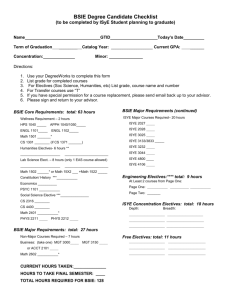

Syllabus

advertisement

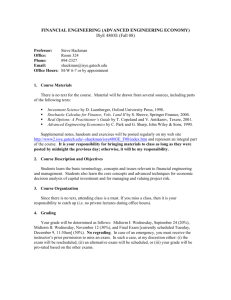

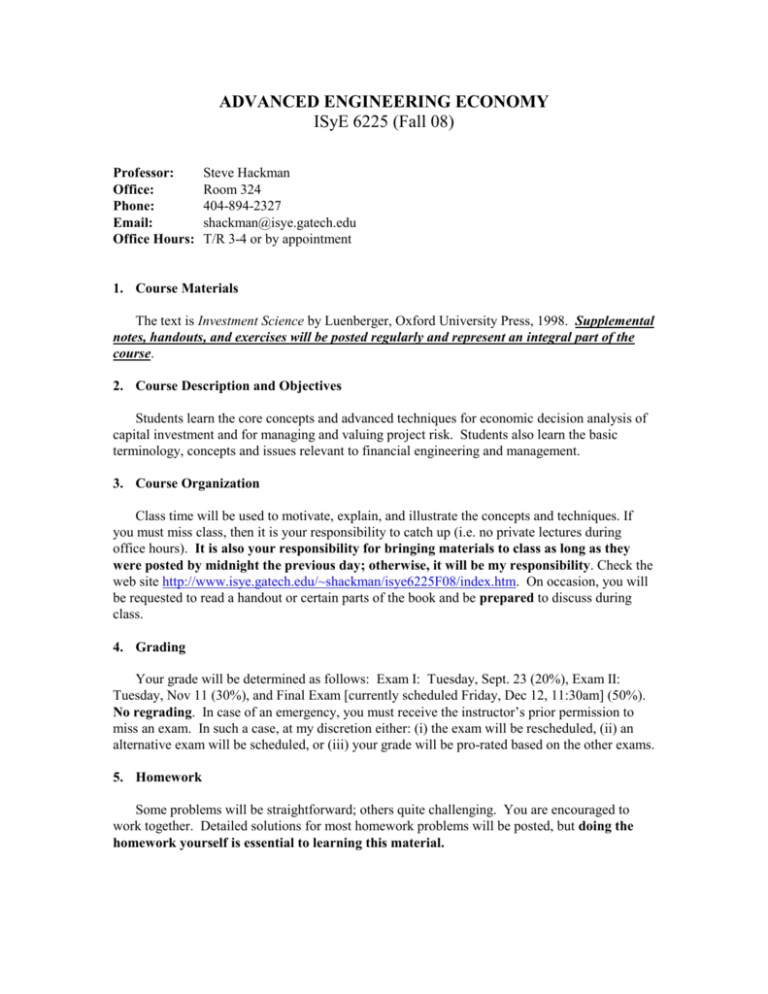

ADVANCED ENGINEERING ECONOMY ISyE 6225 (Fall 08) Professor: Office: Phone: Email: Office Hours: Steve Hackman Room 324 404-894-2327 shackman@isye.gatech.edu T/R 3-4 or by appointment 1. Course Materials The text is Investment Science by Luenberger, Oxford University Press, 1998. Supplemental notes, handouts, and exercises will be posted regularly and represent an integral part of the course. 2. Course Description and Objectives Students learn the core concepts and advanced techniques for economic decision analysis of capital investment and for managing and valuing project risk. Students also learn the basic terminology, concepts and issues relevant to financial engineering and management. 3. Course Organization Class time will be used to motivate, explain, and illustrate the concepts and techniques. If you must miss class, then it is your responsibility to catch up (i.e. no private lectures during office hours). It is also your responsibility for bringing materials to class as long as they were posted by midnight the previous day; otherwise, it will be my responsibility. Check the web site http://www.isye.gatech.edu/~shackman/isye6225F08/index.htm. On occasion, you will be requested to read a handout or certain parts of the book and be prepared to discuss during class. 4. Grading Your grade will be determined as follows: Exam I: Tuesday, Sept. 23 (20%), Exam II: Tuesday, Nov 11 (30%), and Final Exam [currently scheduled Friday, Dec 12, 11:30am] (50%). No regrading. In case of an emergency, you must receive the instructor’s prior permission to miss an exam. In such a case, at my discretion either: (i) the exam will be rescheduled, (ii) an alternative exam will be scheduled, or (iii) your grade will be pro-rated based on the other exams. 5. Homework Some problems will be straightforward; others quite challenging. You are encouraged to work together. Detailed solutions for most homework problems will be posted, but doing the homework yourself is essential to learning this material. Projected Topical Outline: Part I. Discounted Cash Flow Analysis READING: Chapters [2.1-2.6, 3.1-3.6, 4.1-4.6, 5.1-5.4, 5.6] 1. 2. 3. 4. 5. 6. 7. 8. Financial market overview. Present value calculations. Fixed-rate mortgages. Project cash flow analysis. Dynamic cash flow analysis. Capital budgeting. Fixed-income securities. Term-structure estimation and immunization models. Part II. Risk-Return Analysis READING: Chapters [9.1-9.4, 6.1-6.10, 7.1-7.5, 7.7] 6. Utility theory and stochastic dominance. 7. Mean-variance portfolio optimization. 8. Capital asset pricing and cost of capital. Part III. Real Options and Decision-Tree Analysis READING: Chapters [12.1-12.7, 11.1, 11.3-11.9, 12.8] 1. 2. 3. 4. 5. 6. Financial option basics. Lattice models for option valuation. Classification of different types of real options. Real options and decision-tree analysis. Value of information. Continuous-time asset price dynamics. Black-Scholes equation. Part IV. Additional Topics 1. Decision-making psychology.