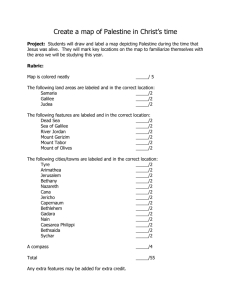

ACC 211 - Intermediate Accounting I

advertisement