Index-20: A New Series For Istanbul Stock Exchange

advertisement

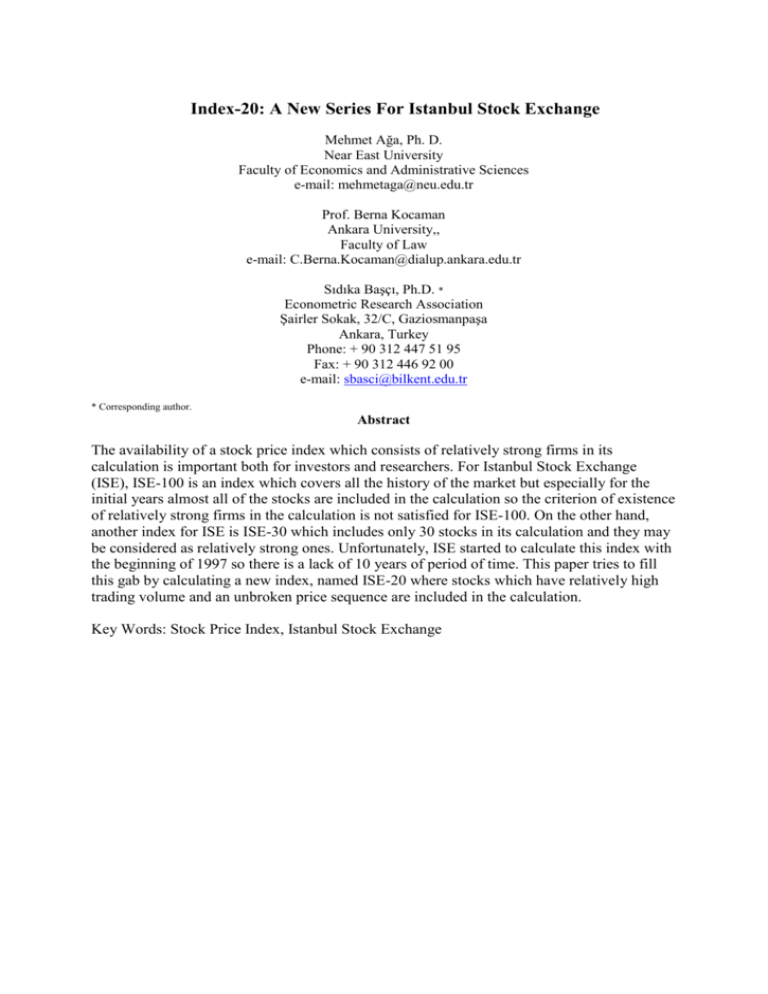

Index-20: A New Series For Istanbul Stock Exchange Mehmet Ağa, Ph. D. Near East University Faculty of Economics and Administrative Sciences e-mail: mehmetaga@neu.edu.tr Prof. Berna Kocaman Ankara University,, Faculty of Law e-mail: C.Berna.Kocaman@dialup.ankara.edu.tr Sıdıka Başçı, Ph.D. * Econometric Research Association Şairler Sokak, 32/C, Gaziosmanpaşa Ankara, Turkey Phone: + 90 312 447 51 95 Fax: + 90 312 446 92 00 e-mail: sbasci@bilkent.edu.tr * Corresponding author. Abstract The availability of a stock price index which consists of relatively strong firms in its calculation is important both for investors and researchers. For Istanbul Stock Exchange (ISE), ISE-100 is an index which covers all the history of the market but especially for the initial years almost all of the stocks are included in the calculation so the criterion of existence of relatively strong firms in the calculation is not satisfied for ISE-100. On the other hand, another index for ISE is ISE-30 which includes only 30 stocks in its calculation and they may be considered as relatively strong ones. Unfortunately, ISE started to calculate this index with the beginning of 1997 so there is a lack of 10 years of period of time. This paper tries to fill this gab by calculating a new index, named ISE-20 where stocks which have relatively high trading volume and an unbroken price sequence are included in the calculation. Key Words: Stock Price Index, Istanbul Stock Exchange 1. Introduction An index can be defined as an indicator, which enables one to reach a conclusion in a fast and correct way by considering various different variables combined together. In other words, just one number summarizes some of the complex events. Several indices are calculated in various different areas of economics and finance such as production, prices, wages, foreign trade and stock market. Indices for all stock markets are composed in order to investigate price and return performances of all shares in a combined way. By this way, both the investors and researchers can have an overall idea about the market. Since these indices are available for all countries it also becomes possible to make relative analysis internationally. Moreover, in stock markets sectoral indices are also composed. This enables investors and researchers to make comparisons among the sectors. Istanbul Stock Exchange (ISE) started to be an active market in 1986. From that time until the end of 1990, ISE computed only the ISE-100 index. Financial and Industrial price indices started to be calculated at the beginning of 1991. From the beginning of 1997, sector and sub-sector indices and ISE-30 index on the basis of prices and total returns could also be realized.1 Among these indices ISE-30 consists of relatively more strong firms. Such an index is important for investigators and researchers since it can be an indicator for the whole market. Unfortunately, this index has started to be calculated with the beginning of 1997 so there is a lack of 10 years period of time. In this study, we tried to fill this gap. We tried to compose an index, which we call Index-20, starting from the beginning of ISE (1986) and ending November 2005 and find its total return series. Index-20 consists of firms that are relatively strong. From being relatively strong, we understand that trading volume of the firm is high and the history of the firm does not contain any interruptions, that is, an unbroken price sequence is available. We believe that availability of such an index can be very important both for investigators and researchers. For this reason, we intend to make the data available to other researchers also. Goetzmann (2001) with a similiar need to feel a gap for NYSE stocks for the period 1815 to 1925 compose a stock price index and total return series. After 1926 data can be obtained from the University of Chicago Center for Security Prices database for US. A very early study, with the same aim is Cowles (1939). Later on Wilson and Jones (1987, 2000) made corrections of the data presented by Cowles (1939). The paper continuous as follows: In Section 2, we firstly give a brief description of index calculation methods. In Section 3, we describe our method of index calculation and present the return series of Index-20 with its some of the descriptive statistics. Finally, in Section 4, we conclude. 1 Istanbul Stock Exchange Web Site http://www.ise.org/indices/stckinxd.htm 2. Index Calculation Methods2 Stock market indices are usually calculated by taking the prices of the stocks as base. For this reason, these indices are called “price indices”. There are three computation methods that are generally used. These are arithmetic average, geometric average and market capitalization formulas. The formula to calculate an index with an arithmetic average is as follows: n It P i 1 it Dt where It is the value of the index at time t, Pit is the price of the ith stock at time t, Dt is the value of the divisor at time t and n is the number of stocks included in the calculation of the index. As examples of indices where arithmetic average is used Dow Jones and Nikkei can be given. The formula to calculate the index with geometric average is as follows: 1n n Pit Pi ,t 1 I t i 1 Dt * I t 1 As examples of indices where geometric average is used Value Line Composite Index, NYSE and AMEX can be given. In the calculation of indices with market capitalization formula, the rate of increase or decrease in the value of stocks are used. The formula is as follows: n It P N i 1 it it H it Dt where Nit is the amount of the ith stock at time t, Hit is the rate of the ith stock to the total. As examples of indices where market capitalization formula is used Morgan Stanley Consumer Index and indices used by ISE can be given. 3. Calculation of Index-20 We can describe the methodology that we use to calculate Index-20, a monthly stock exchange index series, for the period January 1986-November 2005 as follows. The first step that should be taken is the determination of the stocks, which are eligible. We have two criteria while deciding on the stocks that can be included in the calculations. The first one is that the trading volume of the stock should be high relative to the trading volume of other stocks in the market. We think that this can be considered as an indicator that the stock is a 2 The formulas presented in this section are taken from http://www.analiz.com.tr/egitim/endeksler.html relatively strong one. The second one is that an unbroken price sequence is available for the stock. Interruptions mean that there are some problems about the stock so by excluding such stocks from our calculations we guarantee that the stocks that are included are the ones, which are not problamatic for any reason. For each year, we firstly calculated the average trading volume3 of each stock in the market and sorted the stocks starting from the one with the highest average trading volume to the one with the lowest trading volume. Then we determined the stocks where an unbroken price sequence is available. For the year 1986, when we excluded the stocks where interruptions had occurred, we were left only with 20 stocks. This small number of stocks can mainly be explained by the fact that 1986 was the first year of ISE and total number of stocks included in the market was low. Then, we decided to include the 20 stocks which had the highest trading volume among the ones with unbroken price sequences for the rest of the years also. This situation automatically determined the number of stocks that should be included in our calculations of index series. For this reason we called our index series Index20. Surely, from year to year the stocks included in the calculations can change depending on whether they satisfy the two criteria or not. The names of the stocks included in the calculation of index for each year can be provided by the authors upon request. For the kind of index calculation methods described in the above section, automatically, every stock gets a weight depending on its price. This means, even if the returns of two different stocks are same, the one, which has a higher price, will have more effect on the index. In order to avoid this problem, while calculating index-20 we use stock returns rather than stock prices in the formula and we prefer average return formula for the calculation. Since for most of the investors and researchers the return of a stock is more important than the level of its price, we believe that such a change in the formula is important. Because of this change in the formula we can define our index as a “return index” rather than a “price index”. The monthly closing prices were obtained from the CD prepared by Vedat Akgiray for the period 1986-1999 and from www.analiz.com for the period 2000-2005. These are all prices adjusted to splits and dividends. Then, we calculated for each month the monthly returns by taking the logarithmic differences with the following formula: rit=Ln(Pit)-Ln(Pi,t-1) Where rit is the return of the stock i for the month t and Pit is the monthly closing price of the stock i for the month t. Then we calculated the average return of the 20 stocks for that month: 20 rt r i 1 it 20 We set December 1985 as our base month. The index is 100 for that month. Then, for each month the percentage increase is added to the index of the previous month and the new index for that month is calculated. Following is the formula used: 3 Trading volumes are obtained from the CD prepared by Vedat Akgiray for the period 1986-1999 and from www.analiz.com for the period 2000-2005. It=It-1+rt*It-1 Where It is the index for month t. The monthly index series for the period is available upon request in Excel format. We then calculated the monthly return series of index-20. The figure of the return series can be seen below. [Insert figure here] Some descriptive statistics of the return of this index-20 can be summarized as follows: The mean of the series is 5.88% with a standard deviation of 19.03%. The maximum return value of 67.47% is in July 1987. The minimum return value of -98.07% is in December 2000. Skewness is –0.36 and Kurtosis is 7.00. The Jarque-Bera coefficient is 164.15 so rejecting the normality. The autocorrelation coefficient is positive and it is 26.80%. 4. Conclusion The main purpose of this paper is to generate an index for the Istanbul Stock Exchange which starts from the initial day of the market and which consists of stocks which are relatively strong. By being relatively strong we understand that the stocks included in the calculation of the index have high trading volumes and they have unbroken price sequence. We believe that the existence of such an index is important for both investors and researchers. ISE-30 is not sufficient for this aim mainly for the reason that it starts from the year 1997 and so does not cover all the history of ISE. So this paper fills this need for the interested ones. References Cowles, A. (1939) Common Stock Indices, Principia Press, Bloomington. Goetzmann, W. N. (2001) A New Historical Database for the NYSE 1815 to 1925: Performance and Predictability, Journal of Financial Markets 4, 1, 1-32. Wilson, J. W. and C. P. Jones (1987) A Comparison of Annual Common Stock Returns: 1871-1925 with 1926-85, Journal of Business 60, 239-258. Wilson, J. W. and C. P. Jones (2000), An Analysis of the S and P 500 Index and Cowles Extensions: Price Indexes and Stock Returns, 1870-1999, Working Paper, University of North Carolina. Figure 1 0.5 0 Returns -0.5 -1 Jan-04 Jan-02 Jan-00 Jan-98 Jan-96 Jan-94 Jan-92 Jan-90 Jan-88 Jan-86 -1.5 Monthly return series of Index-20 for the period January-1986 – November 2005