Appendix B: Amended Industry Dispute Resolution Principles

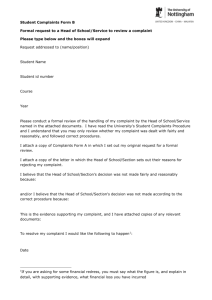

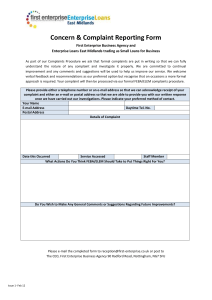

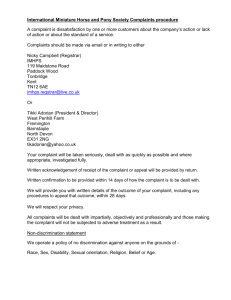

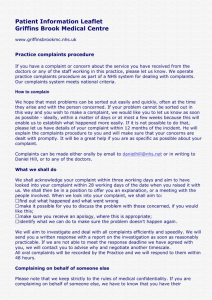

advertisement