ONTARIO SECURITIES COMMISSION RULE 61-501

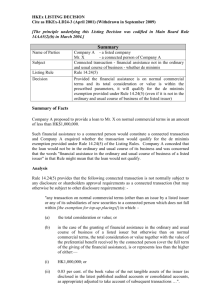

advertisement