AR Workshop 2015

advertisement

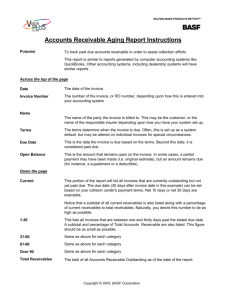

Accounts Receivables Accruals For FY15 June 18, 2015 Information Technology References: 15.02 Release: Finance – Processes – Year End Closing – Chapter 5 AR Invoices (see pages 5-19 to 5-24) Home Page –Help from the top Tool bar - Finance - Year End Reference (see pages 5-19 to 5-24) Home Page – Workshops - Year End Closing Manual – Steps 1, 10 and 11 1. Understanding the Process You must process/clear all outstanding receipts prior to processing any AR accruals o Accrual balances are based on the last known amount remaining on the invoice The accrual balance is not necessarily the original invoice amount It is important to post(deposit) all current year receipts in FY15 before you begin o Invoice amounts will default as accrual dollar amounts for year end processing o Should prevent potential data entry errors If a receipt has not been posted in FY15, a necessary receivable may not be accrued o The posting from the Year-end Closing will show an error (see page 8 for example) Documents with errors will not post o Errors must be resolved first in Finance-AR-Invoices The accrual and carryover columns on the year end list are editable, but may not be set to a negative value o You must clear the negative amount in Finance-AR-Invoices The entire outstanding amount will be set to the accrual column because Escape Online assumes the invoice is to be accrued o You may carryover invoices You must manually change the accrual amount o Watch for negative release amounts (red) when you manually change field amounts The accrual process will result in FY15 journal entries which establish AR’s (debits object 9229) and records revenue (credits objects 8xxx) in 2014-15. Any deposits to AR’s(AR15-XXXXX) must be done in FY16 after 6/25/15 and reference the FY15 accrual invoice o To become an AR in FY16 the invoice must have gone through the year end process o Escape does not have a way to set up receivables without an invoice first being created The use of 9290/9590 objects is now required for any accruals associated with state or federal programs. These entries will need to be manually done via a journal as the normal Year End Processing activity does not allow the use of objects other than 9210/9510. AR Setup FY15 6/18/15 Workshop Page 2 Reminder: The Asset/Liability roll, which takes place after 2014-15 is closed will: o Move General Ledger balances from object 9229 in FY15 to object 9210 in the FY16 General Ledger Escape does not move individual AR balances Any FY15 receipts must be done on accrued invoices in FY16 o Until the Asset/Liability roll is performed There will be no balance in the FY16, 9210 object general ledger, to offset the receipts being made to the FY15 receivables accrued to FY16 2. Review Potential AR’s Run the Fiscal Year End Checklist (Fiscal15) -Provides a list of all items needing to be addressed prior to close Finance - Reports - Fiscal - Fiscal15 1. Click on 2015 2. Can search by Department 3. Reqs/Payments fields default to No since you will be reviewing the AR section 4. Select Go 5. Review checklist for any outstanding receipts Any outstanding AR invoices will be shown after the Requisition detail You cannot process invoices that have outstanding receipts After the last cash deposit date (6/25/15) o You will need to cancel those receipts if unable to make 6/25 deadline Anyone AR’s with a status of Receipts will need to be addressed o Any remaining items on the Year End Closing AR list must be accrued using the Year End Closing Process All invoices in Printed status will accrue o Enter your FY15 receipts in FY16 against the new accrued AR’s AR Setup FY15 6/18/15 Workshop Page 3 6. This report must be totally clean before you are ready to close the year Rerun the report to verify that there are no remaining entries after you have processed all status Printed invoices through Year End Processing The report will show all types of entries o Remember to clear every type of entry o Stores entries have special accrual requirements Must be addressed in the Finance–Stores activity See page 5-17 of the Escape Year End Closing manual o Work order entries cannot be accrued Must be addressed in the Finance-Work Orders activity See page 5-11 in the Escape Year End Closing manual 7. See Step 1 of the Year End Closing Manual dated 05/29/15 for additional information concerning the use of the Fiscal15 report Move next to the Year End Closing screen Provides a list specific to ARs Provides the screens to set up AR accruals AR Setup FY15 6/18/15 Workshop Page 4 Finance - Processes - Year End Closing 1. Enter search criteria: Fiscal Year (2015) Department Order Location Document Type (Select AR Invoice) Reference Number Process Default = No o The No allows you to select which invoices to move forward Vendor Name Accounts 2. Select Go 3. Review the list as shown below AR Setup FY15 6/18/15 Workshop Page 5 Report options: o From Task select Year End Processing Report - Reports all detail for remaining option on the Process List o From the tool bar select the “magnifying Glass” icon - Reports all the detail for the highlighted entry on the Process list 4. Determine to accrual, carry over or release of all items. Setting Up an Accrual for Next Year – This will change the invoice’s fiscal year to the next fiscal year, add the appropriate accounts and write a history record Enter the amount in the Accrual field (Defaults entire amount) Prior Year Receivables can be accrued Watch accrual amounts if prior year Escape Online will automatically set the process flag to Yes Carrying Over the Invoice to Next Year – This will not write any journal entries It will simply add the next year’s accounts and write a history record Enter the amount in the Carryover field Escape Online will automatically set the process flag to Yes Releasing (Close Out) the Invoice – Sometimes it is better to just close out the invoice Escape will reverse the receivable No payments will be reversed Enter zero in both the accrual and carryover amounts Escape Online will enter the remaining balance into the release amount Escape Online will not automatically set the process flag to Yes o You must set the Process flag to Yes AR Setup FY15 6/18/15 Workshop Page 6 5. Post Changes from the task bar menu Select Post from the Task menu to process all Account Receivables flagged Yes in Process column o AR15-00093 is an AR that I did not change amounts but did want to accrue Note in our example post below three were defaulted as shown in the posting box o Be sure you agree with the posting count o In our example we altered AR15-00088, AR15-00093 and AR15-00095 (3 documents) AR15-00088 and AR15-00095 show processed and the accrual will show in the General Ledger in FY15 and now allow receipts in FY16 AR Setup FY15 6/18/15 Workshop Page 7 Any changes to the AR amounts must now be done in FY16 Any receipts to the AR must be done in FY16 Note that one of the invoices we had hoped to process failed upon posting o If you move your cursor over the Message field you will see that the AR15-00093 invoice could not be process because there were outstanding receipts o The outstanding receipts must be dealt with in the AR- Invoice or AR- Receipts depending on what is needed before you can try the year end process again 3. Fixing A/R Invoice Errors Sometimes mistakes are made, data entry errors with the dollar amounts, invoices received but not entered, etc. If you have NOT closed the books for the year and discover a data entry mistake in a year-end receivable that was set up, then you should use the Receivable field in the Invoice record. See AR Scenario’s for additional examples of typical issues and methods for correction (pages 15-24 of this manual) Finance – AR - Invoices 1. Open the invoice that needs to be changed (be sure to enter 2016 in the fiscal year) Remember that once you have posted from the Year end Process screen, the invoice is now in FY16 1. Go to the Accounts tab AR Setup FY15 6/18/15 Workshop Page 8 Enter or adjust the receivable amount in the Receivable field of the prior year revenue account o When the revenue account column is locked, clearly fiscal year 2015 is closed Adjust receivable amount in 2015 Receivable field (now 50.00 shown below) 4. Save and Close the invoice Escape Online will make the appropriate changes to the revenue account and linked account that were set up for the new fiscal year Increasing this value will cause the revenue account amount to be decreased by the same amount and the linked account to be increased When you save the invoice, Escape Online will create a journal entry that adjusts the revenue for the prior fiscal year (shown below) AR Setup FY15 6/18/15 Workshop Page 9 4. Clearing Journal Entries Finance – Fiscal – Journal Entries Post or delete all journal entries that have not been posted or cancelled 1. Search for JEs in the Open, Submitted or Audit status • The order is important as you complete or address an open status item it could then move to the Submitted or Audit status and be missed during other status searches Search Status Open, then Status Submitted, then Status Audit 2. Take the appropriate action (Post or Delete) 3. Re-run the journal search to verify there are no outstanding journal entries 5. Clearing Budget Transfers Finance – Fiscal – Budget Transfers Post or delete all budget transfers that have not been posted or cancelled o Search for Budget Transfers in the Open, Submitted or Audit status • The order of the search is important o As you move/address an open item it could move to the status of Submitted or Audit and be missed during other status searches Search Status Open, then Status Submitted, then Status Audit o Take the appropriate action (Post or Delete) o Re-run budget entry search to verify there are no outstanding budget transfers AR Setup FY15 6/18/15 Workshop Page 10 6. Review of Additional AR Information Three methods to review Receivable (AR) setup, activity and journal information: 1. Finance – Fiscal – Journal Entry In the AR Invoice Number field enter the AR you are interested in (AR1500095) Make sure the Fiscal Year field is zero to get a list of all journals to the AR Select Go All journals associated with that AR will be listed in order of entry Open and review any adjustment entries Note that AR15-00095 shows the journal posting in FY15 o Journal entries will show for the posting year o Unaccrued invoices do not record journal entries in posting year o Note the AR journal number is AR15-00236 while the AR invoice number is AR15-00095 AR Setup FY15 6/18/15 Workshop Page 11 2. Finance – AR – Invoice Enter and open the invoice you need to review (AR15-00095) Blank out the Fiscal Year field to make sure you see all invoice history Select the History Tab from the opened invoice All activity will display in order of entry Remember that until the Asset/Liability Roll is done for your district later in August, you will be viewing 9229 in FY15 and 9210 in FY16 for all AR’s in the G/L for balancing o Note the invoice is in FY16 o Any changes to the invoice must now be done in FY16 3. Finance – Reports – Ledger Run the Ledger 02a- Receivables/Liabilities Activity Enter the fiscal year for which the receivables were setup (2015) Select A/R to limit the report to receivables Specify Invoice # to see only transactions for that invoice or leave blank to see all (Blank is the best setting for first review) Cleared items–Change Cleared items to YES to provide a listing of everything that has been setup Unposted JE– Should be set to NO See report criteria shown on the next page AR Setup FY15 6/18/15 Workshop Page 12 This report shows journal entry activity by: o Account receivable invoice number o Journal entry number as it relates to account receivable and/or liability setup and clearing o Breaks on account type o If account selection is specified only those accrual journal entries that have expense/revenue detail matching the selection criteria will be included in the report o The offset objects the report uses are defined in the Ledger tab of the Organization record The current year is set to 9229 and the prior year is set to 9210 o Journal entries that do not reference a requisition or invoice and only have an offset account and a cash account will be excluded from the report o The journal entries made to 9290/9590 will not be present on the report o The description comes from the AR Invoice comment If the comment is blank, the report will use the comment from the latest JE that is found for this reference number o If the offset account is expired, an asterisk will show next to the amount AR Setup FY15 6/18/15 Workshop Page 13 8. Entering AR Receipts (Invoices that have been processed through Year End Closing) Finance – AR – Enter AR Receipts Enter Fiscal Year 2016 (After 6/25/15 this will always be 2016) Enter the current date Pull in the County Bank Account Enter the invoice number for Receipt #1 (AR’s will always start with AR15) Enter the Amount Received Enter the Reference # Enter a Comment ****You cannot deposit money for FY15 in FY15 after 06/25/15**** AR Setup FY15 6/18/15 Workshop Page 14 Receivable (AR) – Cheat Sheet A. To SET UP a year end receivable from EXISTING invoices during FY15 1. Go to Finance - Processes - Year End Closing Source criteria -Select Department from the drop down menu -Select Document Type from the drop down menu, and choose AR Invoice -Select Go From the list alter the Accrual and/or Carryover column amounts to be as you need by clicking on the fields and entering the data ***The Escape system assumes that since you have printed an invoice that the work has been done so the natural default is the Accrual column*** 2. Select Task from the menu bar at the top of the screen 3. Select Post from the drop down menu The screen should give a count of the ones ready for processing Select Yes if you agree with the count to continue the post Make sure that the Process column shows Yes AR Setup FY15 6/18/15 Workshop Page 15 If any of the postings fail you will see a message bar and it will indicate why the post failed when you hover over the message with your mouse 4. If you receive an error message on an item always follow through on the error message 5. Repeat the process above after the error has been corrected No entries will post for failed items B. To SET UP a year end receivable WITHOUT FY15 invoice having already been set up ***The Escape system does not have a way to set up receivables without an invoice first being created. It takes the Year End Closing’ process to move the receivable entries to the next year so FY15 receipts can be made in FY16. 1. Go to Finance - AR - Invoice Note: Before beginning this process you will need to add a customer if the one you need is not already in the system (Finance-AR-Customers) 2. Select New (Process to create an FY15 invoice) Select 2014/2015 from the drop down Fill in all the criteria required for the Invoice, Items and Accounts tabs Select Save/Close 3. Select Print Invoices Enter your Department from the drop down menu Status option should be Open Select Go (Note the list will provide you with an AR15-xxxxx invoice) 4. From the List screen select the Task menu item 5. Select Print Invoices AR Setup FY15 You do not have to actually print the invoices but you will need to select the printer icon so the system thinks you have 6/18/15 Workshop Page 16 The Print Invoice Step is what moves the invoice to a status Printed and the entry to show on the AR Year End Closing screen 6. Return to the steps under A. To set up a year end receivable from existing invoices during FY15 on page 14 and complete the accrual process as you now have an existing invoice ***You MUST return to the Year End Processing screen and move the new invoice to FY16 to establish an AR*** C. To ALTER an already set up receivable done through the ‘AR Year End Closing’ screen 1. Go to Finance - AR - Invoice Source criteriaEnter the Receivable number you wish to alter (AR15-xxxxx) Clear the Fiscal Year field with the space bar or select the year 2016 Select Go 2. Go to the Items tab and adjust the item amounts as necessary. 3. From the Accounts tab enter or adjust the receivable amount in the Receivable field of the prior year revenue account. AR Setup FY15 Note the FY field shows 2015 When the revenue account column is locked, clearly fiscal year 2015 is closed 6/18/15 Workshop Page 17 The resulting entries will adjust the FY15 receivable amount to 600.00 and apply the difference to the FY16 revenue account to 5.37 If you need to adjust the entire amount invoice amount to 600.00 you would need to also adjust the FY16 revenue amount to 0.00 Return to the Invoice tab and note the red dot on the Undistributed Amount field AR Setup FY15 6/18/15 Workshop Page 18 You must enter the reverse of the Undistributed Amt field in the Adjustment Amt field (-5.37) 4. Select Save/Close (until the red X is cleared the Save/Close will not be available) ****At this point a system created journal is created to reverse the first accrual and process the second accrual***** D. Receivable (AR) Scenario’s ***Pre-Close*** 1. When an AR was set up and should not have been Finance – AR - Invoices a. Blank out the Fiscal Year field on search screen b. Enter and open the AR needing alteration (Do Not Reopen the AR from the Task menu) c. From the Accounts tab enter zero as the receivable amount in all the 2015 Receivable fields of the prior year revenue account (shown on the next page) d. If the 2016 revenue amount line shows dollars be sure to also zero out each line (also as shown on the next page) AR Setup FY15 6/18/15 Workshop Page 19 d. This will automatically alter the 9210 receivable on the screen e. Verify that all the fields show zero f. Return to the Invoice tab and enter an Adjustment Amount to clear the Undistributed Amount and Amount Outstanding o Both the Amt Outstanding and the Undistributed Amount fields must be zero AR Setup FY15 6/18/15 Workshop Page 20 g. Then select “Manually Complete” from the Task menu h. Select Save/Close and a FY15 journal will be created that will alter the FY15 setup to zero 2. When an AR was set up for the incorrect amount Finance – AR – Invoices Refer to the example on pages 17-19 of this manual for screen depictions a. Blank out the Fiscal Year field on the search screen b. Enter and open the AR needing adjustment (Do Not Reopen the AR from the Task menu) c. From the Accounts tab enter or adjust the receivable amount in the Receivable field of the prior year revenue account d. This will automatically alter the 9210 receivable on the screen e. Verify that all the fields reflect the changes you want to make f. Return to the Invoice tab and verify that the Undistributed Amount is now zero and the Receivable Amount is what you wanted to change it to. g. Save/Close and a journal will be created that will alter the FY15 set up and leave the FY16 at the new amount you requested AR Setup FY15 6/18/15 Workshop Page 21 3. When an AR was set up to the incorrect resource/account code The accounts on a FY15 AR line cannot be altered The AR must be manually completed Finance – AR - Invoices Blank out the Fiscal Year field on the search screen Open the AR needing adjustment (Do Not Reopen the AR from the Task menu) From the Accounts tab adjust the receivable amount in the Receivable (2015) field of the prior year revenue account to zero Adjust the 2016 revenue account to zero The 9210 receivable will automatically zero out on the screen when the first two lines are changed to zero Return to the Invoice tab and enter an Adjustment Amount to clear the Undistributed Amount and Amount Outstanding. By adjusting the accounts tab first you will be able to see the undistributed amount on the invoice screen and use that amount needed in the Adjustment Amount field Input this amount as a negative amount to zero it out (shown on the next page) AR Setup FY15 6/18/15 Workshop Page 22 Then select “Manually Complete” from the Task menu A FY15 journal will be created that will reverse the original accrual to the 9229 accounts and allow you to set up a new accrual to the correct resource/account code o Remember that this will require a new 2015 invoice to be created prior to creating the corrected accrual through the Year end process ***Post Close*** 1. When an AR was setup and not received against (Manually Complete) Finance – AR - Invoices a. Blank out the Fiscal Year field on search screen or select 2016 b. Enter and open the AR needing to be closed (Do Not Reopen the AR from the Task menu) c. Make no changes to the Accounts tab d. From the Task menu, select “Manually Complete” e. This will force a journal in FY15 that will relieve the 9210 and debit the 8XXX side f. This will affect FY15 for the amount that was not received (see the example on the next page) AR Setup FY15 6/18/15 Workshop Page 23 2. For a receivable that was partially received against but will not be totally cleared Finance – AR - Invoices a. Blank out the Fiscal Year field on search screen or select 2016 b. Enter and Open the AR needing to be closed (Do Not Reopen the AR from the Task menu) c. Make no changes to the Accounts tab d. From the Task menu, select “Manually Complete” e. This will force a journal in FY16 that will relieve the remaining 9210 balance and debit the 8XXX side for the difference between what was set up and what was received f. This will affect FY16 for the amount that was not received AR Setup FY15 6/18/15 Workshop Page 24