AMH Update - staging.files.cms.plus.com

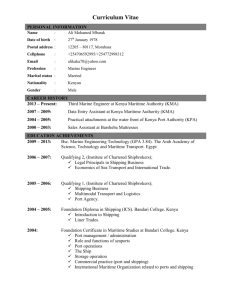

advertisement