TOPIC TITLE

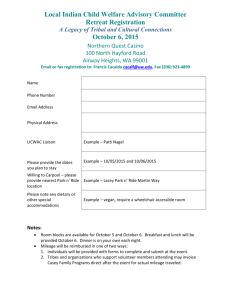

advertisement

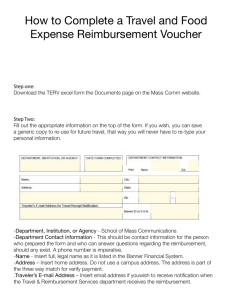

BUSINESS SERVICES PROCEDURES Instructions - Filling Out FRV Form Filling out a Foreign Travel Reimbursement Voucher (FRV) The FRV form should be submitted for reimbursement within ten (10) working days of return from trip with the required supporting documentation attached. If you have any questions you may contact Mark Passmore, Travel Specialist in Accounts Payable or review the Business Services Procedures for Foreign Travel on the SPC Business Services website. o All of the information requested on the FRV form, must be accompanied by sufficient information to permit an audit that will associate the charges with the actual travel. When conversion rates are applicable, a copy of the website showing the conversion rates for the actual travel dates must be attached to the FRV form. Remember to use the conversion rates for the day the transaction occurs (i.e. traveling to Japan; arrive on 05/08/09 and depart on 05/15/09; web pages for each day that transactions occurred must be attached). The following currency converter website is user friendly which provides currency converter help pages, a cheat sheet for travelers, and exchange rates back to 1990; http://www.oanda.com/converter/classic. o If your credit card (i.e. Visa, etc.) shows the currency converter rates applicable to your travel, a copy of this bill may be submitted with the FRV form instead of a screen print copy of the website used in determining your estimated exchange rates. Any applicable fees charged on your credit card for determining currency conversion rates shall be included on the FRV form for reimbursement. If your travel only involved a registration fee advance paid via check request, you must still submit a FRV and attach a receipt for the fee. If accurate mileage cannot be documented via MapQuest for specific destinations, please explain in writing why there is a difference in mileage. Example: mileage to specific destinations such as Tampa International Airport. The form is divided into three sections. Section I pertains to Foreign Travel; Section II pertains to Mileage; Section III pertains to Funding and the appropriate signatures. If you have your FAR form along with the appropriate and required receipts you have accumulated in front of you, then completing this form will be a snap! Begin by putting your FAR number in the box at the top of the form. Mark Passmore, Travel Specialist, EPISVC 341-3225 or mailto:Passmore.Mark@spcollege.edu Revised 02/03/09; 04/30/10 Page 1 of 6 BUSINESS SERVICES PROCEDURES Instructions - Filling Out FRV Form SECTION I – FOREIGN TRAVEL 1. Convention/Conference/Meeting Name – write the name of the event attended and attach the original or copy of the program or agenda. If an employee is teaching a class or seminar, please attach appropriate support that will comply with the Florida State Auditors requirements (i.e. copy of outline or syllabus being taught; copy of advertisement; copy of first page of student attendance sheet showing the teacher’s name and dates). 2. Meeting Location – the city and country in which the event was held. Please remember to be very specific on the location because “metropolitan areas” is insufficient information. When the Travel Specialist and auditors review this form, if a city cannot be located in a particular country on the foreign travel per diem rates for foreign areas, then the “other” per diem rate will be utilized. 3. Travel Beginning and Ending Date and Time – the beginning date and time and the ending date and time of your trip (i.e. What time did you leave home for the airport? What time did you arrive back home from the airport at the conclusion of your trip?). Rates for foreign travel shall not begin until the date and time of arrival in the designated foreign country from the United States, and shall terminate on the date and time of departure from the foreign country to the United States. For example, if the traveler departed Rome @ 1:00 p.m. for Paris (lands in Paris @ 5:00 p.m.) the Rome allowance for breakfast and lunch would be used and the Paris allowance for dinner and lodging would be used. 4. Lodging or Per Diem – you may choose either the subsistence (meal) allowances (below) and lodging costs, or the per diem (daily) rate but not both. No reimbursement will be made for per diem, lodging or subsistence (meals) that are included in conference/registration fees. Lodging includes the room rate plus any taxes times the number of days. You must attach a copy of the paid, itemized hotel receipt which show the name and address of the establishment, the name of the traveler, the daily rate(s) actually paid, the dates checked in and out (the hotel receipt must be either marked paid, have a credit card number attached, or balance must be zero.) The per diem rate allowance per day for foreign travel lists the lodging rate and M&IE rate separately. This information is obtained at the following website www.state.gov/travelandbusiness. 5. Subsistence (Meals) in Lieu of Per Diem – if you elected the per diem rate, you are not eligible for the subsistence allowance. If you elected to be reimbursed for hotel and subsistence allowance, indicate the number of each type of meal and extend the calculations. No receipts are required for subsistence allowances. Mark Passmore, Travel Specialist, EPISVC 341-3225 or mailto:Passmore.Mark@spcollege.edu Revised 02/03/09; 04/30/10 Page 2 of 6 BUSINESS SERVICES PROCEDURES Instructions - Filling Out FRV Form No subsistence allowance will be allowed for meals provided by the event per the program or agenda. 6. College Vehicle or Rental Car – indicate whether you obtained a rental vehicle or a college-owned vehicle. List passengers or driver other than self – if you rode with someone else. Please indicate if you drove and took other passengers with you. You may attach a list if necessary. See the document on travel and car rentals (click here). 7. Personal Car – if you used your own vehicle, please indicate the total number of miles. Extend the total at the allowable rate per mile ($.445 effective 7/01/06) as stated in the BOT Travel Rule 6Hx23-5.16. The total mileage, including vicinity mileage, listed in Section II should equal the amount that you have recorded in this section. 8. Airfare – attach the invoice itinerary and indicate the total ticket cost. If you purchased an airline ticket via the College’s authorized travel agency, you should indicate the total cost of the airfare here. You will deduct that same amount at the line below labeled “Less Airfare,” since the travel agency will have billed the College. If you purchased an airline ticket without going through the College’s authorized travel agency, STOP! You must attach a memo of explanation of why you failed to follow College Travel Procedures as indicated on your FAR. Your memo must be addressed to Theresa Furnas, Associate Vice President for Financial and Business Services. The College is not obligated to reimburse you for a ticket not purchased through its properly authorized travel agency. 9. Toll, Limousine, Parking, Immunizations, Visas, etc. – attach receipts in accordance with the travel BOT Rule 6Hx23-5.16, and insert the total requested for reimbursement. 10. Registration Fee – if you paid a registration fee and received a receipt, you may attach it. If you received a registration fee advance, you will still list the expense here, and you must still provide a receipt, but you will also deduct the advance below in the line marked “Less Registration Fee Advanced.” 11. Total Cost of Travel to College – the total cost to the College, regardless of advances, credit purchases, etc., should be entered here. This total should represent the sum of the Lodging and the Meal Allowances or the per diem, the College, rental, or personal vehicle expenses, the airfare, tolls, limousines, parking, registration fee, and any other charge associated with the trip. 12. Less Air Fare –if your ticket was purchased through the College’s approved travel agency, please insert the amount of the air fare here. It will be deducted from the total cost of the trip in calculating your reimbursement. 13. Less Registration Fee Advanced – if you received an advance for your registration fee, please indicate the amount here. It will be deducted from the total cost of the trip in calculating your reimbursement. Mark Passmore, Travel Specialist, EPISVC 341-3225 or mailto:Passmore.Mark@spcollege.edu Revised 02/03/09; 04/30/10 Page 3 of 6 BUSINESS SERVICES PROCEDURES Instructions - Filling Out FRV Form 14. Less Other Advance – if the College advanced any other funds for any reason, please indicate the amount here, as well as the nature. It will be deducted from the total cost of the trip in calculating your reimbursement. 15. NET REIMBURSEMENT TO TRAVELER – this is the total amount of payment that is due to you. Before submitting the form for reimbursement, be sure to verify that the form is filled out correctly, and the appropriate supporting receipts and documentation are attached. We will make every effort to ensure that you are reimbursed quickly, fairly, accurately, and in compliance with the established Travel Rules. The Travel Specialist reserves the right to alter your reimbursement, but in such cases will send a notice of explanation attached to your check. If you disagree with the alteration, please call Mark Passmore, Travel Specialist at 341-3225 or Susie Carvell, Accounts Payable Supervisor at 341-3207 immediately so that a satisfactory solution can be achieved promptly. 16. Are you receiving anything of value…in conjunction with this FRV? Florida Statutes apply, so be sure to complete this section by checking the appropriate box. If your answer is yes, you must contact the Office of General Council prior to submission of the FRV. If you fail to answer, your FRV will be returned as it cannot be processed. 17. Grant or Contract Restricted Fund Travel – the appropriate Grant Accountant or Facilities Accountant must approve the FRV prior to issuance of any reimbursement. SECTION II – MILEAGE The following notes should help you calculate and prepare your Foreign Travel Mileage reimbursements. If you are requesting mileage reimbursement supporting documentation showing how the mileage was determined (i.e. screen print of MapQuest from home base to airport must be attached). o If accurate mileage cannot be documented via MapQuest for specific destinations, please explain in writing why there is a difference in mileage. You do not need receipts to apply for mileage reimbursement, but you must keep detailed records about mileage being claimed. Joint travel by College personnel in a single vehicle is required wherever feasible. 18. Mileage Log Attached – check the appropriate yes or no box. 19. Date – insert the date of travel. 20. Starting Point – insert the starting point of the travel. Mark Passmore, Travel Specialist, EPISVC 341-3225 or mailto:Passmore.Mark@spcollege.edu Revised 02/03/09; 04/30/10 Page 4 of 6 BUSINESS SERVICES PROCEDURES Instructions - Filling Out FRV Form 21. Destination – insert the destination of the travel. 22. Returning Point – insert the returning point or end of the travel. 23. Mileage – is the total mileage allowable for reimbursement. This mileage must be recorded in #7 of Section I (the totals in #23, including any vicinity mileage must agree with #7). 24. Vicinity Mileage – travel in the surrounding area, which is necessary for the conduct of official business, is allowable, but must be shown as a separate item on the FRV. An example of vicinity mileage is mileage from airport destination to hotel. 25. Purpose – describe the purpose of the travel and if applicable justify amount in the vicinity mileage column. SECTION III – FUNDING Use this section to complete the FRV. This section provides the funding source, traveler identification, and information on where the check will be sent. 26. G/L Account/Cost Center/Project/Grant – Who’s funding your travel? Insert the appropriate general ledger account (6 digits); then the Cost Center which is the Fund (2 digits), Deptid (8 digits), Program/Site (5 digits); Project (15 digits) refers to construction projects; Grant (10 digits) refers to restricted funds information, Refer to the Travel General Ledger Account Codes listing (click here). This information should agree with the data submitted the FAR. 27. Traveler Name (printed) – please print the name of the traveler. Be sure to use the full name, as there are many duplicates possible. We want to be sure we reimburse the correct person. 28. Phone – please provide a phone number where the traveler can be reached if there are any questions associated with this TRV. 29. Traveler Signature – the traveler must sign the FRV, indicating his or her knowledge and understanding of Section 112.-61 (3) (a), Florida Statutes. 30. Date – the traveler should date his/her signature. 31. Employee ID/Social Security Number – for College employees, the employee ID number associated with the HR/Payroll system should be utilized. For nonemployees, a social security number is required. 32. Date Prepared – please indicate the date the FRV is prepared. 33. Send Check To – reimbursements can be sent to the Funding Cost Center or directly to the traveler, assuming the traveler’s home mailing information has been provided to the Travel Specialist. Please specify where you would like the check to be sent. 34. Department Name –please indicate the name of the traveler’s home department. 35. Campus – please indicate the traveler’s home campus. Mark Passmore, Travel Specialist, EPISVC 341-3225 or mailto:Passmore.Mark@spcollege.edu Revised 02/03/09; 04/30/10 Page 5 of 6 BUSINESS SERVICES PROCEDURES Instructions - Filling Out FRV Form 36. Grant Accountant / Facilities Accountant Approval and Date – the appropriate Grant Accountant / Facilities Accountant must sign and date the FRV before submission. 37. Budget Supervisor Approval and Date – the Budget Supervisor must sign and date the FRV before submission. A Pledge from the Travel Desk: We will make every effort to turn your reimbursements around in two weeks or less. Delays can result from inconsistent data, lack of required receipts and/or signatures, and for other reasons. If we are unable to process your reimbursement for whatever reason, Mark will contact you via email to let you know the nature of the problem and how it must be resolved in order to proceed. If you haven’t received a check or an email within two weeks, you should certainly follow up to determine if your paperwork was lost in transit. Be sure to keep a copy of any FRV submitted, along with copies of receipts. These can be destroyed once your check is received, but are invaluable in case of lost paperwork. Before submitting the FRV to the Travel Specialist, please make sure that the form: Has all required signatures; Shows the actual date and hour of departure and return; Has the airline ticket invoice itinerary attached; Has the itemized lodging bill attached; Has an official registration receipt attached if claiming for reimbursement or if it was advanced; Shows the FAR Number; Has original or copy of program or agenda, syllabus, itinerary or other supporting documentation attached. Mark Passmore, Travel Specialist, EPISVC 341-3225 or mailto:Passmore.Mark@spcollege.edu Revised 02/03/09; 04/30/10 Page 6 of 6