Chapter 05-Willowbrook Solution

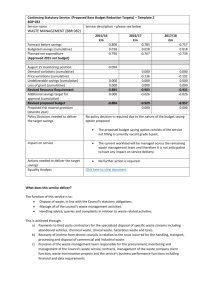

advertisement

Willowbrook School 1. Provide an overview of the proposed system, including costs and benefits, with an explanation of the various cost-and-benefit types and categories. Cost or Benefit Eliminate 30 hours of overtime each month at $8.50 per hour Eliminate need for additional 40 hours per month in next school year Eliminate monthly errors For in-house option: consultant’s time to develop system For in-house option: Networked commercial database software for inhouse development For package option: vertical software package from vendor For package option: consultant's time to install, configure, and test vendor package For package option: vendor tech support contract Clinic staff time to perform maintenance, file backups, and updating Consultant's time to provide initial training and support Hardware requirements Financial Impact Annual savings of 30 hours * $12 hourly rate * 12 months = $4,320 Description of Cost or Benefit Direct, operational, variable, positive benefit Avoidance of annual cost of 40 hours * $12 hourly rate * 12 months = $5,760 Potential annual savings of 10 hr/month = 10 * $12 hourly rate * 12 months = $1,440 $50 hourly rate * 25 hours * 8 weeks = $10,000 Direct, operational, variable, cost-avoidance benefit $2,000 Direct, developmental, fixed cost $2,500 in year 0, followed by 2 annual payments of $2,500, for a total of $7,500 $50 hourly rate * 40 hours * 3 weeks = $6,000 Direct, developmental, fixed cost Annual cost of $1000 after first year of operation Annual cost of 4 hours * $12 hourly rate * 52 weeks = $2.496 $50 hourly rate * 5 hours * 8 weeks = $2,000 $3,000 Direct, operational, fixed cost Direct, operational, variable, positive benefit Direct, developmental, fixed cost Direct, developmental, fixed cost Direct, operational, fixed cost Direct, developmental, fixed cost Direct, developmental, fixed cost 2. Develop an economic feasibility analysis, using payback analysis, ROI, and present value (assume a discount rate of 8 percent). COST BENEFIT SUMMARY DATA FOR PLAN A: In-House Development Costs: Consultant time to develop system Purchase necessary software platform Hardware Consultant training time Office staff maintenance, backup, and update Total Costs: Benefits: Eliminate overtime Eliminate additional position Eliminate daily errors Total Benefits: Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 10,000 2,000 3,000 2,000 17,000 2,496 2,496 2,496 2,496 2,496 2,496 2,496 2,496 2,496 2,496 - 4,320 5,760 1,440 11,520 4,320 5,760 1,440 11,520 4,320 5,760 1,440 11,520 4,320 5,760 1,440 11,520 4,320 5,760 1,440 11,520 DATA FOR PLAN B: Purchase Vertical Software Package Costs: Purchase price for vendor package Tech support contract Consultant time to install, configure, and test Hardware Consultant training time Office staff maintenance, backup, and update Total Costs: Benefits: Eliminate overtime Eliminate additional position Eliminate daily errors Total Benefits: Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 2,500 2,500 500 2,500 500 500 500 500 6,000 3,000 2,000 13,500 2,496 5,496 2,496 5,496 2,496 2,996 2,496 2,996 2,496 2,996 - 4,320 5,760 1,440 11,520 4,320 5,760 1,440 11,520 4,320 5,760 1,440 11,520 4,320 5,760 1,440 11,520 4,320 5,760 1,440 11,520 PAYBACK ANALYSIS PLAN A: In-House Development Costs 17,000 2,496 2,496 2,496 2,496 2,496 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Cumulative Costs 17,000 19,496 21,992 24,488 26,984 29,480 Benefits 11,520 11,520 11,520 11,520 11,520 Cumulative Benefits 11,520 23,040 34,560 46,080 57,600 70,000 60,000 Payback: about 11 months into year 2 50,000 40,000 30,000 20,000 10,000 Year 0 Year 1 Year 2 Year 3 Cumulative Costs Year 4 Year 5 Cumulative Benefits PLAN B: Purchase Vertical Software Package Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Costs 13,500 5,496 5,496 2,996 2,996 2,996 Cumulative Costs 13,500 18,996 24,492 27,488 30,484 33,480 Benefits 11,520 11,520 11,520 11,520 11,520 Cumulative Benefits 11,520 23,040 34,560 46,080 57,600 70,000 Payback: about 2 months into year 3 60,000 50,000 40,000 30,000 20,000 10,000 Year 0 Year 1 Year 2 Cumulative Costs Year 3 Year 4 Cumulative Benefits Year 5 RETURN ON INVESTMENT (ROI) PLAN A: In-House Development Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Costs 17,000 2,496 2,496 2,496 2,496 2,496 Cumulative Costs 17,000 19,496 21,992 24,488 26,984 29,480 ROI = (Total Benefits - Total Costs) / Total Costs Benefits 11,520 11,520 11,520 11,520 11,520 Total Benefits: Total Costs: Net ROI: Cumulative Benefits 11,520 23,040 34,560 46,080 57,600 57,600 29,480 28,120 95% PLAN B: Purchase Vertical Software Package Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Costs 13,500 5,496 5,496 5,996 2,996 2,996 Cumulative Costs 13,500 18,996 24,492 30,488 33,484 36,480 ROI = (Total Benefits - Total Costs) / Total Costs Benefits 11,520 11,520 11,520 11,520 11,520 Total Benefits: Total Costs: Net ROI: Cumulative Benefits 11,520 23,040 34,560 46,080 57,600 57,600 36,480 21,120 58% PRESENT VALUE ANALYSIS PLAN A: In-House Development (Using 8 percent discount factor) Benefits Factor (8%) PV of Benefits Year 0 1.000 - Year 1 11,520 0.926 10,668 Year 2 11,520 0.857 9,873 Year 3 11,520 0.794 9,147 Year 4 11,520 0.735 8,467 Year 5 11,520 0.681 7,845 Costs Factor (8%) PV of Costs 17,000 1.000 17,000 2,496 0.926 2,311 2,496 0.857 2,139 2,496 0.794 1,982 2,496 0.735 1,835 2,496 0.681 1,700 Net Present Value: Total 46,000 26,967 19,033 PLAN B: Purchase Vertical Software Package (Using 8 percent discount factor) Benefits Factor (8%) PV of Benefits Year 0 1.000 - Year 1 11,520 0.926 10,668 Year 2 11,520 0.857 9,873 Year 3 11,520 0.794 9,147 Year 4 11,520 0.735 8,467 Year 5 11,520 0.681 7,845 Costs Factor (8%) PV of Costs 13,500 1.000 13,500 5,496 0.926 5,089 5,496 0.857 4,710 5,996 0.794 4,761 2,996 0.735 2,202 2,996 0.681 2,040 Net Present Value: Total 46,000 32,302 13,698 3. Provide a brief explanation of the various alternatives that should be investigated if development continues, including in-house development and any other possible strategies. Chapter 5 presents an extensive discussion of development strategies, including in-house development, purchase of a software package from a vendor, customizing a vendor-supplied package, using an application service provider, outsourcing, and developing user applications. Students should mention each alternative, and cite the main advantages and disadvantages of each. 4. Suggest a coding scheme for use in the after care hours report, that would identify which time block(s) are being billed for on any particular day. You will need to refer back to Chapter 3 to review the time blocks available in after care. The following is a sample coding scheme. Student schemes should be exclusive, and simple. Time Block Coding Scheme Time Block Code Noon – 1:30 Noon – 3:30 Noon – 5:30 1200_130 1200_330 1200-530 1:30 – 3:30 1:30 – 5:30 3:30 – 5:30 130_330 130_530 330_530