The Association for the Study of Peak Oil and Gas

advertisement

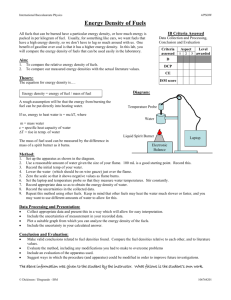

1 NEWSLETTER No 51 –MARCH 2005 ASPO is a network of scientists, affiliated with European institutions and universities, having an interest in determining the date and impact of the peak and decline of the world’s production of oil and gas, due to resource constraints. The following countries are represented: Austria, Denmark, Finland, France, Germany, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom. Missions: 1. To evaluate the world’s endowment and definition of oil and gas; 2. To study depletion, taking due account of economics, demand, technology and politics; 3. To raise awareness of the serious consequences for Mankind. Newsletters: This and past newsletters issues can be seen on the following websites: http://www.asponews.org http://www.energiekrise.de (Press the ASPONews icon at the top of the page) http://www.peakoil.net A Spanish Language edition is available on www.crisisenergetica.org CONTENTS 489. Oil debate revving up 502. Profit and Profiteering 493. Doubts about Nuclear Energy 503. Climate Change 494. Country Assessment – Malaysia 504. The US Department of Energy 495. Bishop Wolfstan saw it coming in addresses Peak Oil 1014 505. Decline in the Deepwater Gulf of 496. ASPO International Workshop in Mexico Lisbon 506. Indonesia contemplates leaving 497. Depletion Conference in Scotland OPEC 498. Doubts about Nuclear Energy 507. Heresy is alive and well 508. Recognition of Peak 500. Venezuela’s new ties Russia and 509. New Book and Film address China Depletion 501. The IEA deserves Praise on its 510. Exporting birthright Limitless Planet Calendar of Forthcoming Conferences and Meetings Abu Dhabi Algeria Angola Argentina Australia Azerbaijan Brasil 42 41 36 33 28 44 26 Canada China Colombia Denmark Ecuador Egypt Gabon 48 40 19 47 29 30 50 Indonesia Iran Iraq Italy Kazakhstan Kuwait Libya 18 32 24 43 49 38 34 Malaysia Mexico Nigeria Norway Oman Peru Russia 51 35 27 25 39 45 31 S. Arabia Syria Trinidad Turkey UK USA Venezuela Index of Country Assessments with Newsletter Reference 21 17 37 46 20 23 22 2 The General Depletion Picture OIL AND GAS LIQUIDS 2004 Scenario 35 25 20 M.East 15 Other 10 Russia 5 Europe US-48 0 1930 1940 1950 1960 US-48 Europe 1970 Russia 1980 1990 Other M.East 2000 Heavy etc. 2010 2020 Deepwater 2030 Polar THE GROWING GAP Regular Oil 2040 2050 NGL ESTIMATED PRODUCTION TO 2100 Amount Gb Annual Rate - Regular Oil Regular Oil Mb/d 2005 2010 2020 2050 Past Future Total US-48 3.4 2.7 1.7 0.4 Known Fields New Europe 5.2 3.6 1.8 0.3 945 760 145 1850 Russia 9.1 8 5.4 1.5 905 ME Gulf 20 20 20 12 All Liquids Other 28 25 17 8 1040 1360 2400 World 66 59 46 22 2004 Base Scenario Annual Rate - Other M.East producing at capacity Heavy etc. 2.4 4 5 4 (anomalous reporting corrected) Deepwater 4.8 7 6 0 Regular Oil excludes oil from Polar 0.9 1 2 0 coal, shale, bitumen, heavy, Gas Liquid 8.0 9 10 8 deepwater, polar & gasfield NGL Rounding 0 2 Revised 26/01/2005 ALL 82 80 70 35 End 2004 Gb Peak Total Date 200 1972 75 2000 220 1987 680 1974 675 2004 1850 2006 160 70 52 275 -7 2400 2021 2014 2030 2027 2007 Oil Price 60 50 45 Past Discovery 40 Future Discovery 40 Production 30 Past discovery based on ExxonMobil (2002). Revisions backdated 20 Brent Crude $/b 50 Gb/a Billion Barrels a year (Gb/a) 30 35 30 25 20 15 10 10 5 0 1930 1950 1970 1990 2010 2030 2050 0 1996 1998 2000 2002 2004 3 489. Oil debate revving up The following article from The Australian, speaks of a new awareness of the Oil Depletion issue Neil McDonald 03 February 2005 FORGET the hip-pocket pain caused by rising petrol prices. Depending on whom you speak to, there's something more sinister happening to our global oil supplies - we're running on empty.The word is we're fast depleting crude oil supplies and we're ill-prepared for the fallout on global economies, Australia's included. The worst-case scenario is that depleted oil reserves will cause petrol prices to skyrocket, forcing a rethink on our transport systems, and affect manufacturing and the sustainability of our existing indulgent lifestyles. Throw into the mix the political tensions of the main oil producers in the Middle East, Venezuela, Nigeria and the former Soviet Union and the scenario does not look promising. So what are our options? Car makers are rushing ahead with research into alternative fuels while countries like Iceland hope to be selfsufficient in energy in another 40 years by using hydrogen fuel cells. Wider issues of pollution and traffic congestion in the world's big cities are also forcing drastic action. Governments are rethinking vehicular access to cities and some are even proposing "green" taxes on fuel-guzzling four-wheel drives. Congestion in London and Singapore has forced the introduction of a levy to drive through their CBDs, and Britain also enforces a pollution tax on the size of your company car. Last year, the Paris city council passed an "anti-sports utility vehicle" resolution that could mean a ban on SUVs in 18 months. It's all part of a broader plan to reduce traffic and improve traffic flow. The argument over our global oil supplies falls into two camps, optimists and pessimists, according to the 24member scientists of the European-based Association for the Study of Peak Oil (ASPO). The association clearly falls into the latter camp. It suggests the world's global oil production will peak as soon as 2010 and demand will outstrip production - a scenario known as "peak oil". Apart from academic and scientific circles, "peak oil" enjoys little currency locally and it runs wide of any government radar. Only the West Australian Government and the state's Sustainable Transport Coalition (STC) have acknowledged it. It's also rated a mere mention in the South Australian government Hansard. The STC's Perth-based Bruce Robinson claims there's an "intelligence failure of information" on the part of governments to clearly define any debate. The public is bombarded with incongruous information from governments and the oil industry, he says. Robinson also attacks the "perverse subsidies" that see a fuel-guzzling Toyota LandCruiser four-wheel drive enjoy an import tariff of just 5 per cent when a fuel-efficient Toyota Prius hybrid/electric hatch is 10 per cent. He welcomes more discussion on the country's fuel situation and raises a scary notion of $10-a-litre petrol prices. "What would $10 a litre (petrol prices) do to the outer suburbs of Melbourne and Sydney?" he says. "It would take out the major new suburbs on our fringes and impact severely on that mortgage belt." The Australian Petroleum Production and Exploration Association is another voice in the wilderness. It warns of declining local production and advocates a significant review of our energy policy and the development of a long-term alternative energy strategy. The ASPO's view, somewhat alarmingly, is that within a generation the oil price per barrel could be up to threetimes what it is today. In a contentious 2003 report, ASPO president Kjell Aleklett and a team of scientists suggest that oil and gas supplies will run out too fast for doomsday global warming scenarios to materialise. The British-based Oil Depletion Analysis Centre estimates the world's original endowment of sweet crude conventional oil to be somewhere between 2000 billion barrels and 2400 billion barrels. Humanity has consumed almost 50 per cent of that total, it says. With both the tiger economies of China and India now emerging as major consumers of oil, this usage is expected to accelerate. Conversely, oil producers and the Organisation of Oil Exporting Countries (OPEC) are confident supplies will keep on pumping for another 50 years, but they are reluctant to provide exact figures. In its 2003 "Sustainability Report", one of the world's biggest energy suppliers, BP, says we have about 40 years in reserves of crude oil and 60 years of gas at current rates of production - an estimate that rankles with STC's Robinson. "It's not possible for someone to say 'no worries we've got plenty of oil'," he says. "They're on risky ground." It's hard to dismiss the doomsayers based on conflicting estimates and the rise last year of crude oil to $US50 a barrel. Apart from petrol pump prices, the ultimate fallout will be on economies - Australia's included - with Treasurer Peter Costello, albeit belatedly, warning that Australia's inflation would rise if oil prices remained high in the longer term. Whatever field of thought, one thing is patently clear - the internal combustion engine will be joined by a variety of new power systems for cars. CSIRO scientist David Rand says technological developments will also deliver further economy gains in conventional petrol and diesel engines, but he admits that fuel cells, petrol/electric hybrids and hydrogen power are gaining ground. But problems still exist, with cost, delivery and infrastructure problems for these new technologies. The challenge for the lead-acid battery industry is to develop satisfactory battery-to-power new-generation vehicles, he says. Just about every car maker has worked, or is working, on alternative fuels for the family car. Local car maker Holden, in conjunction with parent General Motors, spiked its Hy-wire hydrogen research late last year. The car boasts a skateboard-like platform housing fuel cells, batteries and the car's control systems. There's no conventional engine and the car's occupants sit on the power-train and look through a panoramic windscreen that's almost from bumper to roof height. Other countries are also embracing the technology. The US, Germany, Canada, the Netherlands, Spain, Britain, Belgium, Singapore and Japan have developed or are developing hydrogen fuel stations. Iceland has gone one step further, declaring that it wants to become a hydrogen economy, using its vast reserves of 4 hydroelectric and geothermal energy to power the nation's 180,000 vehicles - a task that will take between 30 and 40 years. The US and Japan are developing "hydrogen highways" expected to be operational by 2010 where hydrogen-fuelled cars can refuel just like conventional cars. Japan - which relies solely on oil imports - wants the highway to run the entire length of the country. California dedicated its first hydrogen filling station a couple of months ago. Its plan is to have a network of 150 to 200 hydrogen refuelling stations within 10 years at a cost of $US90 million ($116 million). Why hydrogen? It's plentiful and non-toxic, the only emission from the exhaust pipe being water vapour. But apart from the vast infrastructure cost, detractors point to the huge technological hurdles to overcome before we see hydrogen as a mainstream fuel. Hydrogen is highly volatile, storage is also a problem and fuel-handling systems must be hardened and hermetically sealed, which is a big consideration in the family sedan. It also takes between five and 10 minutes to fill a tank as against an average four minutes for petrol. Despite questions over hydrogen, it has not stopped car makers like DaimlerChrysler, BMW, Honda, Toyota, Peugeot, Hyundai, Volvo, Audi, Nissan, Ford and General Motors from pushing ahead with the technology. Predictions are that we'll see mass-produced hydrogenpowered cars on our roads as early as 2010. Research is also continuing into petrol/electric hybrids, bio-diesel, ethanol and all-electric vehicles. The Japanese, not surprisingly, were first to market with petrol/electric hybrids. Honda's Civic hybrid and Toyota's Prius established a global beachhead but sell here in relatively small numbers to government fleets and buyers who fall into the "early adopter" category. There's also a belief in the car industry that petrol/electric hybrids are a stepping stone to hydrogen vehicles. The local divisions of Ford, Holden, Toyota and Mitsubishi all have access to well-funded global research into hybrids and hydrogen through their global parents. Ford and Holden are also known to be looking at the latest-generation diesels that could hit our roads sooner than alternative energy cars. Fancy a Holden Commodore or Ford Falcon travelling more than 1000km on one tank of diesel? Well, the technology exists - it's just a matter of the market, diesel quality and infrastructure making it happen, according to Ford vice-president of product development Trevor Worthington. A major stumbling block is cost. Because of their inherently higher levels of technology, diesels cost more to manufacturer than an equivalent petrol engine, adding as much as $3000 to a car's retail price. It does not help matters that diesel at the fuel pump is more expensive than petrol and emits harmful pollutants. Latest-generation direct-injection diesels use particulate filters to trap emissions. Importers such as BMW, MercedesBenz, Peugeot, Citroen, Audi and Volkswagen have secured small, but important, niches with their diesels - and interest is growing. Demand for VW's new Golf diesels is running at 40 per cent, way up from VW Australia's original forecast of less than 10 per cent. But if car buyers are worried by rising petrol prices and an empty global oil tank, they're not showing it. Ford Australia president Tom Gorman says that, so far, consumers "haven't voted with their feet in changing buyer preferences". Last year vehicle sales were at an all-time record of 955,229 vehicles, according to the Federal Chamber of Automotive Industries. There is as yet no evidence to suggest higher fuel prices are driving people into smaller cars, it says. Quite the contrary, in fact. Sales of luxury off-roaders have never been better. They were up 24 per cent last year over 2003 and mid-size off-roaders grew almost 58 per cent. (Reference furnished by Jim Meyer) 494. Country Assessment - Malaysia Malaysia covers an area of some 330 000 km2, and controls large sectors of the Gulf of Thailand and the South China Sea, separating the Malay Peninsula from Borneo. The Malay Peninsula has a mountainous core rising to 2000m, consisting largely of karst country, whereas the Borneo territories comprise heavily forested ranges, capped by Mt Kinabalu rising to over 4000m, and drained by the mighty Rajang and Baram rivers. Malaysia is a somewhat artificial construction being a federation of diverse former British colonies. Some indigenous tribes just survive, but most have now lost their identity through integration and extinction. The Malays themselves are of mixed origins, coming from various places throughout southeast Asia. They may also have some Arab blood from early traders. Most belong to the Muslim faith. Chinese immigrants comprise about onethird of the 25 million inhabitants, some having been there for generations. They control much of the business life. Politically, the territories were controlled by a series of Sultans until the opening of the Suez Canal in 1869 brought increasing western influences and trade. In MALAYSIA Population M Rates Mb/d Consumption 2004 per person b/a Production 2004 Forecast 2010 Forecast 2020 Discovery 5-yr average Gb Amounts Gb Past Production Reported Proved Reserves* Future Production - total From Known Fields From New Fields Past and Future Production Current Depletion Rate Depletion Midpoint Date Peak Discovery Date Peak Production Date *Oil & Gas Journal Regular Oil 25 0.52 7.6 0.855 0.58 0.29 0.31 5.9 3.0 4.6 4.0 0.6 10.5 6.4% 2002 1973 2004 5 D is c o v e r y G b ( s h a d e d ) P r o d u c t io n k b /d Borneo, an Englishman by the name of James Brooke, the so-called White Rajah, took control in 1841 of a territory, known as Sarawak, operating it as a family estate until the Second World War, while North Borneo was administered by the British North Borneo Company. Eventually, the various sultanates and territories in Borneo were absorbed into the British Empire. They were occupied by Japan during the Second World War, before becoming the Federation of Malay States in 1948, and attaining full independence in 1957. However, the trading city of Singapore seceded in 1965, and the small oil rich Sultanate of Brunei on the coast of Borneo has managed to retain its independence. The political life of the territories seems to have developed in a fairly orderly and stable fashion, although deep-seated ethnic divisions remain and may well erupt in the future as economic stress bites deeper. Early trade in Malaya was dominated by the export of rubber and tin. The timber industry now decimates the forests of Borneo, destroying the habitat of the Punan indigenous people who, with their blow guns and parangs (machetes), previously survived on wild sago and wild boar. Seepages of oil in Brunei and adjoining areas attracted the interest of the Shell Company in the early years of the 20th Century, to be rewarded first by the discovery of the modest Miri Fields in Sarawak, and later by the giant Seria Field of Brunei, found in 1928 with about 1.2 Gb. The oil is of Tertiary origin lying in gentle Miocene structures. Attention turned offshore during the 1960s and 1970s both in the Gulf of Thailand and off Borneo. A series of oil-bearing Tertiary troughs was found, yielding a large number of generally modest to small oil and gasfields, although the Seligi and Samarang fields, found in respectively 1971 and 1973, just attain giant status. A giant deepwater discovery (named Kikeh) off North Borneo was reported in 2003, lying in 1400m of water, but the deepwater potential otherwise seems rather limited. Some 20 wildcats had been drilled prior to 1930, mainly in Sarawak and Brunei. Exploration drilling then lapsed until after the Second World War, reaching peaks of about forty wells a year in 1970 and 1991, but has now declined to about half that number. It has resulted in the discovery of almost 10 Gb, of oil, of which almost 6 Gb have been produced. Exploration is now at a mature stage, as confirmed by the decline in drilling, and is not expected to yield more than about another 500 Mb. Production stands at 855 kb/d, which is believed to be the peak, being set to decline at about 6% a Malaysia year, which is typical of an offshore environment. If so, 1000 1.4 production will have declined to about 570 kb/d in 2010 and 300 kb/ in 2020. Consumption stands at 520 kb/d meaning that 1.2 800 the need for imports is set to rise markedly in the years ahead, 1 which will likely pose a serious economic constraint. 600 0.8 Gas production has risen to 1.7 Tcf/a from current reserves 0.6 400 of some 85 Tcf, being mainly used for indigenous electricity 0.4 generation, much in demand for air conditioning. Production 200 0.2 can be held at this level for 20-30 years, assuming no increase 0 0 in demand. 1930 1950 1970 1990 2010 2030 2050 495. Bishop Wolfstan saw it coming in 1014 The Bishop made the following pronouncement as long ago as 1014. Sounds as if he might have foreseen the curse of oil "Beloved men, recognise what the truth is: this world is in haste and it is drawing near the end there fore the longer it is, the worse it will get in the world. And it needs must thus become much worse as a result of the people´s sins (prior to the Advent of Antichrist) and then indeed it will be terrible and cruel throughout the world........... Understand properly also that for many years now (the Devil) has led this nation too far astray” (Reference furnished by Walter Ziegler) 496. ASPO International Workshop in Lisbon IV INTERNATIONAL WORKSHOP ON OIL AND GAS DEPLETION Lisbon, Portugal, the 19-20th May 2005 Updated Information ASPO's 2005 Annual Conference, the IV INTERNATIONAL WORKSHOP ON OIL AND GAS DEPLETION, will be held in Lisbon, Portugal, on the 19-20th May 2005, in the Caluste Gulbenkian Foundation, with the sponsorship of both Calouste Gulbenkian Foundation and PARTEX Oil and Gas, and the organizing support of Geophysics Centre of Évora, the University of Évora. With the contributions of over 25 international leading specialists on topics such as: Reality in Oil Exporting Countries: The Supply Limits 6 Impacts of Depletion in Oil Importing Countries: The Demand Pressure How-Much Regular Oil and Non-Conventional Oil: Utopia versus Reality The Case for Political Action: The Depletion Protocol The World Past Peak Oil Age Complete information on this event, including updated program and registration form are available at the URL: http://www.cge.uevora.pt/aspo2005/ . Email contact address is: aspo2005@uevora.pt . 497. Depletion Conference in Scotland Peak Oil UK - Entering the Age of Oil Depletion A conference to discuss the impending peak then decline in global oil production, and implications for the UK. VENUE: The Royal Museum of Scotland Chambers Street Edinburgh DATE: Monday 25 April 2005 9:00am - 5:00pm PROGRAMME 09:00 Registration 09:30 Why Britain Needs an Indigenous Energy Policy- Brian Wilson MP 10:15 The End of the First Half of the Age of Oil- Colin Campbell 11:30 Depletion – The Reality in Action- Chris Skrebowski 12:15 Can Market Efficiency Overcome Depletion? Or Why Economists Don’t Get It- Matthew Simmons 14:00 Transport – An Oil Crisis and More- David Spaven 14:45 Half Gone – the third and biggest global energy crisis- Jeremy Leggett 16:00 Roundtable Discussion Moderator: Mark Stephen, BBC Radio Broadcaster 498. Doubts about Nuclear Energy Opinions about the nuclear energy seem to be sharply divided and often rather passionate. The following thoughtful analysis by John Busby points to the net energy issue, stressing the large amounts of conventional fuels used indirectly in producing nuclear energy, as well as the finite nature of uranium reserves. Why Nuclear Power is not the answer to Global Warming By John Busby Although not every scientist agrees, emissions of carbon dioxide from the combustion of fossil fuels, mostly petroleum, natural gas and coal are considered to be a major factor in causing the onset of global warming. Unacceptable rises in temperature are leading to rising sea levels from the melting of polar ice and corresponding climate changes may affect plant and animal life in otherwise temperate zones. Technological advances reduce the growth in energy demand to around 1% below the rate of economic growth, but the world’s demand for energy is expected to continue to rise exponentially, particularly in respect to emerging economies such as China and India. What is desired is a number of renewable sources of energy, not limited by resource depletion (as is the case with fossil fuels) that are “clean” in that they emit little or no so-called “greenhouse gases”. Renewable sources include wind and sea current power, but nuclear power, which is purported to meet both criteria, must be excluded, as it does not fulfil either. Before considering alternative sources, it is necessary to understand the size of the problem by examining current global energy consumption. Energy units exhibit little uniformity, but the joule can be used as a universally acceptable basis for analysis. Big numbers have to be employed to express global energy parameters, i.e., the exajoule (joule x 1018) and the petajoule (joule x 1015), abbreviated as EJ and PJ respectively. The world’s energy consumption in 2003 was 409 EJ, of which fossil fuels provided 90% as primary energy. Of this 60 EJ was in the form of electrical energy, with only 10 EJ provided by nuclear generation. Transport constrained to fixed guide systems, such as rail and tramways can use electrical energy directly from current collectors, but mobile transport able to move on roads or rough terrain uses mostly liquid fuels derived from oil. As oil reserves deplete, liquid fuels will be synthesised increasingly from natural gas and then coal, until all fossil fuels able to be economically extracted are exhausted. To use electrical energy as an alternative to conventional liquid fuels for mobile transport requires the production of hydrogen from electrolysis and its subsequent cryogenic liquefaction for on-vehicle storage. This has an inherent energy penalty over the derivatives of primary fuels and of course, unless the electricity used to produce the hydrogen fuel is from a renewable and “clean” source, offers no panacea to global warming. Assuming mobile transport requires 40% of global energy and taking into account the energy loss in conversion, the requirement for global electrical generation rises to 700 EJ. The problem is that electrical energy of whatever means of generation is a poor substitute for the adaptable primary energy obtained from fossil fuels. A typical 1200 MW nuclear power plant produces 32 PJ per annum, so to provide for 700 EJ around 20,000 nuclear power stations would have to be built. To fuel this number of stations, around 4,600,000 tonnes/annum of uranium would be required. 7 Current world annual mine production totals only 36,000 tonnes of which Canada produces 10,000 tonnes and Australia around 8,000 tonnes. The balance of 30,000 tonnes required to meet the generators’ demand for 66,000 tonnes/annum comes from inventories, ex-weapons material, MOX and re-worked mine tailings. So primary production would have to be increased 140-fold to match present global energy needs exclusively from nuclear power. * However the emerging economies of China and India are setting the pace for growth and rising energy demand, so to meet their aspirations the initial requirement for the building of 20,000 nuclear power stations is likely to be insufficient. In reality there is little chance of fuelling the current modest building programme of new stations as secondary sources of uranium are expected to be exhausted by 2012, creating a shortfall in supply unable to be filled by additional mining, so the first desired characteristic of sustainability is unattainable. Then the claim for the carbon-free status of nuclear power proves to be false. Carbon dioxide is released in every component of the nuclear fuel cycle except the actual fission in the reactor. Fossil fuels are involved in the mining, milling and enrichment of the ore, in the fuel can preparation, in the construction of the station and in its decommissioning and demolition, in the handling of the spent waste and its re-processing and in digging the hole in the rock for its deposition. The lower the ore grade, the more energy is consumed in the fuel processing, so that the amount of the carbon dioxide released in the fuel cycle depends on the ore grade. Only Canada and Australia have ores of a sufficiently high grade to avoid excessive carbon releases and to provide an adequate energy gain. At ore grades below 0.01% for ‘soft’ ores and 0.02% for ‘hard’ ores more CO 2 than an equivalent gas-fired station is released and more energy is absorbed in the cycle that is gained in it. Ores of a grade approaching the “crossover” point such as those in India of 0.03%, if used, risk going into negative energy gain if there are a few “hiccups” in the cycle. ** The industry points to the presence of uranium in phosphates and seawater, but the concentrations are so low that the energy required to extract it would exceed many times the energy obtained from any nuclear power resulting. Maybe the world does not need to stop all carbon dioxide emissions, but even a doubling of nuclear generation capacity would only provide 20 EJ, i.e., 5% of world energy consumption. There is no possibility of an extension of nuclear capacity solving to any significant degree the problem of global warming. It is claimed that nuclear power meets the two characteristics of sustainability and zero or low carbon dioxide emissions and so might be able to substitute for fossil fuels once they are exhausted and in the meantime to avoid release of some greenhouse gases. The claims are baseless. In conclusion, perhaps the scale of global warming has been overstated by omitting to take into account fossil fuel depletion. A guide to the maximum amount of carbon dioxide released from the combustion of fossil fuels can be calculated, given that they are limited. The graph *** attached shows that if economic growth continues as currently, the reserves of oil, gas and then most of the coal will have emptied by the end of the century. From a knowledge of the carbon content of the three fuels, it is then possible to work out the total amount of carbon dioxide likely to be released. This comes out as 5 exagrams or 5,000 billion tonnes. An earth scientist should be able to work out the likely temperature rise that the release of this limited amount, mostly over the next 50 years, is likely to produce. Before hampering the world with useless measures unable to reduce the eventual amount of the release of carbon dioxide, it would be more appropriate to estimate the ultimate consequences of today’s immoderate exploitation and exhaustion of fossil fuels. * WNA Symposium 2004, Dzhakishev, http://www.world-nuclear.org/sym/2004/pdf/dzhakishev.pdf ** Storm van Leeuwen and Smith, http://www.oprit.rug.nl/deenen/ *** http://www.after-oil.co.uk/energy3.gif For a full analysis of the consequences of fossil fuel depletion see The Busby Report on http://www.afteroil.co.uk 499. The G7 Ministers begin to grasp Peak Oil Oil security was evidently high on the agenda when the G7 Finance Ministers and Central Bank Governors met in London, on 4-5th February 2005, as the following statement confirms. "We discussed medium-term energy issues and the risks of current oil prices. Market transparency and data integrity is key to the smooth operation of markets. We welcomed concrete actions in improving data provision to oil markets and encouraged further work, including on oil reserves data, by relevant international organisations. The Extractive Industries Transparency Initiative can increase fiscal transparency and help improve the use to which oil revenues are put. We call on international institutions to work with oil producing countries to ensure a climate conducive to investment. We recognised the importance of raising medium-term energy supply, of energy efficiency, and of the importance of technology and innovation in ensuring energy security." Professor Kjell Aleklett comments: Since the start of ASPO, we have clamed that the world needs better transparency of important oil data. If everyone had the same policy as Norway and U.K., it would be very easy to estimate the future of the 8 industry. We members of ASPO are doing the best we can and I'm sure that ASPO is among "relevant international organisations" mentioned in the Press Release. Another report amplifies the results of the meeting. It is evident the British Chancellor still has classic blind faith in market pressures and investment to resolve the issue. It is also revealing that the Sauds consider knowledge of their reserves as a source of power (which might be an oblique way of describing loss of power if their reserves are in reality less than widely supposed). The IEA, which has deliberately denied itself access to industry data, no doubt fearing the unpalatable conclusions that would arise from an internal study, now proposes more public disclosure to spare itself responsibility. G-7 Calls for Oil Producers to Give Data on Reserves, Output Feb. 5 (Bloomberg) -- The Group of Seven industrial nations called on oil-producing nations and companies to lift the secrecy surrounding output and reserves, aiming to keep a lid on prices and open new sources of supply. ``Transparency and data is key to the smooth operation of markets,'' G-7 finance ministers said in a statement after two days of talks ended today. The ministers said their aim was to ensure ``energy security'' and ``a climate conducive to investment'' in the industry. The measures are designed to give traders better information on supply, replacing the estimates now made by consultants who track oil tankers because producing nations such as Saudi Arabia withhold the data. Threats to supply in Iraq, Russia and Nigeria sent New York crude to a record $55.67 a barrel last year. ``We need more information about oil reserves,'' said U.K. Chancellor of the Exchequer Gordon Brown, whose nation hosted the talks. ``Transparency in the oil markets is now something that is necessary.'' Brown said he wants industry groups and international financial institutions to draw up worldwide standards for accounting for reserves. He also wants producing nations to publish exact figures on supply. The proposals would force companies such as BP Plc and the Royal Dutch/Shell Group, Europe's two biggest oil companies, to publish data about their reserves on an internationally agreed basis. More Art Than Science: For the oil industry, estimating reserves is more art than science. Companies hire consultants such as DeGolyer & MacNaughton and Ryder Scott Co. to assess how much oil is in the ground based on how much wells are currently producing and the results of seismic surveys that map underground rock formations. The plan would require the world's biggest oil-producing nations to provide more details on their national oil companies, budgets and government spending plans, an official with the U.K. Treasury said. ``Western nations are not dealing with oil-producers as partners, why should they have the advantage of knowing details of oil-producers reserves?'' said Ihsan Bu-Hulaiga, an economist and adviser to the government of Saudi Arabia. ``Data on reserves is information and information is power.'' Brown wants producing countries to reduce ``barriers to investment.'' State-run oil companies such as Aramco in Saudi Arabia and Petroleos de Venezuela SA in Venezuela dominate the industry in some countries. Shell Reserves The International Energy Agency will coordinate discussions between companies and standard-setting bodies with expertise in measuring reserves. Earlier this week, Shell reduced its estimate of 2003 reserves by 9.8 percent and said its holdings may not rise until next year. Because of the lost reserves, first disclosed in January 2004, Shell paid $151.5 million in U.S. and U.K. fines and dismissed three executives. The U.S. Justice Department is conducting a criminal probe. Last year, Brown pressed the Organization of Petroleum Exporting Countries to take action that would reduce oil prices, saying the cost of fuel is creating upward pressure on inflation. (Reference furnished by Jean Laherrère) 500. Venezuela’s new ties Russia and China Venezuela is clearly in a vulnerable position as a major Western Hemisphere producer of oil under increasing pressure to meet the growing needs of its traditional market. It may be looking for insurance against suffering the same fate as Iraq. WORLD WATCH http://www.energyintel.com/ President Hugo Chavez can count Russia among his new friends as he talks of steering Venezuela's oil future away from its high traditional dependency on the US. Despite having the world's biggest market on his doorstep, the leftist leader has complained of "subsidizing Bush," and recently signed 19 oil and gas cooperation deals with China. Russia's biggest oil company, Lukoil, said it hoped during a visit to Caracas this week to sign an upstream deal for acreage in the Orinoco Belt. Lukoil would probably also be interested in processing crude oil at Venezuela's Citgo refineries in the US to supply its chain of more than 2,000 filling stations on the US East Coast. Chavez's visit to Moscow at the end of last year has brought quick results, with Russian majors Gazprom, Surgutneftegas and Rosneft also having returned the visit to Caracas. Nelli Sharushkina in Moscow 501. Item 501 has been removed on request by International Energy Agency. 9 502. Profit and Profiteering The oil companies are making record profits from high oil prices, which reflect capacity limits rather than any particular performance on their part. Lord Browne, the Chief of Executive of BP, has received extensive press coverage, making it quite clear that his motive is to make the maximum profit that circumstances permit, admitting to a personal cut of five million pounds this year alone. He is interviewed in one article under the title Are We Really Running Out of Oil? (Daily Telegraph 12th February). An honest straightforward answer would have been: “Yes, we started doing that when we produced the first barrel, given that oil is a finite resource formed but rarely in time and place in the geological past”. But his telling reply was “You can measure reserves any way you want so long as you are consistent”. So, how did the major companies report reserves? They were subject to SEC rules that were designed to prevent fraudulent exaggeration but smiled on under-reporting as laudable commercial prudence. By under-reporting, the companies were thus able to revise their estimates up over time presenting a comforting image of “reserve replacement” although globally discovery has been falling below consumption since 1981. But Shell’s experience suggests that the days of under-reporting are coming to an end. The same Daily Telegraph article states that BP claims to have reserves of 57 Gb, of which 20 Gb qualify under SEC rules. This sounds implausible even accepting that it may include gas in terms of oil equivalent. The 57 Gb might perhaps refer to oil and gas in place, even though no serious petroleum engineer accepts that anywhere near 100% is recoverable. However, Lord Browne does face a conflict of interest. On the one hand, he has what he describes as “a noble cause” of making excessive profits, in this case by exploiting world capacity limits, but as a peer of the realm he has national responsibilities which might include presenting a fair and accurate statement of what the status of depletion actually is. He is definitely in a position to know, and therefore is forced to accept responsibility for any reticence. But the Chief Executives of principled oil companies do begin to explain the situation honestly, as the following statement by the Head of Chevron-Texaco confirms. His reference to “an inflection point” is another way of describing the peak and decline of supply: DJ - The world has entered a new era of more expensive oil and greater competition for resources, and the US will have to formulate a national energy policy to keep up, ChevronTexaco Corp CEO David J O'Reilly said Tuesday. "We're seeing the beginnings of a bidding war for Middle Eastern oil between East and West," he said. The strong growth in energy demand in China has been a main contributor to the past year's surge in oil prices. The Asian giant is not only drawing in greater volumes of imports from the Middle East and elsewhere, but is agrressively bidding for access to resources. Some analysts have argued rising demand in China and the US has forced a permanent upward shift in the price of oil. O'Reilly gave some support to those views, saying the era of cheap oil is over. The coincidence of rising demand and the decline in oil production by members of the OECD have produced and "inflection point," O'Reilly said. "The time when we could count on cheap oil and even cheaper natural gas is clearly ending" he said. 503. Climate Change A book entitled The Little Ice Age by Brian Fagan (ISBN 0-465-02272-3) explains how severe changes in climate between 1300 and 1850 had a profound effect on the history of Europe. It seems that a phenomenon, known as North Atlantic Oscillation (NAO), controlled the climate by altering the pressure differential between the Azores High and the Iceland Low. In the absence of long range transport, people depended on local conditions, meaning that a harvest failure spelt famine, disease and colossal suffering, in turn carrying political implications. A fall in transport, consequent upon declining oil supply in the years ahead, may again make people more subject to the vagaries of local weather conditions, whatever their cause. 10 504. The US Department of Energy addresses Peak Oil Hirsch, R.L: My colleagues and I are working the peaking problem from the public policy point of view. We just completed a study for the U.S. DOE on the mitigation of world oil peaking. In the thought that it might be of interest to you and your colleagues, I've attached a brief summary of the work in a form that might fit your newsletter format. The Mitigation of the Peaking of World Oil Production Summary of an Analysis, February 8, 2005 A recently completed study for the U.S. Department of Energy analyzed viable technologies to mitigate oil shortages associated with the upcoming peaking of world oil production. 1 Commercial or near-commercial options include improved vehicle fuel efficiency, enhanced conventional oil recovery, and the production of substitute fuels. While research and development on other options could be important, their commercial success is by no means assured, and none offer near-term solutions. Improved fuel efficiency in the world’s transportation sector will be a critical element in the long-term reduction of liquid fuel consumption, however, the scale of effort required will inherently take time and be very expensive. For example, the U.S. has a fleet of over 200 million automobiles, vans, pick-ups, and SUVs. Replacement of just half with higher efficiency models will require at least 15 years at a cost of over two trillion dollars for the U.S. alone. Similar conclusions generally apply worldwide. Commercial and near-commercial options for mitigating the decline of conventional oil production include: 1) Enhanced Oil Recovery (EOR), which can help moderate oil production declines from older conventional oil fields; 2) Heavy oil/oil sands, a large resource of lower grade oils, now produced primarily in Canada and Venezuela; 3) Coal liquefaction, an established technique for producing clean substitute fuels from the world’s abundant coal reserves; and 4) Clean substitute fuels produced from remote natural gas. For the foreseeable future, electricity-producing technologies, e.g., nuclear and solar energy, cannot substitute for liquid fuels in most transportation applications. Someday, electric cars may be practical, but decades will be required before they achieve significant market penetration and impact world oil consumption. And no one has yet defined viable options for powering heavy trucks or airplanes with electricity. To explore how these technologies might contribute, three alternative mitigation scenarios were analyzed: One where action is initiated when peaking occurs, a second where action is assumed to start 10 years before peaking, and a third where action is assumed to start 20 years before peaking. Estimates of the possible contributions of each mitigation option were developed, based on crash program implementation. Crash programs represent the fastest possible implementation – the best case. In practical terms, real-world action is certain to be slower. Analysis of the simultaneous implementation of all of the options showed that an impact of roughly 25 million barrels per day might be possible 15 years after initiation. Because conventional oil production decline will start at the time of peaking, crash program mitigation inherently cannot avert massive shortages unless it is initiated well in advance of peaking. Specifically, Waiting until world conventional oil production peaks before initiating crash program mitigation leaves the world with a significant liquid fuel deficit for two decades or longer. Initiating a crash program 10 years before world oil peaking would help considerably but would still result in a worldwide liquid fuels shortfall, starting roughly a decade after the time that oil would have otherwise peaked. Initiating crash program mitigation 20 years before peaking offers the possibility of avoiding a world liquid fuels shortfall for the forecast period. Without timely mitigation, world supply/demand balance will be achieved through massive demand destruction (shortages), accompanied by huge oil price increases, both of which would create a long period of significant economic hardship worldwide. Other important observations revealed by the analysis included the following: 1. The date of world oil peaking is not known with certainty, complicating the decision-making process. A fundamental problem in predicting oil peaking is uncertain and politically biased oil reserves claims from many oil producing countries. 2. As recently as 2001, authoritative forecasts of abundant future supplies of North American natural gas proved to be excessively optimistic as evidenced by the recent tripling of natural gas prices. Oil and natural gas geology is similar in many ways, suggesting that optimistic oil production forecasts deserve to be viewed with considerable skepticism. 3. In the developed nations, the economic problems associated with world oil peaking and the resultant oil shortages will be extremely serious. In the developing nations, economic problems will be much worse. 4. While greater end-use efficiency is essential in the long term, increased efficiency alone will be neither sufficient nor timely enough to solve the oil shortage problem in the short term. To preserve reasonable levels of 1 Hirsch, R.L., Bezdek, R.H, Wendling, R.M. Peaking of World Oil Production: Impacts, Mitigation and Risk Management. DOE NETL. February 2005. 11 economic prosperity and growth, production of large amounts of substitute liquid fuels will be required. While a number of substitute fuel production technologies are currently available for deployment, the massive construction effort required will be extremely expensive and very time-consuming, even on a crash program basis. 5. Government intervention will be essential, because the economic and social impacts of oil peaking will otherwise be chaotic, and crash program mitigation will need to be properly supported. How and when governments begin to seriously address these challenges is yet to be determined. Oil peaking discussions should focus primarily on prudent risk management, and secondarily on forecasting the timing of oil peaking, which will always be inexact. Mitigation initiated earlier than required might turn out to be premature, if peaking is slow in coming. If peaking is imminent, failure to act aggressively will be extremely damaging worldwide. World oil peaking represents a problem like none other. The political, economic, and social stakes are enormous. Prudent risk management demands urgent attention and early action. 505. Decline in the Deepwater Gulf of Mexico The January issue of Offshore contains a valuable table of deepwater discoveries in the US Gulf of Mexico, commenting that discoveries have declined from 21 in 2002 and 17 in 2003 to 12 in 2004, despite every effort and the impressive technological achievements, covered elsewhere in the journal. Predictably enough, production is falling too: from about 333 Mb in 2002 to 186 in 2004 for fields in >600 ft of water. 506. Indonesia contemplates leaving OPEC We have long suggested that Indonesia had no good reason to remain in OPEC as its production is in terminal decline, having passed depletion midpoint in 1992. Ecuador and Gabon left earlier when their declining resource base removed the justification for membership. Now, the Jakarta Post reports that the Government has set up a team to review its membership. Without swing production to manage, OPEC has nothing to do, and it would spare itself a lot of political odium by closing its doors. (Reference furnished by Patrick Klintbom, Volvo) 507. Heresy is alive and well A group of prestigious US foundations have sponsored a major flawed study, published on www.energycommission.org (URL://64.7.252.93/082F4682.pdf). It is apparently oblivious of depletion and natural resource limits, parading the outdated economic notions that production is just a matter of investment, technology and politics, echoing the absurd pronouncements of the IEA (see Item 501). (Reference furnished by Frank de Winter) Another work in a similar vein is The Twilight Of Fuel, The Virtue Of Waste, And Why We Will Never Run Out Of Energy; Basic Books, 2005 By Peter Huber and Mark P. Mills. The first author is a lawyer and journalist, while the latter is an electronics physicist, who has consulted for the White House Science Office. The sheer volume of talk about energy, energy prices, and energy policy on both sides of the political aisle suggests that we must know something about these subjects. But according to Peter Huber and Mark Mills, the things we "know" are mostly myths. They explain why demand will never go down, why most of what we think of as "energy waste" actually benefits us; why more efficient cars, engines, and bulbs will never lower demand, and why energy supply is infinite. In the automotive sector, gas prices matter less and less, and hybrid engines will most likely lead us to cars propelled by the coal-fired grid. As for the much-maligned power grid itself, it's the worst system we could have except for all the proposed alternatives. Expanding energy supplies mean higher productivity, more jobs, and a growing GDP. Across the board, energy isn't the problem, energy is the solution. (Reference furnished by Richard Duncan) 508. Recognition of Peak Bloomberg’s News of February 18th has assembled a number of oil company statements that directly and indirectly speak of peak. The most direct are the words of the famous corporate raider, Boone Pickens, who says “We’re damn close”. The CEO of Shell Canada says that producing tarsands costs double drilling in the North Sea, and interest in them stems only from the limits of conventional oil. Shell replaced only 15-25% of what it produced, while BP claimed 90%, putting its trust in Russian ventures. Reserve replacement is however a misleading financial term because it includes the proceeds of acquisitions, mergers, revisions as well as new discovery. Adding tar sands might be an easy way to “replace reserves”. The companies go out of their way to obscure the amounts they actually find in new field discoveries. Charles Maxwell (an investment adviser with Weedon & Co) comments that the major oil companies, (termed “the old elite”) remain dividend-paying investments, but sees their growth being “closed off by peak oil”, eventually finding “salvation” as royalty trusts, whereby the shareholders get to own the oil in the reservoir of existing fields directly. It is indeed hard to imagine a better investment than the direct ownership of the remaining conventional oil in existing fields, being spared the gross managerial excesses of oil companies bent self-remuneration 12 (see Item 502), false imagery and abortive exploration, admittedly being largely funded by unconscious tax payers as allowable expenses against taxable income. 509. New Book and Film address Depletion A new book has appeared in France, entitled La Vie après le Pétrole, by Jean-Luc Wingert (ISBN 207467-0605-9) covering, amongst other things, the proposed Depletion Protocol. Jean Laherrère writes the Foreword. Amund Prestegard, the Norwegian film-maker, is launching both Norwegian and International editions of a new film entitled “Peak Oil – are we ready for the Decline?”. It exposes the reality of the situation with many interviews, and explains why so many politicians, organisations and oil companies are in denial. A CD is also available: queries should be addressed to troposdoc@hotmail.com US Oil Suppliers Canada 584 Mb/a 510. Exporting birthright Mexico 584 The US Department of Energy reports the origin of the country’s 4.4 Gb of S.Arabia 548 annual imports. The two largest suppliers are its neighbours which have lost a degree of sovereignty under NAFTA, and are more or less forced to deliver. In Venezuela 475 fourth place is Venezuela, which now seeks new customers (see Item 500). Most Nigeria 402 of the others are major exporters, but what stands out as remarkable is the Iraq 256 presence of the United Kingdom which itself becomes a growing net importer Angola 110 from 2006 onwards. Since American companies own rights to many of the North UK 110 Sea fields, they are of course at liberty under the present regime to export to their Algeria 73 home country, but it is strange for a country to feed someone else while starving Kuwait 73 itself of this vital ingredient for its economic survival. When its voters start to have to walk to work they may deliver a message encouraging their government to abandon the mindset of the First Half of the Age of Oil, and recognise the old adage that charity begins at home. Calendar - Forthcoming Conferences and Meetings The subject of Peak Oil will be addressed at the following conferences and meetings, with presentations being made by ASPO members and associates [shown in parenthesis]: March 1st 2005 - Why the Industry should prepare for less oil, Perstorp AB, Ystad, Sweden [Aleklett] March 9th , 2005 - Oil reserves, Swedish Energy Agency, Eskilstuna, Sweden [Aleklett] March 17th 2005 - Oil and Natural Gas: Geopolitical considerations, The Committee on Foreign Affairs, The Swedish Parliament, Stockholm, Sweden [Aleklett] March 20th – When will oil and gas decline, Salon du Livre, Paris [Laherrère] March 22nd – Cork Environmental Forum, Cork, Ireland [Campbell] March 22-25th – Romania Oil & Gas Conference, Bucharest [Laherrère] March 30th – Energy Forecasts, University of Corsica, Bastia [Laherrère] April 7th - Conference, Swedish Royal Academy of Science, Stockholm [Aleklett] April 14-15th – Swiss Pension Fund Managers, Interlaken [Campbell] April 22nd – Sanders Research, London [Campbell] April 25th – Depletion Scotland, Edinburgh [Campbell, Skrebowski, Simmonds] May 18th - SYNBIOS - the Syngas Route to Automotive Biofuels in Stockholm, [Aleklett] May 19-20th – 4th ASPO International Workshop, Gulbenkian Foundation, Lisbon [various] May 31st Oil and Gas Operations summit 2005, 31 May – 2 June 2005, Dubai, UAE [Aleklett] June 18-19th - Permaculture Conference, Cork, Ireland [Campbell] June 22-25th – Fourth Forum for Debate, Salamanca, Spain [Aleklett] October 28-30th – Pio Manzu Energy Conference, Rimini, Italy [Campbell] [Information on future events for inclusion in the Calendar is welcomed] Acknowledgements The help of Rory O’Byrne and Arne Raabe in Canada in distributing the Newsletter electronically is gratefully acknowledged, as are the generous financial contributions towards operating costs, received 13 from many others. Articles and references from readers wishing to draw attention to items of interest, or the progress of their own research, are welcomed. Permission to reproduce the Newsletter, with acknowledgement, is expressly granted. Compiled by C.J.Campbell, Staball Hill, Ballydehob, Co. Cork, Ireland