable de financiación autonómica, Madrid: Fundación BBVA, 109-378. van Doorslaer, E. Wagstaff, A. Bleichrodt, H. Calonge, S. Gertham, UG. Gerfin, M. Geurts, J. O’Donnell, O. Propper, C. Puffer, F. Rodríguez, M. Sundberg, G. Winkelhake, O. (2000a): “Income-related inequalities in health: some international comparisons”. Journal of Health Economics. 16. 93-112. van Doorslaer, E. Wagstaff, A. van der Burg, H.; Christiansen, T. de Graeve, D. Duvhesne, I. Gertham, U. Gerfin, M. Geurts, J. Gross, L. Hakkinen, U. John, J. Klavus, J. Leu, R. Nolan, B. O'Donnel, O. Propper, C. Puffer, F. Schellhorn, M. Sundberg, G. Winkelhake, O. (2000b): “Equity in the delivery of health care in Europe and the US”. Journal of Health Economics. 19. 553-583. Wagstaff, A. van Doorslaer, E. Burg, H. Calonge, S. Christiansen, T. Citoni, G. Gertham, UG. Gerfin, M. Gross, L. Häkinnen, U. Johnson, P. John, J. Klavus, J. Lachaud, C. Lauritsen, J. Leu, R. Nolan, B. Perán, E. Pereira, J. Propper, C. Puffer, F. Rochaix, L. Rodríguez, M. Schellhorn, M. Sundberg, G. Winkelhake, O. (1999): “Equity in the finance of health care: some further international comparisons”. Journal of Health Economics. 18. 263-290. 6. Appendices Appendix 1. Cointegration tests The cointegration of the variables was tested by Engle Granger methodology (Engle and Granger, 1987) in two steps: a) determine the order of integration of the variables, and b) determine the order of integration of residuals. In both cases the order of integration was estimated by the augmented Dickey-Fuller method (ADF) (Dickey and Fuller, 1979). Lags in ADF are estimated based on the DF-GLS test (Elliott et al., 1996), AIC and Perron. The cointegration test was conducted on the time series of the aggregate variables, not the panel data. The results of these tests should be interpreted with caution given the few degrees of freedom in a sample of 22 observations. 8 TABLE 4. PIT MODEL: AUGMENTED DICKEY-FULLER AND COINTEGRATION TESTS variable lags pit 0-1 wages 6-7 income 4-8 ct 0-1 profits 0-6 residuals 0-3 ADF -1.793 (0.384) -1.317 (0.621) -0.258 (0.931) -0.938 (0.775) -0.570 (0.877) -5.595 (0.000) diagnosis I(1) I(1) I(1) I(1) I(1) I(0) The first part of the ADF test shows that all the variables are non-stationary. The second part of the test, conducted on the estimated residuals, concludes that the variables are stationary and I(0). TABLE 5. VAT MODEL: AUGMENTED DICKEY-FULLER AND COINTEGRATION TESTS variable lags vat 0-1 cons_terr 0-1 residuals 1-6 ADF -1.806 (0.378) -0.931 (0.778) -3.421 (0.010) diagnosis I(1) I(1) I(0) In the case of the VAT model, the three tests on the variables indicate that the variables are first-order non-stationary. Regarding the residuals, the ADF test indicates that the variables are stationary and I (0) with 99% certainty. Appendix 2. Specification test TABLE 6 SPECIFICATION TESTS (LM) Breusch-Pagan (χ2) Hausman (χ2) PIT 1053.83 (0.0000) 74.67 (0.000) VAT 2376.17 (0.0000) 2.86 (0.240) Appendix 3. Collinearity test TABLE 7. PIT MODEL: COLLINEARITY TEST Variable wages profits income ct dummy Mean VIF VIF 1/VIF 100.34 0.010 55.46 0.018 16.85 0.059 14.55 0.069 2.25 0.444 37.89 9 Collinearity exists in a variable when the value VIF (variance inflation factor) exceeds 30. The PIT model results may be influenced by this problem and it can affects increasing the standard errors of estimated parameters. 10