Tax Frequently asked Questions

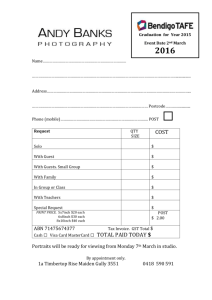

advertisement

Tax Queries Examples 1. Are purchases made from University Consulting funds exempt from FBT? Consulting funds are not exempt from FBT. Expenditure such as seminar attendance fees, airfares (where the private component is not greater than the business component), professional membership fees and amounts that would otherwise be an allowable deduction to the employee had the University not paid for or reimbursed the expense are exempt from FBT. Items purchased with consulting funds remain the property of the University, however this does not automatically exempt the items from fringe benefits tax. Fringe benefits tax is a ‘payment’ to an employee but in a different form to salary or wages. Benefits may also include rights, privileges or services. For example a fringe benefit may be provided when an employer: Reimburses an employee for the purchase of second laptop with the same FBT year Allows an employee to use a work car for private purposes Pays an employee’s child care costs whilst away on business Gives an employee a cheap loan Rents a university owned house to an employee at a discounted rate (a rate less than the current market rate as determined by a third party) Non cash benefits to employees in lieu of salary or wages 2. A member of the academic staff has requested reimbursement for a desktop computer for working from home. Will this incur FBT as it is not a laptop? The staff member wants the cost to be charged to his grant for the reimbursement plus the FBT to be no more than $1,500. The cost of the computer was $1,765 including GST. Can you please advise how much he can be reimbursed? A desktop computer provided by Flinders University and located at the employee's residence will be a residual fringe benefit unless it is an exempt benefit. Subsection 47(3) provides an exemption where an employee has personal use of an employer's property but only where it is ordinarily located on the employer's business premises and wholly or principally used directly in connection with business operations. Section 47(3) will not apply as the desktop is ordinarily located at the employee's residence, not on the employer's business premises. Fringe Benefits Tax will therefore be payable by the employee from their own after tax income (not consulting or grant funds) should a reimbursement be paid to them for the cost of the computer. 3. Does Flinders University pay any tax in Australia? Do you have a certificate issued by the Tax Office which shows that Flinders is a legal entity and pays tax in Australia? Flinders University is exempt from Income Tax in Australia under s 50-B of the Income Tax Assessment Act 1997(ITAA97). Flinders University however does pay Goods & Services Tax (GST) and Fringe Benefits Tax (FBT) in Australia. Flinders University has notification of Registration of an Australian Business Number (ABN) as issued by the Australian Taxation Office effective 1 July 2000. 4. Does Flinders University have to invoice GST Branch members for sales made between them? Flinders University of South Australia has its own GST Group and GST Branch. A group and branch account for GST differently. Flinders University GST Group members are; The Flinders Art Clinic Trust Flinders Consulting Pty Ltd National Institute of Labour Studies Foundation Inc 16 929 151 772 70 058 894 456 30 446 004 417 Flinders University GST Branch Members are Flinders University of South Australia Centre for Remote Health AHURI Southern Research Centre 65 542 596 200 65 542 596 200 003 65 542 596 200 004 A GST branch effectively operates as a distinct entity for reporting purposes and GST is payable on taxable sales between GST branches and the parent entity. This means that when a GST branch member makes a taxable sale it is required to issue a tax invoice that must show the registration number of the GST branch (which incorporates the Australian business number (ABN) of the parent entity). http://www.ato.gov.au/businesses/content.aspx?doc=/content/13190.htm 5. I am travelling interstate Thursday evening for a 1 day conference on Friday and my supervisor has approved for me to stay the weekend, flying back home Sunday evening. Will FBT apply/will I have to pay part of the air fare? Where the private days exceed business days, it is difficult to sustain the argument that the prime purpose is for business. Therefore, FBT will be incurred as the private days exceed the business days. (i.e. 1 business day and 2 private days). The assessment of private days does not change where the private days are on a weekend. (a) Flight cost $260 (including GST) (b) Private component = 66% (2 of 3 days) Private component: (a) x (b) = $260 x 66% As the University policy on Combining Business and Private Travel requires that staff pay the private component, rather than the University incurring FBT, the private component to be reimbursed by the employee = $171.60 (including GST) 6. One of our staff is travelling to Brisbane for a 3 day conference but returning to Adelaide via Melbourne and spending the weekend in Melbourne on their own time. Can you please advise if there are any FBT implications for this travel? FBT will only be incurred if the return flight from Brisbane via Melbourne to Adelaide costs more than the return flight from Brisbane to Adelaide direct. Any additional cost will have to be reimbursed by the employee to the University. 2 There are no other FBT implications of this travel as the predominant purpose of the trip is business (assuming a minimum of 4 hours has been performed on each work day) and the private component of the travel does not exceed the number of business days. 7. A postgraduate PhD student was funded for a research trip to France. She has asked if she needs to do a travel diary as the details are in the application and the student was away for 7 weeks. The student, supervisor and Executive Dean have signed to say the trip was completed according to its purpose. Will the student be required to complete a travel diary? The ATO (MT2038) requires employees to complete travel diaries where the employer pays or reimburses the employee’s expenses for travel outside Australia. As the student does not currently fall under the definition of an employee there is no such requirement. This is also supported with the University policy on Combining Business and Private Travel. 8. A staff member is going on OSP for Semester 2 on an approved study program for an extended period of time, will they be required to fill in a travel diary for every day of the 4 months they are away or is there another acceptable means of meeting requirements which is less onerous on the traveller? The travel has been booked and paid for by the University through Phil Hoffman. For longer trips like sabbaticals the ATO unfortunately states that entries would still need to be maintained on a regular basis throughout the trip, however some flexibility is granted but it is generally expected that entries be made on at least a weekly basis. The overall objective is to provide a record of events giving sufficient basis on which to determine the extent to which the trip was undertaken for a deductible purpose (i.e. work/business purpose) and to calculate any fringe benefits tax. If the employee’s daily activities can be obtained from another source (e.g. conference confirmation advice) then a travel diary entry for that event would not need to list start and end times and activities as these are listed in the confirmation. ATO miscellaneous tax ruling MT2038, paragraphs 11 to 13 go into more detail regarding longer trips like sabbaticals. 9. We have an employee who sometimes needs to travel on business with their children accompanying them as they are a sole parent. I would like to draw your attention to the following clause in the travel policy and ask if we can use this clause to have a supervisor approve in advance to use the employees consulting fund to pay for their children to travel or that the FBT be paid for from the fund also? 9.5.2 Dependent care expenses arising from University travel While staff members are responsible for making their own dependent care arrangements, the University may provide financial assistance where additional dependent care costs are directly incurred as a result of the staff member travelling on University business. Requests for the reimbursement of such costs must be made to the Authorised Person in writing, in advance of travel. Proof of the expenditure must be submitted to be reimbursed. Private travel provided to associates of an employee is subject to FBT. Accommodation, airfares and other expenses paid by the University on behalf of the partner and/or child for all of the trip would also be subject to FBT as these costs are not work related. Unfortunately the ATO does not allow FBT to be paid for from consulting funds. The ATO states that any FBT payable by an employee is must be made from the employees own after tax income. http://www.ato.gov.au/taxprofessionals/content.aspx?menuid=43140&doc=/content/00218241.htm&pag e=21&H21 10. How much detail is required to be included in the travel diary? I have listed on 3 lines the 3 countries I visited and what I did there. If I am attending a conference over three days do you 3 expect me to say three times that I was in lectures listening to speakers instead of saying it once? If so, this is bureaucracy gone mad! Miscellaneous Tax Ruling MT2038 outlines the requirements of Fringe Benefits Tax on Travel Diaries. Section 5, income tax law requires an employee to record in a diary each business activity, the elements required are: the place where the activity was undertaken the date and approximate time when the activity commenced the duration of the activity; and the nature of the activity It is a requirement of the University to ensure compliance with the law as outlined by the ATO. It’s not a policy that Flinders University made up. For further information please refer to the link below; http://law.ato.gov.au/atolaw/view.htm?locid='MTR/MT2038/NAT/ATO An example of a completed travel diary form can be found on the Flinders University intranet. 11. Can you please tell me the University Charity Tax Concession number? Flinders University was endorsed for Charity Tax Concessions on the 8 July 2005. There is no specific Charity number. The ABN is used as the equivalent number and for Flinders University this is 65 542 596 200. Flinders University is also registered for the following; Goods and Services Tax (GST) from 1 July 2000 Income Tax Exempt Concession (ITEC) from 1 July 2000 Deductible Gift Recipient (DGR) from 1 July 2000 Goods and Services Tax Concessions from 1 July 2005 12. Are there new rates from the ATO for reasonable per diem allowances for 2012-2013? The rates for 2012/2013 have been updated by the ATO on the 27th June 2012 and are available on the Flinders University intranet under the following link; http://www.flinders.edu.au/finance/tax-information/tax-information_home.cfm Please note that the exempt portion of a daily allowance has risen from $113.10 to $116.25 13. What needs to be included in an invoice for it to be classed as a valid tax invoice by the ATO? A valid tax invoice is a document that meets the following criteria; It is issued by the supplier, unless it is an RCTI (in which case it is issued by the recipient) It contains enough information to enable the following to be clearly identified; o The suppliers identity and ABN o A brief description of what is sold, including the quantity (if applicable) and the price of what is sold o The extent to which each sale is a taxable sale – this can be shown separately or if the GST to be paid is exactly one-eleventh of the total price, as a statement such as ‘total price includes GST’ o The date the document is issued o The amount of GST (if any) payable for each sale 4 o o If the document was issued by the recipient and GST is payable for any sale – that the GST is payable by the supplier That the document was intended to be a tax invoice or an RCTI if it was issued by the recipient In addition, if the total price of the sale is at least $1,000 or if the document was issued by the recipient, the recipient's identity or ABN must be able to be clearly identified. If a document issued by a supplier does not contain all of the required information, you may treat that document as a Valid Tax Invoice if the missing information can be clearly identified from other documents provided by the supplier. Without a valid tax invoice, the University is unable to claim back the GST paid. 14. How do I tell if a person working for the University is an employee or an independent contractor? A person who is an employee of the University will usually report to a supervisor who will be responsible for that person’s work direction. Work undertaken by an employee needs to be carried out in a particular way in accordance with the University policies, practices and procedures. Ordinarily, the University would control how the work is performed throughout an employee’s engagement. An independent contractor is usually a person who has established their own business and puts themselves out into the marketplace in a commercial capacity undertaking work for a variety of different clients. An independent contractor will enter into a contract for services with the University and is usually paid to achieve agreed results within an agreed timeframe. An independent contractor generally controls how and when the work is performed. Please also see the University policy on Engagement of Individuals as Independent Contractors and the ATO decision tool to assist in determining is a person is an employee or independent contractor 15. Is a contractor required to provide an invoice to be paid under the contract and does the University pay GST on these payments? Yes,all payments made to a contractor must be supported by an invoice / tax invoice (where contractor is registered for GST). Invoices must not be prepared by University departments on behalf of contractors in any circumstances. Where a contractor is registered for GST, generally any supplies made by the contractor will be subject to GST. It is not up to the University to decide whether the contractor should / should not charge GST. Where a contractor does charge GST, then a valid tax invoice must be submitted to the University by the contractor before payment will be approved. 16. I have a question about an impending parcel. I have ordered AUD $3271.19 worth of equipment from the US and its being posted here. My understanding is that the package will need GST+duty from customs? I looked it up on the customs website and went through the process there, and after the 'first notice' from Aust Post, I need to lodge the import declaration B374 form and get my package. Just had a coffee with another employee and they said the University is exempt from the GST? According the website if the ABN holder is registered for GST deferral then the B374 can't be used. So hypothetically what do I need to do next? (My package hasn't been dispatched but I like to know what to do early) The University is not exempt from GST; however it is entitled to GST concessions that mainly relate to gifts, donations, fundraising etc. Flinders University is exempt only from Income Tax. The package from the US will have customs duty + GST added to it. The University is not registered for GST deferral as the quantity and value of good imported is not high enough to warrant registering for the GST deferral scheme. 5