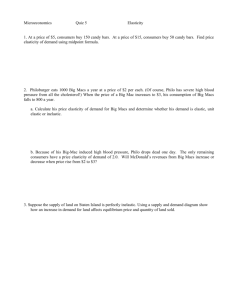

Elasticity Review

advertisement

AP Economics – Elasticity Review – 09/23/05 Note: This review guide should not be considered complete; it is a place to start with your review. You should also consult your text, notes, worksheets, quizzes and classmates. Elasticity; Define: • • • • • • • • • • • • • price elasticity of demand income elasticity of demand cross elasticity of demand elastic demand inelastic demand unitary elastic demand perfectly elastic demand perfectly inelastic demand total revenue total cost profit luxuries necessities • • • • • • • • • • • • normal goods inferior goods substitute goods complementary goods independent goods midpoint formula price elasticity of supply elastic supply inelastic supply perfectly elastic supply perfectly inelastic supply tax incidence Differentiate between: • • • • • elasticity and slope price elasticity of demand, income elasticity of demand, & cross elasticity of demand elastic demand, inelastic demand, & unitary elastic demand elastic supply, inelastic supply, & unitary elastic supply market period, short run, long run Know: • • • • the relationship between ∆Ed and TR 4 determinants of Ed: • availability of substitutes • degree of necessity • % of budget spent on the good • time period determinant of Es: • time period (market period, short run, long run) the role of elasticities in determining tax incidence Formulas: • price elasticity of demand: • price elasticity of supply: • income elasticity of demand: • total revenue: • cross elasticity of demand: • profit: 2 Directions: Each of the following questions or incomplete statements below is followed by five suggested answers or completions. Select the one that is best in each case. 1. A 20% increase in price generates an 8% increase in sales; hence, the price elasticity of demand is: A. 5.00 B. 1.25 C. 0.50 D. 0.40 E. 0.33 2. If a demand curve is perfectly elastic: I. the quantity demanded is the same regardless of the price. II. the demand curve is horizontal. III. the elasticity of demand is zero. A. B. C. D. E. 3. I only II only III only I and II only I, II, and III If a demand curve is perfectly inelastic, a decrease in supply will result in: A. a lower price and a greater quantity sold. B. a higher price and a lower quantity sold. C. a higher price and the same quantity sold. D. a lower price and the same quantity sold. E. no change in price and no change in quantity sold. Questions 4 and 5 are based on the following information. A local pizzeria lowers the price of a large pizza from $9 to $6 in order to increase revenue. Consequently, the owner sees sales increase from 100 pizzas a week to 200 pizzas a week. 4. Using the midpoint formula, the price elasticity of demand for large pizzas at this pizzeria is: A. 0.40 B. 0.67 C. 1.40 D. 1.67 E. 1.75 5. Based on the price elasticity of demand for pizzas, we can see that consumers at this A. are not price sensitive. B. are price sensitive. C. are indifferent to a change in price. D. switched consumption to substitute goods. E. have relatively inelastic demand for large pizzas. 6. The proprietor at Al's Fish and Beer Emporium knows the shape and elasticity of his firm's demand curve. If Al wants to increase his total revenue, he can do so if: A. present prices are in the elastic range of his demand curve and he lowers prices. B. present prices are in the inelastic range of his demand curve and he lowers prices. C. present prices are in the elastic range of his demand curve and he raises prices. D. competition is such that his demand curve is infinitely elastic and he raises prices. E. competition is such that his demand curve is perfectly inelastic and he lowers price. pizzeria: 3 7. The original equilibrium price for good B is $12. The government then passes a $5 per unit sold tax on good B that will be collected from the producers. The equilibrium price after the tax has taken effect is $14. It can be assumed that the demand curve for good B is: A. perfectly inelastic. B. relatively inelastic. C. unit elastic. D. perfectly elastic. E. relatively elastic. 8. In the market period, the supply curve is: A. perfectly elastic. B. upward sloping. C. perfectly inelastic. D. horizontal. E. relatively elastic. 9. A tax levied on producers will be paid entirely by producers: A. if demand is relatively price inelastic. B. if demand is perfectly price elastic. C. if demand is relatively price elastic. D. if supply falls. E. if no substitutes exist for the good. P S D Q 1. The demand and supply curves of cigarettes are depicted in the diagram above. (a) Use supply and demand analysis to describe the impact of a per-unit tax on each of the following. (i) (ii) (iii) (iv) (v) The price paid by consumers for cigarettes The quantity of cigarettes sold Consumer surplus Producer surplus Deadweight Loss (b) If the demand for cigarettes becomes more elastic, explain how each of the following will differ from part (a). (i) (ii) (iii) (iv) The price and quantity sold of cigarettes The government's tax revenues Consumer surplus Producer surplus 4 2. (v) Deadweight Loss Assume that the market supply and demand curves for wheat are price inelastic, but not perfectly price inelastic at the equilibrium price. For ALL parts of the question, assume that price remains in the relatively inelastic portions of the supply and demand curves. (a) As a result of favorable growing conditions, the number of bushels of wheat produced increases. Use a graph to explain the result of this change on each of the following. (i) Market price of wheat (ii) Industry output of wheat (iii) Revenue of wheat farmers (b) Use a new graph to show what happens in the wheat market if the cost of fertilizer used in the production of wheat increases, and if the government announces that the consumption of wheat products greatly reduces the risk of having a heart attack. Explain the impact these events will have on each of the following. (ii) (iii) (iv) (v) (vi) Market price of wheat Industry output of wheat Consumer surplus Producer surplus Deadweight Loss (c) assume now that the government establishes an effective price floor for wheat. Use a new graph to indicate where an effective price floor will be set. Explain the effects of such a program on each of the following. (i) (ii) Consumer surplus in the wheat market Allocative efficiency (societal efficiency and deadweight loss)