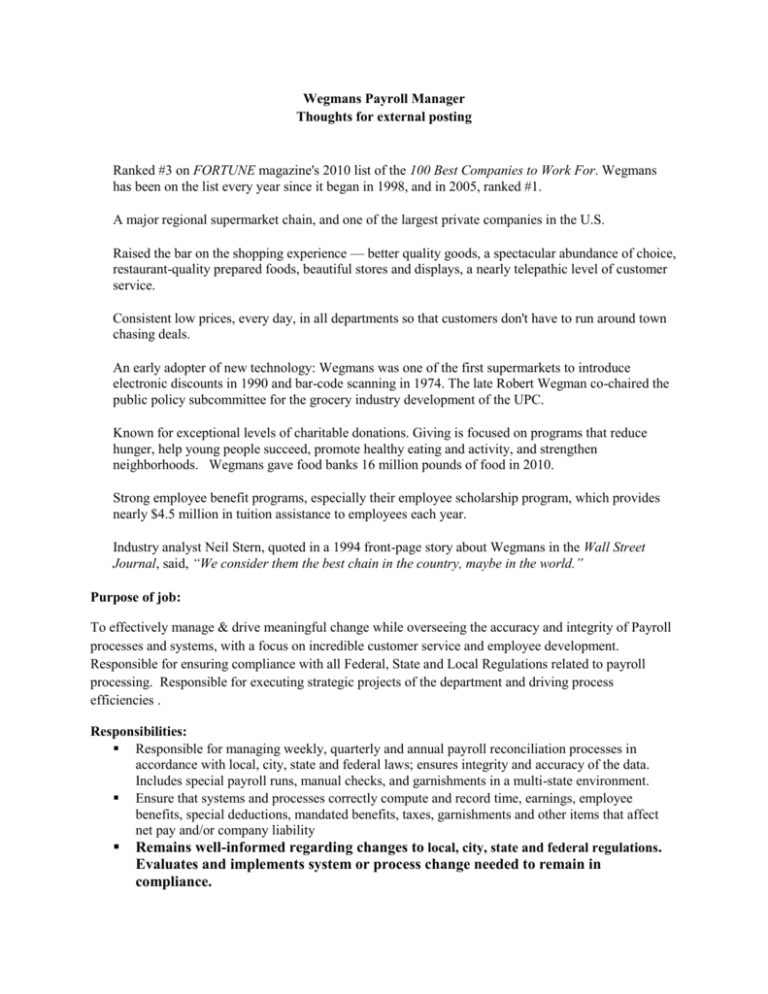

Wegmans Payroll Manager Thoughts for external posting Ranked

advertisement

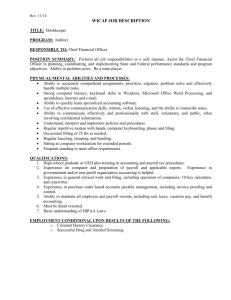

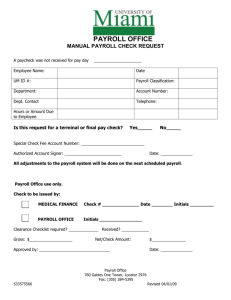

Wegmans Payroll Manager Thoughts for external posting Ranked #3 on FORTUNE magazine's 2010 list of the 100 Best Companies to Work For. Wegmans has been on the list every year since it began in 1998, and in 2005, ranked #1. A major regional supermarket chain, and one of the largest private companies in the U.S. Raised the bar on the shopping experience — better quality goods, a spectacular abundance of choice, restaurant-quality prepared foods, beautiful stores and displays, a nearly telepathic level of customer service. Consistent low prices, every day, in all departments so that customers don't have to run around town chasing deals. An early adopter of new technology: Wegmans was one of the first supermarkets to introduce electronic discounts in 1990 and bar-code scanning in 1974. The late Robert Wegman co-chaired the public policy subcommittee for the grocery industry development of the UPC. Known for exceptional levels of charitable donations. Giving is focused on programs that reduce hunger, help young people succeed, promote healthy eating and activity, and strengthen neighborhoods. Wegmans gave food banks 16 million pounds of food in 2010. Strong employee benefit programs, especially their employee scholarship program, which provides nearly $4.5 million in tuition assistance to employees each year. Industry analyst Neil Stern, quoted in a 1994 front-page story about Wegmans in the Wall Street Journal, said, “We consider them the best chain in the country, maybe in the world.” Purpose of job: To effectively manage & drive meaningful change while overseeing the accuracy and integrity of Payroll processes and systems, with a focus on incredible customer service and employee development. Responsible for ensuring compliance with all Federal, State and Local Regulations related to payroll processing. Responsible for executing strategic projects of the department and driving process efficiencies . Responsibilities: Responsible for managing weekly, quarterly and annual payroll reconciliation processes in accordance with local, city, state and federal laws; ensures integrity and accuracy of the data. Includes special payroll runs, manual checks, and garnishments in a multi-state environment. Ensure that systems and processes correctly compute and record time, earnings, employee benefits, special deductions, mandated benefits, taxes, garnishments and other items that affect net pay and/or company liability Remains well-informed regarding changes to local, city, state and federal regulations. Evaluates and implements system or process change needed to remain in compliance. Ensures high service levels are maintained with employees; Resolves employee questions/issues in a timely manner. Solves day-to-day operational problems of varied scope and complexity. Develops, coaches and mentors team members; providing team members with feedback and recognition that is fair, accurate and helps them to continuously improve Establishes, implements and maintains appropriate controls related to expense management; makes budgetary decisions that are fiscally responsible Responsible for the processing of Multi-State Taxation, Company Car Programs, elements of Executive Compensation and Unclaimed Property as defined by each state. Manages and coordinates a variety of projects ranging in scope and complexity, while driving cross-functional collaboration with Wegmans business partners /leaders at all levels to ensure alignment between business objectives and project deliverables. Responds to requests for ad hoc analysis and projects in a fast-paced operating environment. Drives continuous improvement of payroll systems and implements new technology to maximize efficiency and integrity of the payroll processes and information. Develops, maintains, updates and communicates organization-wide payroll policies and processes regarding earnings, deductions, time keeping as well as government compliance reporting Required experience: 7+ years direct experience in payroll and/or related accounting roles, reflecting increasing levels of responsibility to include Supervisory or Managerial experience Multi-state, multi-location high volume payroll processing experience Bachelor’s degree A business driver and a creative/strategic thinker with strong analytical, financial and system skills Excellent project management skills and proven influencing skills with peers and senior management Well-organized, extreme attention to detail and a self-directed individual Working knowledge of HRIS programs, Excel, Word, and report writing tools (Crystal Report Writer preferred) Specialized knowledge of payroll processing and related laws and regulations. General knowledge of accounting procedures as they relate to payroll Strong customer service focused approach to problem solving Maintains high level of confidentiality, integrity and ethics. Must be able to handle multiple projects simultaneously, support and embrace a changing environment with shifting priorities, and be highly self-motivated and self-directed Excellent presentation skills, and the ability to effectively communicate professionally and tactfully with all levels of management and across all functional areas Demonstrates teambuilding by communicating a common purpose, empowering team members to contribute their best and selecting candidates with a variety of skills and styles for inclusion on the team Easily build relationships with others, gaining trust and support, finding common ground and using team-based approaches to solve problems and achieve goals Preferred: Certified Payroll Professional (CPP). Previous experience with Lawson