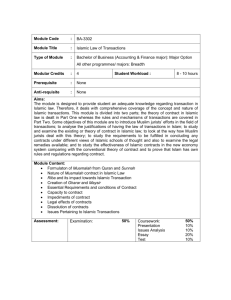

Investment Analysis for Islamic Banks in Karachi

advertisement